Donald Trump’s election win has sent shockwaves through European capitals. For European leaders, the outcome foreshadowed a challenging shift in transatlantic relations. Trump’s campaign promise to impose sweeping tariffs on imported goods is threatening European economies heavily reliant on exports to the U.S., igniting fears of a trade war.

In a previous blog post, we discussed the inflationary effect that tariffs would have on the U.S. economy and how they would hurt growth. In this piece we outline what Trump’s election might mean for Germany’s economy.

Germany is experiencing its worst economic crisis since WWII

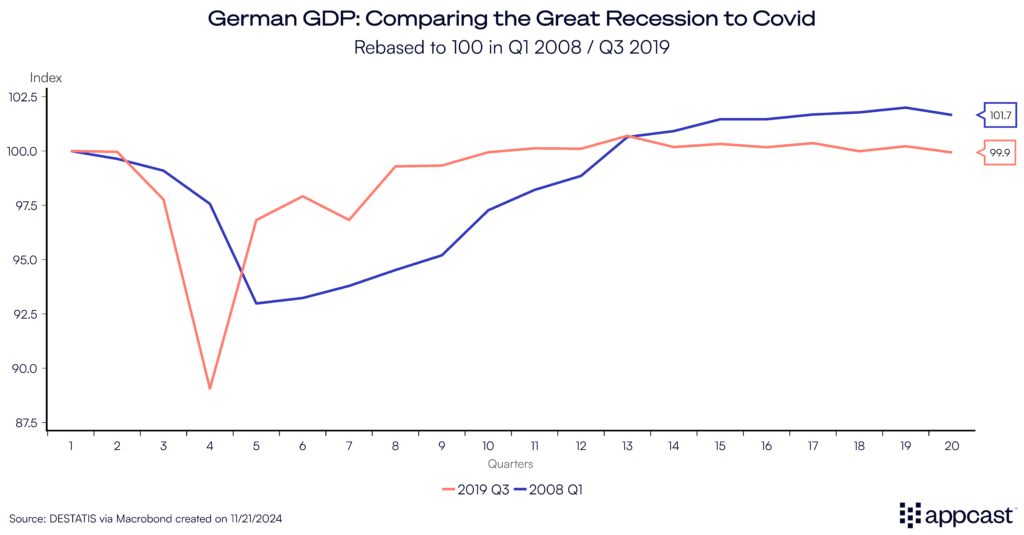

Germany is experiencing its worst economic crisis since World War II, reigniting fears of being the “sick man of Europe” again. The country never fully recovered from COVID-19 and per capita GDP remains stuck below pre-pandemic levels. Subsequent economic shocks have hit the economy particularly hard. The manufacturing sector has struggled to remain competitive due to rapidly rising energy costs, a stagnating workforce, and deteriorating public infrastructure. High interest rates set by the European Central Bank (ECB) to contain inflation together with weak global demand for German products have led to a severe crisis in manufacturing, which is spilling over to other sectors in the economy.

Following the election, the growth outlook is deteriorating further. The German council of economic advisors has revised the GDP forecast for 2025 from about 1% to just 0.4%. The main reason is that Germany will suffer tremendously from Trump’s tariffs and a new trade war. As of now, the country remains stuck in a perpetual crisis with little improvement in sight.

