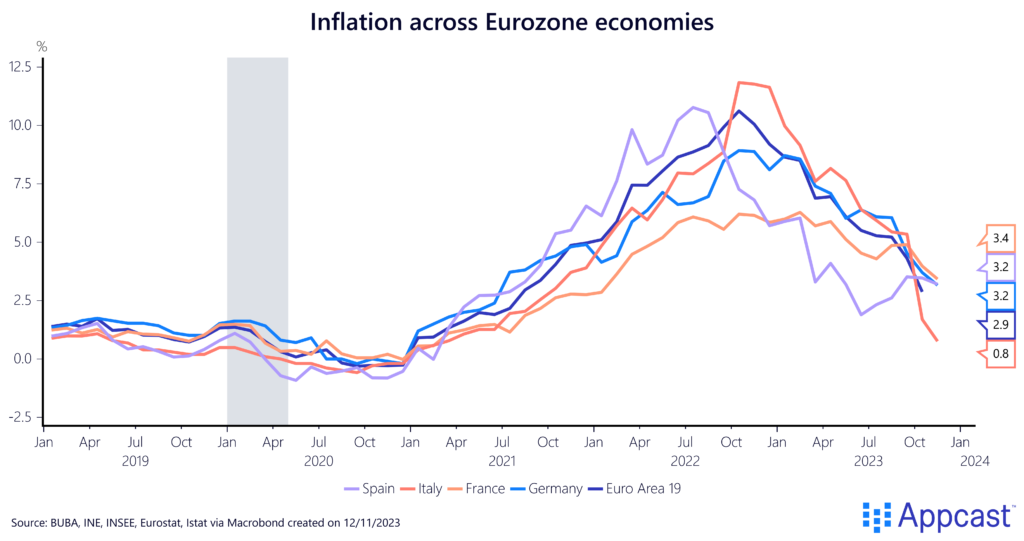

Inflation is falling faster than anticipated

The Eurozone was one of the regions affected the most by the energy price shock following the Russian invasion of Ukraine. Due to its high dependence on Russian gas, energy prices skyrocketed in Europe.

Throughout 2023, energy prices declined to more normal levels. This has also led to a significant drop in price pressures across all Eurozone economies: In recent months, inflation rates have fallen much faster than anticipated. The Eurozone’s inflation rate now stands at 2.9% and is expected to decline further next year and therefore fall within reach of the European Central Bank’s (ECB) 2% inflation target.

Money and credit are contracting

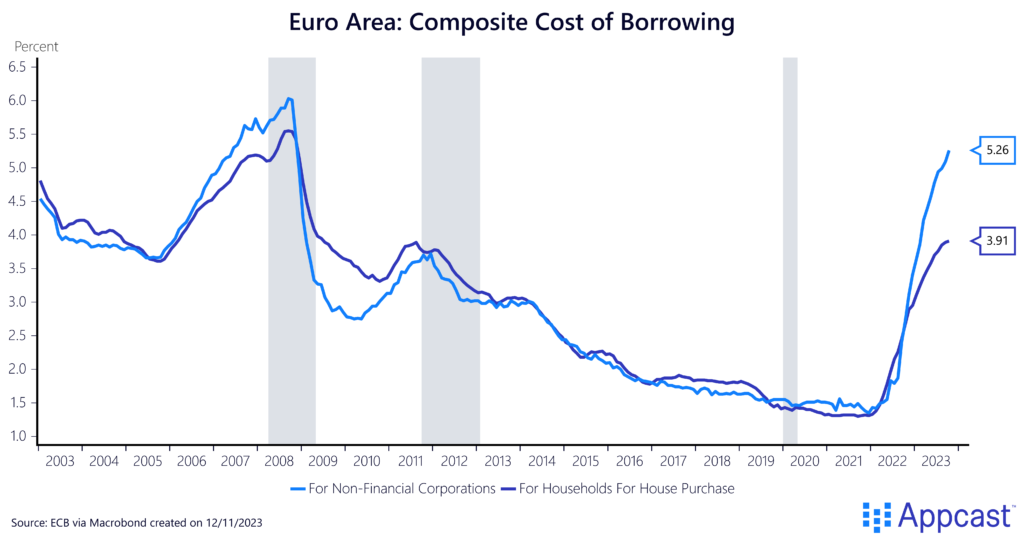

Similar to other central banks, the ECB has responded to the high inflation of the post-pandemic era by raising interest rates all the way to 4%. Consequently, borrowing costs for corporations and households have surged to levels not seen since the years before the financial crisis of 2008.

