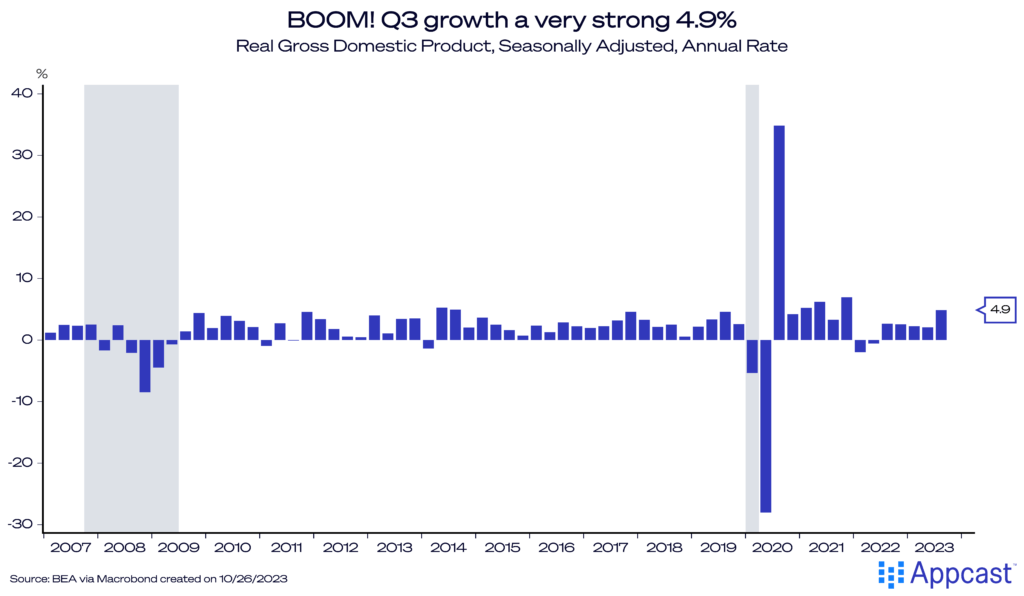

Is “boomy” a word? Or is booming more accurate? Whichever adjective you choose is an accurate description of the U.S. economy in Q3. The initial estimate for inflation-adjusted GDP growth came out as 4.9%! Except for the immediate post-COVID recovery period, this would be the highest quarterly growth rate since 2014. Kudos to the Atlanta Fed’s GDPNow model for projecting 5.4% growth – far higher than consensus forecasters, but more accurate in the end.

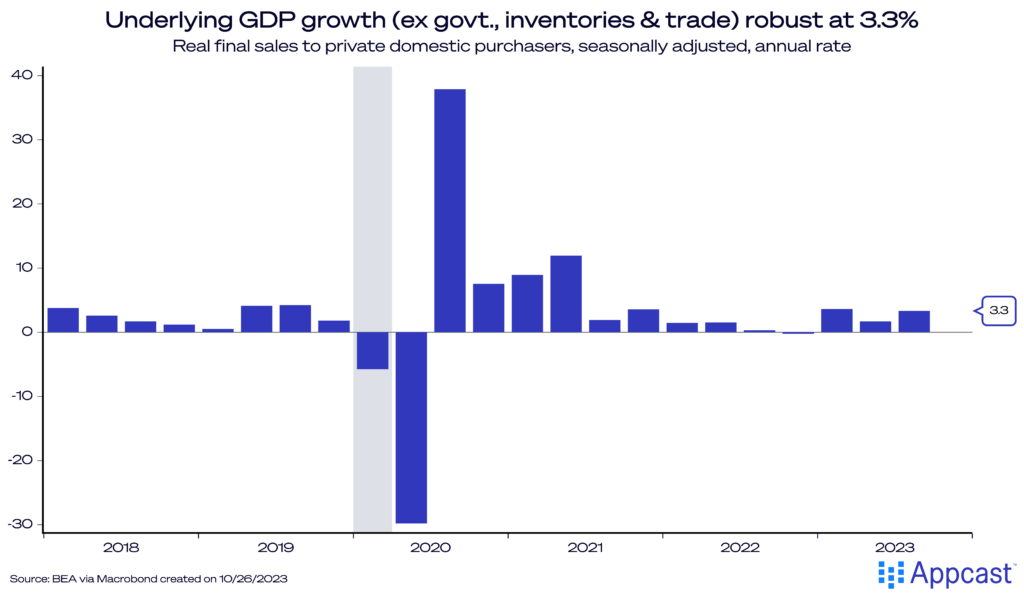

While overall real GDP growth was very strong, what we call “underlying” GDP growth – elegantly defined as “real final sales to private domestic purchasers” – was also robust at 3.3%. This strips out volatile components: international trade, inventory changes, and government spending. After a hiccup of slow underlying growth in the second half of 2022 (amidst the worst of the recent inflation surge), trends have reversed and potentially accelerated.

