Last week, Fed Chair Jay Powell said: “Overall, the economy is in solid shape; we intend to use our tools to keep it there.” Indeed, the overall economy looks solid. With inflation falling, the story is the labor market has caused anxiety. That narrative may be poised to change.

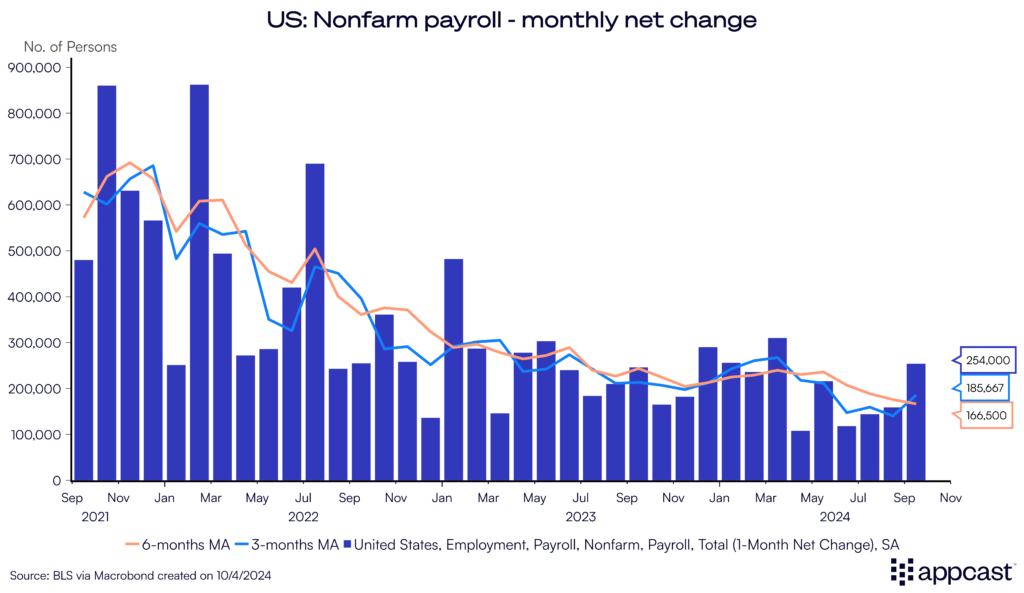

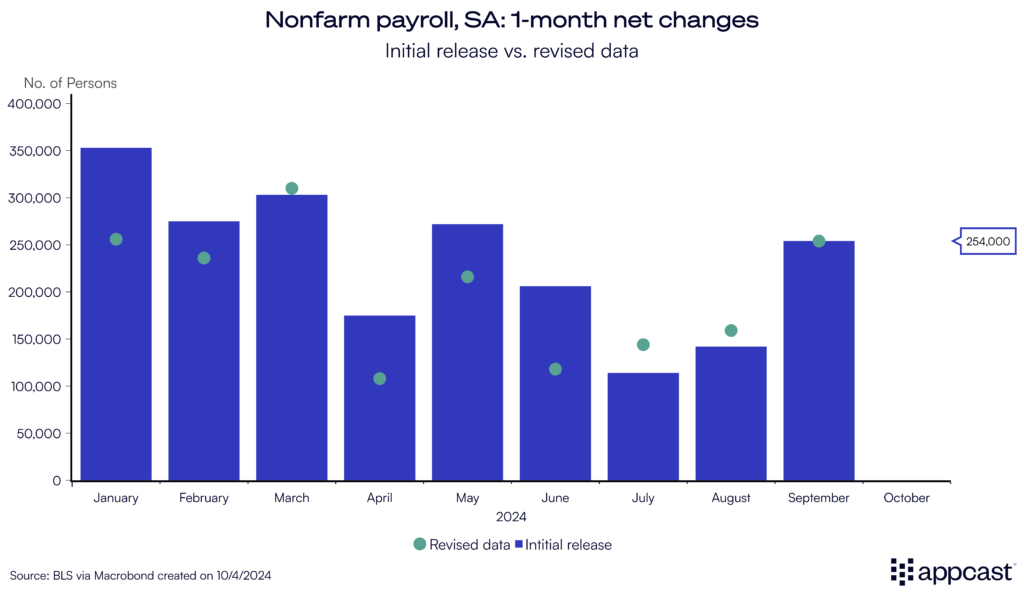

September saw surprisingly strong job growth, an indication the U.S. labor market may have found its footing after months of substantial cooling. Payroll employment rose in September by 254,000, far higher than the 150,000 expected by forecasters.

