Maybe like me, you’ve heard a lot of assertions over the past year along the lines of: “nobody wants to work anymore.” Well, apparently they do. From where we sit at Recruitonomics: A strong labor supply rebound is underway.

First, labor demand has been super-strong

After the initial COVID shock to the US economy, the bounceback in job growth has been remarkable. There remains an unsatiated appetite to hire by US employers. Through March 2022, we’ve recovered over 93% of the jobs lost in the COVID recession of 2020. That said, we have a 1.6 million job “deficit” to make up. After gaining 431,000 jobs in March, the US labor market is poised to close that gap by this summer. This is just to recoup our job losses; we’re perhaps millions of jobs short of where we “should be” given pre-COVID trends.

Labor demand is through the roof: Job openings, which took over six years to recover to the levels just before the Great Recession started in 2007, instead bounded back within 12 months from when the COVID downturn began. And since then, openings are up 60%. Widespread labor shortages have been reported, driving more “Help Wanted” signs and higher pay for new hires.

This has created the fundamental imbalance in the labor market: demand outstripping supply. One (albeit crude) way to visualize this is to compare levels of job openings to levels of unemployed persons. Among economists, this metric is often expressed as a ratio but the visualization of the levels is useful in telling us a story about the US labor market over the last 20 years. Simply put, the number of job openings outnumber the unemployed by 5 million (11.3 vs. 6.3) through February 2022. That is the widest gap on record (JOLTS data began in 2001).

Finally, labor supply is recovering

Now we’re finally witnessing a strong bounceback not just in Americans having jobs but in Americans without a job actively searching for work. As Derek Thompson brilliantly expressed in The Atlantic, the economy has experienced not a shift in worker sentiment but a change in worker opportunity.

It increasingly seems that labor supply, not demand, has been the limiting factor to job growth. So are workers returning to meet this demand? Yes, at least in recent months. Despite the Omicron surge that infected more than 15 million Americans in January, many measures of labor supply have experienced strong growth since Fall 2021.

The best measure of success from the perspective of “full employment” labor market policy is the prime-age employment-to-population ratio (or EPOP for short). That is the share of 25- to 54-year olds who are employed. Fear not – this isn’t overt age discrimination. Workers 55 and over are excluded to avoid the demographic distortions of retirement (namely the Baby Boomer generation’s ongoing exit from the labor force). This “prime age” metric also corrects for those early twentysomethings who disproportionately are out of the labor market to pursue education.

Just prior to the COVID recession, prime-age EPOP peaked at 80.5% before plummeting. With two consecutive monthly leaps, by March 2022 it has recovered to 80.0%. At this rate, the US economy will soon reach the same employment levels it reached in 2019, according to the EPOP metric.

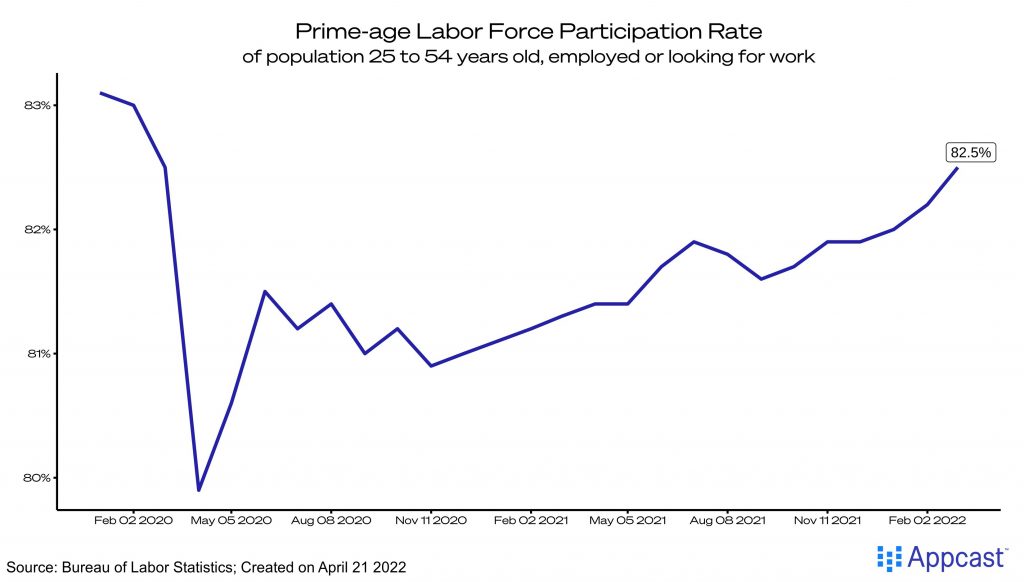

EPOP may be the most important metric for labor market success – with “success” defined as a high share of working-age adults with a job. What concerns us at the moment is not just who has a job but who among those without one is looking for work. The labor force combines those who are currently employed and those who are actively searching for work. It is the denominator for the unemployment rate calculation. And by this metric, too, prime-age labor force participation is on the upswing. Since September 2021, it has risen nearly one full percentage point: from 81.6% to 82.5%. Just prior to the recession it was 83%. Again, at this rate the prime age labor supply should fully recover by the summer of 2022.

Put another way: the quarterly annualized change in the prime age labor force was 6.3% in Q1 2022, the fastest quarterly increase in 22 years!

The labor supply rebound is encouraging but it can expand only so much in the short-term. In the long-run, we’re going to need millions of workers to fill our future worker demands. Something has to give: either productivity, immigration, retirement ages, and/or birth rates must increase; or the economies of North America, Europe, and East Asia will be worker-constrained in future decades.

How will those economies adapt to entering a new era of labor scarcity? That’s a topic Recruitonomics will visit frequently.