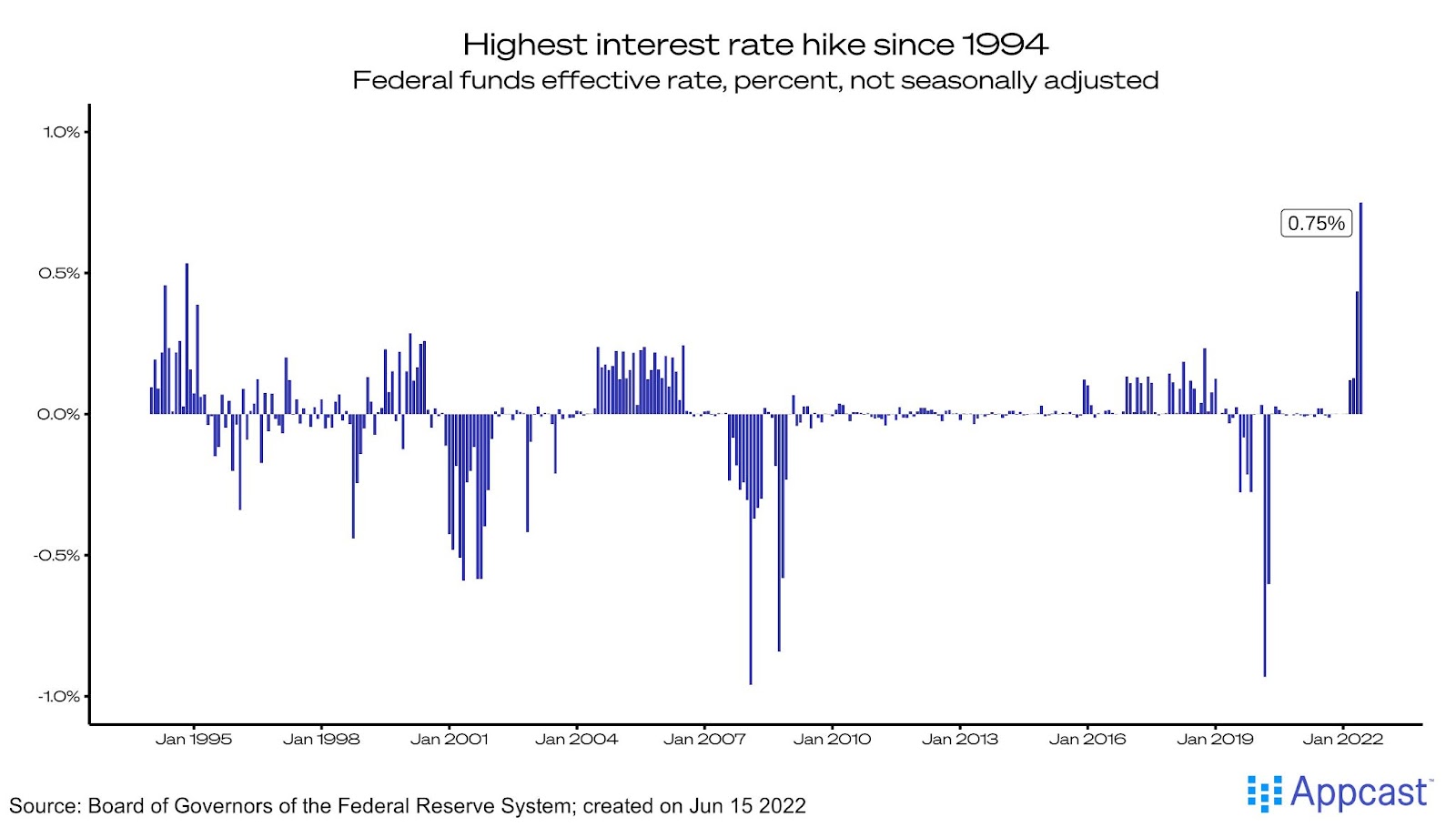

The Fed has just confirmed a 75 basis point (0.75%) rise in interest rates – the highest increase since 1994. Announced in the still-looming shadow of a bleak May CPI report, this is an aggressive move by the Fed in the ongoing fight against high inflation.

In the weeks leading up to this meeting, signals from the Fed had pointed to a 0.50% rise, and markets have been responding to this expectation. While 50 basis points is still notable, the signaling of ratcheting up rates even faster with a 75 basis point move is intended to establish credibility with investors that the Fed is serious: rates will continue to rise aggressively until inflation cools. There had also been discussion of a rise higher than 0.75%, an extremely combative response from the Fed that would indicate they hold shocking levels of inflationary anxiety.

The 75 basis point increase is a very notable increase indeed – the Fed is certainly hoping that aggressive monetary policy will be enough to fight inflation. With consumer sentiment very low, and inflation continuing to rise, the pressure is on. We will have to see whether this bold move by the Fed has the power to bring down inflation.

Coauthor: Sam Kuhn