The U.S. jobs market started off the new year with a bang! In January, the labor market once again looked very strong, toppling market expectations. Unemployment remains at the low level of 3.7%, while measures of labor force supply flattened.

This is a surprisingly hot start to the year but January’s data is often marred by statistical quirks. For example, in January 2023 the initial estimate for nonfarm payrolls was a whopping 517,000, which eventually was revised down to 482,000. However, this will not bolster confidence in the Federal Reserve to soon start rate cuts. This labor market might still be a bit too heated to inspire confidence in a slowing economy that will not prompt inflation to resurge.

Surprisingly robust gains

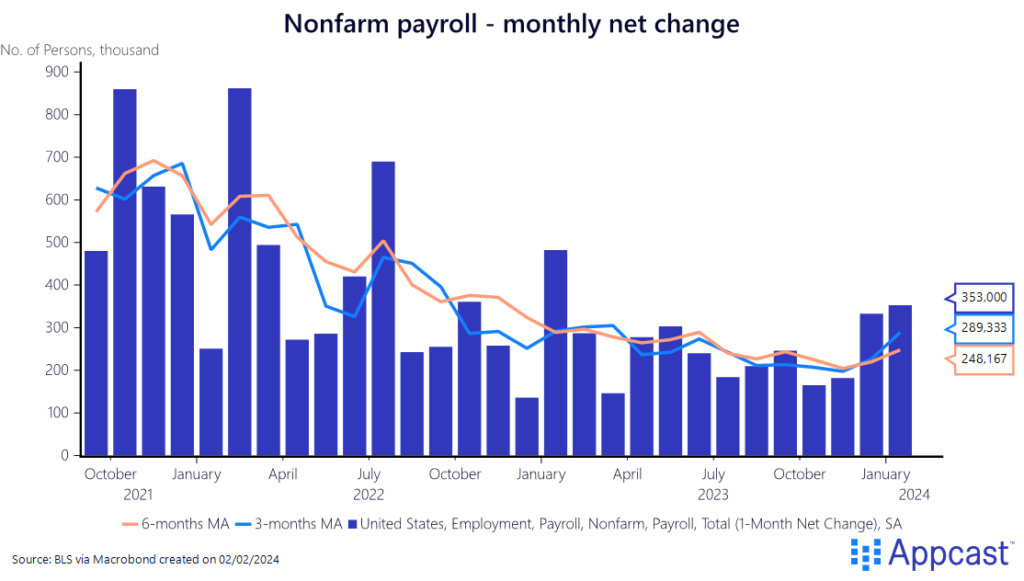

The U.S. labor market added an impressive 353,000 net new jobs in January, nearly double market expectations. Once again, it seems the labor market is a beast that cannot be tamed; not by recession expectations, not by the highest interest rates in over twenty years, nor by inflationary pressures. We shouldn’t be too swayed by one month of data, though – the labor market is still on a cooling trend (or “beige” as Recruitonomics has recently described) compared to recent years and January’s data historically includes some statistical quirks.

Notably, there were also positive revisions in November and December, somewhat distorting the vision of a slowdown towards the end of the year. November’s upward revisions were modest, with just 9,000 jobs uncovered, while December’s were massive: over 117,000.

Even more surprising, the BLS revised the labor market data for the entire year of 2023. The new data now shows that the U.S. labor market created about 3,050,000 jobs in total during 2023 instead of the 2.7 million jobs we thought it added before this jobs report. Revisions therefore added a total of 350,000 jobs to last year’s job growth, an impressive number.

