Around the world, recruiting has become more challenging. Tight labor markets, economic headwinds, and new technologies have rewritten the rules of finding the right talent. But the recruiting environment, of course, differs between countries, even between metro areas. The ten charts below showcase the trends shaping recruiting across the globe.

Advanced Economies

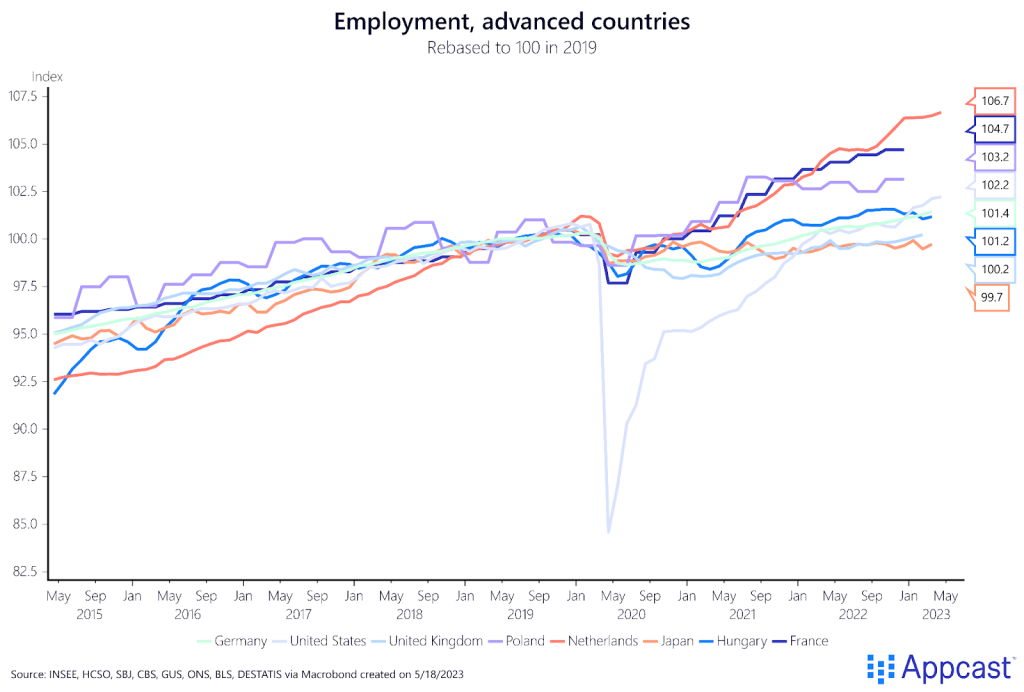

- Employment growth has surged

As recruiters around the world know, labor demand has been strong following the pandemic recession. The slight softening of the labor market, demonstrated by the recent round of reported layoffs, has not made a large dent yet: growth remains strong. Employment levels in 2023 have exceeded those seen in 2019 in many advanced economies, Japan being the exception.