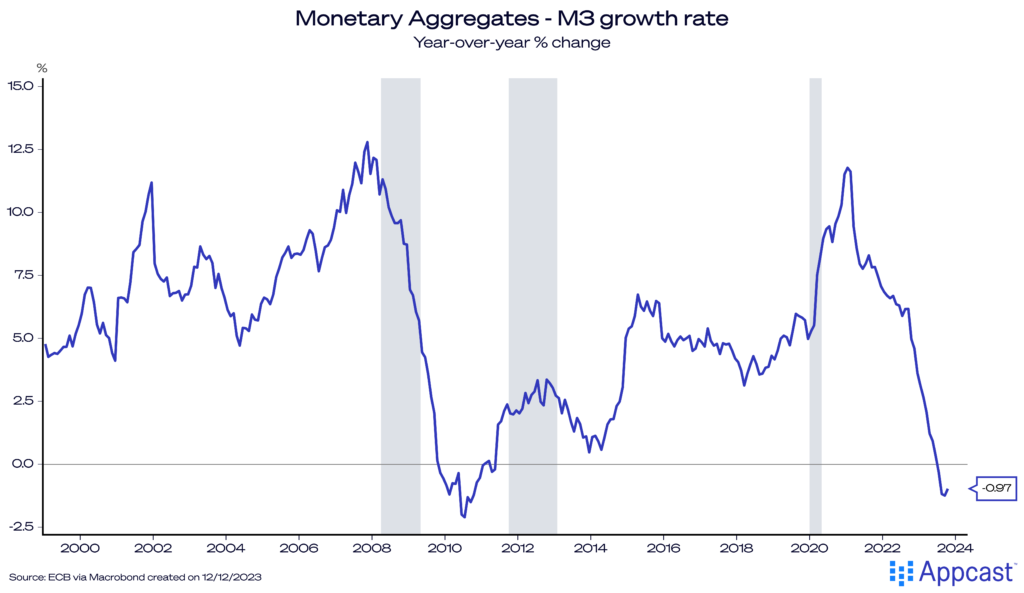

M3 money growth, an indicator that includes not just cash and bank deposits but also money-like assets, has now turned negative for the first time in over a decade. Historically, contractions in money growth usually coincide with or precede economic downturns.

The total number of loans outstanding to households and non-financial corporations has been declining since late 2022. The demand for credit is falling as interest rates and borrowing costs have surged. The credit contraction that the Eurozone is experiencing is indicative of an economy whose demand is falling rapidly across all sectors.

