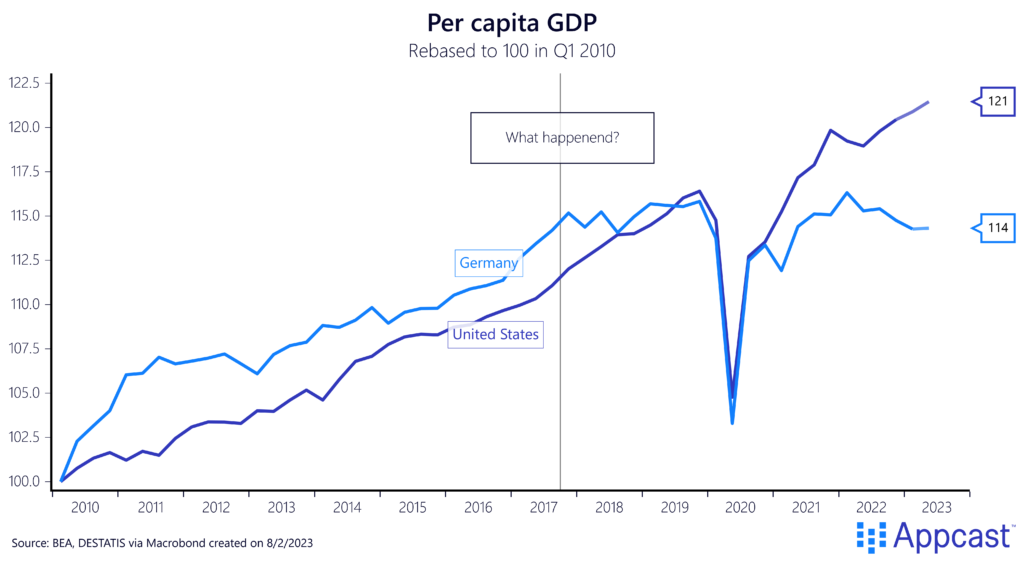

We ended the last blog post with the following chart that shows how Germany has recently underperformed. The country was in a technical recession earlier this year and GDP per capita in 2023 is no higher than in 2017. The reasons why Germany’s economy has struggled to such an extent are multifaceted. In this blog post, we will outline the main culprits and explain in detail how they have contributed to Germany’s underperformance in recent years:

- Germany’s stagnation in the industrial sector

- The massive energy price shock

- The global growth slowdown

- The country’s (skilled) worker shortage

- The lack of fiscal spending and stagnating domestic consumption

- Germany’s industrial sector has been stagnating for years

The industrial sector has been the backbone of the German economy for many years. As discussed in the previous blog post, Germany is the only large, advanced economy that has seen job growth in the manufacturing sector over the last two decades. The country’s hidden champions – mid-size, highly specialized, often family-owned companies – have been part of Germany’s growth engine for a long-time.

However, in recent years, industrial production has stagnated. Germany’s car manufacturing sector is in trouble and total car production declined from a peak of 6 million in 2012 to under 4 million last year. According to estimates, about three million jobs are linked to the domestic car industry.

Manufacturing orders in real terms have been stagnant since about 2016. This is not just true for domestic orders but also for demand from abroad, which had performed extremely well until the mid-2010s.

- The massive energy price shock has made Germany uncompetitive

Another reason for why the German industrial sector was so competitive before COVID is that the country was very much reliant on cheap energy coming from Russia. In fact, the German government’s energy strategy explicitly fostered that relationship and was active in promoting Nordstream and other projects that helped Germany get access to cheap Russian gas, despite warnings from the US and other European partners that an overreliance on Russia would be a mistake.