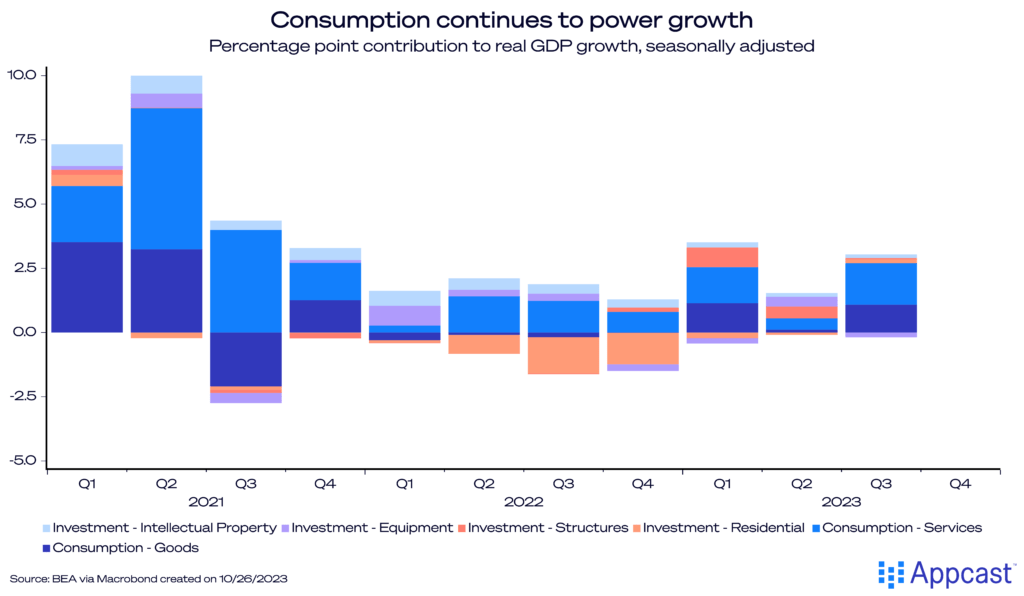

Looking at the components driving strong growth: consumption continues to stand out! Goods consumption added 1.1 percentage points to growth, while services spending gave a 1.6 percentage point boost.

It’s remarkable that consumer spending continues to be resilient despite higher prices. Durable goods spending saw a tick up, jumping more than a half percentage point from Q2. Motor vehicle purchases (a typical bellwether) for the average consumer jumped almost 300,000 units from August to September.

Investment in structures – purchases of buildings to grow business fell from the previous quarter and was just a hair above negative territory adding .05 percentage points. Likewise, investment in equipment fell as well, perhaps indicating businesses are pulling back spending due to uncertain economic conditions in 2024.

A clear diversion is happening – consumers are slowly feeling better about the economy, while businesses are more skittish. Sentiment about the manufacturing industry dropped to its lowest level since Q2 of 2020.

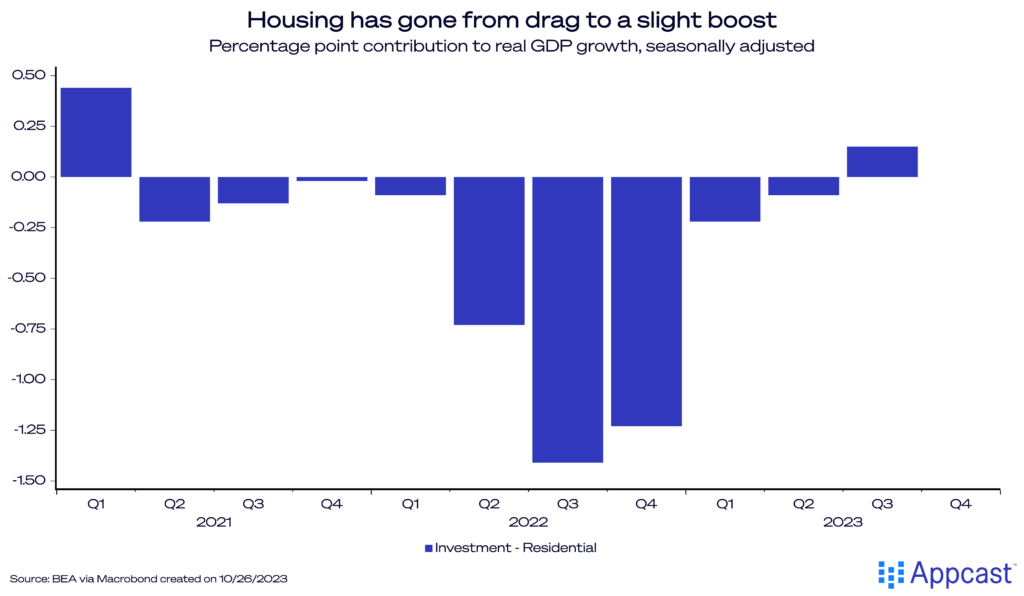

Another notable detail from this report is that housing has reversed its drag effect. For the past nine quarters, housing was a negative contribution to overall GDP growth, but for the first time since Q1 of 2021 it returned to positive territory.

Though it only contributed 0.15 percentage points to growth, this is a positive signal that the housing market is more resilient than analysts and economists predicted. Both housing starts and completions had a modest increase month-over-month from August to September despite slumping existing home sales falling 2% last month. Mortgage rates for a 30-year fixed loan have reached a recent high of 8%, and applications for new loans have dipped as well.

Perhaps the housing market could be more robust than the Fed’s appetite and could fuel the debate about where long-term interest rates should remain in 2024.

What does this mean for recruiters?

Recruiters observing this complicated economy may be scratching their heads: wasn’t a recession a sure thing? Sure, some forecasters made overly confident predictions of a downturn in 2022. Bloomberg (somewhat infamously) projected a 100% chance of a recession… a year ago. Respected data releases like the Conference Board’s Index of Leading Economic Indicators have also been flashing deep red for a while now. Recruitonomics has covered why most economists (earlier this year) were expecting a recession. And, with that, why we at Recruitonomics were not.

Recruiters should prepare for continued labor market tightness – even as labor demand is easing, and especially so in white-collar positions. In other words, recruiters shouldn’t expect an imminent recession (and thus an increase in joblessness) to suddenly make their process of finding workers easier in the short term.

This boomy booming Q3 GDP number officially confirms that reports of a recession were greatly exaggerated.