The labor market is easing

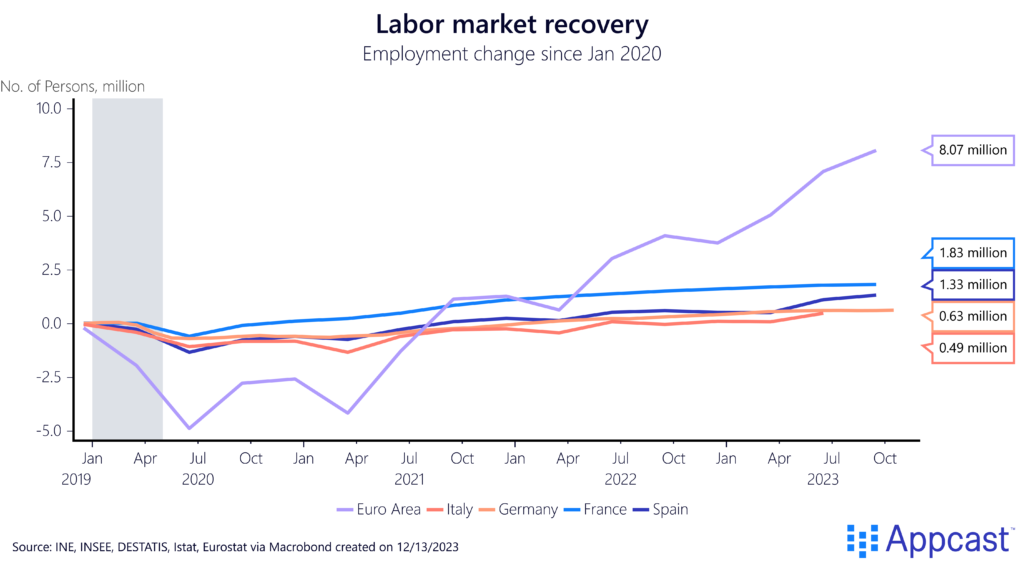

Thanks to the strong recovery, Eurozone unemployment has declined to a record low during this year. But it’s not just high economic performance that has created a tight labor market; adverse demographic factors are also a likely culprit as rapidly aging countries like Germany are experiencing massive worker shortages due to a stagnating labor force.

Eurozone employment has increased by about 8 million since the beginning of 2020, even as many of the jobs are either part-time or in sectors with shorter working hours – average working hours across the Eurozone have declined in recent years.

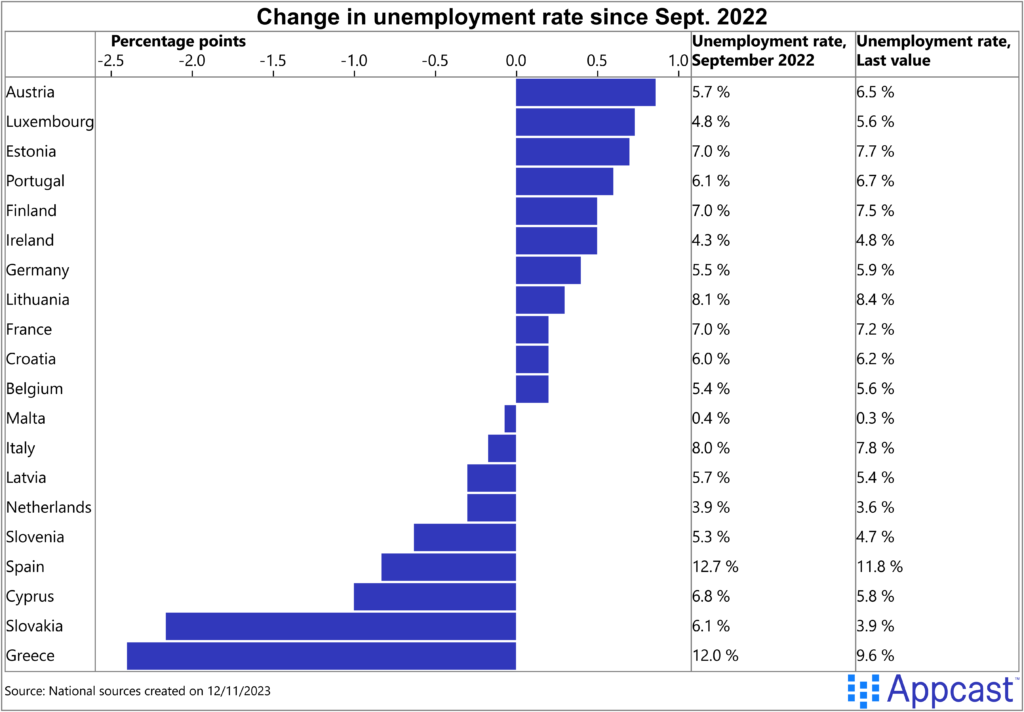

However, there are now signs that the labor market in the Eurozone is easing. Unemployment rates across several Eurozone countries, including Germany and France, have started to tick up compared to the fall of last year.

An increasing number of European countries have begun to see stalling growth. Some have even fallen into a technical recession – defined as two consecutive quarters of negative GDP growth.