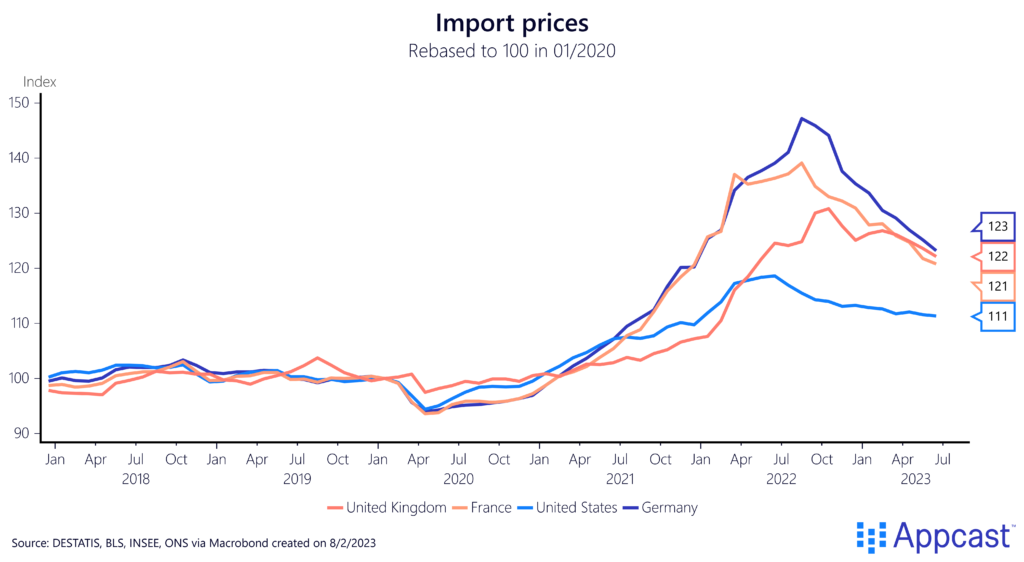

In retrospect, one can say that these policies were a blunder and completely backfired. With the war in Ukraine, cheap energy from Russia dried up as Western governments imposed sanctions. As the following chart shows, Germany is one of the countries that suffered the largest consequences. Import prices in Germany soared by more than 50 percent within less than two years and remain highly elevated, most of this reflecting the higher price of energy imports. Meanwhile, France and the U.K. saw a smaller import price shock, but the U.S. was least impacted thanks to a massive domestic energy sector developed in recent decades. U.S. import prices increased by less than 20 percent and are now 10 percent higher than pre-pandemic levels, compared to 25 percent in Germany.

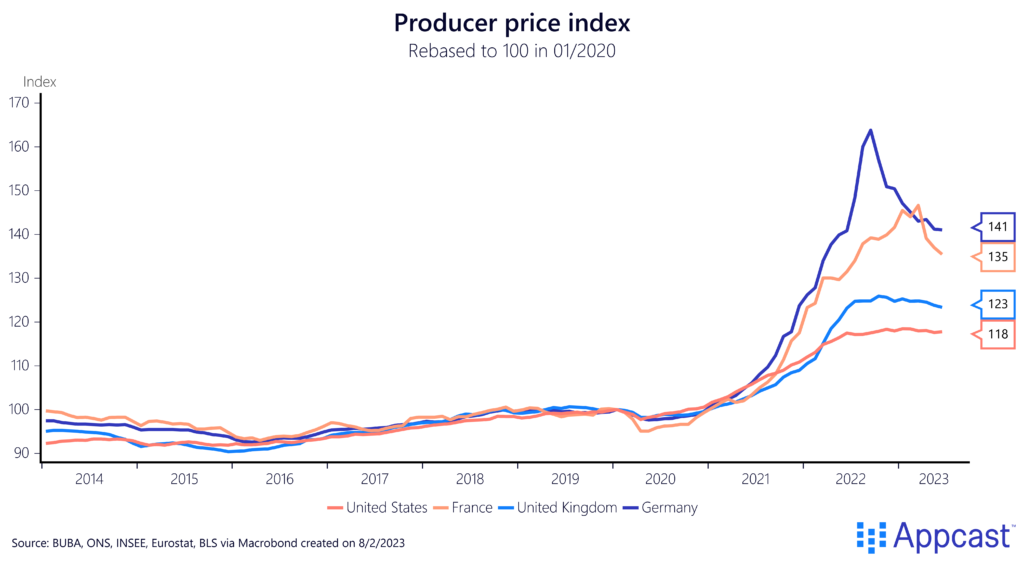

The massive increase in import prices also led to surging producer prices across advanced economies. Producer prices reflect the cost of produced goods and services sold at home by domestic producers.

In Germany, producer prices increased by more than 60 percent within one-and-a-half years and are elevated by more than 40 percent compared to pre-COVID levels. In comparison, producer prices increased by less than 20 percent in the U.S. and by only about 25 percent in the U.K.

A big chunk of this increase is due to soaring energy prices. German producers either had to pass on the costs to customers or absorb the losses from higher input prices. Either way, this massive divergence in input prices represents a massive supply shock to the domestic industry and makes German goods less competitive in international markets.

