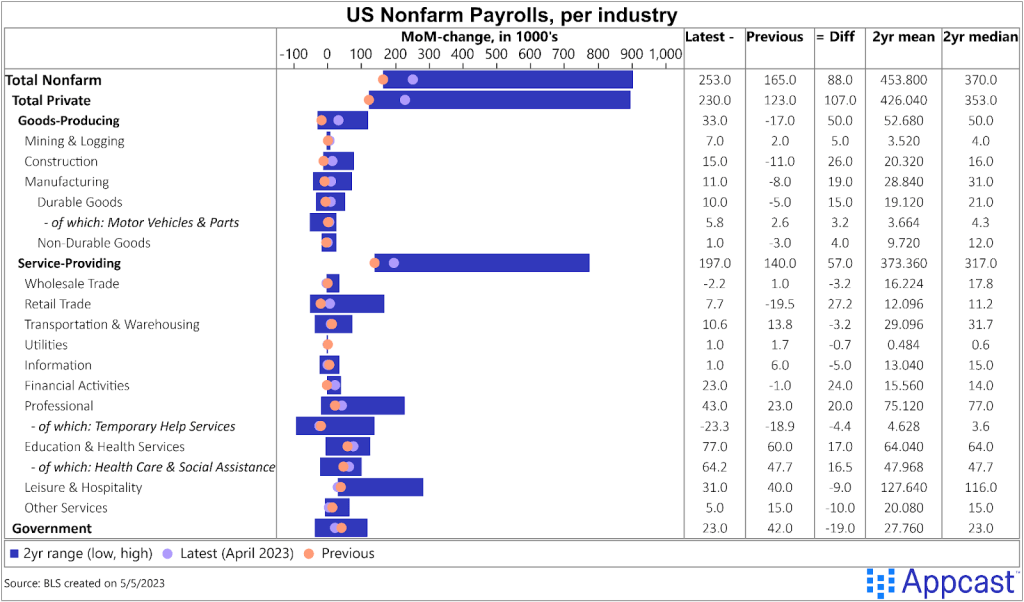

The labor market remains strong, but there has been some softening since the incredible growth and demand seen last year. In April, the U.S. economy added 253,000 jobs. In March, that number was just 165,000 after revisions. To be clear, this is still impressive strength but slower than many months during the hiring crazes of 2021 and 2022 – or even the first months of 2023.

Within the labor market, some sectors continue to be potential powerhouses. There is still plenty of room – and reason – to grow in two of the fastest-growing sectors: leisure and hospitality and healthcare. In the past two years, these two sectors have exploded as leading job creators in the U.S. economy, after vaccinations made it easy to go outside again and consumers turned their attention away from goods and towards services. In the coming months, as the economy continues to slow (assuming things go the Fed’s way), these sectors could prove immune.

Growth and demand are strong

In April, the leisure and hospitality sector gained a strong 31,000 jobs, with the subsector accommodation and food services leading the gains with 25,000. Employment in both the overarching sector and the subsector remains below the February 2020 pre-pandemic levels – by 402,000 for leisure and hospitality and by 338,500 in accommodation and food services. In other words, even though the sector has been growing strongly for over a year now, there are plenty more gains to be made.