And, finally, there were some upward revisions to previous months – July and August job growth moved up by 72,000. That’s a reversal of several months of downward revisions.

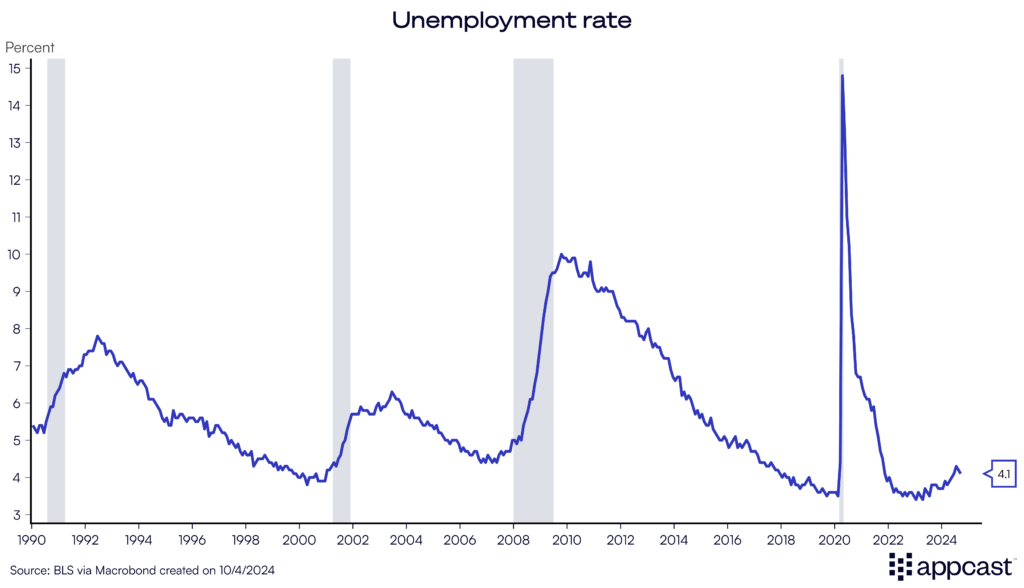

The unemployment rate ticked down to 4.1% for all the right reasons – increasing labor force participation and fewer unemployed workers. Prime-age LFP remains high at 83.8%.

