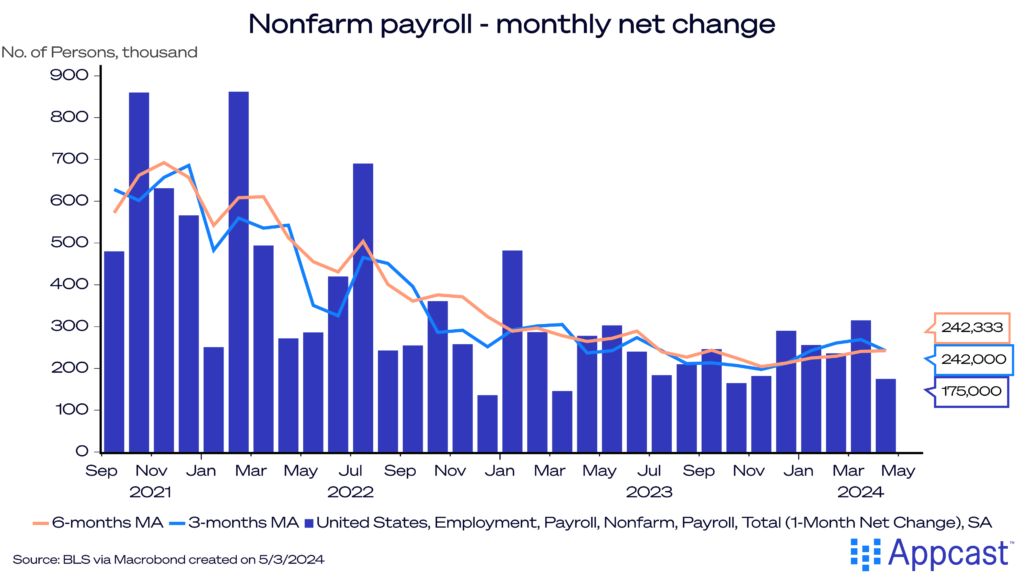

The labor market started the year off with a bang, boasting several months of job gains surpassing market expectations. In April, the opposite was the case: 175,000 new jobs were added against a forecast in the range of 250k, a bit weaker than economists and traders were hoping for. The labor market is not accelerating nor decelerating – it is maintaining a healthy clip that should reaffirm the Federal Reserve’s desire to cut rates later this year.

However, this is not a serious cause for concern as the labor market remains quite resilient. The gap between supply and demand continues to narrow. The unemployment rate ticked up just a smidge, to 3.9%. This continues the streak of unemployment being at or below 4% for 29 straight months.

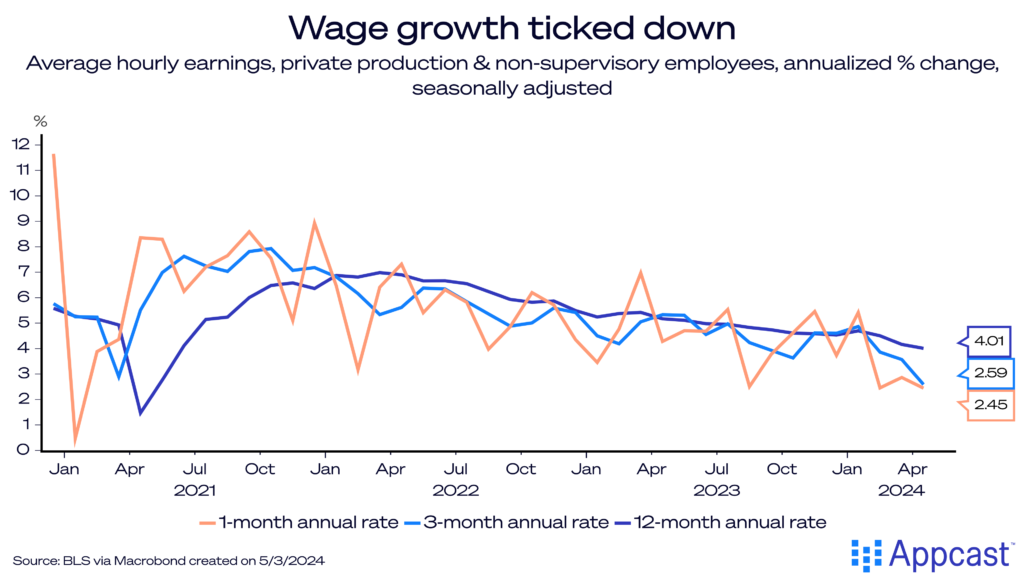

Wage Growth

Wage growth continues its deceleration pattern – increasing 0.2% from March to April for all workers against a forecast of 0.4%. The Federal Reserve is closely watching for signs of wage growth to potentially reignite in a similar pattern as inflation in Q1.

