A China shock is threatening to upend manufacturing in Germany. The original China shock describes the economic hardships experienced by manufacturing workers in the United States following China’s rapid integration into the global economy. While U.S. consumers benefited from cheap Chinese imports, the domestic manufacturing sector suffered major losses. The China shock created waves that continue to impact regional economies and even national politics.

In the years since, China’s economy has slowed as structural factors like decades of malinvestment in the real estate sector together with a rapidly aging population are now weighing on growth. As the country’s growth rate has halved since the 2010s, it has responded with an aggressive strategy of dumping industrial products on global markets at low cost to export itself out of the crisis. This strategy is currently imperiling manufacturing jobs across Germany, creating a new China shock affecting European industries this time.

China shock 2.0: Germany at the epicenter

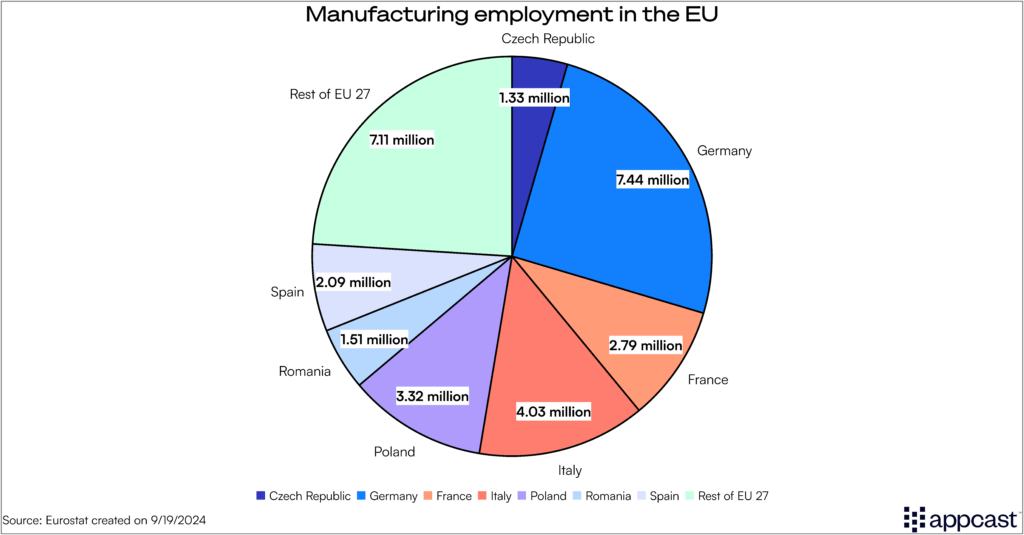

Germany has been a global manufacturing powerhouse for decades. While its population of 85 million is just under 20% of the European Union’s total, Germany hosts about 25% of all European manufacturing jobs – more than 7.4 million.

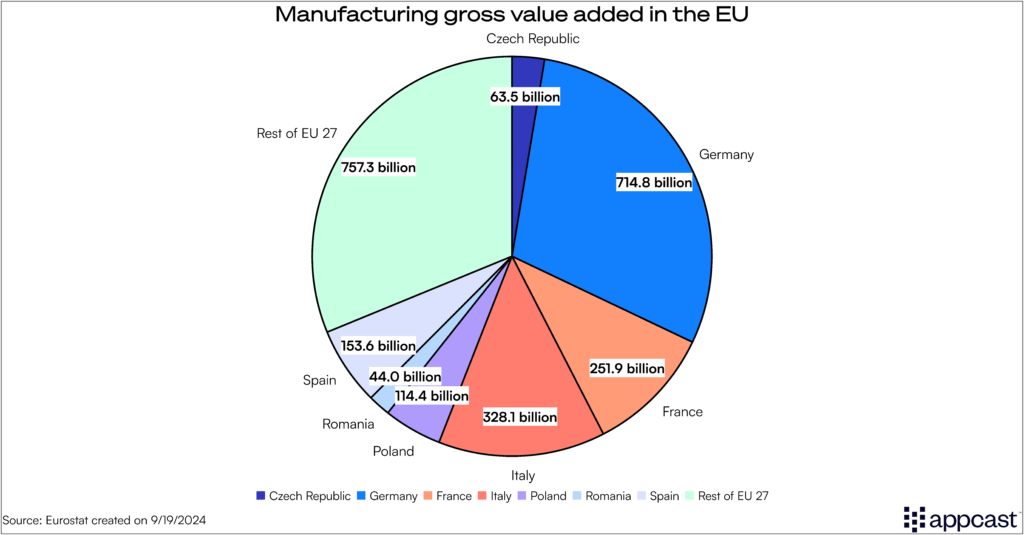

Thanks to Germany’s high productivity, the country’s manufacturing output adds disproportionate value to Europe’s overall economy. German manufacturing companies are extremely efficient and highly automated. Germany is recognized as a global leader in industrial automation, with a high density of robots used in manufacturing compared to other nations.

