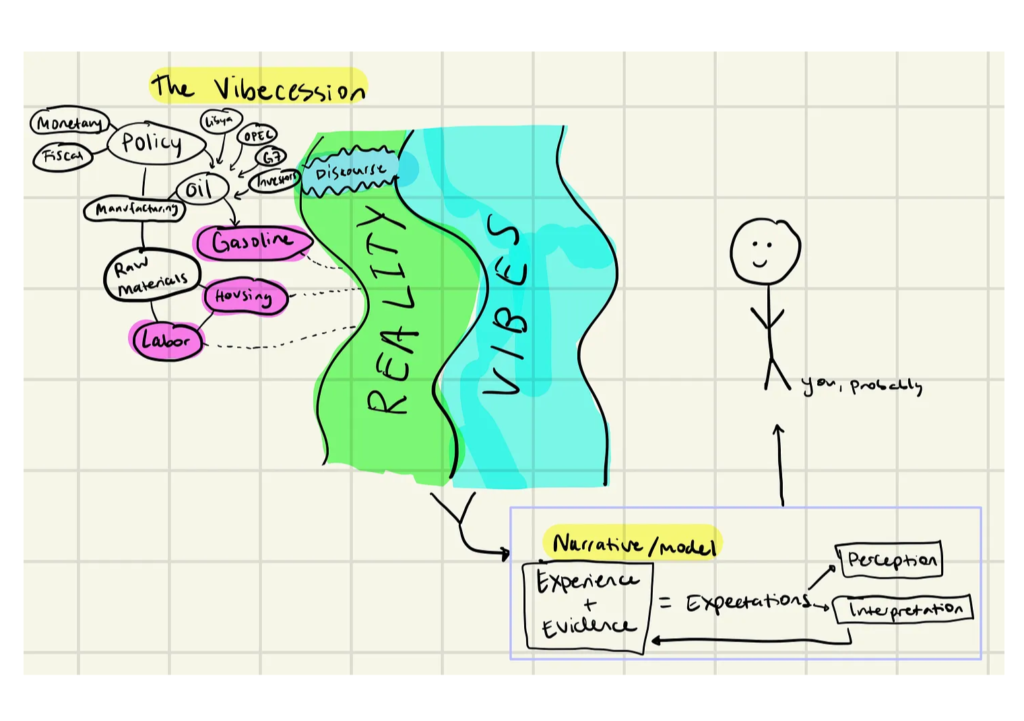

On June 30th, 2022, Kyla Scanlon coined the term “vibecession”, suggesting that despite the economy performing better than expected, there were persistent negative “vibes” about the future of the economy. Could this scenario potentially cause a recession? If consumers tightened their belts and stopped spending as much, then yes!

The “Vibecession”

