Recession calls were misguided

It’s officially been a year since Bloomberg’s confident 100% recession call that would happen within one year. But instead of experiencing an economic contraction, the U.S. economy just continued to add jobs over the last 12 months. And employment growth has been well above trend.

Moreover, inflation has come down significantly and it looks like real growth is currently accelerating if the Atlanta Fed Nowcast is to be believed – the actual Q3 GDP figures will come out later this year.

Instead of owning up to their mistake, many economists are currently doubling down on their recession call: The downturn has only been postponed instead of avoided, the argument goes.

However, the U.S. is currently enjoying the best labor market in decades. Revisions to the GDP figures show that pandemic savings are not exhausted after all. And most importantly, the Fed’s Survey of Consumer Finances released last week shows that Americans are more prosperous than ever. Absent a major economic shock, it is hard to see why the economy would slow substantially even as interest rates have surged. Asset prices have been relatively immune to rising rates so far and with record employment Americans will just continue to spend out of current income.

Wealth has never surged like this before

The Fed’s recent data release shows that American wealth has surged substantially between 2019 and 2022. And before you say “but inflation was also extremely high” – all data in the Fed’s Survey of Consumer Finances is inflation-adjusted! It therefore takes the rise in prices into account. Moreover, most of the Fed data below will consider the median instead of averages. High income and high wealth individuals highly skew the average to the upside whereas this is not a problem with the median.

The Survey of Consumer Finances is released every three years and thus shows data on family income and wealth in three-year intervals.

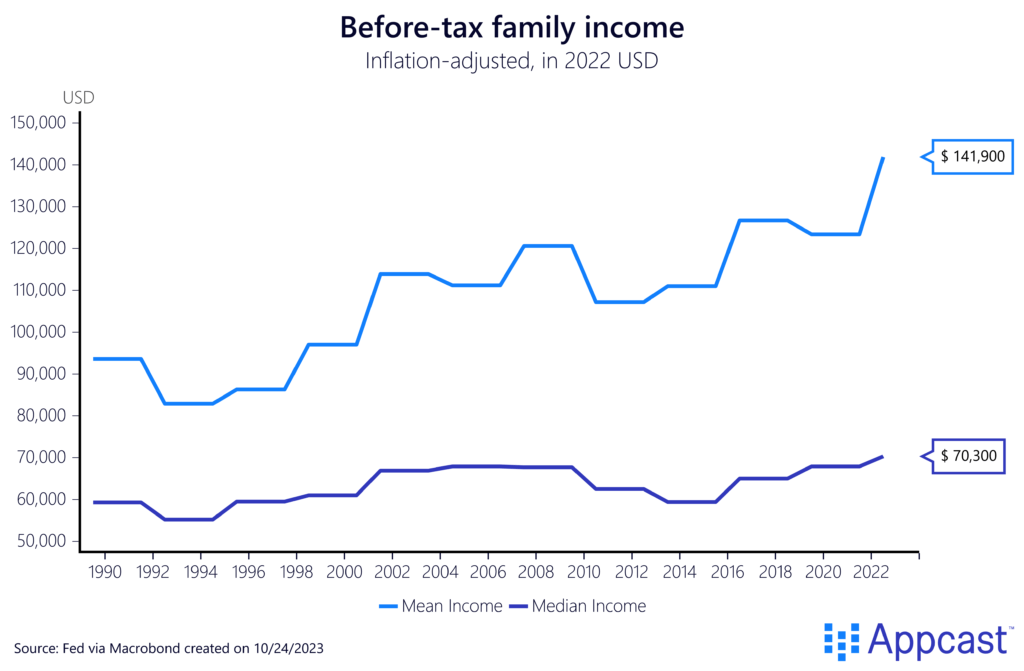

Median family income in constant prices (inflation adjusted) stagnated for almost a decade after the financial crisis. This has changed after the COVID-19 pandemic. Both median and, even more so, average family incomes saw a significant surge between 2019 and 2022.