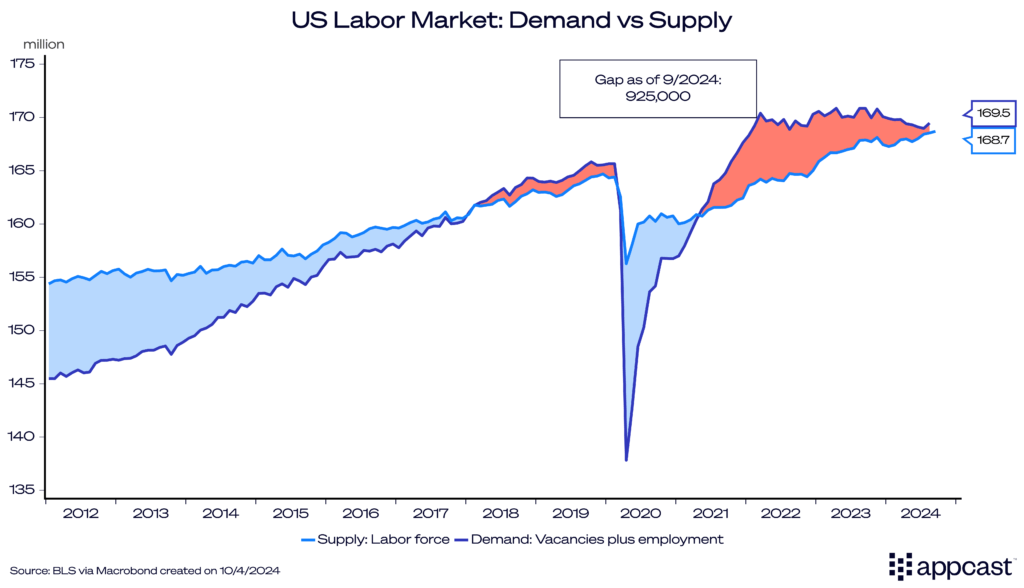

As supply has steadily risen and demand has cooled, the labor market is at nearly perfect balance. We see this in our go-to approximation of supply and demand:

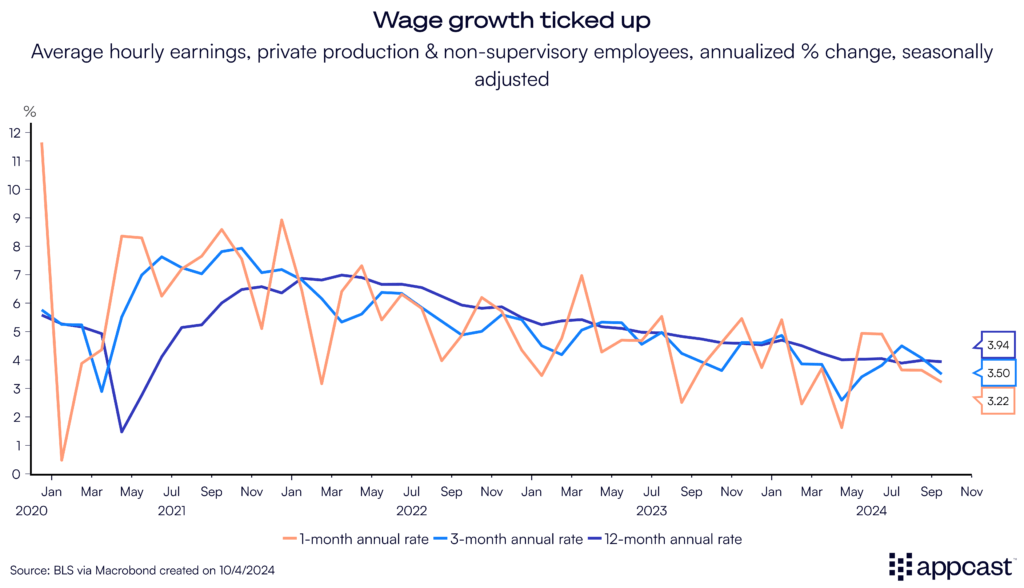

We also see balance with indicators of wage growth bottoming out. Average hourly earnings for non-managers are at 4% year-over-year.

