The U.K., a former manufacturing powerhouse

The Industrial Revolution started in the North of England two centuries ago. Birmingham was known as the “workshop of the world” due to its diverse metalworking industries. Manchester became known as the world’s first industrial city thanks to its rapid growth, particularly in the textile (cotton) industry.

Massive infrastructure investment in railways and canals helped those regions to propel forward and temporarily become some of the wealthiest cities worldwide.

But it wouldn’t last. The rapid deindustrialization during the 1970s and 1980s marked a significant shift in the nation’s economy and had profound social and economic impacts. The rise of global competition, particularly from countries with lower labor costs in Asia, undermined traditional U.K. industries.

British industries at the time suffered from numerous challenges – including operating with outdated equipment and practices – that made it difficult to compete internationally, especially while other countries leapfrogged obsolete technologies.

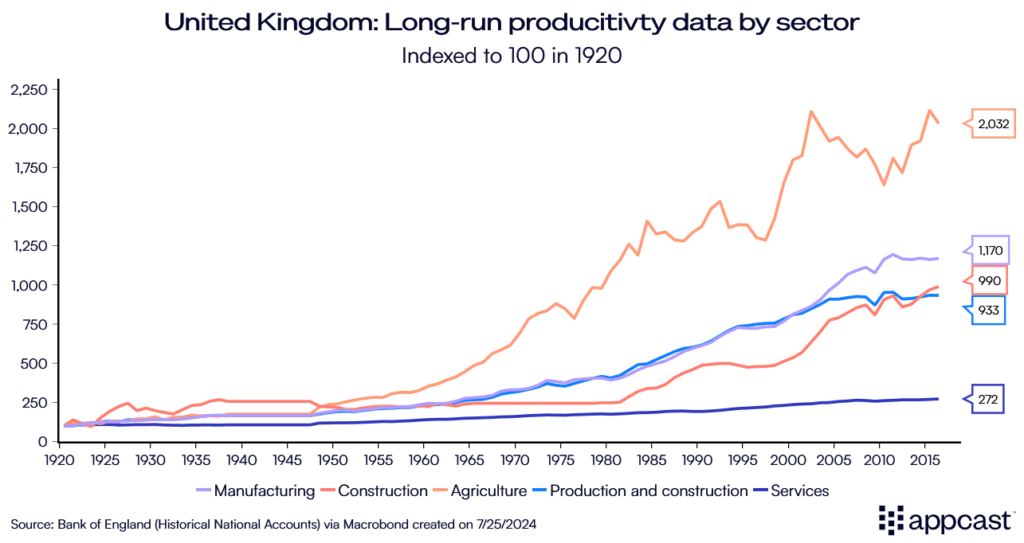

More importantly, continued technological progress, leading to high productivity growth, dramatically reduced the demand for workers in the industrial sector over time. Historical data shows that labor productivity increased by a factor of 12 in manufacturing between 1920 and 2015.

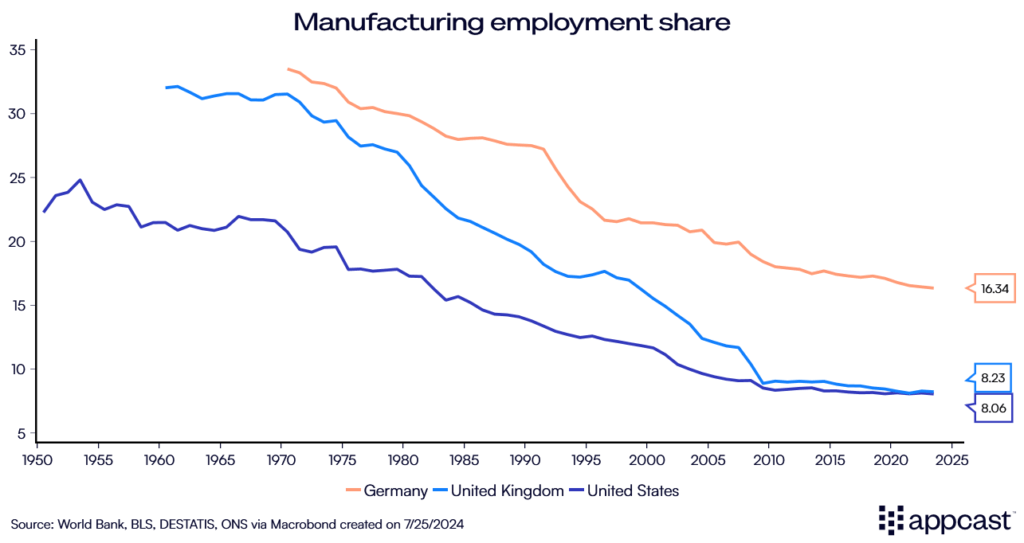

Consequently, the share of manufacturing employment plummeted over time. In the 1960s more than 30% of workers were still employed in manufacturing. Today, that share has dropped to just over 8%.