But ever since COVID-19 and the war in Ukraine, Germany’s industrial sector has weakened considerably. Manufacturing output has been contracting for several years since high domestic energy prices are hurting energy-intensive production, like the chemical industry, steel producers, and glass and ceramics, for example.

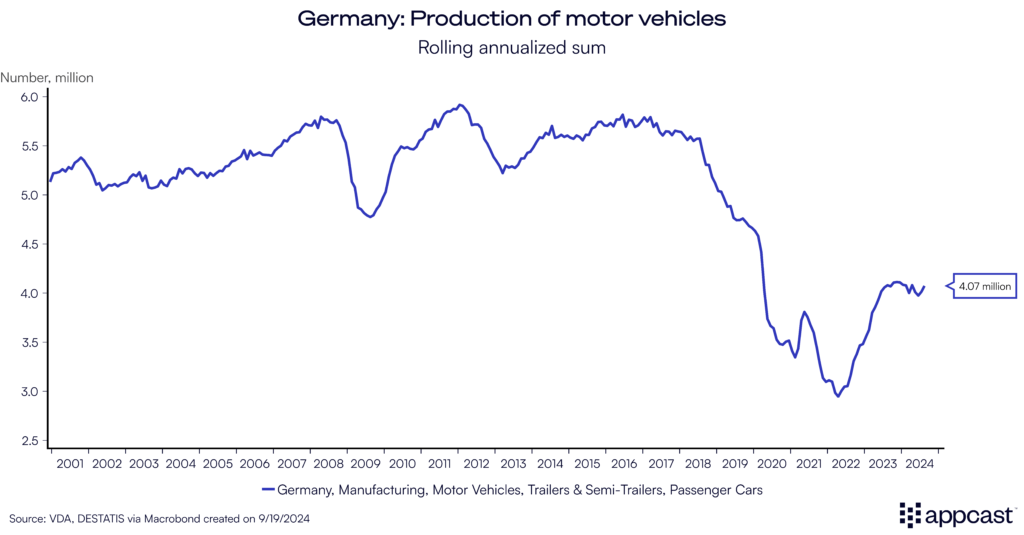

On top of that, German manufacturing output is now also in stiff competition with China. Nowhere else can that be felt more than in the car industry. Germany has a proud tradition of being a global leader in car manufacturing. A decade ago, the country was still producing some 5.5 million cars annually. That number has now fallen to about 4 million.

Bloomberg is reporting that German car manufacturers are struggling to be profitable as some of their production plants are operating at about 50% capacity or less.

For the first time in its 80-year-old history, Volkswagen, Germany’s largest car producer, is considering closing some of its German factories due to weak demand in Europe and competition with cheaper Chinese models.

Number of Volkswagen employees at German manufacturing plants

Source: Tagesschau

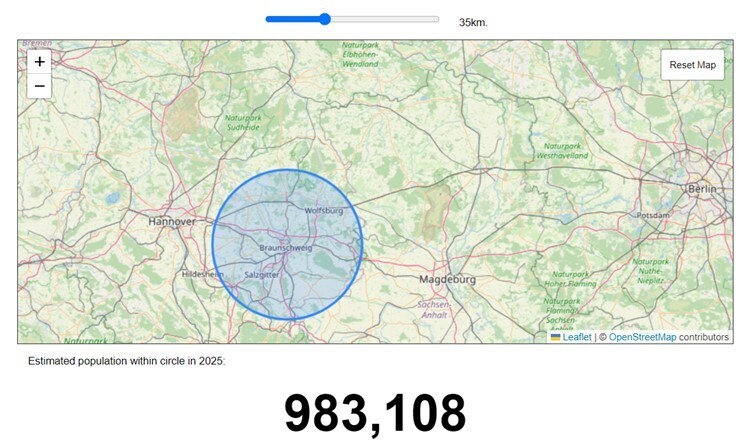

Volkswagen employs some 85,000 workers in the region Braunschweig-Wolfsburg in Northern Germany where the company’s headquarters are located. This is a sizeable chunk of total employment for a region that has about one million inhabitants and half a million workers.