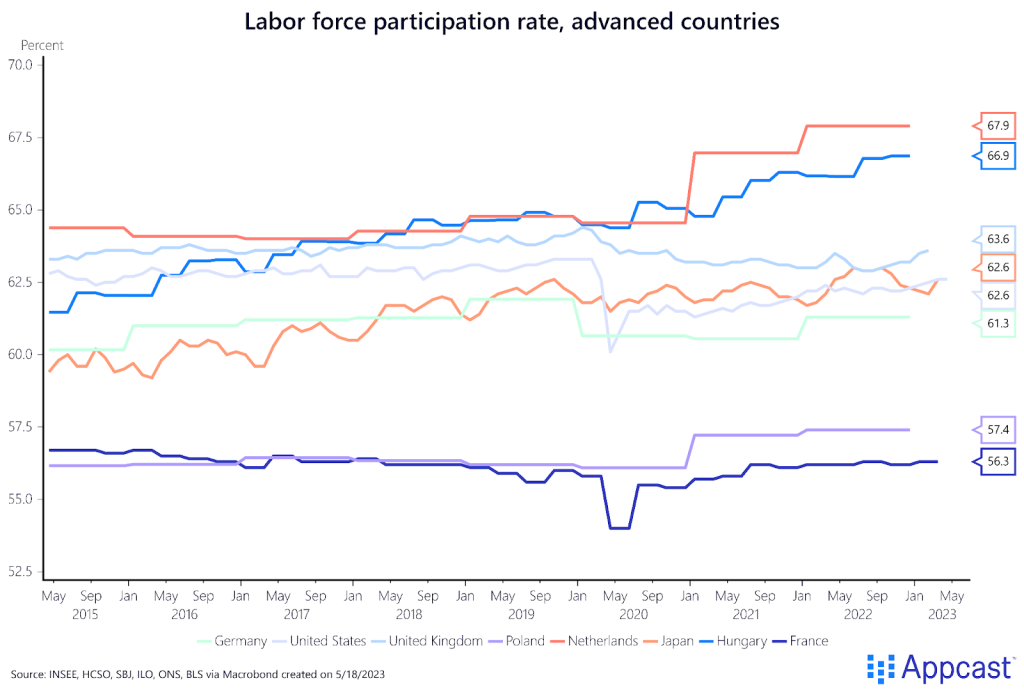

- Labor force participation has rebounded modestly

For some time, this high demand for labor contrasted with a sluggish rebound in labor supply. Over the last year, however, labor participation has picked up. Workers have jumped off the sideline into a hot labor market, helping to balance the outsized demand seen in many advanced economies.

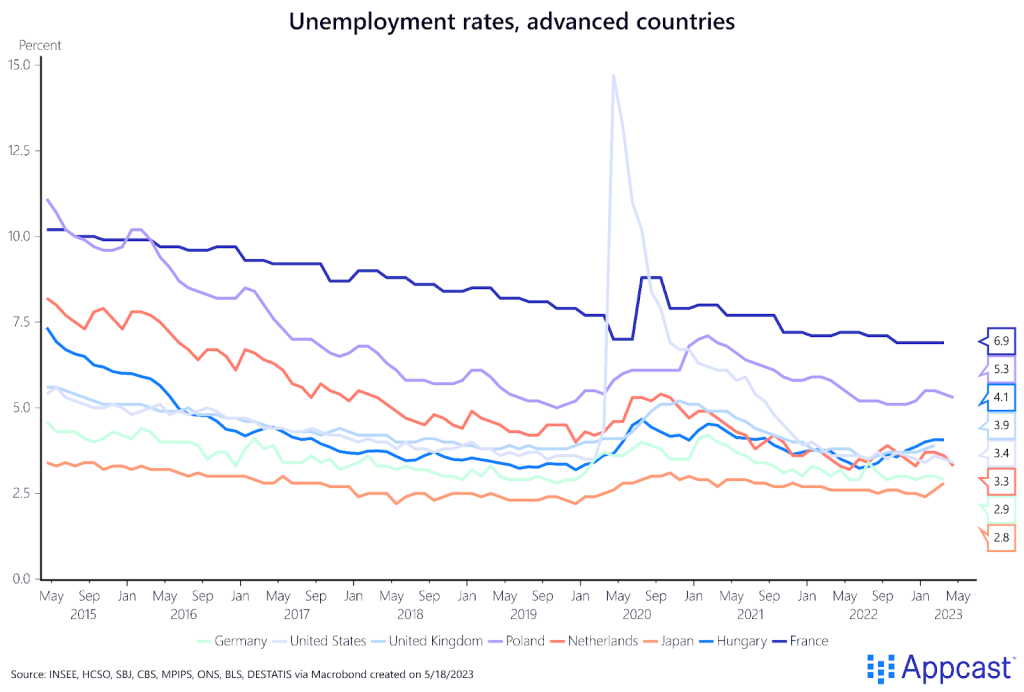

- But it remains a worker’s market (unemployment rates are low)

That’s not to say supply and demand has completely rebalanced, though. Even with increases in participation, economies around the world are experiencing very tight labor markets. Historically low unemployment rates in the United States, United Kingdom, and other advanced economies demonstrate just how much demand is outpacing supply. Across continents, job seekers and workers are enjoying a market where they have the power.