Only the agricultural sector can boast higher productivity gains, explaining why fewer than 1% of workers perform farm and agricultural work today.

Many manufacturing workers who lost their jobs initially faced long-term unemployment or were forced to take lower-paying and less secure jobs. The U.K. also experienced a much steeper and sudden decline in manufacturing employment than Germany.

Regional inequalities persist

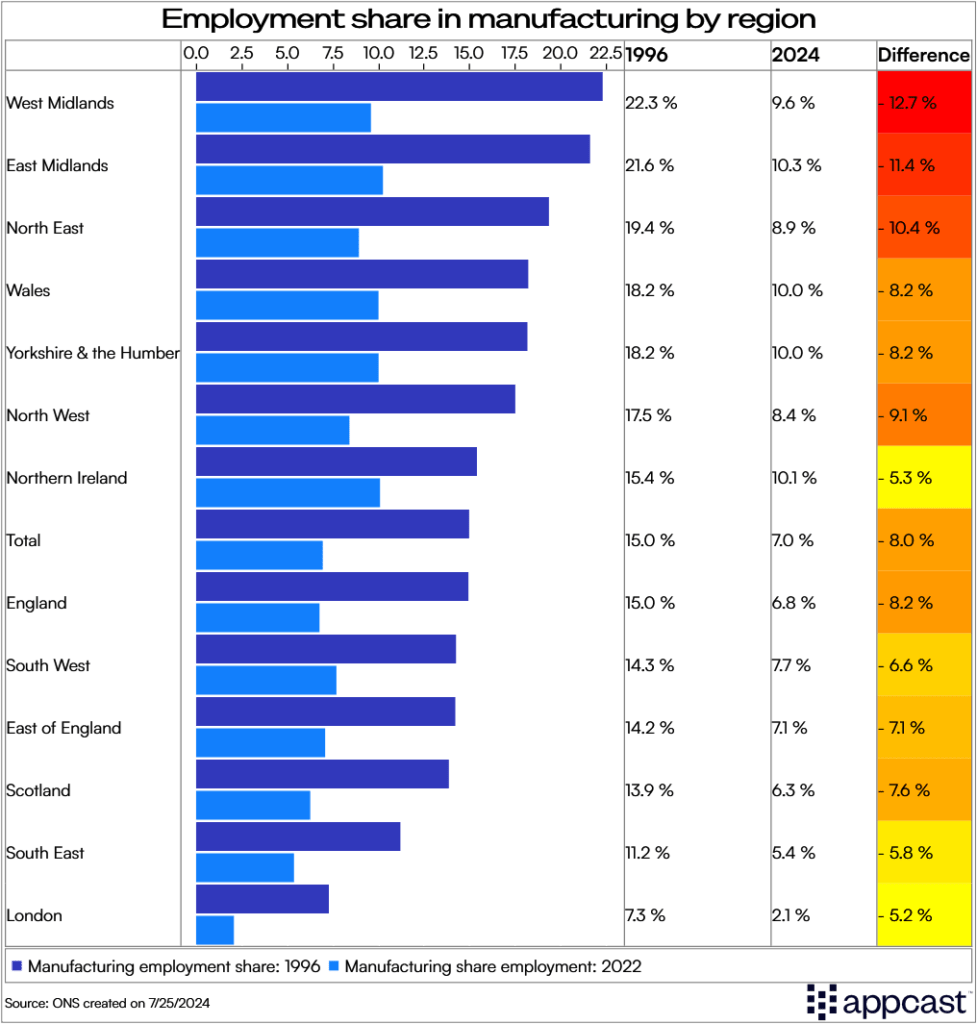

The decline in manufacturing jobs hit the North of England much harder than the South, exacerbating regional economic disparities within the U.K.