Source: Tom Forth, Population around a point

On top of being the largest direct employer, studies suggest that at least two to three times as many jobs in the region are dependent on Volkswagen. Consider not only all the suppliers to the company, but also the jobs in hospitality and food services, retail, etc., all of which benefit from the demand that the high-paid Volkswagen employees generate.

Assuming a job multiplier between two and three, a quite conservative estimate, some 15% to 30% of all local jobs might be in peril even if Volkswagen only downsizes by 20,000 jobs in the coming years, a number that may not be out of question. This is to show the notable economic impact that a large industrial employer can have on the economy and labor market of an entire region.

Job massacre in Germany: death by a thousand needles

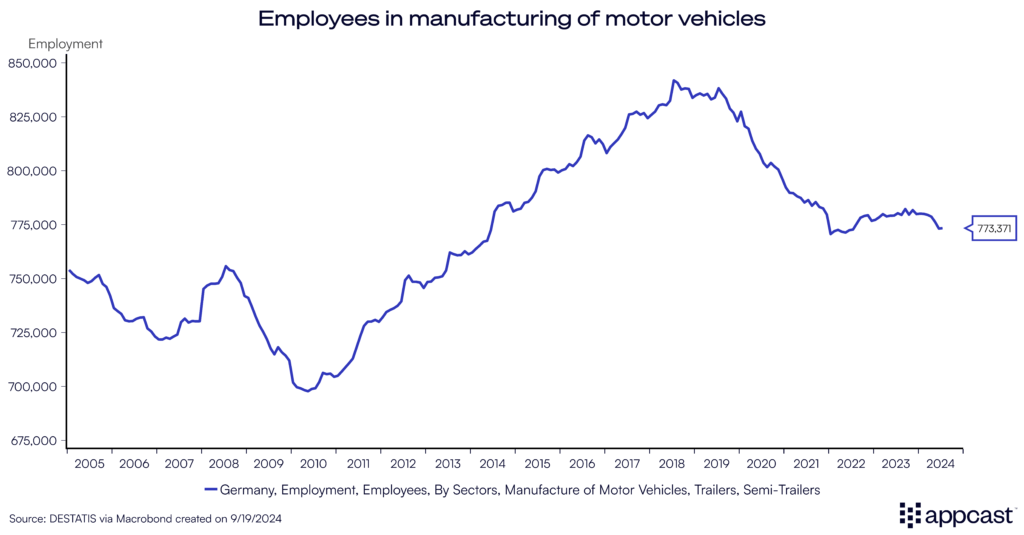

Employment in German car manufacturing has already declined from its peak of 830,000 in 2018 to about 770,000 more recently, with more job losses expected as Chinese producers are gaining market share.

While the car manufacturing employs less than 2% of all German workers, another two million jobs are dependent on the sector, ranging from downstream and upstream suppliers to services provided to the industry. One study suggests that the sector is responsible for about 5% of German GDP and close to 7% of total employment.

And it is not just the car producers that have been struggling. Manufacturing has shed some 100,000 jobs over the last year. Dozens of large employers have recently announced that they will need to lay off workers. The prominent companies that are shedding jobs in Germany span across many different manufacturing industries, showing how the country’s economic weakness is broad-based.