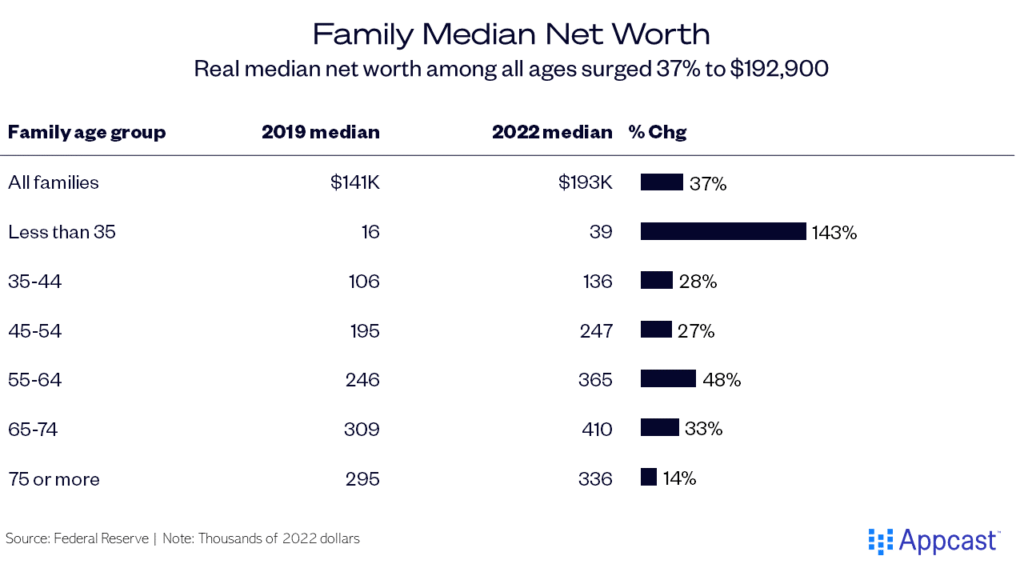

The Fed data also shows that median family net worth increased by even more. Net worth is the sum of your total financial assets – houses, stocks, cars, etc. – minus all your liabilities – student debt or mortgages, for example.

The median American family saw its net worth surge by more than 37% from $141,000 in 2019 to $193,000 in 2022.

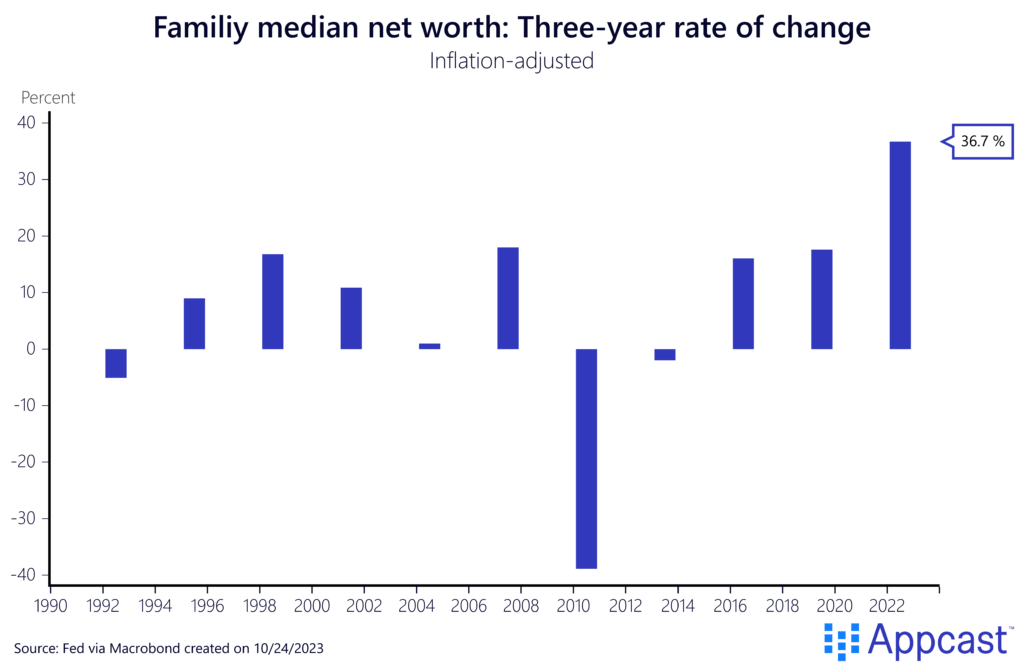

This is by far the largest surge in wealth in recent history, more than twice as large as the second-highest increase between 2004 and 2007.