The Midlands, which had been an industrial powerhouse since the Industrial Revolution, experienced a period of rapid deindustrialization from the 1970s onwards.

Between 1996 and today, employment in manufacturing fell by 13 percentage points in the West Midlands and by more than 11% in the East Midlands. The North of England and Wales saw a decline of about 10% and 8%, respectively. London and the South East already had extremely low manufacturing employment in the mid-1990s and were therefore least affected.

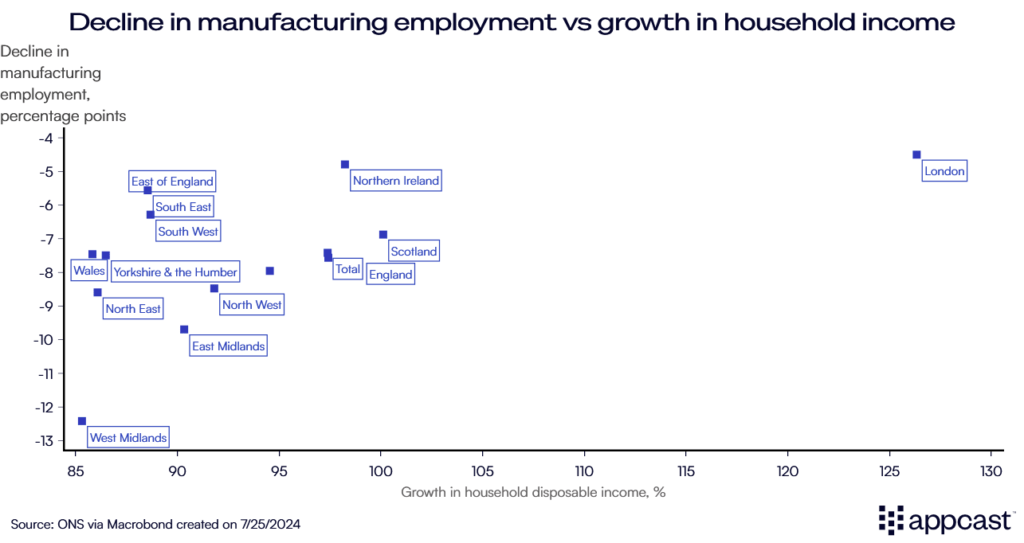

Academic research shows that the rapid decline in manufacturing employment in the North has contributed to the region’s economic stagnation, leading to what is often referred to as the North-South divide.

The South experienced faster economic growth as the U.K. became a service-exporting nation centered around London’s dominance in technology, finance, consulting, and media.