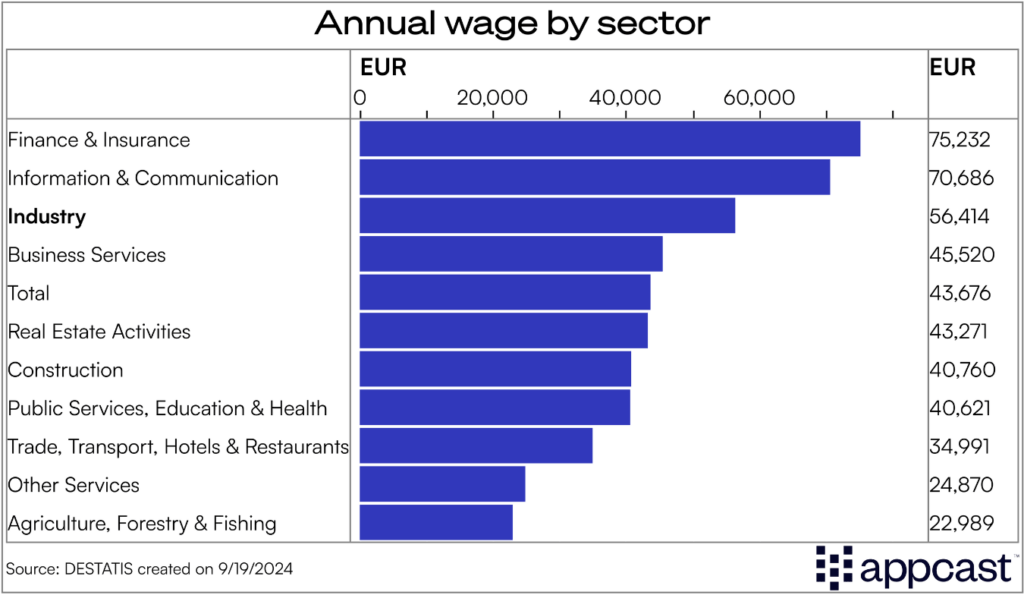

While the public sector and services continues to add jobs, manufacturing is a high-paid sector with annual wages exceeding the economy-wide average by a solid 30%. Even if manufacturing workers can eventually find jobs following layoffs, they might have to accept substantial wage cuts to be employable in the service sector.

All of this speaks to the fact that certain regions in Germany might experience the same phenomenon as the U.S. Rust Belt or the U.K. Midlands. As manufacturing jobs disappear, social and economic distress increases because those regions struggle to make a successful transition from goods-producing to services-based industries.

Job vacancies are plummeting in Germany as hiring slows

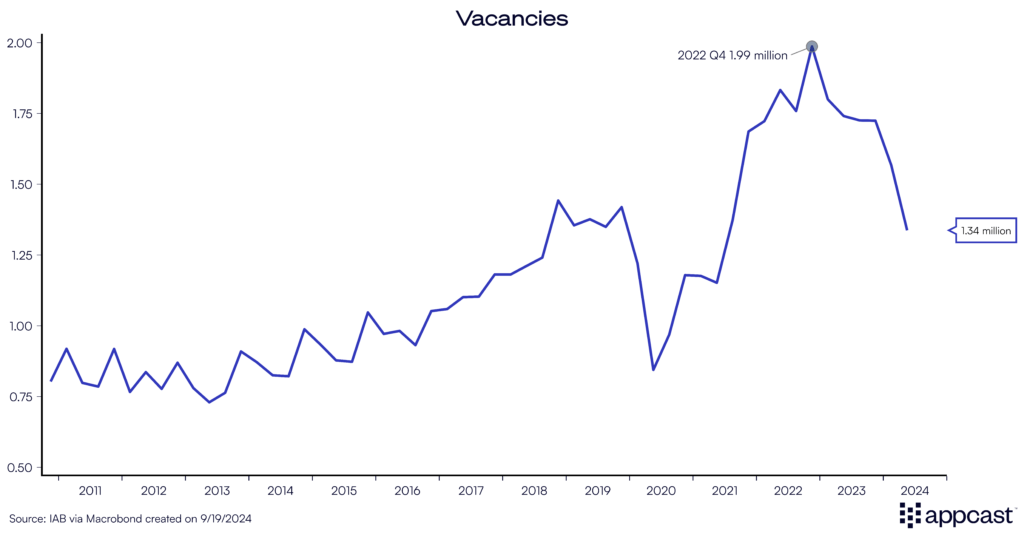

Job vacancies have plummeted in Germany at the same time as layoffs are rising, showing the extent to which labor demand is cooling down. At the height of labor shortages during the economic recovery from COVID-19 in 2022, vacancies soared to almost two million. Since then, they have fallen quickly back to pre-pandemic levels. And with the labor market being as weak as it is, we might expect some further decline from the current level of 1.3 million.