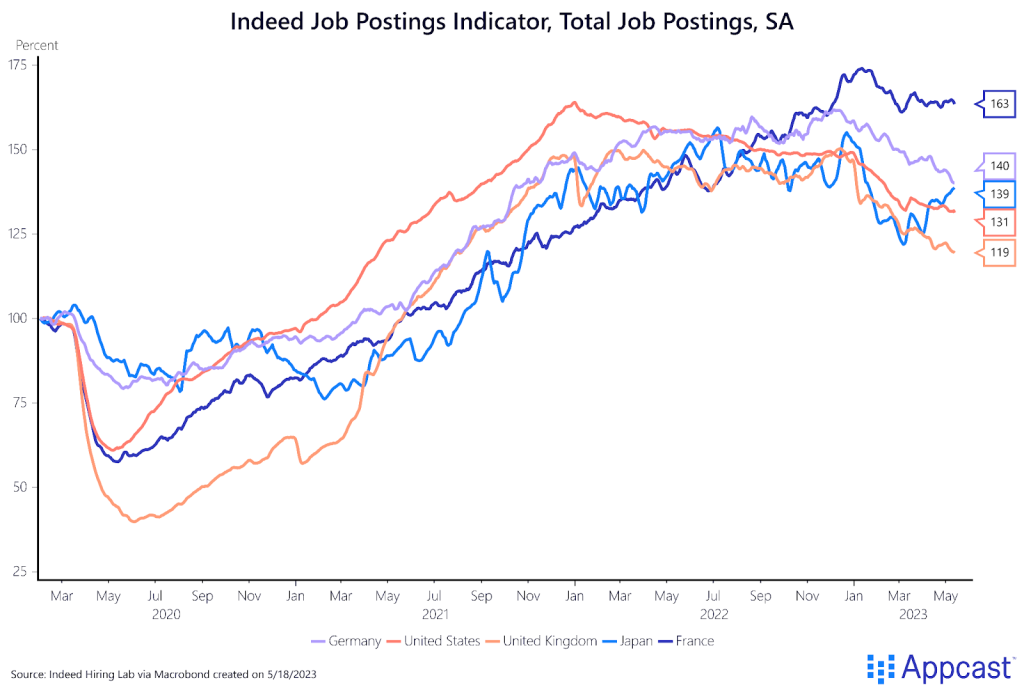

- Job postings are cooling

With economic uncertainty abound, forward-looking indicators of labor demand – like job postings – are showing signs of moderation. Though it remains at historically-high levels across many advanced economies, job postings are forecasted to fall in 2023, bringing even more balance to supply and demand and further normalizing recruiting costs.