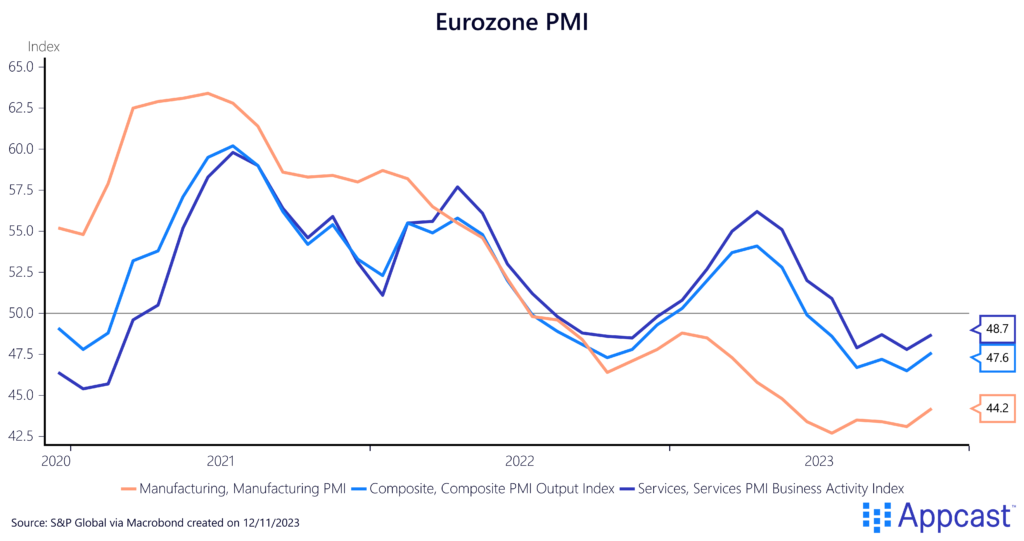

The Purchasing Managers Index (PMI) shows that the Eurozone economy has been in a state of economic contraction in the second half of 2023 in both the service sector as well as manufacturing (figures below 50 indicate contraction).

The employment outlook is deteriorating

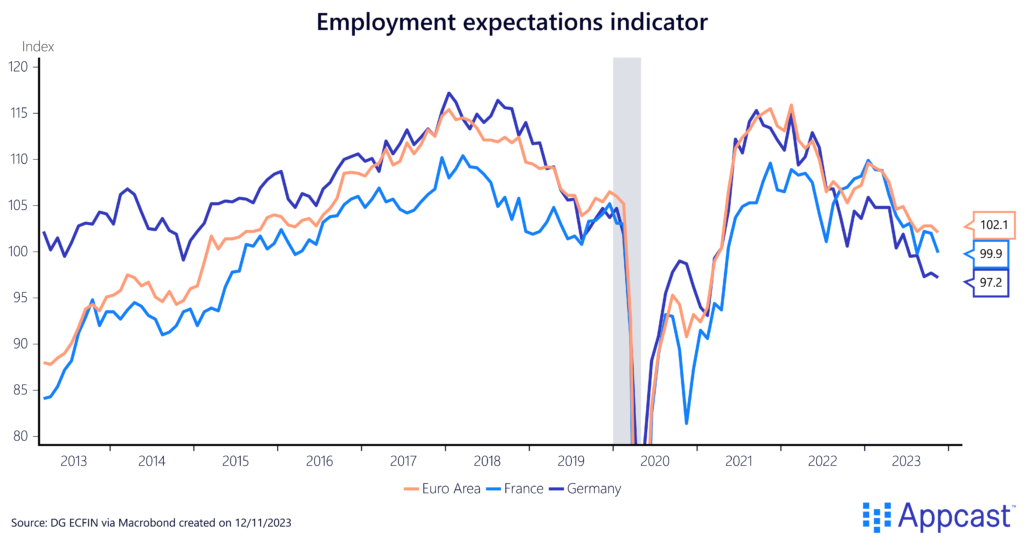

The employment outlook is already worsening for next year. The employment expectations indicators, which assess the labor market outlook over the coming three months, have been gradually worsening since early 2022. The data clearly shows an easing of labor market conditions in the two biggest Eurozone economies – Germany and France – as well as for the entire common currency area.