- Germany’s export-led model is suffering from global headwinds

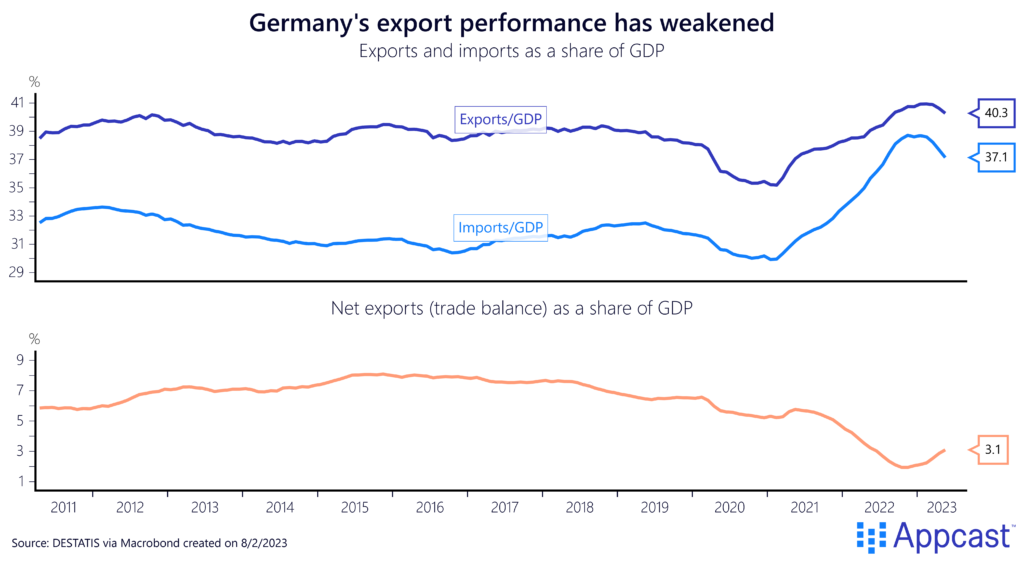

It is no secret that Germany has been adopting an export-led growth model in recent decades that was to some extent reliant on domestic wage moderation. Many German companies are global champions and produce for international markets. The German trade balance exceeded more than 7% of GDP throughout most of the decade after the Great Recession.

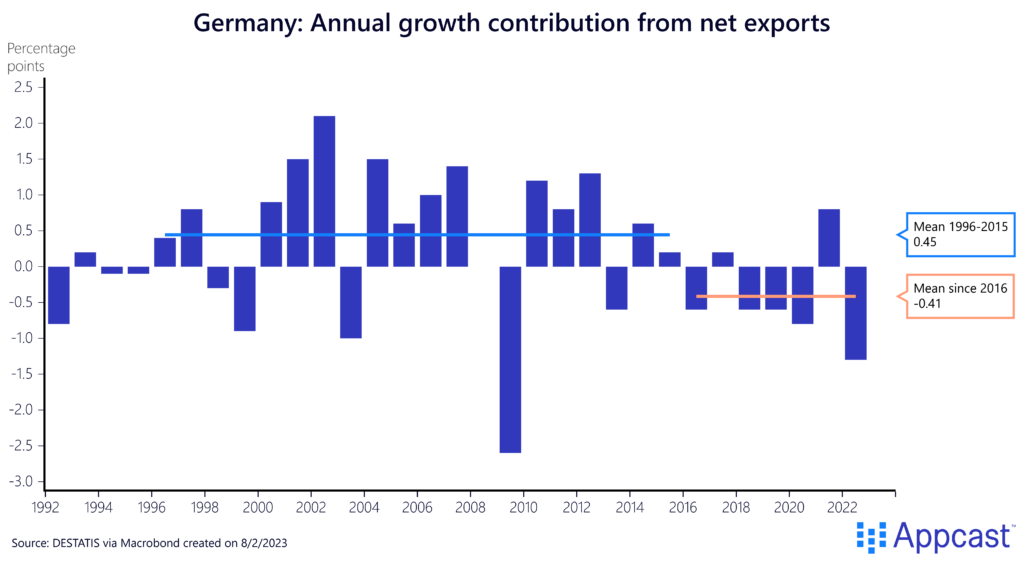

The following chart shows to what extent the German economy benefited from globalization for the first two decades. The average contribution from net exports to domestic GDP was averaging about 0.45 percentage points between 1996 and 2015. That is a heck of a lot for an advanced economy with a rapidly aging population that might only have a domestic trend growth rate of about one percent.

But as the chart shows, exports have negatively contributed to GDP growth by about minus 0.4 percentage points since 2016, which is a substantial negative drag on domestic growth each year due to international headwinds. This reversal can explain why part of the growth slowdown the German economy has been experiencing in recent years.

- The skilled worker shortage is hurting businesses

Another factor hurting German growth is a massive skilled worker shortage that the country is currently experiencing as its population is aging rapidly and the workforce has started to shrink. Even as record-high migration is providing some relief, the mismatch in the labor market remains and the skilled worker shortage is not getting solved. Many of the recent immigrants are low-skilled workers and face language barriers and other obstacles that make integration into the German labor market difficult. The labor shortage index from the IAB (institute for employment research) stands at a record high, even as the German economy fell into a technical recession in early 2023.

