Following a whirlwind of labor market strength over the past few years, the labor market has cooled down considerably since the beginning of the year. This has particularly threatened the security of workers in what we call “sitting down” positions.

Despite the slowing, employment losses have been rather minimal so far and workers with a graduate degree still have an extremely low unemployment rate. However, there is no doubt that it has become significantly harder to change jobs. The reason is that after the hiring boom of 2021 and 2022 (when employers were aggressively competing for workers), many companies have reduced or frozen hiring altogether.

Sectors and job roles that require a significant amount of skill and higher education are currently facing a “hiring drought.” This is particularly true for the tech sector, but it is also affecting roles in consulting, marketing, and the like. Some are even speaking of a “white-collar recession.” We will explain in this piece what’s going on and how we got here.

Boom and bust in job postings

The American economy recovered extremely quickly from the COVID-induced economic downturn once the lockdowns had ended and vaccines became widely available.

The unprecedented economic stimulus measures undertaken by congress and the Fed supported households and businesses during the pandemic and led to a massive surge in economy-wide demand as soon as the threat of COVID faded.

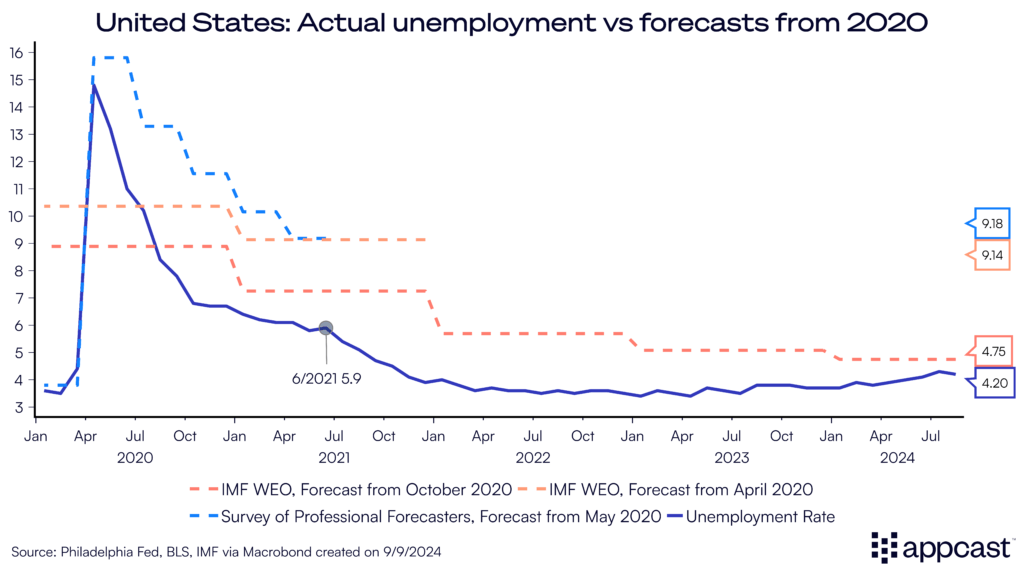

Consequently, the job market recovery turned out to be much quicker than most economists had anticipated. The unemployment rate fell back to pre-pandemic levels of below 4% just two years after having surged to almost 15% in April 2020.

The IMF, for example, projected back in April 2020 that the U.S. unemployment rate would stay at 9% throughout 2021 while the actual unemployment rate was closer to 5% during that year.

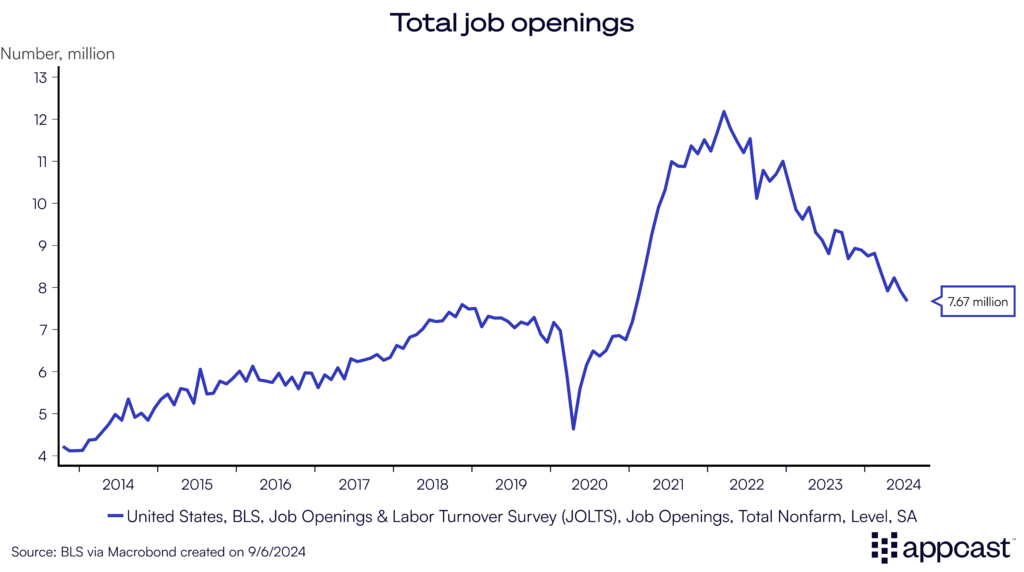

The economic recovery also created a hiring boom. In the U.S., open vacancies surged to a record high of more than 12 million in early 2022 compared to about 7 million before the pandemic.

