110 measures

Chancellor Jeremy Hunt announced 110 growth measures in the Autumn Statement last week. While most of them will be relatively inconsequential, there are several measures that will affect both workers and employers.

The government introduced several tax cuts – by some measure the largest tax cuts in modern history – together with various supply-side reforms. Some of the policies will have a positive, albeit modest, effect on economic growth and labor supply in the coming years.

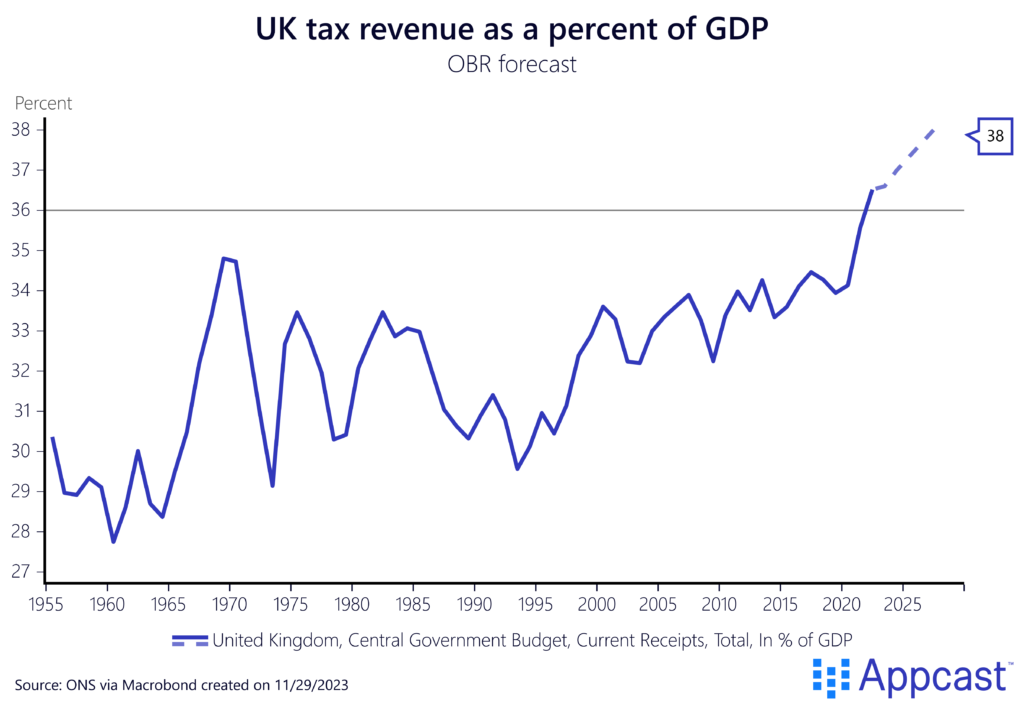

That being said, the government is also relying heavily on money illusion – people’s bias to think in nominal rather than real terms. Given the massive increase in inflation and wages, the tax burden of many workers has surged significantly despite the cut to the National Insurance tax. In fact, taxes in the U.K. are at their highest since the end of World War II.