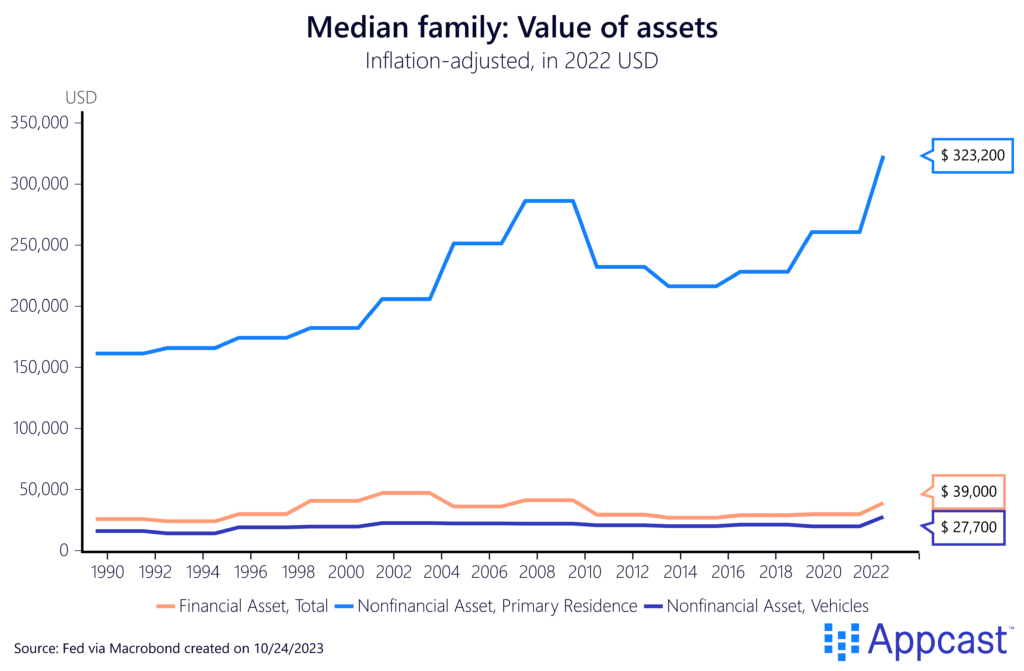

The chart below shows how the value of assets has risen substantially over the last three years. A large part of the increase can be attributed to rising “non-financial” asset prices, more specifically real estate and cars. The median family who owns a home saw their wealth go up by more than $60,000. The homeownership rate in the U.S. currently stands at about 66%, and in general, homeowners are significantly wealthier than renters. Car owners saw the value of their vehicle go up by more than $8,000.

The median value of financial assets for all families – stocks, bonds, retirement accounts, etc. – increased from $30,000 to more than $38,000 between 2019 and 2022.

While this is a marked increase, it also shows that the median family has most of their wealth tied up in non-financial assets like housing and cars.