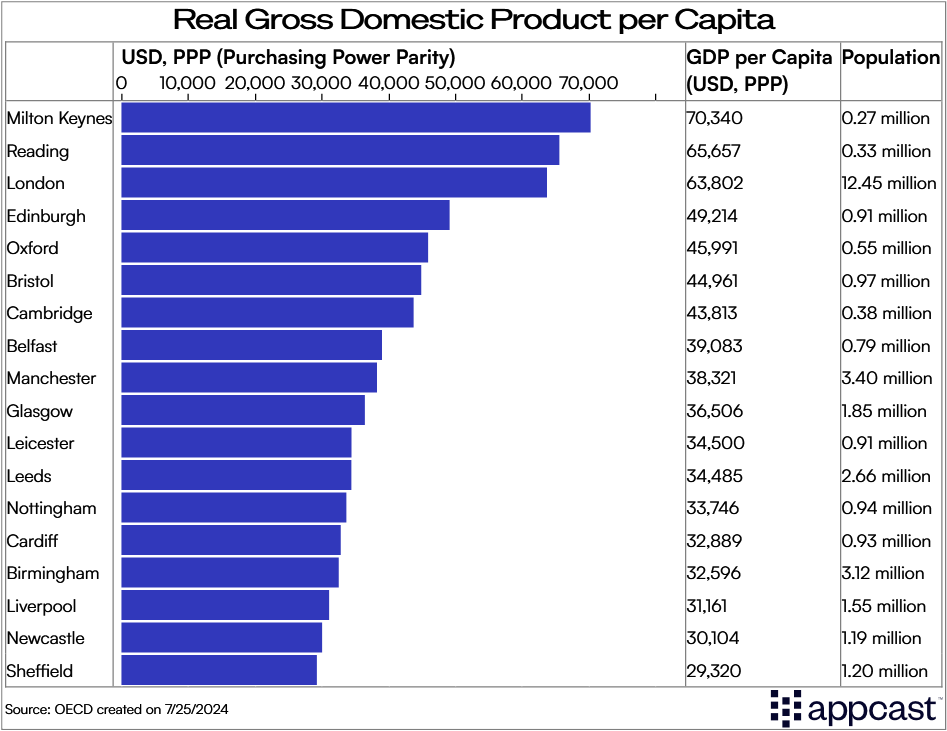

According to OECD data, real GDP per capita in London is basically twice as high today as in many other large U.K. metropolitan areas, including Birmingham, Leeds, Liverpool, and Sheffield. Even Manchester’s GDP per head would have to grow by more than 60% to equal that of London.

The gap between the South of England and the rest of the country is now the most significant regional difference within an advanced economy. Even East Germany, with its legacy of communism, is now closer in terms of income levels to West Germany than the North of England is to the South.

What explains the economic underperformance vis-à-vis the South?

While the reasons why England’s other regions have underperformed are multifaceted, there are two primary factors that stand out. First, as a global city, London was always primed to benefit from the shift from industries to services. Second, underinvestment in regional infrastructure in the rest of the U.K. have exacerbated regional inequalities.

With the decline of industries, workers in the North and Midlands were exposed to a regional labor market shock (very much like the decline of the U.S. Rust Belt). The skills of former manufacturing workers were not always easily transferable to other employers.

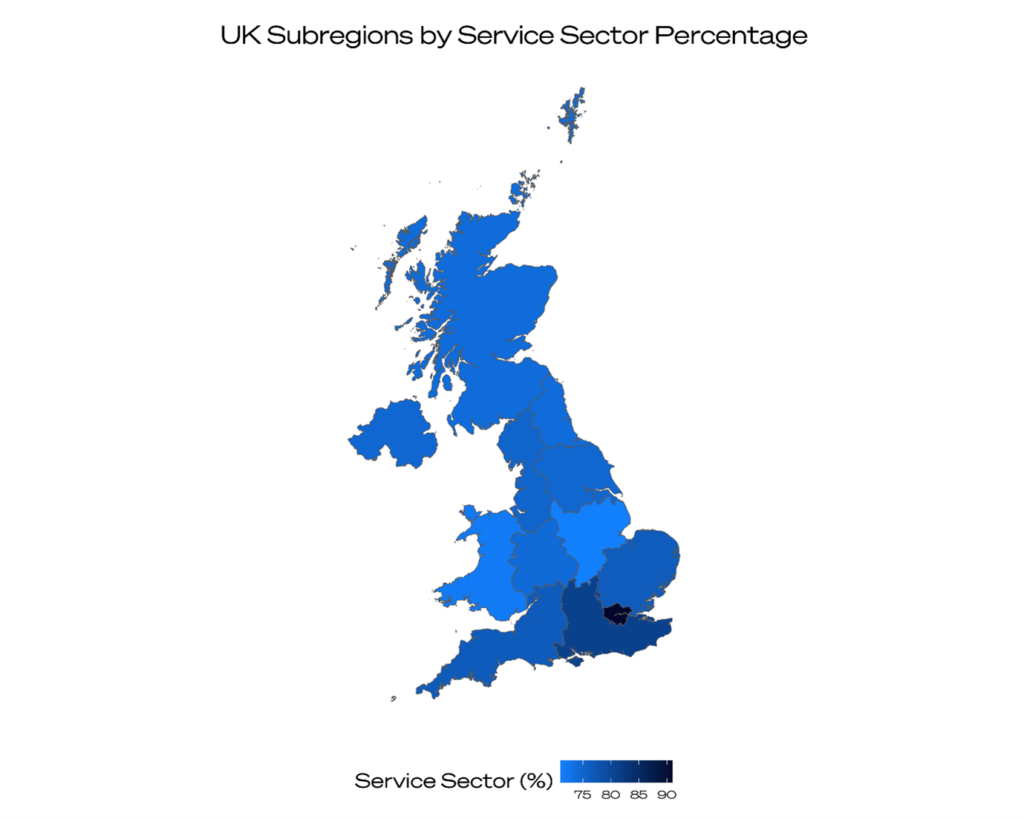

Moreover, cities like Birmingham and Leeds did not benefit from the transition from a goods to a service-producing economy. Instead, it was London as a global city that solidified its position as a hub for Britain’s service sector. About 90% of London’s GDP today is generated by services, far exceeding that of any other region. With the U.K. becoming a global service export-power, the capital benefited disproportionately.