Germany’s economy is particularly vulnerable to a trade war

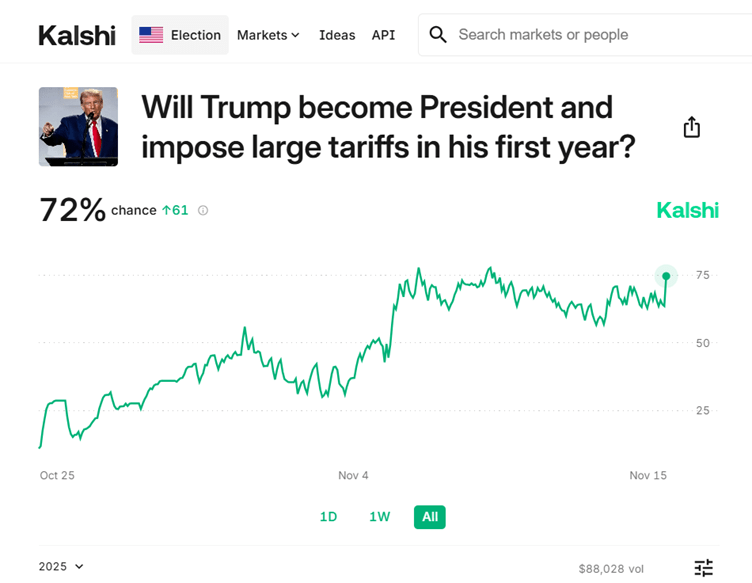

Trump ran on a platform of protecting American production by raising tariffs—taxes on imported goods— across the board. Prediction markets assess the likelihood that Trump will introduce substantial tariffs within his first year in office as high (above 70% as of November 17th).

Source: Kalshi

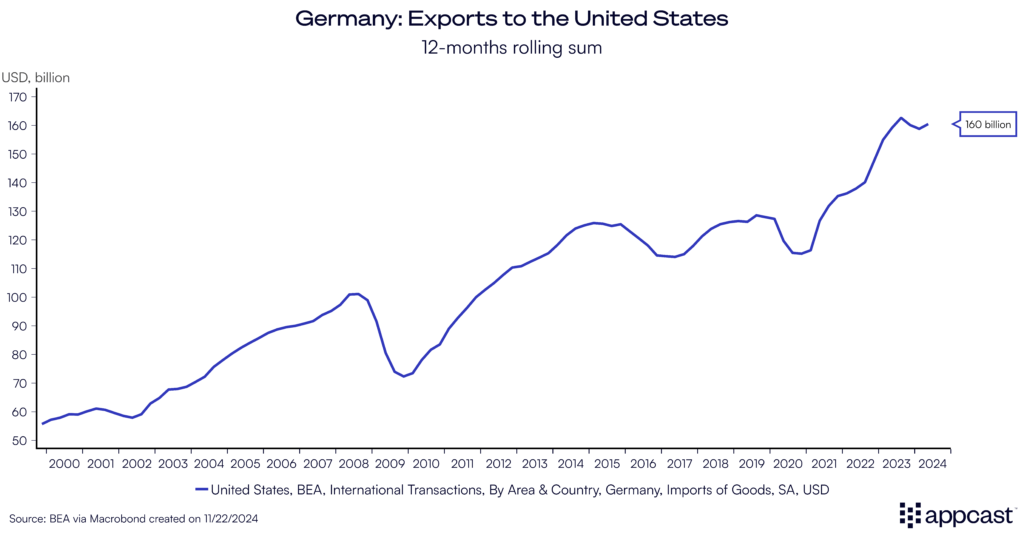

The U.S. economy is the largest in the world, and as such, U.S. consumers have a disproportionate amount of purchasing power. The U.S. imports about $4 trillion of goods each year, $500 billion of which are from the European Union (EU). More than 30% of all EU imports, about $160 billion per year, come from Germany.