Tax cuts for workers

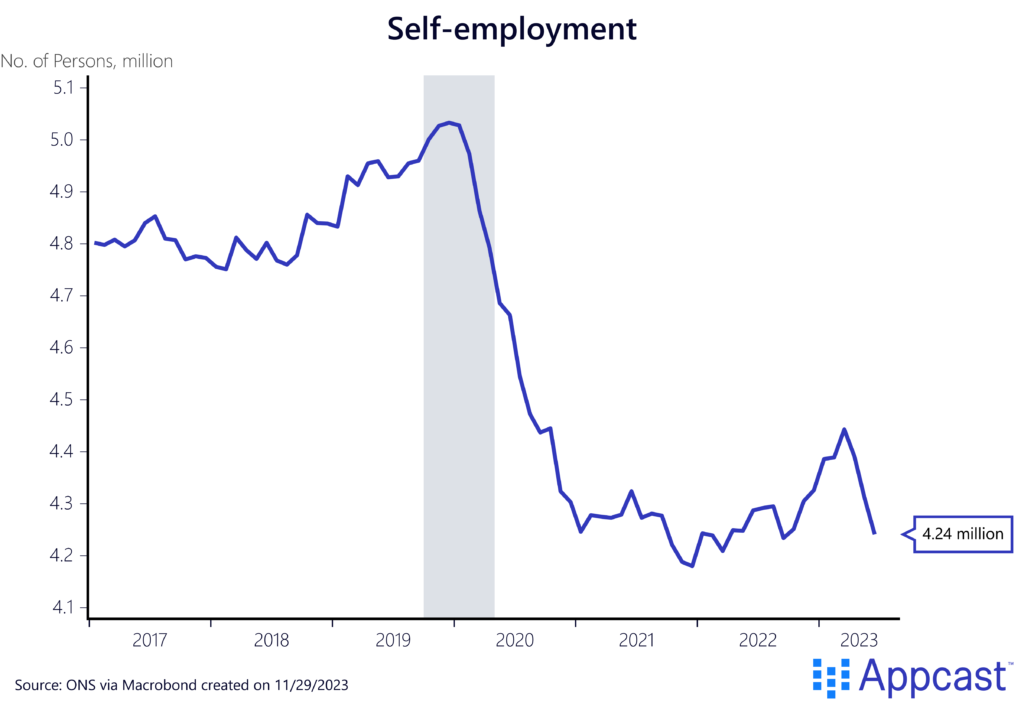

Many self-employed workers experienced revenue losses and higher uncertainty when the economy contracted during lockdowns at the start of the COVID-19 pandemic. As a result, self-employment saw a considerable decline of more than half a million workers since early 2020 whereas payroll employment grew.

Hunt announced cuts to National Insurance contributions (NIC) for the self-employed workers by one percentage point. This, together with abolishing the class 2 NIC, represents a decrease of about £350 in taxes for the average self-employed person earning £28,200 a year.

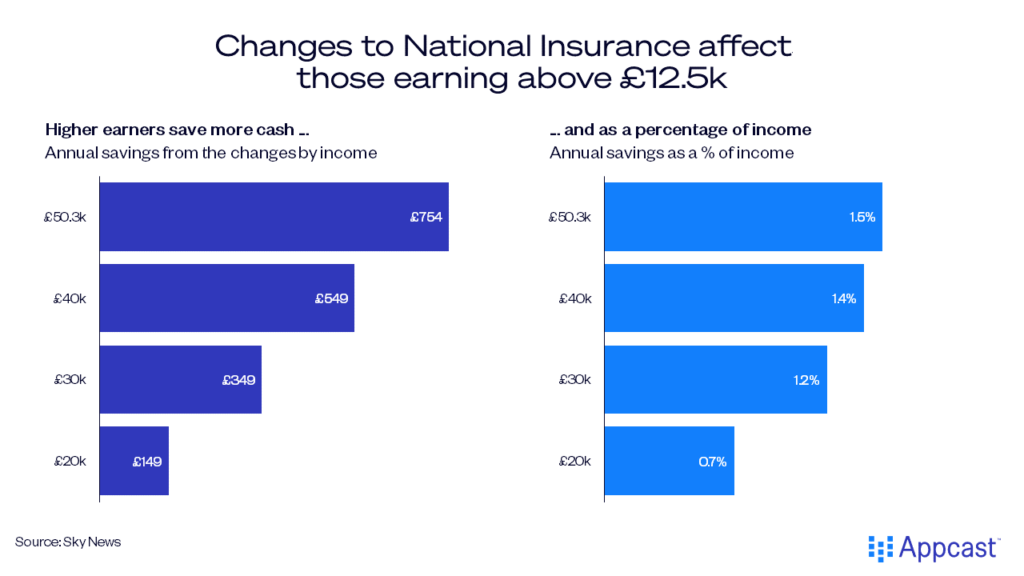

Employees will see their NIC decline from 12 to 10 percent. This would save someone on an average salary of £35,000 about £450 per year.

Note that this tax cut is regressive. Low-income earners just below the £12,570 threshold will see none of these gains. High-income earners with salaries above £50,270 will see an annual tax decrease of £753.84. The tax is a perfect pre-election gift for the upper middle class with over 80% of the tax cut going to the top half of earners.