Industry highlights

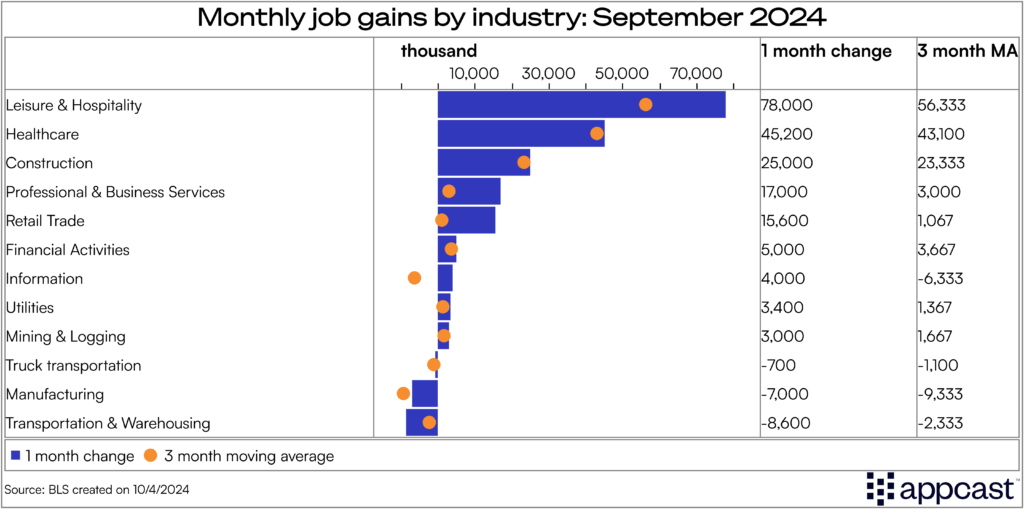

While these gains were impressive, they were not exactly broad-based across industries: 60% of employment gains occurred in just three industries! Leisure and hospitality, healthcare, and construction all added jobs, but not exactly at the same pace.

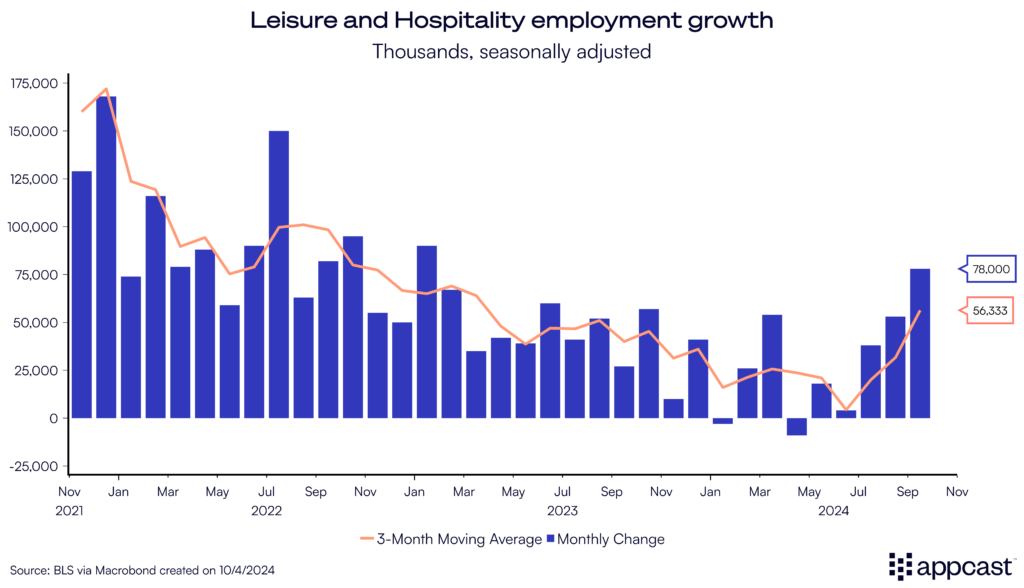

After falling into the doldrums earlier this year, leisure and hospitality jobs have been on a tear recently. In September, the industry led with 78,000 jobs added. Healthcare can be described as solid. It added 45,000 net new jobs in September – gains are not as strong in this powerhouse sector as they once were, but it remains a boon for overall gains. Construction has remained steady, adding 25,000 net new jobs.

Elsewhere, other sectors struggled. Manufacturing continues to decline (-9,300 over the last three months). The struggle in the tech sector continued, with the information sector adding just 4,000 net new jobs.

September jobs report fueling an October surprise?

This report could be a sort of October surprise, an event that changes the outlook of the November election. This October surprise may be pulling from September, but we’ll allow it. A strong report could be a boon for Harris, as it lends a final piece of evidence on the strength of the labor market under the Biden Harris administration. Of course, there will be one more jobs report before the election in November. Additionally, the swing state voters that will determine this election may care more about their lived experiences than one positive job report. So, we will have to wait to see how it shakes out in the polls.

On October 15th, Andrew will be reviewing the potential outcomes of the U.S. election, and how either one would impact your 2025 recruiting strategy. Register today and watch out for election coverage on Recruitonomics.

What does this mean for recruiters:

Recruiters should be pleased with this report: Strong employment gains and an even stronger labor force participation. The balance between supply and demand means some of the power in the recruiting process has shifted back to recruiters. If the labor market has truly found its footing in September, recruiters should be walking proud right next to it.