Labor force composition

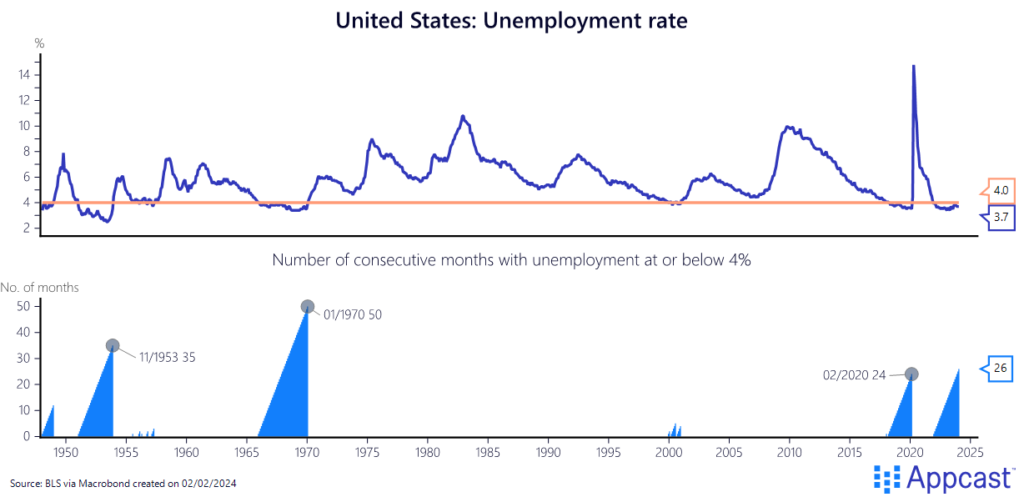

Unemployment remained flat at the low level of 3.7% – adding to the 26-month long run of 4% or below unemployment. This is still a tight labor market, with very little wiggle room.

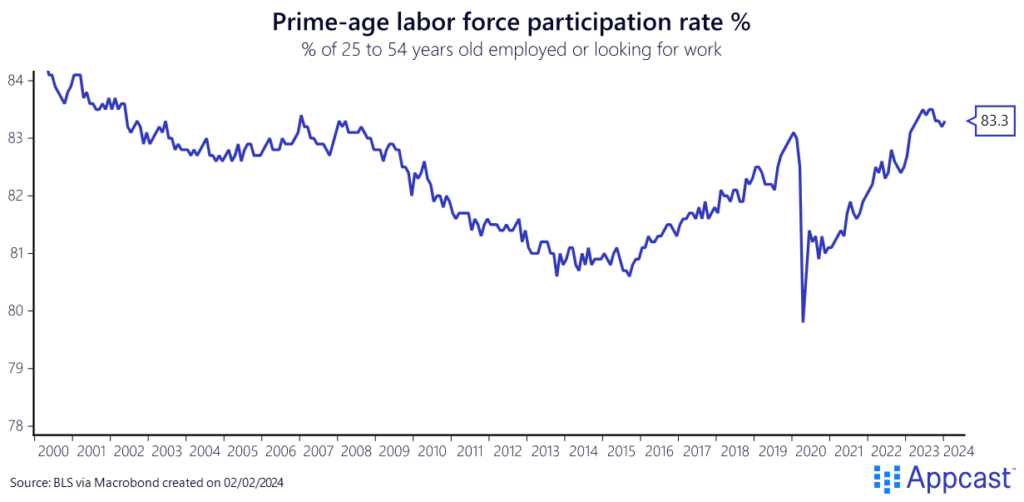

Something to note, though, is that prime-age labor force participation once again flattened in January, at 83.3%. The labor force expanded impressively throughout 2023 – this stalling is certainly something we’ll be watching this year.

