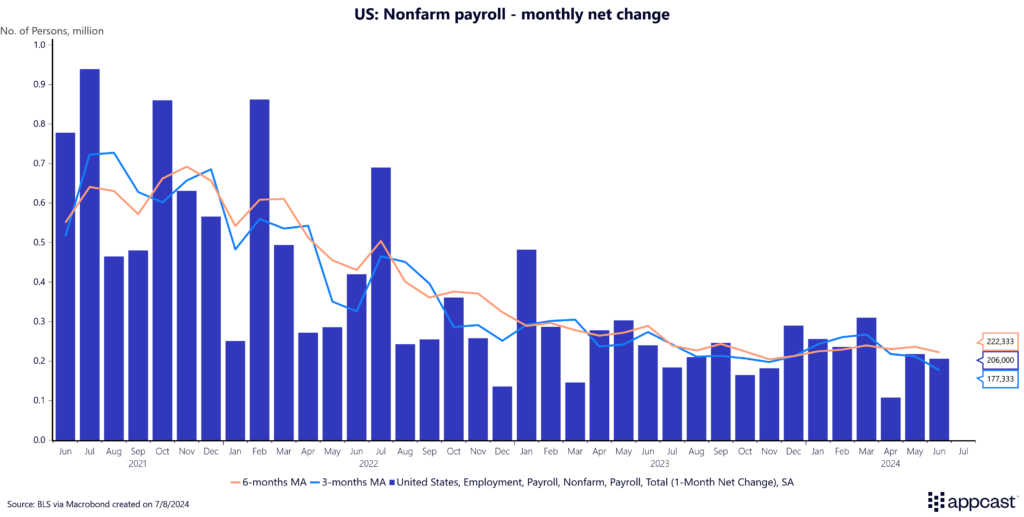

Despite a heat wave stretching across the United States causing scorching temperatures (including Plam Springs hitting 124 degrees!), June’s employment numbers were much cooler. The U.S. economy added 206,000 net new jobs and the unemployment rate increased to 4.1% – the highest since November 2021.

April and May’s jobs numbers were also revised down significantly, a total 111,000 lower than what was originally reported. These revisions drag down the three-month average of job growth to just 177,000, the lowest in the post-COVID recovery.

Slower job growth and an increasing unemployment rate may seem nerve-wracking, but this is (mostly) okay. Why? Because it’s the goal of the Federal Reserve to bring supply (labor force) and demand (hiring) into better balance while reducing inflation. We may be witnessing the soft landing happening in real time: Nearly every industry has recovered its lost jobs since 2020 and inflation is nearly within reach of the 2% target range.

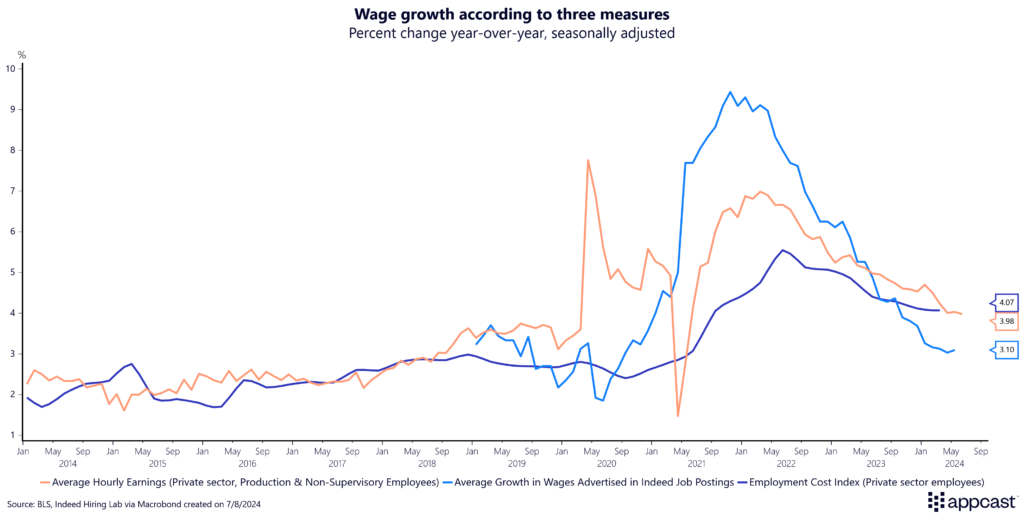

Wage growth has continued to slow as well, now below 4% year-over-year for non-supervisory employees.