Given the competitive nature of hiring, companies were unable to ramp up staff quickly enough and hire as much as they needed when economy-wide demand for goods and services surged during the economic recovery.

Since early 2022, however, labor markets have started to rebalance as economic conditions have normalized. Vacancies have fallen back to about 8 million, but the decline in job postings varies substantially by occupation and industry.

Blue, gray, and white

We generally distinguish between white, gray, and blue-collar jobs.

White-collar jobs usually require a high level of education and can be upper management positions. In healthcare, this would be doctors and surgeons. In construction, this would be architects. Lawyers, bankers, and software developers are also in the group of what we sometimes call “sitting-down jobs.”

Gray-collar jobs typically involve working with people and/or customers. They include occupations in the fields of health or social care, for example. Administrative and customer service roles and certain jobs in sales can also be in the group.

Blue-collar occupations are what we call “standing-up jobs.” They often require less education and more manual work. These are jobs in construction, manufacturing, driving, and agriculture. The food and hospitality sector also consists of mostly blue-collar work.

The white-collar hiring boom and bust

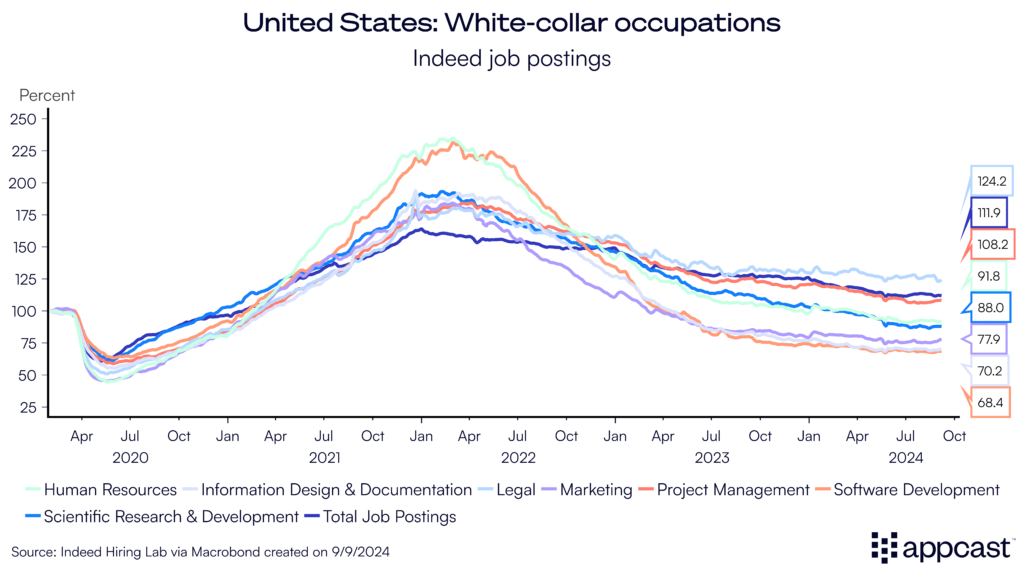

The economic boom throughout 2021 was most pronounced for white-collar jobs like professional and business services. A lot of these “sitting down” jobs are dependent on “derived demand,” meaning that they only do well when the demand for goods and services across other industries increases. This is particularly true for jobs that are often outsourced, including roles in marketing, consulting, and project management, all of which saw a surge in vacancies following the pandemic.

But the hiring boom of 2021 has now completely reversed as overall demand in the economy has normalized. As a result, job postings for many white-collar roles like software development have fallen rapidly.

There are two factors that can explain this so-called white-collar recession. First, during the rapid recovery, there was a certain hiring frenzy in some sectors, especially in tech. It makes sense to recruit if the business outlook is optimistic and every competitor is recruiting as well.

With central banks hiking interest rates up rapidly since 2022 to contain the boom, businesses started to see a deterioration in the outlook and began to cut costs.

These cost-cutting measures affect outsourced work before anything else, thus explaining the decline in demand for consulting, project management work, and marketing, all of which is work based on derived demand and often not done in-house.