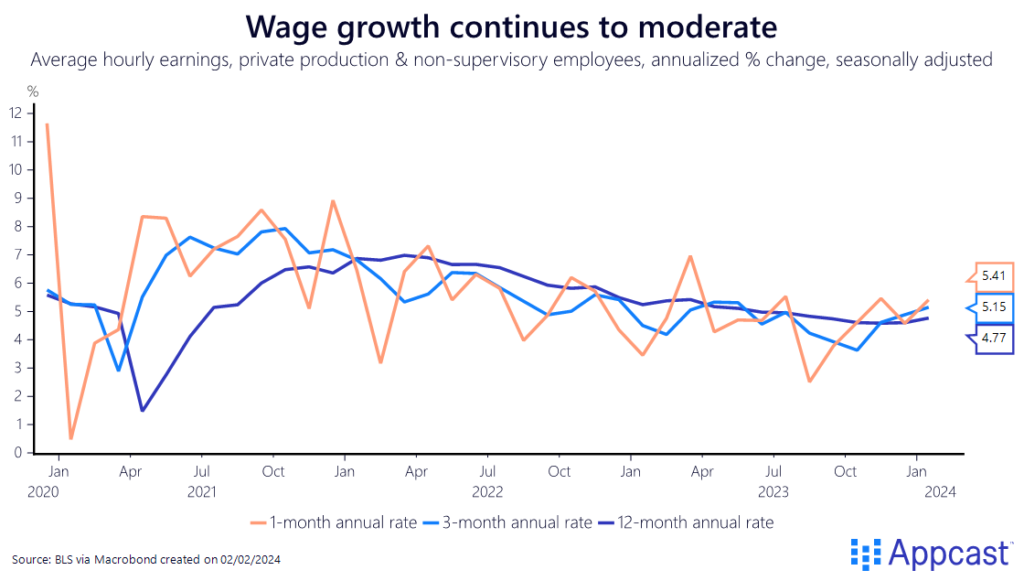

Wage growth accelerated slightly in January, up to 5.15% annualized over three months. As inflation has fallen within target range of the Federal Reserve’s goal, wage growth will be monitored closely for signs of potentially reigniting price gains.

Industry surprises

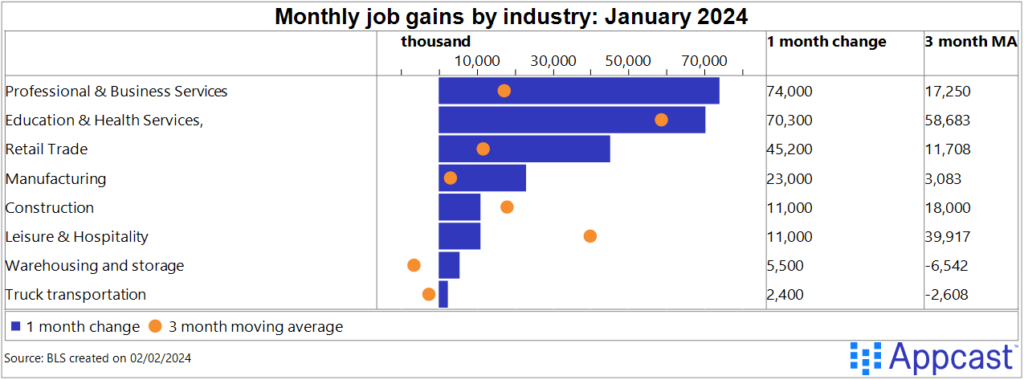

Industry gains were broad-based but there were a few stand-out sectors. Some were expected standouts, such as healthcare adding 70,000. Others were a surprise. Professional and business services’ gains were especially shocking; the sector added 74,000 jobs in January, compared to just 14,000 on average throughout 2023. A small majority of these gains (42,000) were in the professional, scientific, and technical services subsector – perhaps tech is beginning to turn around? This is also supported by a continuation of the upward trend in the information sector, which added 15,000 jobs in January.

What does that mean for the Fed?

The U.S. labor market simply does not stop and the Fed will be watching those numbers. Job growth in 2023 exceeded three million and the January jobs number came in much higher than expected. Wage growth also accelerated slightly, which will be a concern for monetary policy makers. Last but not least, real GDP growth exceeded 3% in 2023 and the Atlanta Fed’s Nowcast is suggesting an equally impressive growth rate in Q1. The Fed will need to see slower wage gains and lower inflation in the service sector before thinking about rate cuts. While financial markets have priced in more than one percentage point of rate cuts for this year, all economic data right now seems to suggest higher interest rates for longer.

What does this mean for recruiters?

Although this was a surprisingly hot month for the labor market, recruitment costs are still down across sectors. This is still a strong jobs market, but the competition is much reduced for recruiters. Some talent acquisition teams are struggling more than others, depending on sector and location. In healthcare, for instance, cost-per-applications for critical care nurses peaked at $70 in January. That extreme example is not indicative of the easing in recruiting competition across the jobs market on the whole.

Sam Kuhn also contributed to this piece.