Tax cuts for businesses

The chancellor also announced the intent to permanently allow “full expensing” for businesses. This means that companies can deduct the full cost of new machinery and plant equipment from their profits. It allows them to write off 100% of their cost of investment. It’s equivalent to a 25-pence savings for every pound spent! As the biggest corporate tax cut in U.K. history, this will certainly stimulate investment in the economy. This tax measure is the largest boost within the Autumn Statement and will moderately increase economic growth by encouraging investment, especially in capital-intensive industries like manufacturing.

Supply-side measures to boost employment

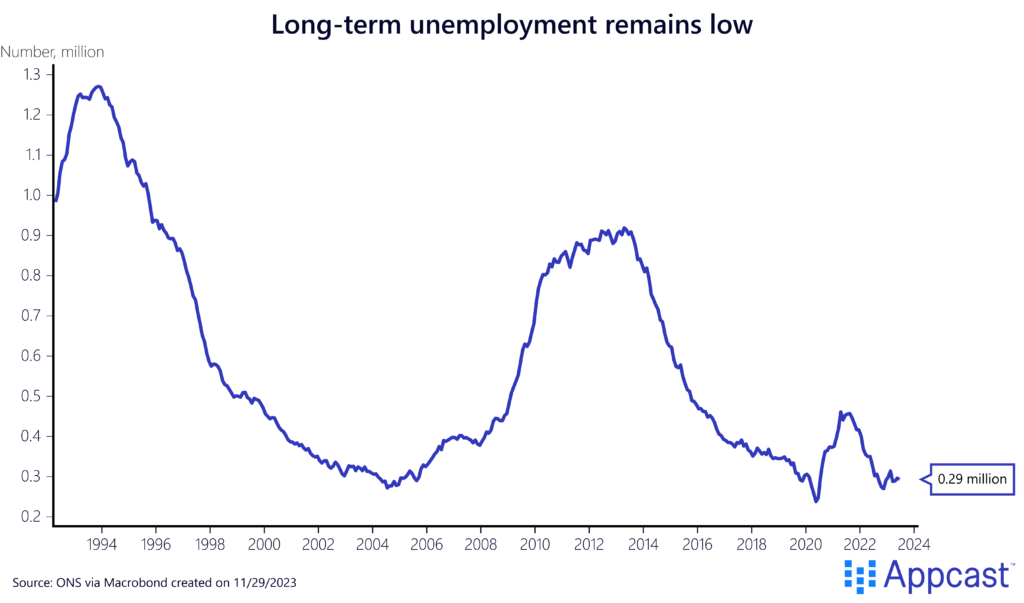

Hunt also announced various supply-side measures to boost the labor market. Even with net migration at a record high, total employment has stagnated since the beginning of the pandemic. The labor supply has shrunk as a record number of people have become inactive for long-term health reasons.

The chancellor promised to address this crisis by spending some £1.3 billion over the next five years to help nearly 700,000 people with health conditions to find jobs. The Universal Support Programme will help 180,000 more people and nearly 500,000 more people will be offered treatment for mental health conditions and employment support. Another £1.3 billion is set aside to offer help for 300,000 people who have been unemployed for over a year not due to sickness or a disability.

While all these measures are applaudable and would certainly help to boost labor supply, it is questionable how quickly resources can be built up to implement them, even with the additional funding available.

The government also made it clear though that they want to use both “carrots and sticks“ to bring people back to work. For the unemployed who do not find work after 18 months, unemployment benefits will be phased out. In the words of the chancellor:

“But we will ask for something in return. If after 18 months of intensive support jobseekers have not found a job, we will roll out a programme requiring them to take part in a mandatory work placement to increase their skills and improve their employability. And if they choose not to engage with the work search process for six months, we will close their case and stop their benefits.”

If the difficult-to-implement carrots don’t work out, there’s a severe stick to follow.

Money illusion doing some heavy lifting

While the cuts to National Insurance are providing a lift to the net income of most workers, it should be noted that the overall tax burden has still significantly increased in recent years.

With inflation in the double digits until earlier this year and nominal wage growth in excess of 7%, most workers have seen their tax burden rise due to higher income. When a person’s income rises above the £50,270 tax threshold, they start paying the higher rate of 40% instead of the basic rate of 20% for each additional pound they earn – a stealth tax that can be particularly painful.

To make things worse, some workers face marginal tax rates of more than 70%, depending on the number of children they have, once their salary exceeds this threshold because of the high-income child benefit charge.