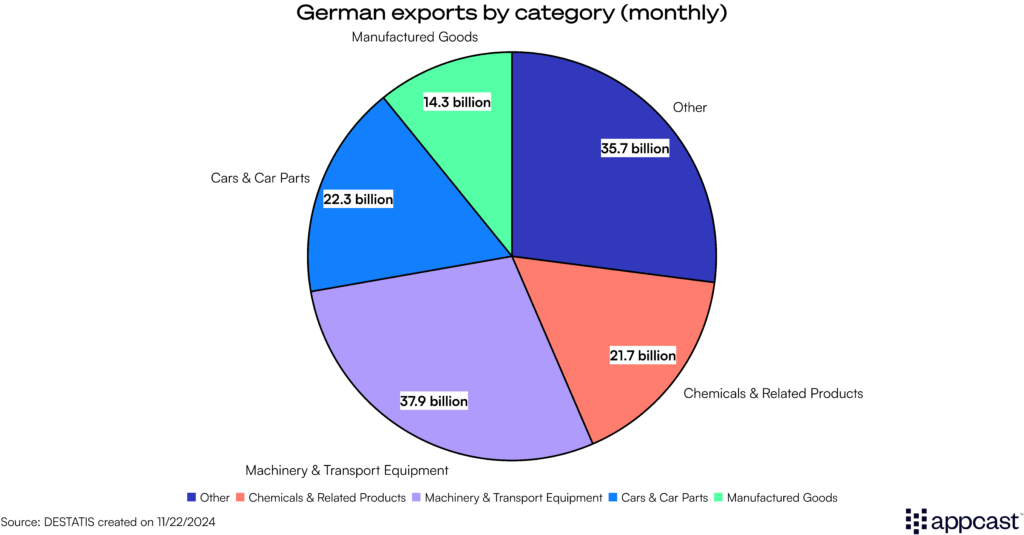

Germany’s economy remains heavily dependent on its world-class manufacturing sector. Machinery, cars, and manufactured goods are making up the largest share of Germany’s exports.

Source: Observatory of Economic Complexity

As the third-largest exporting-nation in the world with about 10% of all exporting goods going to the U.S., Germany is particularly vulnerable to Trump’s tariffs and a potential global trade war.

German manufacturers are increasingly producing in the U.S.

Financial markets agree that Europe’s largest economy will suffer. Just days following the U.S. election, GDP figures have been revised down to under 0.5% for 2025. The Euro depreciated by several percent vs. the dollar. While U.S. stock markets soared, the DAX declined with stocks of German car manufacturers losing many billions in market capitalization.

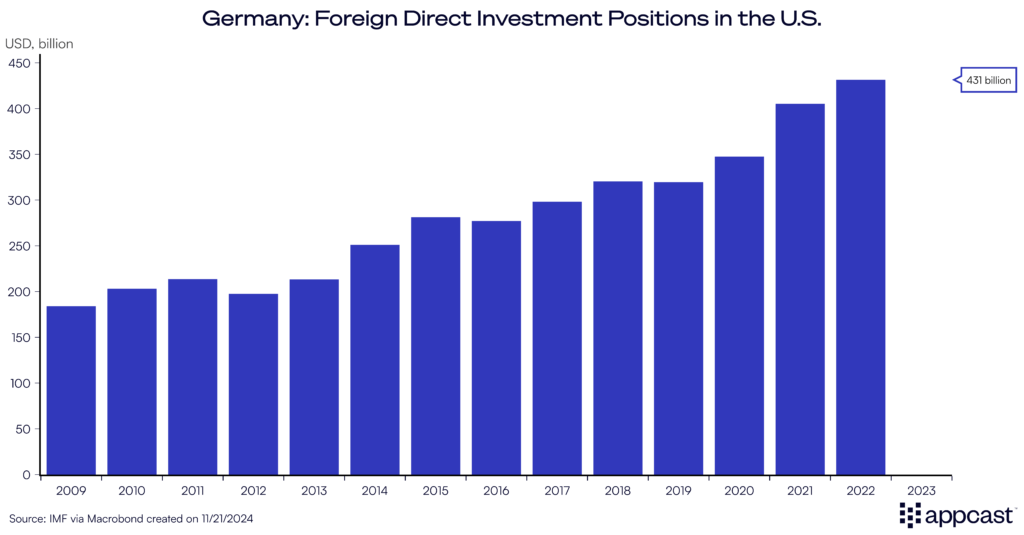

And it is not just the loss of potential exports that will hurt Germany. As the U.S. economy has massively outperformed Europe in recent years, European companies have started to invest heavily in America.

German car manufacturers are producing on a large scale in the U.S. Volkswagen has a large plant in Tennessee. BMW is producing some 400,000 cars annually in Spartanburg, South Carolina, and Mercedes Benz has a production plant in Alabama. Other large German companies like BASF (chemicals), Siemens (engineering), and Fresenius (medical devices) also have large manufacturing operations across the country.

The total amount of foreign investment from German companies in the U.S. has doubled since 2010 to over $400 billion. With Trump’s tariffs driving up the cost of trade, German corporations will further ramp up their investments and local production plants in the U.S. Germany will thus not just suffer from the loss of exports but also from a loss of domestic investment spending that will be redirected into the U.S. economy instead.