As we have previously explained, higher education does not seem to hold back the rest of the country nowadays. University graduation rates are high across the U.K. Nevertheless, the university wage premium has fallen in recent years, indicating that it is a lack of well-paying graduate jobs, rather than missing skills, that is holding back other large urban areas.

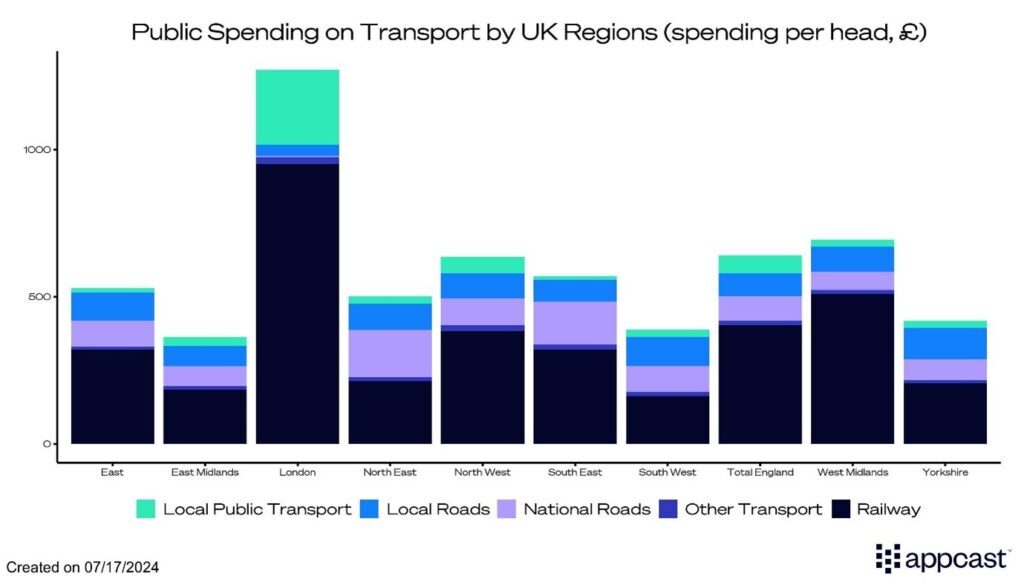

Another reason why the rest of the U.K. has fallen further behind the capital is due to a lack of infrastructure investment. Public investment is heavily tilted towards London. Per capita investment in transport throughout 2022-2023 was roughly four times higher in London than in the rest of the U.K., largely driven by spending on railways. Meanwhile, road and rail congestion in other large British cities is excessive, pointing towards underinvestment in regional infrastructure there.

This lack of infrastructure is limiting the total addressable market for local businesses by reducing the pool of potential workers, clients and customers, and suppliers.

Birmingham and Manchester stand out amongst European cities with a very high share of inhabitants living more than 30 minutes away from the city center by public transport, a large constraint on growth.

There is a high correlation between population density and productivity. You can either generate economic growth by upzoning and creating denser cities, or alternatively, improve connectivity between workplaces and residences with high-speed or intercity railway connections, for example.

The U.K. does neither! Planning regulations have completely stifled the housing market nationwide, restricting housing supply in high-productivity cities where they are needed the most. Combine this with a lack of investment in public infrastructure, and you get a toxic mix that can explain why the U.K. economy has stagnated for almost two decades now.

What does that mean for recruiters?

While deindustrialization has harmed Northern regions, it is a lack of high-paying jobs for graduates in the service sector combined with massive underinvestment in public infrastructure that is now holding back other British cities.

Remote and hybrid work can potentially provide a solution. For many roles, it is not necessary to be in the office five times a week. While face-to-face interactions and networking are important, research suggests that hybrid work does not have any negative effects on productivity. On the contrary, not only will it increase employees’ happiness, but it can also widen the available worker pool by a significant amount, and therefore help address Britan’s productivity problem.

Long commuting times are much more feasible if one must be in-office only once or twice a week. If feasible, companies should offer workers such flexibility for their own benefit to attract the best available talent pool.