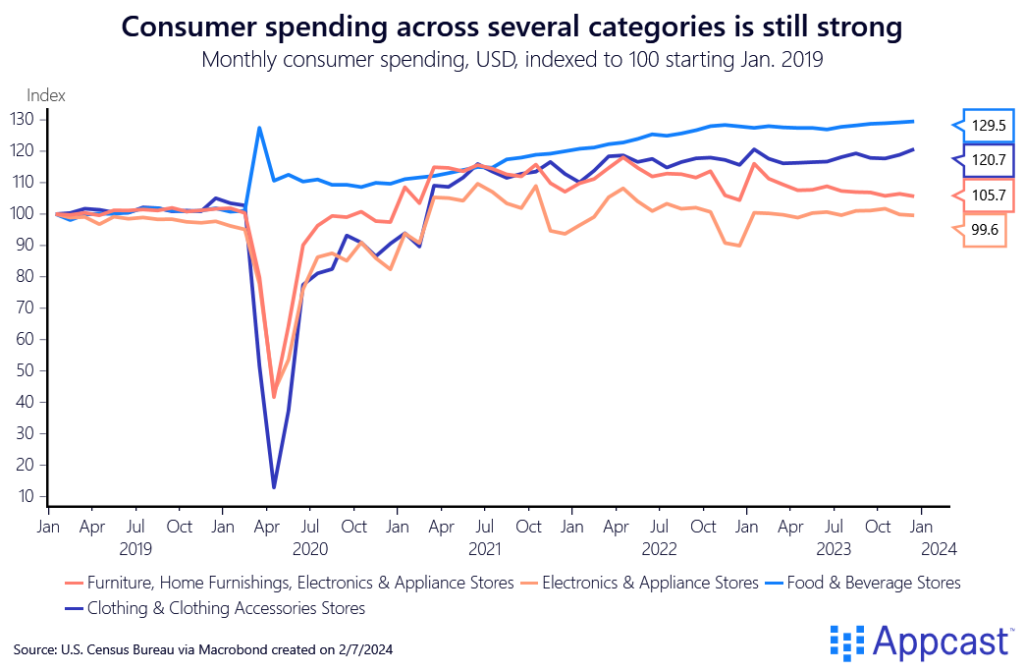

As we review the previous year, did this gloomy prediction come to fruition? No. Consumers are still spending quite strongly across many different categories. The chart below illustrates this nicely: across all major groups spending is at or above its pre-pandemic level. Nominal spending (not adjusted for inflation) for food & beverage stores increased almost $20 billion dollars in 4 years!

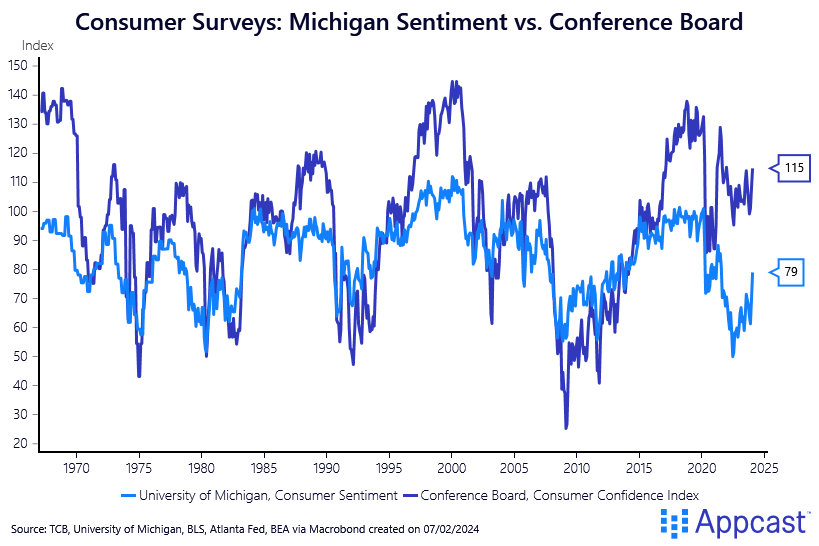

Though consumers’ wallets are painting a very different story, consumer sentiment, a measure of the degree of optimism that consumers feel, has been depressed throughout 2021 and 2022. That is especially true for the widely quoted Michigan consumer sentiment.

Meanwhile, the Conference Board Index also showed a significant decline between 2021 and 2023, but it was nowhere near as catastrophic.

The massive divergence between the two indices can maybe be explained by the fact that they focus on slightly different aspects of sentiment. The Conference Board Index places more weight on the employment situation. The Michigan survey puts more emphasis on personal finances and spending power.

The labor market has generally been very good since the recovery from the COVID-19 shock. However, inflation has also been at its highest point in decades and real wage gains have not been evenly distributed across income groups. It therefore shouldn’t be that surprising that the average consumer feels good about job prospects but not so great about their spending power right now.