A trade war will lead to job losses across all sectors

The current manufacturing crisis that is ailing Europe’s largest economy will therefore worsen under a Trump presidency, with massive implications for the labor market. German manufacturing companies are paying their workers high wages. Job losses across large manufacturing plants can cause regional labor market shocks as upstream and downstream suppliers will be affected as well. The loss of local purchasing power spills into the service sector, too. A decline in the number of manufacturing jobs thus has broader economic implications.

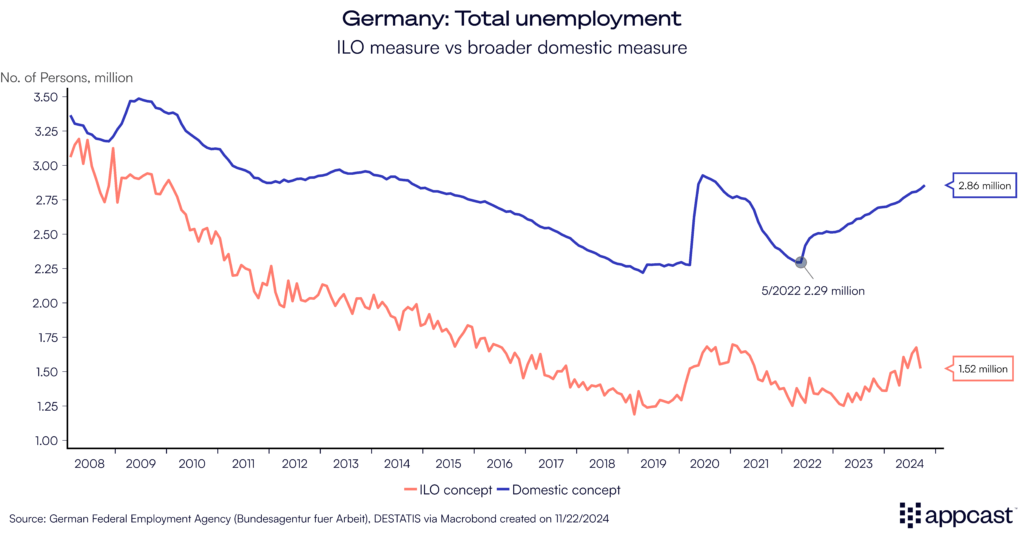

The Federal Employment Agency (BfA) in Germany is responsible for calculating the domestic unemployment rate. The German metric is a little broader than the standard definition from the International Labor Organization (ILO), which is commonly used for international comparisons.

The German measure also includes certain forms of underemployment and is therefore a more inclusive concept that captures different aspects of labor market weakness.

It shows that total unemployment in Germany has increased by almost half a million since early 2022 to a total of 2.9 million, an increase in the unemployment rate from about 5% to just over 6%.

While previous forecasts for 2025 suggest that the unemployment rate will stabilize just above 6%, current political events (the U.S. election and the collapse of the German government) are now throwing this projection into doubt. Further job losses are to be expected in a trade war. The number of German companies that are laying off workers is through the roof. This is unlikely to change as the economic outlook continues to worsen.

What does that mean for recruiters?

The effects of Trump’s presidency will be felt unevenly across Europe’s economies and labor markets. Germany’s economy is the most vulnerable to tariffs due to its high dependency on manufacturing and the export sector. The German growth model, reliant on foreign demand, is now in serious peril. Manufacturing orders are in recessionary territory. Car manufacturers and suppliers have announced large job cuts. Other industries are affected as well.

Following two years of extreme tightness throughout 2021 and 2022, labor market conditions have weakened considerably. The German unemployment rate has risen from 5% in 2022 to 6% this fall. It is all but likely that Germany’s economy, and by extension its labor market, will continue its prolonged period of stagnation now that Trump has been elected.

Recruiters should expect that vacancies will continue to fall across sectors. This will particularly be true for many white-collar roles, which have been more severely affected by the economic downturn. Some hiring challenges will remain in the blue-collar space since labor shortages remain more prevalent. There will also be some geographical variation. Regions where manufacturing plays an outsized role, and one large company is responsible for many thousand jobs (car manufacturers) might be particularly vulnerable to current macroeconomic shocks.

Compared to two years ago, recruiters who continue to hire in Germany should find that recruitment difficulties have eased substantially in this stagnant economy.