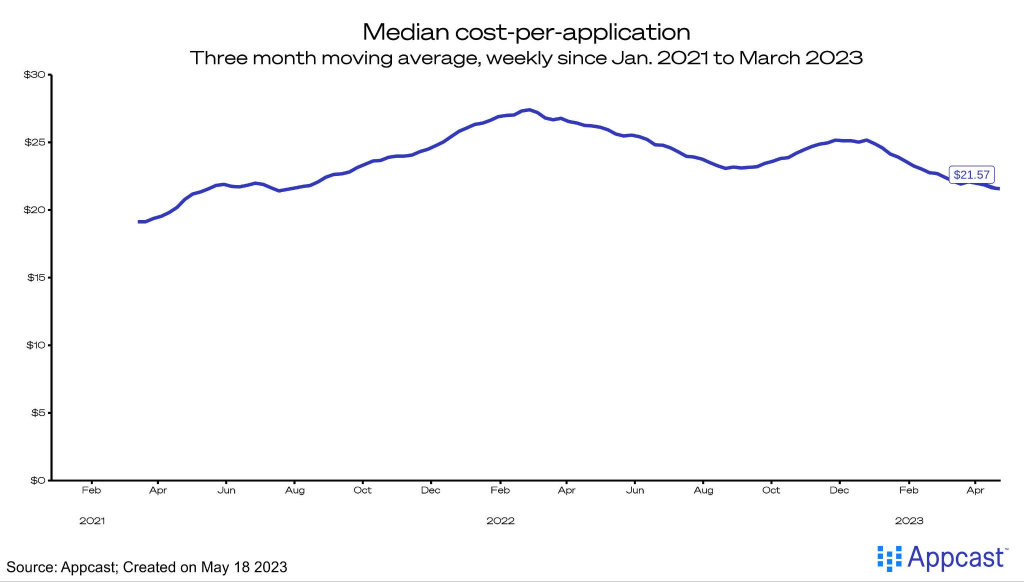

- Recruiting costs are moderating

Already, these costs are beginning to moderate. No matter the sector, recruiters are seeing lower costs than they were at this point last year. In the U.S., median CPAs across all industries have fallen to $21.57 – the return to pre-pandemic recruiting trends has been a long and grueling road, but recruiters can finally spot a light at the end of the tunnel as costs return to something relatively normal.

For more in depth recruiting trends in the U.S. market, check out the Labor Market Snapshot library and download the report for your industry.

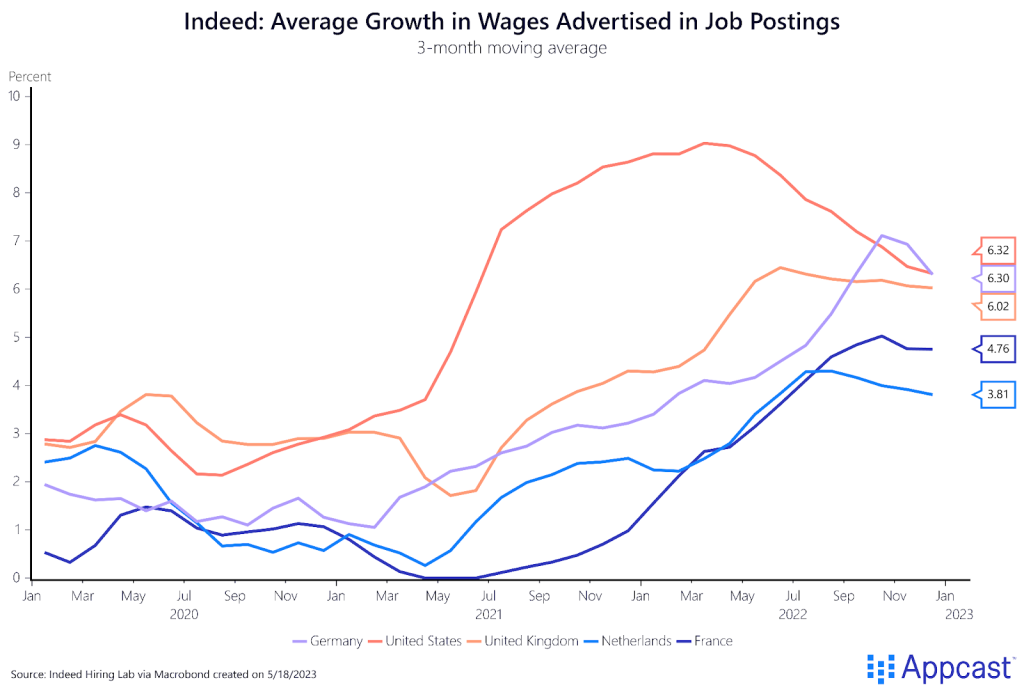

- Wage growth remains elevated, not yet back to “normal”

The latest harmonized wage growth data – from our friends at the Indeed Hiring Lab – is only through December 2022. What it shows is that wage growth has begun to come down for most advanced economies, although remains elevated at historically-high levels.