Economic factors have explained consumer sentiment well – until recently

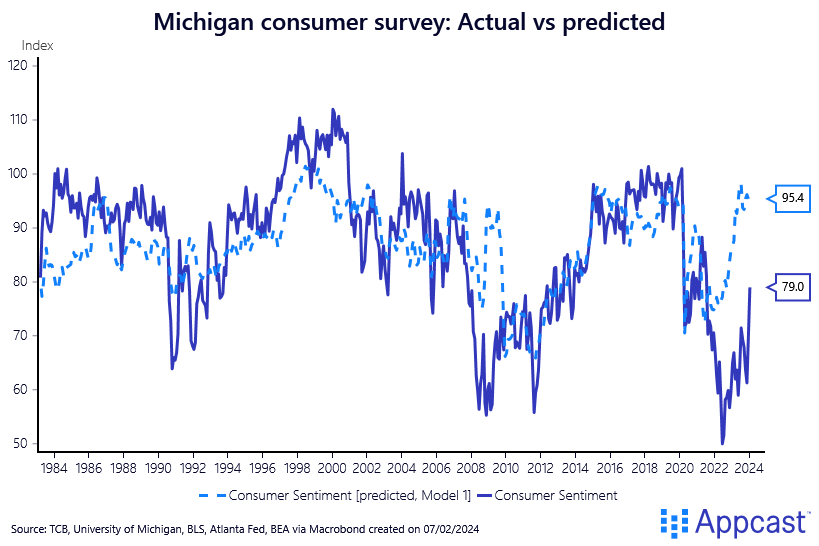

The unusually low score for the Michigan index still needs an explanation though. Historically, consumer sentiment is highly correlated with the “health” of the economy. A strong labor market, meaning low unemployment, low inflation, and robust wage growth are some of the most important factors determining the economic perceptions of consumers.

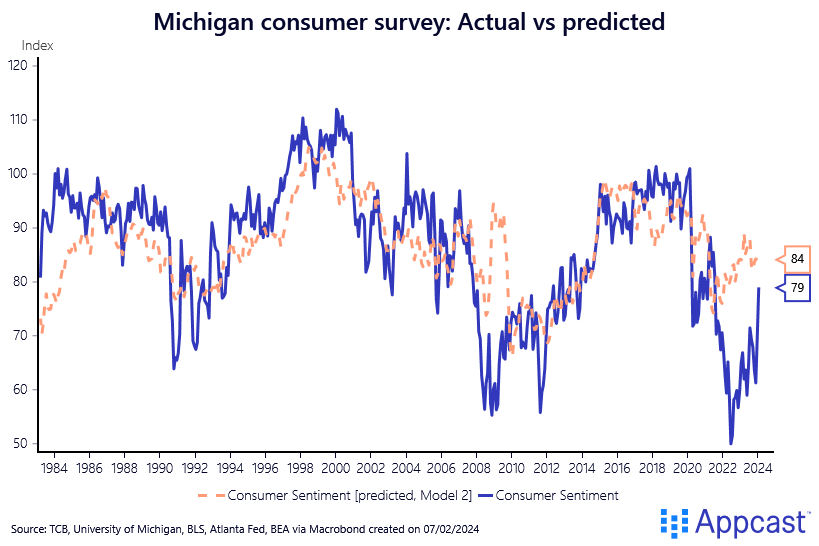

We have estimated a very simple regression (statistical model) that just uses three economic variables to explain consumer sentiment: the unemployment rate, the inflation rate, and nominal wage growth – the latter two variables are expressed as an annual rate of change.

One can see that such a simple model has historically tracked consumer sentiment quite closely. It can explain most of the changes in consumer sentiment in recent decades – until recently, that is.

From about 2021 onwards, the economy has been doing quite well, staging a robust economic recovery from the economic downturn during the first stage of the COVID-19 pandemic. And yet, consumer sentiment has been horribly depressed until very recently and much lower than what our simple model would predict.

One argument is that even though inflation has come down quite a lot over the last year, the price level has increased significantly since the pandemic, which consumers have noticed. Adding the three-year inflation rate to the model reduces – but does not totally eliminate – the gap between the predicted value for consumer sentiment and the actual value.

This tells us that the price surge that happened during 2021 and 2022 has definitely affected consumer sentiment negatively. This is not too surprising since inflation before the pandemic had been running below 2% for about a decade.

However, the inflationary surge cannot entirely explain the “vibecession” that occurred throughout 2022 and 2023. Even when taking the three-year inflation rate into account, the gap between the actual and predicted consumer sentiment has been larger than ever during those two years.

If not inflation, then what?

If you turned on the news on March 10th, 2023, you would hear about the collapse of Silicon Valley Bank and what it could potentially mean of the U.S. economy. It was the second largest bank failure after Washington Mutual in 2008. This was a significant moment not only for financial services and the Federal Reserve, but how average Americans viewed the economy.