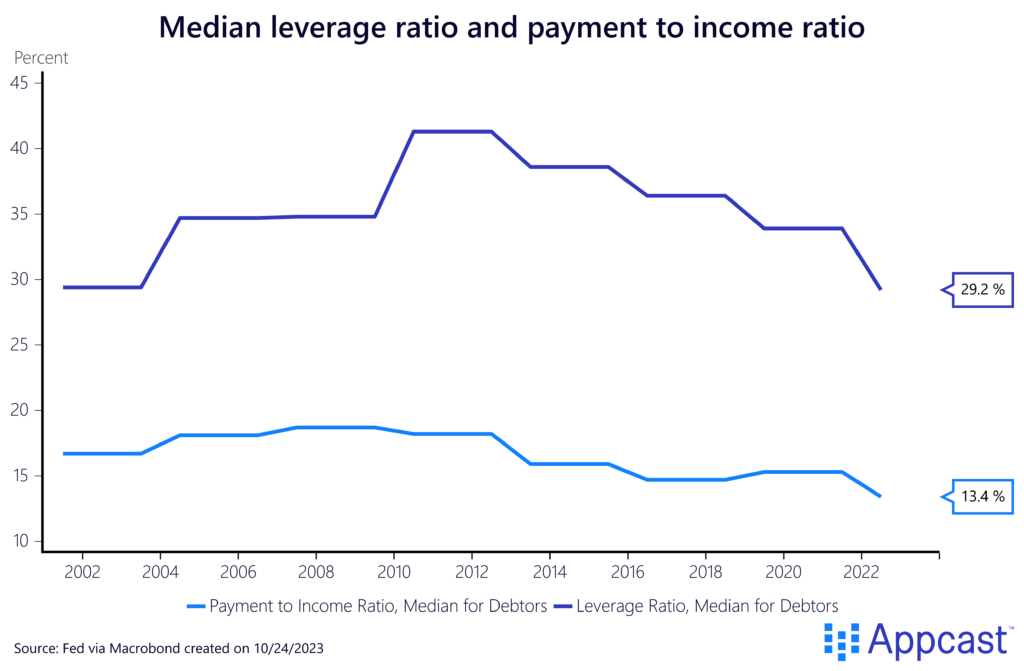

Another important trend is that American households are much less indebted than in the past. The median leverage ratio, which measures households’ total debt relative to assets, decreased to below 30% for the first time in more than two decades. Payment to income ratios have also gone down despite rising interest rates. Overall, Americans’ household finances are much more solid than in the past.

Minorities and young people have benefited disproportionally

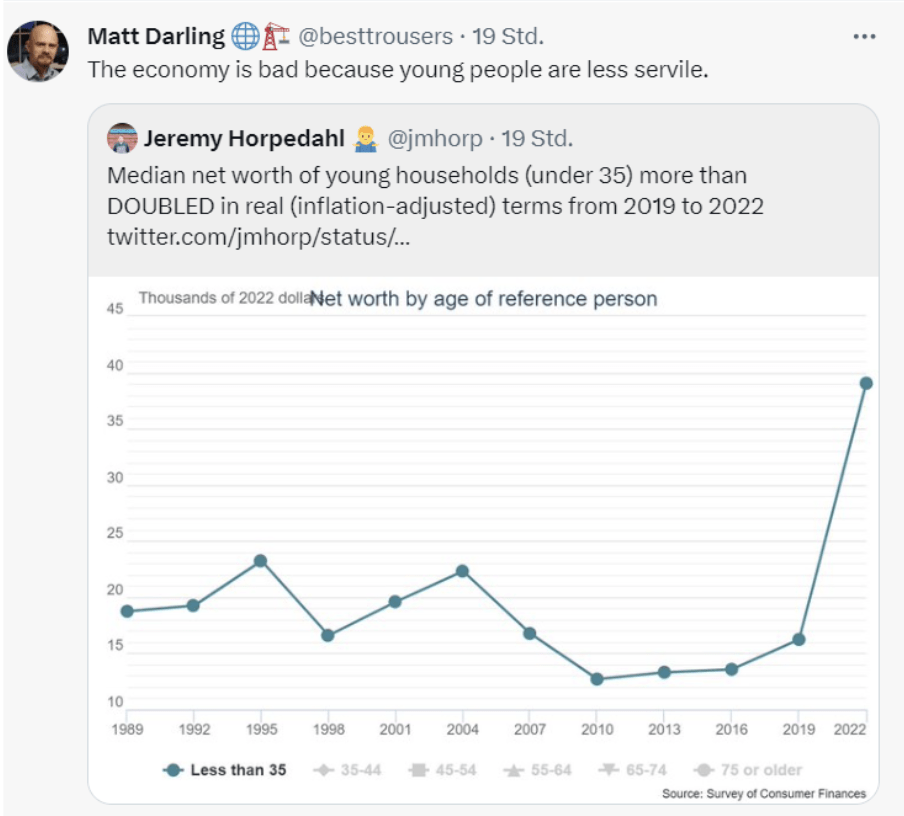

The Fed data also shows that young people and minorities have benefited disproportionately from the surge in wealth in recent years. Median net worth of families younger than 35 increased by 145% from $16,000 to $39,000.