The only way to protect yourself against these marginal tax rates at the 50k or 100k mark is to pay more of your salary into a workplace pension or worse – reduce your income by working fewer hours.

These U.K. tax cliffs are therefore not just deeply unfair but also lead to negative labor supply effects and continue to have perverse incentive effects on workers.

As this is a negative for the labor market, it is extremely unfortunate that the government has not tackled this problem.

GDP still expected to stagnate

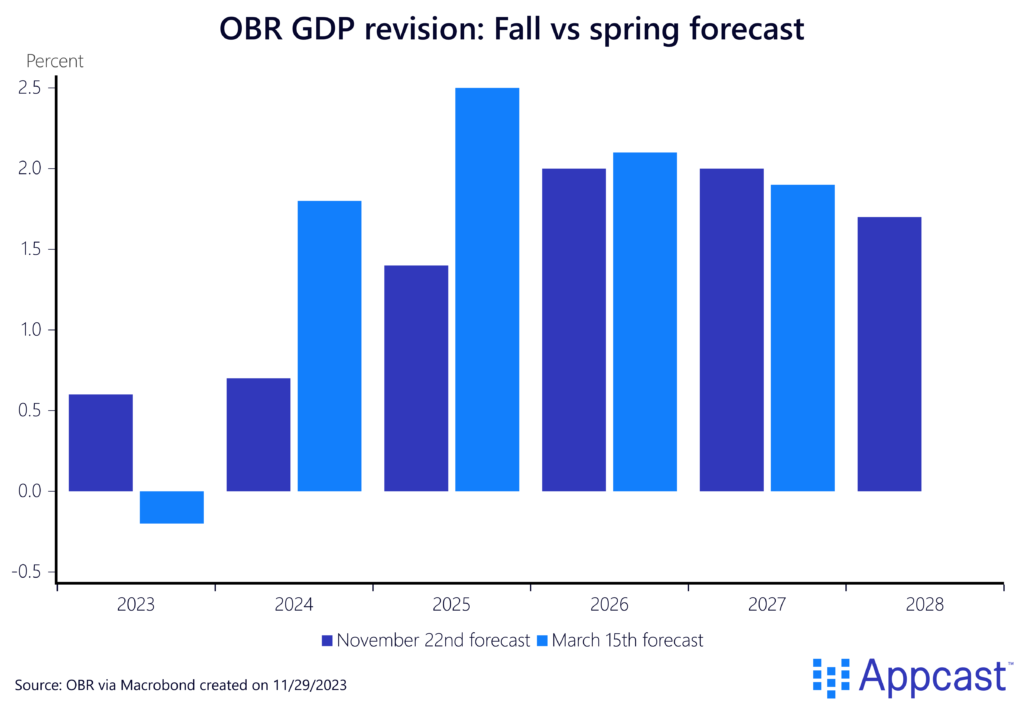

Despite Hunt announcing tax cuts for workers and businesses alike, it should be noted that the growth outlook for the U.K. has somewhat deteriorated. While the Office for Budget Responsibility (OBR) has revised the growth forecast for this year up by about 0.8 percentage points, the growth outlook for 2024 and 2025 was revised down. Instead of growing at 1.5% and 2.5% in the coming two years, the U.K. is now expected to grow at 0.6% and 1.3% instead – a significant slowdown.

Restrictive monetary policy by the Bank of England is assumed to weigh on growth and maybe even cause a moderate contraction at the beginning of next year. That being said, the U.K. economy has so far defied predictions of an imminent downturn caused by high interest rates. It is quite possible that the economy will outperform expectations again next year.

What does that mean for employers?

There are certainly positive aspects in the Autumn Statement that will lead to better economic performance in the long run, especially the tax cut on corporate investment.

While employers will be happy to see that their workers saw their net pay improve thanks to tax cuts, companies should not think that this is the end of the cost-of-living crisis. Due to the stealth tax, workers’ tax burden has increased in recent years.

Some of the measures announced might also boost labor supply at the margin. However, they do not address the biggest problems that this country is facing: the lack of affordable childcare is pushing mothers out of the labor market. Unaffordable housing is preventing workers from moving towards where the best job opportunities are. High marginal tax cliffs are disincentivizing work. All these obstacles barely received an honorable mention, if they were mentioned at all, but continue to be unaddressed by the government.