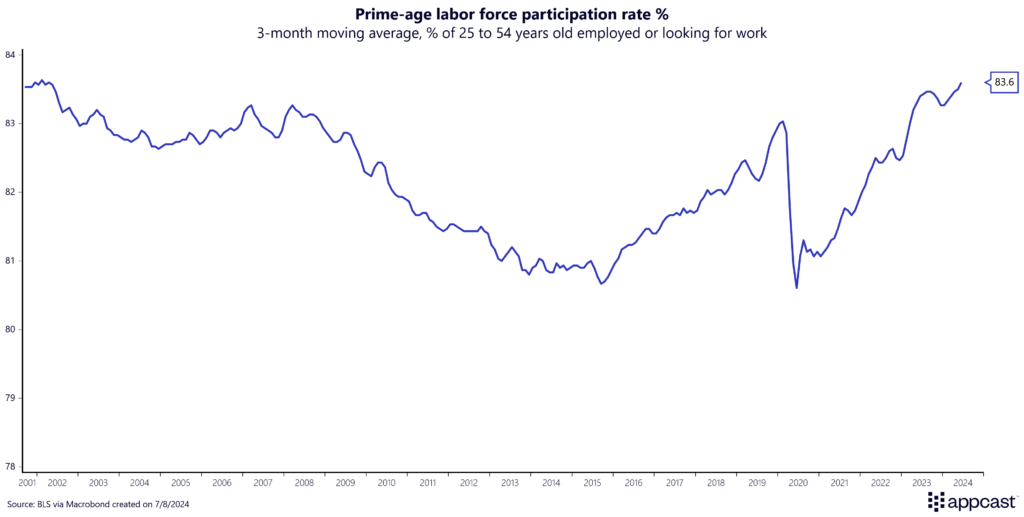

Labor supply continues its upward trajectory, now at 83.7% for workers aged 25-54 years old, just shy of the previous record of 83.8% in May 2001.

Labor Force Insights

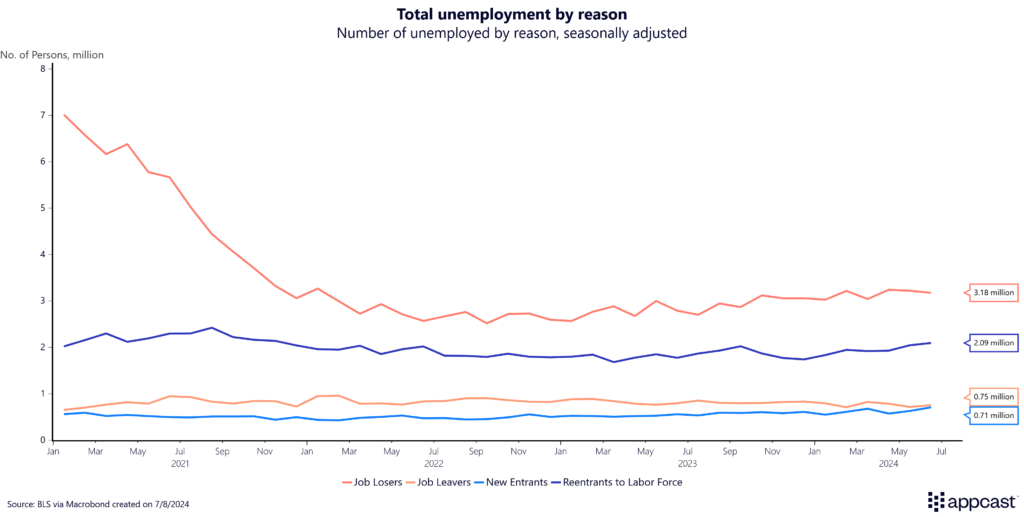

What’s going on with the rising unemployment rate? The Bureau of Labor Statistics has four categories for unemployment reasons: Job Losers (laid off or finished temporary job), Job Leavers (quitting), Reentrants (people of out the workforce looking for work again), and New Entrants (looking for first job).

The first cohort has remained relatively stable at 3.18 million, which has not risen much over the past twelve months. However, for those that were out of the workforce (reentrants) or first-time job seekers (new entrants) there has been a substantial increase of 410,000 combined since June of last year.

Potentially, since the hiring rate has declined, employers can be pickier about their hiring decisions and are choosing more experienced workers over those that haven’t been in the workforce recently.

While it is important to track the overall unemployment rate, it is also important to dig into the details. There hasn’t been a substantial increase in layoffs (job losers) but an increase in workers trying to break into the labor force, which is ultimately helping close the gap between supply and demand.