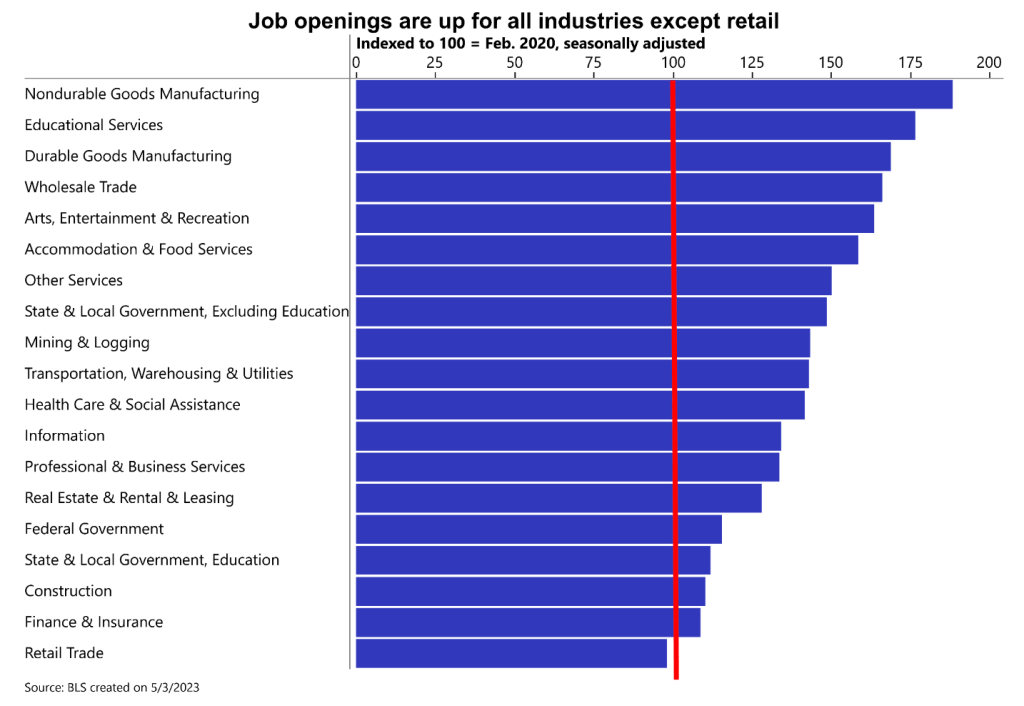

Even as this sector continues to add workers, demand remains high. In March, the leisure and hospitality sector had over 1.5 million job openings – even as the economy becomes more and more uncertain, this industry based on travel and dining out continues to expand. Labor demand in the industry is up 59.5% from February 2020 levels. And while openings rates aren’t as high as they were in, say, December 2022 (10.2%!), there remains a healthy level of demand as the economy transitions.

The healthcare sector, too, has seen strong jobs growth. Employment in the healthcare sector increased by 39,600 in April. This sector had difficulty growing during the pandemic for obvious reasons, and growth plateaued for much of 2020 and 2021. Last year, growth came back swinging, and the gains have not let up, even after surpassing February 2020 levels.

Healthcare and social assistance demand is also elevated from pre-pandemic levels, up 42%. Job openings have fallen more precipitously in this sector than in leisure and hospitality – but there are still openings even as employment levels have recovered, showing there is more room to grow.

Can these sectors continue to be powerhouses in the future?

With all the tide shifts in the economy happening lately, there has been much talk about a potential recession occurring as soon as this year. But the labor market could be safe (or at least safer than in recessions past) – in part because of the potential resilience of leisure and hospitality and healthcare.

Consumers, despite stubborn inflation, continue to spend strongly at food and drinking places – sales at these establishments were up 0.4% in March, and up 12.5% from the same month the year before. The continued demand for leisure and hospitality services has allowed for strong demand for labor, and therefore impressive employment growth. With the sector still yet to recover all the lost jobs from the pandemic, this demand is sure to continue as long as customers continue to spend on dining out and travel. With strong wage growth and deeper pockets post-pandemic, it may be some time before consumers halt their spending altogether.

As for education and health services, the sector is not, of course, recession-proof because no sector is. But, it has a different makeup than the rest of the labor market and recessions (barring, of course, those caused by public health crises) tend to have lesser effects in the healthcare sector than the rest of the labor market. For instance, during the Great Recession, total payrolls decreased by 5.4%. Education and health services, meanwhile, grew by 3.3%. The sector is not recession-proof, but it’s recession-hearty – and could help the labor market skirt through an upcoming recession relatively unharmed.