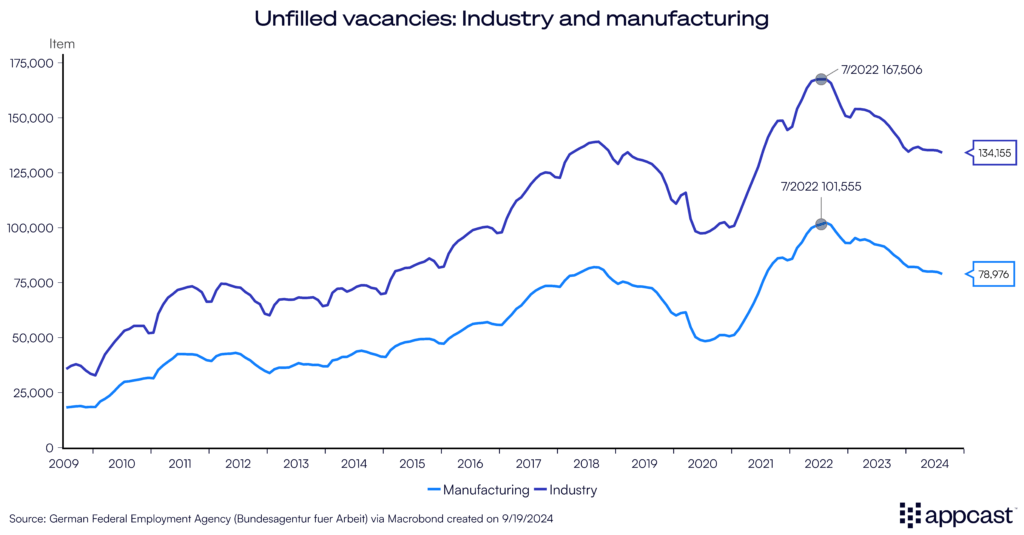

Vacancies in the industrial sector have declined by more than 30,000 over the last two years. In manufacturing alone, they decreased from over 100,000 in summer 2022 to under 80,000 more recently (-20%). There is therefore little doubt that the demand for workers has fallen rapidly and that hiring has slowed down severely as the German industrial sector is suffering from a prolonged period of economic weakness.

What does that mean for recruiters?

Even as Germany’s unemployment rate remains reasonably low due to a rapidly aging workforce, the demand for workers is clearly slowing. While some sectoral shortages remain in the blue-collar space, vacancies for high-skilled workers are declining rapidly.

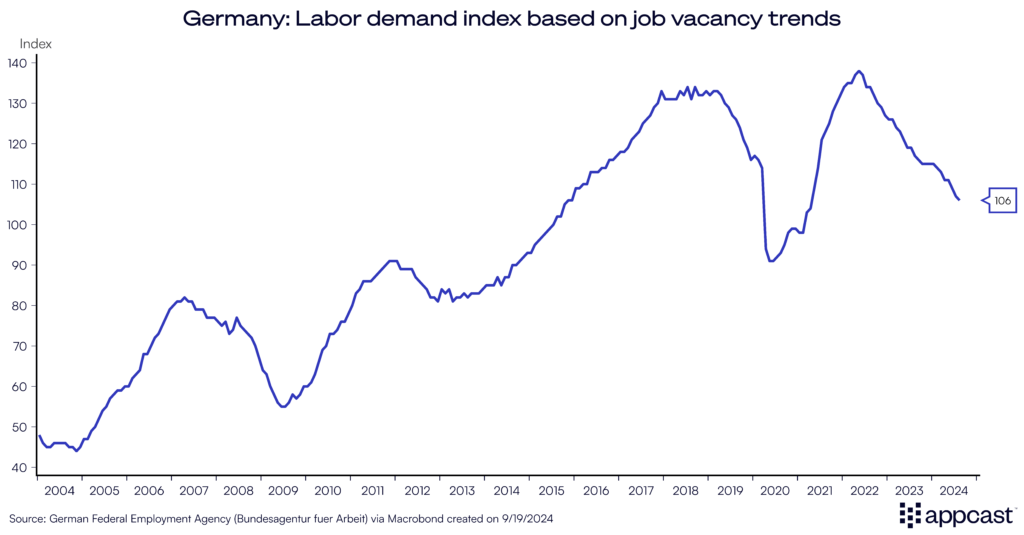

The German Federal Employment Agency releases a labor demand index based on official vacancies submitted to the agency as well as to staffing firms. The index has fallen for about two consecutive years now since the peak of labor market tightness in early 2022.

But the decline has been quite steep and total labor demand now seems to be lower than in the years preceding the pandemic. There is no doubt that the labor market has slowed considerably as hiring is stalling and layoffs across manufacturing are creating negative ripple effects across other sectors.

For recruiters, this means that the severe hiring challenges that companies have faced in Germany due to labor shortages have eased for now because of the substantial weakening of the labor market. If your business is still recruiting in Germany, you will be able to attract more clicks and applies to your job postings, and at a lower cost, since there is less competition.

The current economic weakness caused by the struggling manufacturing sector and tight monetary policy, both of which remain headwinds for the German economy for the time being. But eventually, these cyclical factors will fade as ECB policy makers are already cutting rates. In the long-run, Germany remains a tough market to recruit in due to its very challenging demographic outlook and a stagnating labor force.

In the meantime, let’s hope that that the current economic downturn will not inflict too much damage on the economy and labor market.