Business confidence has cratered, especially in the industrial sector. Germany has been affected most severely by the energy price spiral and its manufacturing sector has been in contraction for more than a year.

Employment expectations in retail trade have also declined in recent months, again more severely impacting France and Germany than other Eurozone economies.

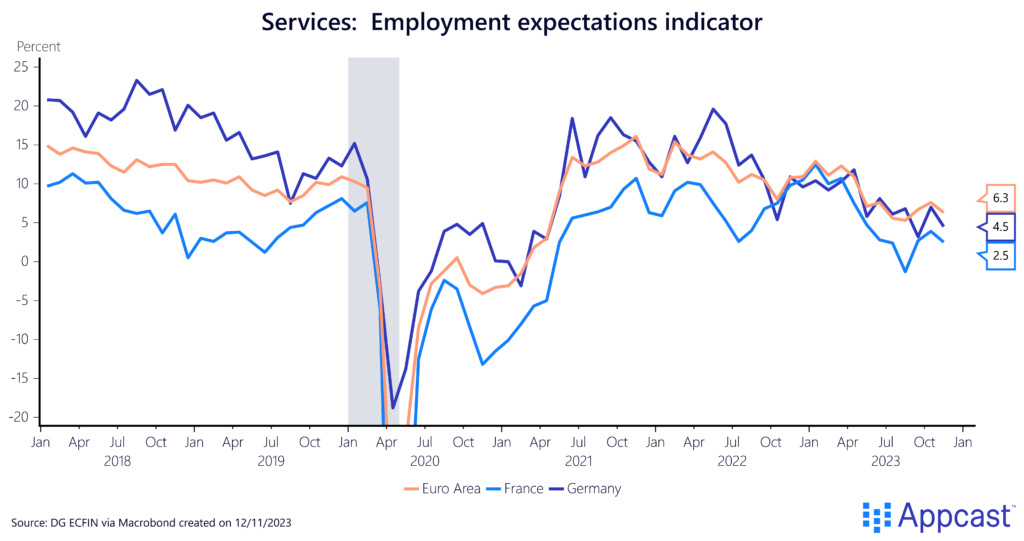

The only bright spot is the service sector, as the employment expectations indicator remains in positive territory. Economic growth this year and last has been supported by a quick recovery in the service sector post-COVID. However, even for this sector, the data is pointing towards a gradual slowdown compared to 2022.

However, some central bank officials worry that the current economic weakness in the Eurozone will soon spill over into the labor market. Demand for workers is after all “derived demand.” As spending on goods and services declines, so does the need for workers.

Tight money might create a recession in 2024

The concern that the ECB has already overtightened is not unfounded. In fact, it wouldn’t be the first time. It is now more or less consensus that the ECB reacted far too timidly during the financial crisis of 2008. To make matters worse, the ECB hiked rates and pursued a policy of tight money during the Eurozone crisis, thus deepening the economic downturn.

While it is too early to tell, Eurozone inflation has eased significantly faster now than many forecasters expected. Falling money growth and declining corporate loans are an indicator that economic activity is easing substantially. And the recent rate hikes have not completely fed through to the real economy. There is a case to be made that the ECB should start to ease as soon as next spring. Recent remarks, however, show that some ECB policy makers are still too worried about inflation and not worried enough about faltering growth.

What does that mean for recruiters?

Macroeconomic factors continue to dominate the economy and labor market. The ECB’s monetary policy stance will be the most important driver of the Eurozone economy in 2024. It remains to be seen whether high interest rates will cause a severe economic downturn or simply a very moderate contraction in the beginning of next year before economic conditions pick up again. A lot will depend on how quickly monetary policy makers at the ECB will reverse the current interest rate policy again when inflation falls even more and the economy contracts. There is a good chance that ECB policy accidentally overtightened already.

For recruiters, an easing labor market means that the recruitment difficulties that many companies have experienced throughout 2021 and 2022 will moderate. However, the other side of the coin is that the decline in economic activity will lead to falling demand across all sectors. Hiring activity might therefore slow down at many companies. We are seeing some signs that recruitment is already moderating.

Unfortunately, we will only be able to understand the impact on recruiters as the ECB adjusts its policy in the new year. Stay tuned!