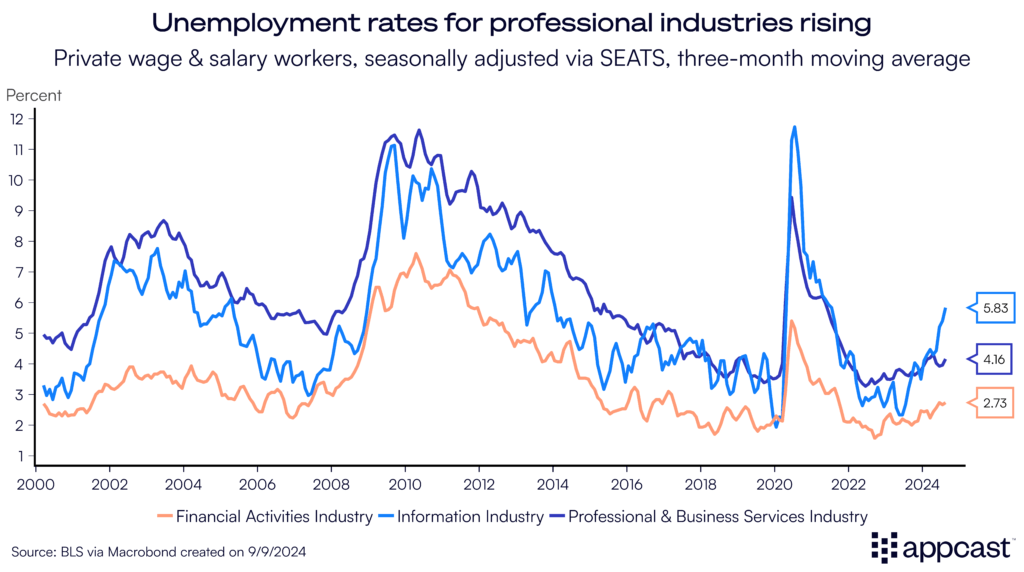

Therefore, unemployment across white-collar sectors has been rising since the beginning of the year. While it is nowhere near the highs seen during either recession in the 21st century, the increase is worrisome. Anecdotally, this also tracks. For example, McKinsey plans to make hundreds of staff redundant across the globe as demand for consultant work has dropped.

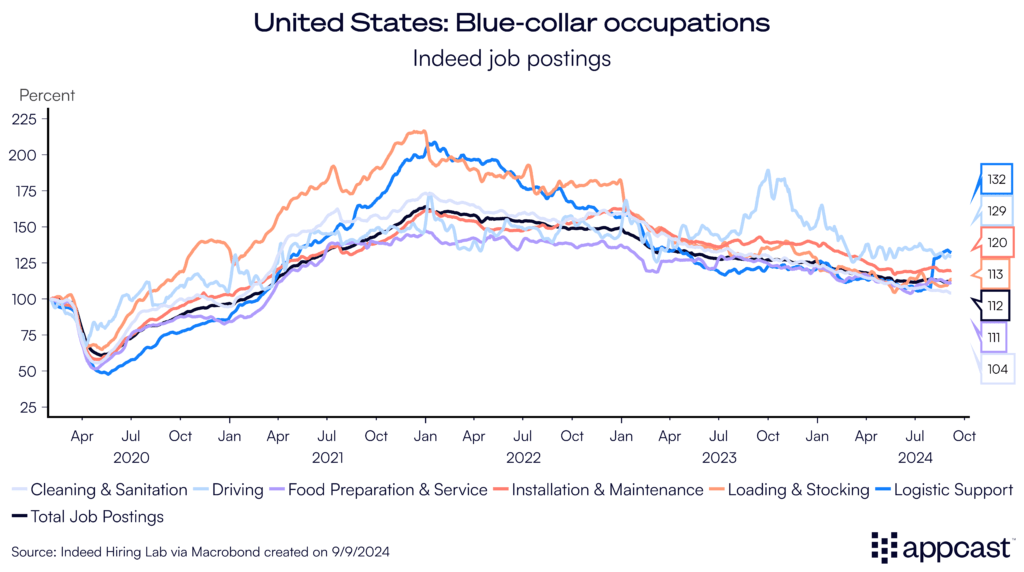

The blue-collar resurgence

The high-pressure economy has largely benefited manual workers. For the first time in decades, workers have seen significantly higher wage gains at the bottom of the wage distribution than at the top. As worker churn rose, companies needed to raise wages and benefits in sectors like hospitality, retail, food services, transportation and the like to not lose workers en masse.

And as the U.S. economy continues to grow at a decent pace and defying recession predictions, the demand for blue-collar workers remains elevated compared to pre-pandemic levels.

We are therefore currently seeing a dual labor market with demand for “sitting-down jobs” falling while demand for these so-called “standing-up jobs” remains high.