The time to fill vacancies across industries has soared in recent years, reflecting the fact that recruiters find it increasingly challenging to fill positions in a timely manner. And this is starting to hurt businesses. Not only does it increase recruitment costs substantially, but more and more employers report that production is being constrained because of missing workers.

While it is challenging to precisely quantify the effects from the missing worker shortage, they are large enough to make a difference on the macroeconomic level.

According to our estimate, there are more than half a million missing workers in Germany. Assuming an average annual salary of about 45,000 euros, this would represent some 30 billion in lost wage income alone, or about 0.6% of GDP.

Furthermore, one needs to add the corporate costs of having unfilled vacancies, the lost output that isn’t produced as a result of unfilled positions, missing tax revenues, etc. Those additional factors could easily push economy-wide cost well-above 1% of GDP.

- Fiscal spending is insufficient and domestic consumption is struggling

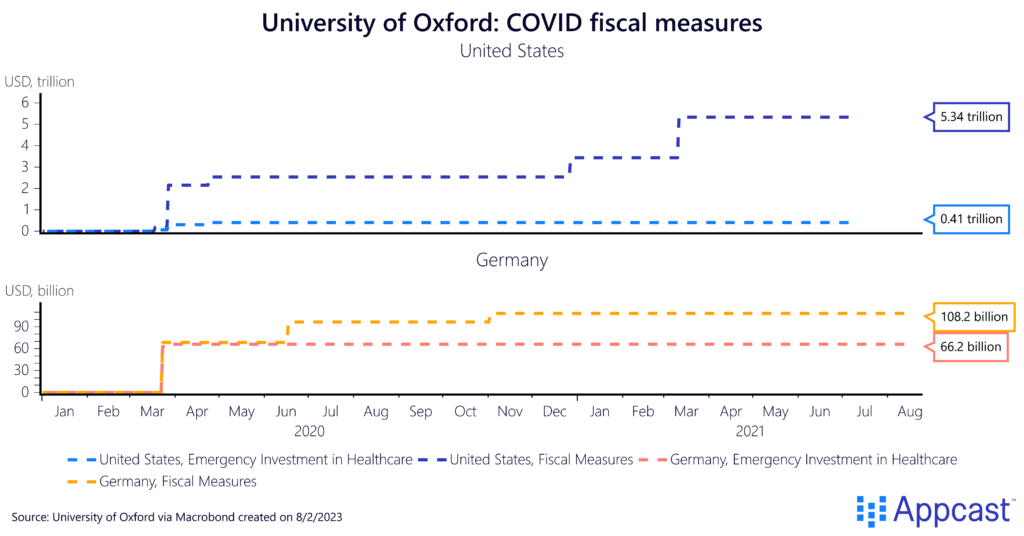

The diverging economic performance between the U.S. and Europe is also the result of different macroeconomic policy responses during the COVID pandemic.

The Oxford University COVID tracker shows that the U.S. government decided to spend about 5.3 trillion USD in stimulus in 2020 and 2021 – and a significant share of this was direct support to households in the form of stimulus checks. Another 400 billion USD were emergency investment in the healthcare sector during COVID. Altogether, the total fiscal impulse in the U.S. was about 25% of GDP, spread out over the course of two years.

For Germany, the Oxford tracker shows a total stimulus package of about 110 USD billion in stimulus together with some 66 USD billion in healthcare emergency investment. While the German government also supported the economy with a temporary VAT tax cut and credit support for businesses, the IMF puts the total German fiscal stimulus at a little over 10% of GDP, so roughly half of what the U.S. provided.

Many other Eurozone economies implemented smaller fiscal support measures than Germany and relied more heavily on funds from the European Union.