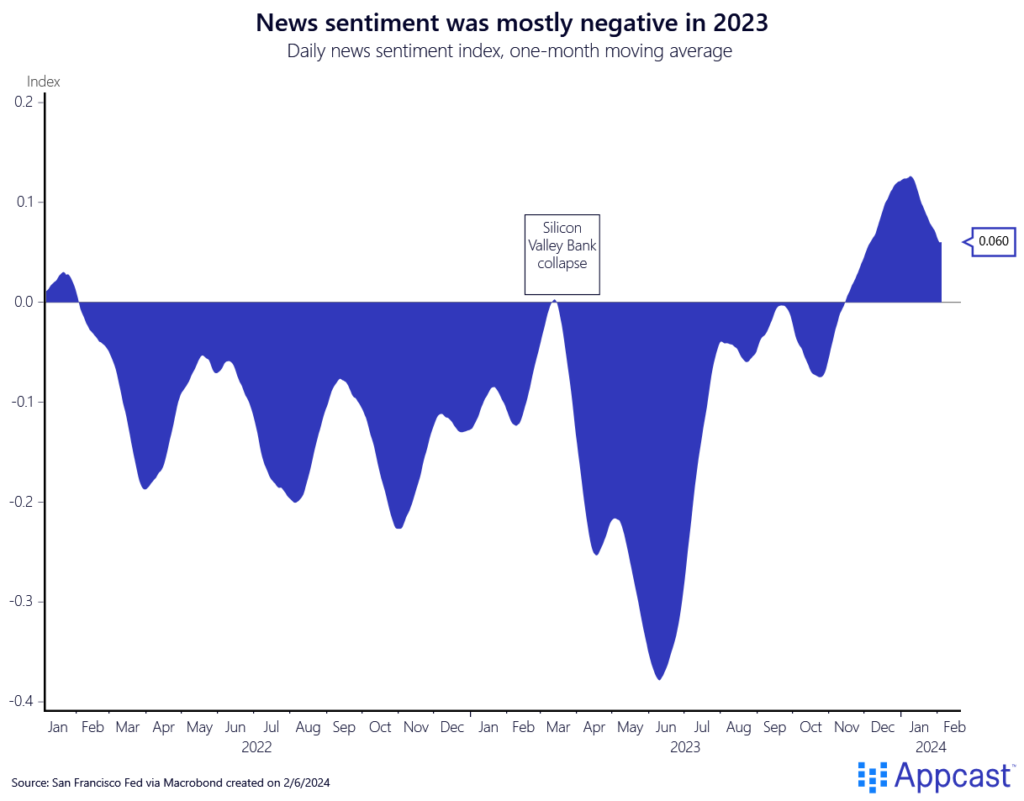

Researchers from the San Francisco Federal Reserve publish the “Daily News Sentiment Index” which tracks economic sentiment across news articles. From the chart below, the shaded blue area below 0 indicates a negative portrayal of the economy in the media, while above it indicates a positive portrayal. Following the recovery post-COVID, “vibes” slowly recovered and almost made it to positive territory.

The SVB collapse erased all the progress made in an instant. Following the meltdown, the depiction of the economy hit a series-low, and by the summer it was in dire straits. Despite robust macroeconomic growth, strong consumer spending, and near all-time low unemployment, the news media was very negative!

Ultimately, this is a large portion of what drove the ”vibecession” of 2023. A constant barrage of unfavorable news coverage seeped into consumers’ heads and drove uncertainty about the months ahead.

The good news is this blip appears to be in the rear-view window. Negative sentiment peaked in June last year and since then has turned positive. This shift has been mirrored in the recent uptick in consumer confidence, showing just how powerful the news media really is.

Conclusion

Despite a host of macroeconomic indicators that could explain a well-performing, growing economy, analysts failed to identify why consumer sentiment was in the dumps for almost all of 2023. Inflation was a major cause, undoubtedly. However, there was still a missing piece to the puzzle. The SVB collapse and ensuing negative news stories flooded our email inboxes, took over our TV screens, and popped up relentlessly as we scrolled. This simply made us more pessimistic. Now that the tide has turned, consumers feel more confident which could drive a strong period of hiring in 2024!