Industry Insights

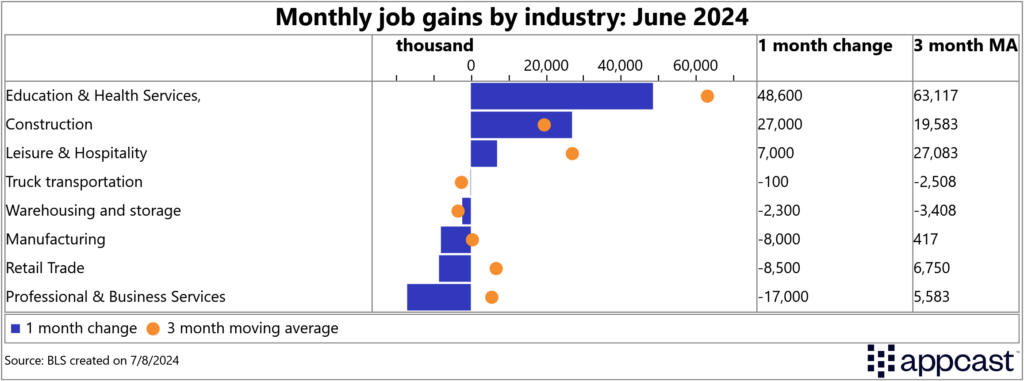

Once again, healthcare added an impressive number of jobs in June, gaining 49,000 net jobs last month. This is lower than the average gains over the last three months in the sector. Other industries that chalked up gains for the month include construction and leisure and hospitality – “standing up” positions that continue to thrive in a slower market.

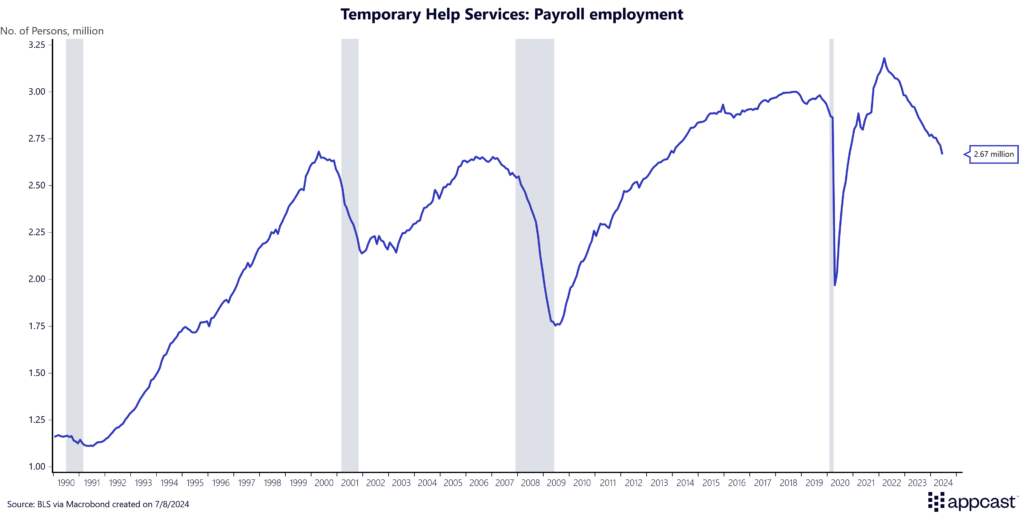

Gains were not broad-based, though. Professional and business services lost 17,000 last month, compared to the three-month average gain of nearly 5,600. The real red flag, though, is the continued decline in the temporary help services sector. In June, temporary help employment declined by 49,000 jobs. Declines like these have historically been a harbinger of recession, but this time may be different. Following the COVID-19 pandemic, employment in temporary help services skyrocketed. Now, they may simply be returning to stability.

What’s the biggest risk?

This weaker jobs report, along with soft inflation data in June, should be a flashing sign to policy makers to continue with their rate cut planned for September. The biggest risk now is the idea of Too High for Too Long – where the Federal Reserve keeps interest rates elevated for too long, tipping the economy into a recession.

There are certainly cracks beginning to show that are raising concerns. Consumer spending is slowing which has buoyed GDP growth. Initial unemployment claims have ticked up recently (as has the overall unemployment rate). The hiring rate is below the pre-pandemic average.

Each one of these cracks plays a small role in the bigger picture. Adding them up could throw the economy off its trajectory of a soft-landing.

What does this mean for recruiters?

Under a soft landing, recruiters are hiring in an easier labor market. For some, this may be a breath of fresh air after years of hectic recruiting patterns. For others, this may be causing stress, especially if you’re in a sector that has stalled completely, like certain “sitting down” industries such as tech. The good news, though, is that as inflation returns to the 2% target, the Federal Reserve will begin loosening interest rates, hiring will likely rebound.