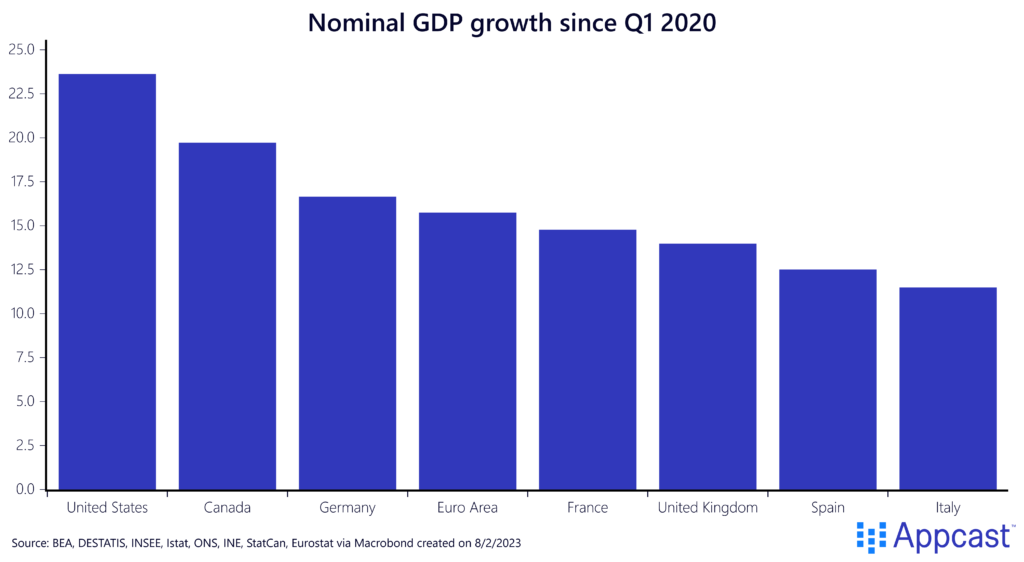

The massive stimulus injections together with the easy-money policy by the Fed can explain why nominal GDP surged more in the U.S. than in other advanced economies. The fiscal impulse in Europe was significantly smaller. While a large share of the additional nominal demand translated into higher prices, the U.S. has also outperformed Europe in terms of real GDP growth since 2020.

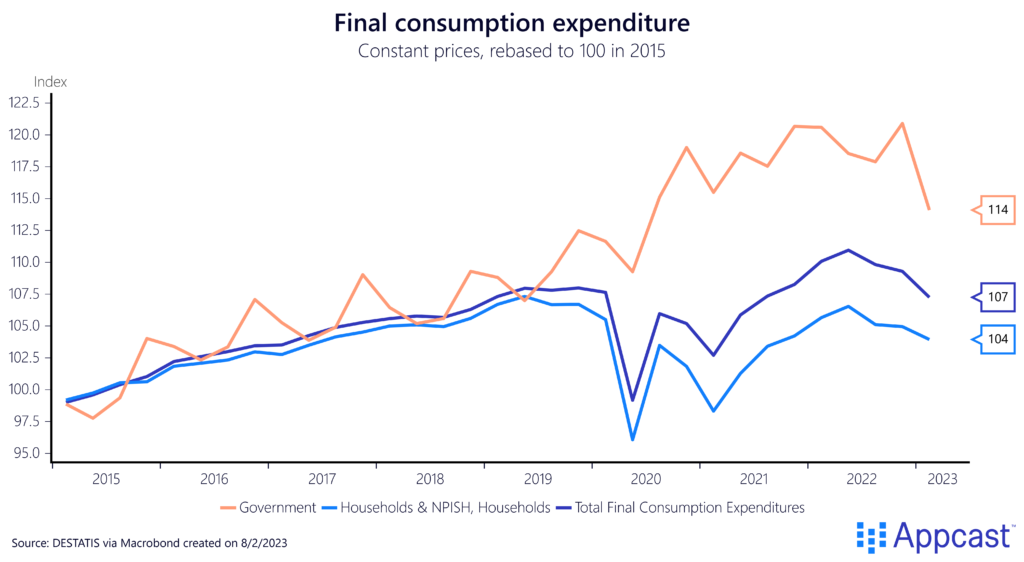

Even as Germany’s fiscal expansion from 2020 to 2022 was on the larger side in Europe, it is now being undone. The German economy was tipped into a technical recession earlier this year precisely because there was a large negative impulse from fiscal spending.

German consumers have faced various headwinds: First the COVID economic shock, then soaring food and energy prices as a result of the war in Ukraine, and now soaring interest rates and declining economic activity. It is a bad idea to pull back government spending while the rest of the economy isn’t holding up.

Conclusion

Germany’s economy performed well during the mid-2010s when the country was facing a favorable international macroeconomic environment. However, economic growth has fizzled in recent years. Soaring energy prices are hurting domestic production. Net exports have contributed negatively to domestic growth since 2016. Labor productivity is stagnant, and the economy is missing more than half a million workers. Finally, government expenditures have recently declined sharply. All these factors are contributing to the growth stagnation that started even before the pandemic. While the IMF is forecasting an economic recovery for 2024 with more than 1% growth, it is unlikely that all of the economic headwinds will subside until then. The near-term growth outlook for Germany remains very challenging.