Developing Economies

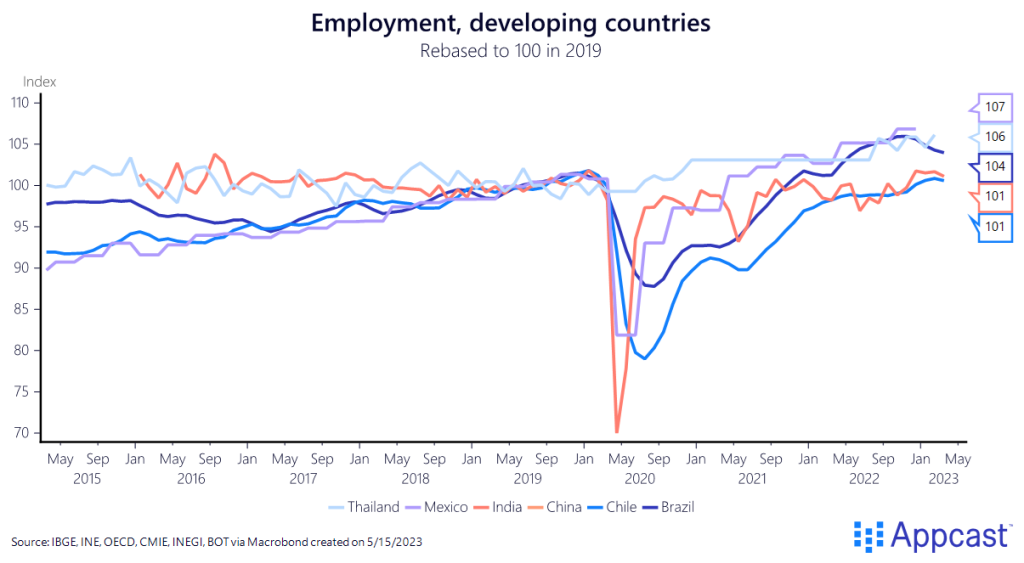

- Variation in recovery of labor demand post-COVID

In developing economies, employment growth has not been so straight and narrow as within advanced economies. The post-pandemic recovery was varied across developing economies, with more dips than flat-out growth, but employment levels have largely recovered beyond 2019 levels.

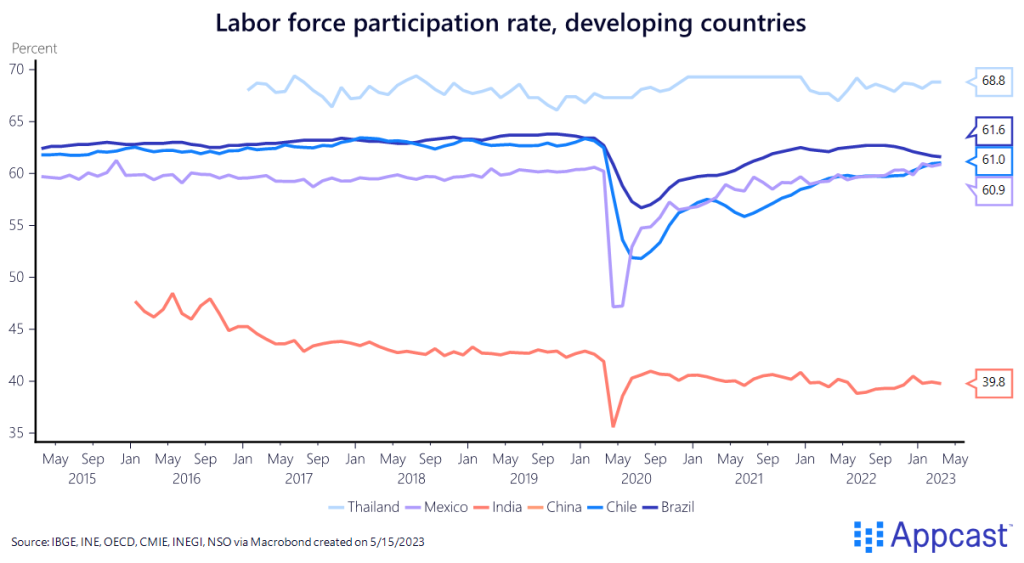

- Labor force bounceback is less dramatic

While advanced economies have seen workers return to the labor force, developing economies have seen a less-robust bounceback in participation. In India, participation has suffered, falling even before the pandemic and then taking a more dramatic hit that the economy has failed to recover from.