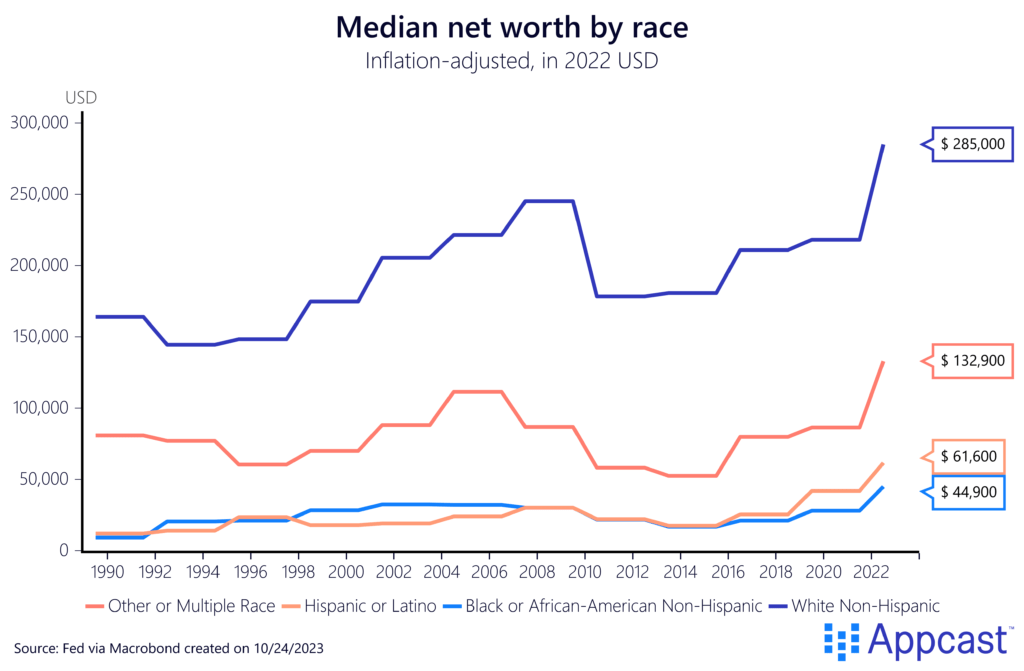

Another piece of good news is that minorities have also benefitted from the recent economic recovery. Median net worth for Hispanics and African Americans recorded a remarkable increase of 47% and 60%, respectively, much higher than the still respectable 30% increase for white Americans.

Nevertheless, racial disparities remain large even as minorities have been able to catch up somewhat.

Vibes are bad because the privileged are worse off, relatively speaking

If Americans’ income and wealth are higher than ever before and surged during the pandemic, then why are there so many people reporting that the economy is bad?

It is a little bit puzzling, to be honest. Earlier this year, we wrote about the vibecession. Because inflation surged for the first time in decades, people felt the economy was bad even though their own incomes and wealth were doing fine, even when adjusted for the increase in prices.

Excessive reporting about disappointing economic news does not exactly help. Of course, writing about doom and gloom is more newsworthy than reporting that everything is fine.

Moreover, 2022 saw the tightest labor market in decades. While this is good news for workers, it is more problematic for businesses, which had to start competing for workers. Businesses also had to raise wages massively as labor shortages started to bite.

While this is a little tongue in cheek, there might be some truth to what Matt Darling, a senior policy fellow at Niskanen, is alluding to.

To the displeasure of business and shareholders, workers’ bargaining power has massively increased over the last couple of years. Labor activity like strikes and unionization, not just in the U.S. but also other advanced economies, is at a record high. As work stoppages have become more common, workers’ wages have started to adjust to the new reality of global labor shortages due to adverse demographics, which will remain with us for the foreseeable future. Since younger people and minorities have benefitted relatively more from the tight labor market, it really might just feel that times are bad for older, wealthy business owners. Is it maybe just a CEO vibecession?