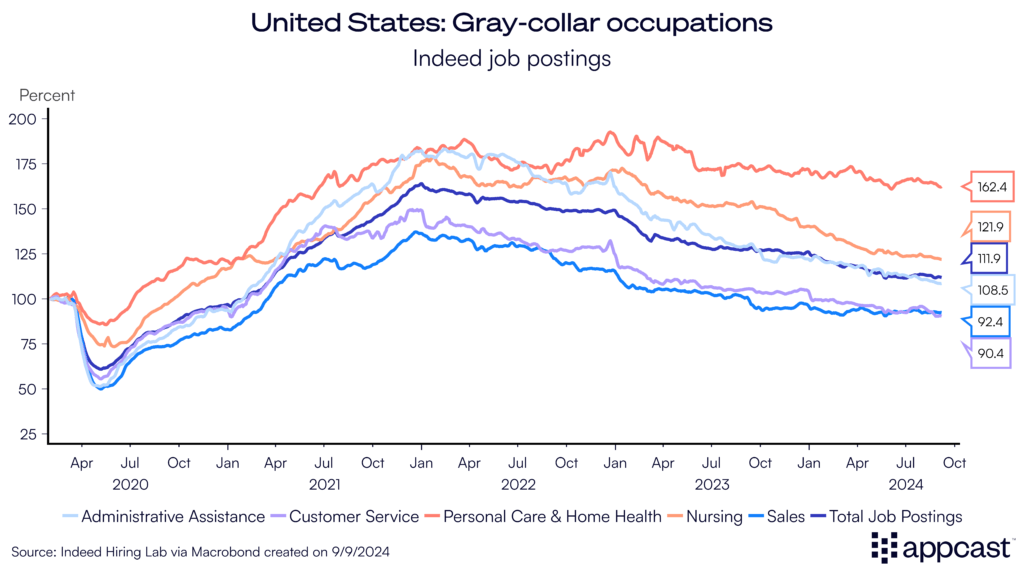

Divergence across gray-collar occupations

Gray-collar positions tend to be semi-skilled jobs that often require interaction with people/customers. Within that category, we are currently seeing two different trends, closely mirroring the recent development for “sitting-down” and “standing-up jobs.”

Administrative and customer service gray-collar jobs have slowed down quite substantially. Hospitality and food services has also seen some decline, but less severe.

Job postings for healthcare related jobs like nursing and personal care have remained extremely elevated compared to pre-pandemic trends. As we have previously discussed, employment growth in healthcare has outpaced all other industries since the pandemic.

The future of collars: Transformed by demographics and tech

Even as we track shifts in these occupations, there are more changes coming. Technological and demographic developments are on the horizon, which will transform hiring in white-, gray-, and blue-collar sectors even further.

Unsurprisingly, one of these developments will come from the most talked-about piece of tech in the last 18 months: Artificial Intelligence. AI has already made a splash in the consumer space and is set to transform the labor market as well. But not every segment of the labor market will be impacted equally. In the white-collar space, AI capabilities are set to augment these workers, empowering a new type of centaur workers. Rather than displacing white-collar jobs in the tech and business sector, this technology will increase productivity and allow for more creative thinking (and perhaps even more fun?) in the workplace.

On the other side of the employment spectrum, blue-collar workers will be least affected by AI. Manual jobs in the hospitality and food services sector will not be “teched-away,” and demand for these positions is unlikely to stutter.

The gray-collar position is more nuanced: some of the most dramatic displacement is likely to occur within this jobs segment. Companies have already had relative success in replacing administrative and customer services jobs with AI. These lower-skilled office positions are most at risk of becoming obsolete, but these workers could use AI to augment their skills and potentially find better paying or even more satisfying jobs.

Other gray collar workers have less to fear: Those who hold jobs in healthcare and nursing positions are not likely to be rendered redundant. In fact, demand for these positions will grow as society ages, necessitating more and more medical care.

Conclusion:

Companies went on a hiring frenzy throughout 2021 and 2022 as the economy recovered quickly from the lockdowns during the pandemic. In retrospect, many companies probably over-hired, a phenomenon that was more pronounced across white-collar occupations.

However, the labor market is now experiencing a white-collar recession as job postings have plummeted and some companies have frozen hiring. For blue-collar workers, on the other hand, the labor market remains tighter. The situation for gray-collar jobs is more nuanced: high demand for healthcare related positions, but lower demand for customer service and sales roles.

This means that hiring difficulties will very much depend on the particular role (and geography) you are hiring for. Recruiters are currently facing a dual labor with some worker shortages across the blue-collar space and a relative abundance of talent across the white-collar space. The difficulty of finding the right talent very much depends on what kind of worker you are looking for. While the white-collar weakness is currently just a cyclical phase that will eventually fade, AI might turn out to be a transformative technology that could create some long-term weakness for certain sitting-down jobs. Stay tuned!

Liz Anderson contributed to this article.