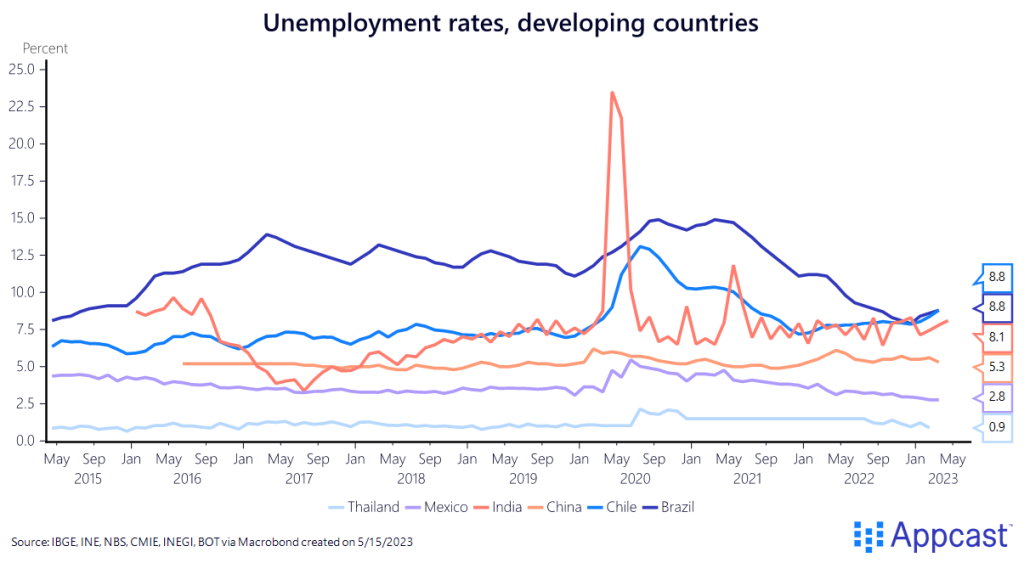

- Unemployment rates vary among developing economies

Unemployment rates are also varied across developing economies – labor markets are extremely tight in Thailand and Mexico, with rates of 0.9% and 2.8%, respectively. Elsewhere, unemployment is high and rising, at 8.8% in Chile, 8.8% in Brazil, and 8.1% in India. China’s rate is moderate, at 5.3%.

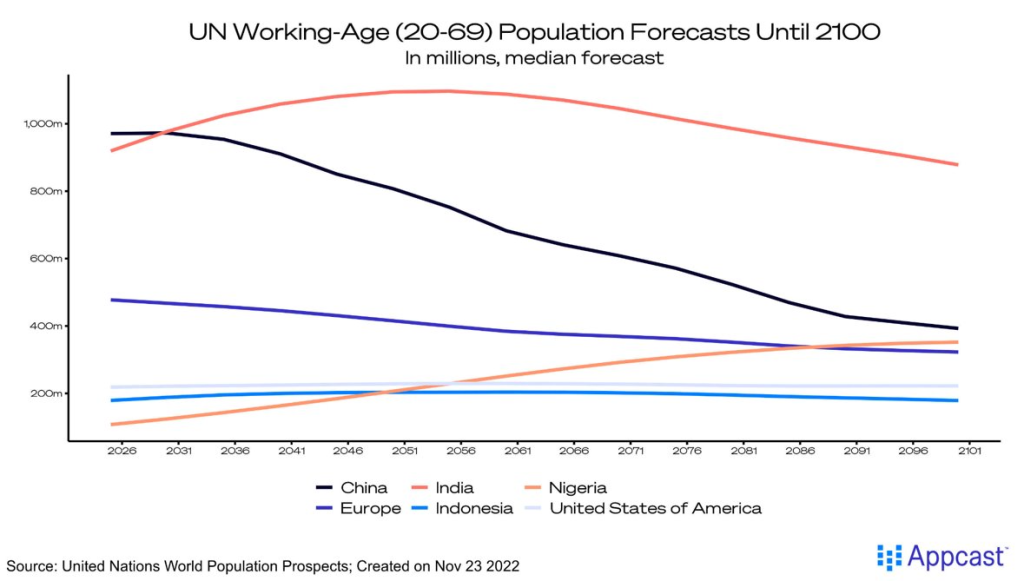

- Demographic shifts will reshape labor markets even further

Aging populations and lower fertility rates are transforming labor markets around the world, especially in developing economies. China, notably, will suffer from this labor market phenomenon: in the future, the labor market in China will become even tighter, challenging recruiters.

Conclusion

The world of recruiting underwent a shift after the pandemic and now in many areas it is in the process of correcting. But with economic strife of varying degrees occurring around the world, talent acquisition leaders are entering a new challenging phase of recruiting.