However, such a resurgence has yet to materialize, partly due to less job-switching by workers, a factor that drove much of the wage growth observed in 2021 and 2022. Recent data from the Job Openings and Labor Turnover Survey shows that overall separations (either voluntarily or involuntarily leaving a job) decreased by nearly 340k in March, further cementing the shift away from the “Great Resignation” to the “Great Stay”. As opportunities dwindle for job switching – this tampers wage growth. According to the Federal Reserve Bank of Atlanta, wage growth for job switchers has decelerated rapidly, down to 4.7%, returning to late 2021 levels.

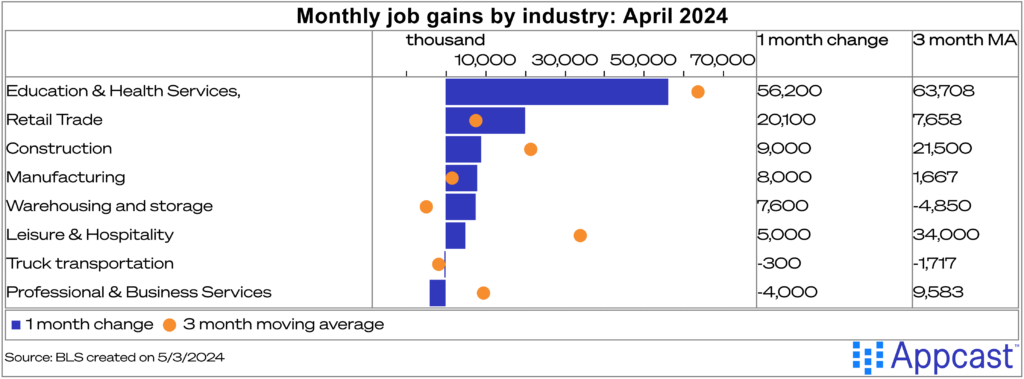

Industry specifics

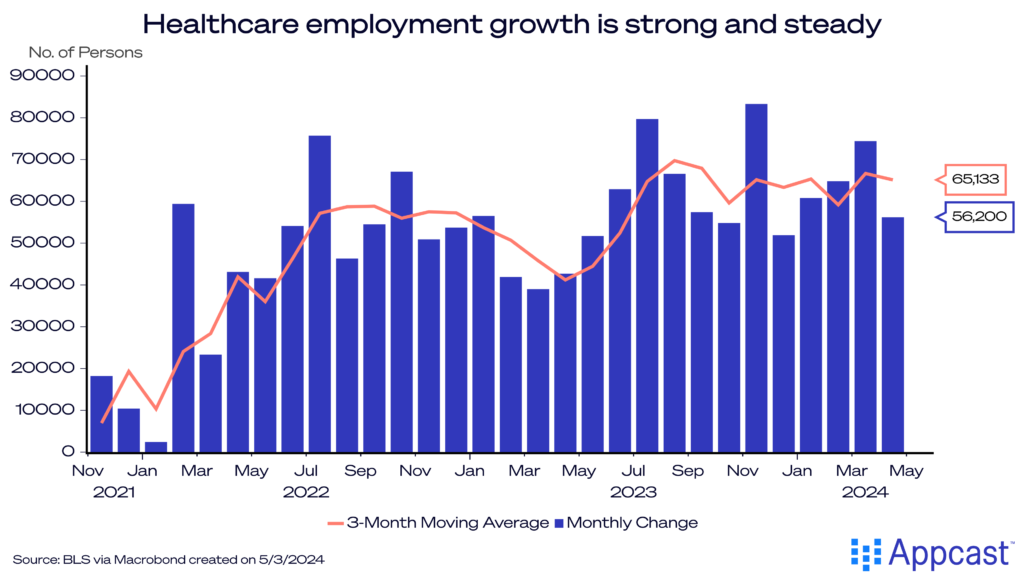

Once again, healthcare was a powerhouse, adding 56,000 net new jobs last month. This sector has been the true bastion of “standing-up” job strength. With continued strength in demand, this sector does not look poised to slow anytime soon.

This report also featured a few notable surprises. First, the usually strong construction and government sectors wobbled slightly, adding 9,000 and 8,000 net new jobs, respectively. Leisure and hospitality and professional and business services, other dependably strong sectors, also stumbled, with business services shedding 4,000 and leisure adding 5,000.

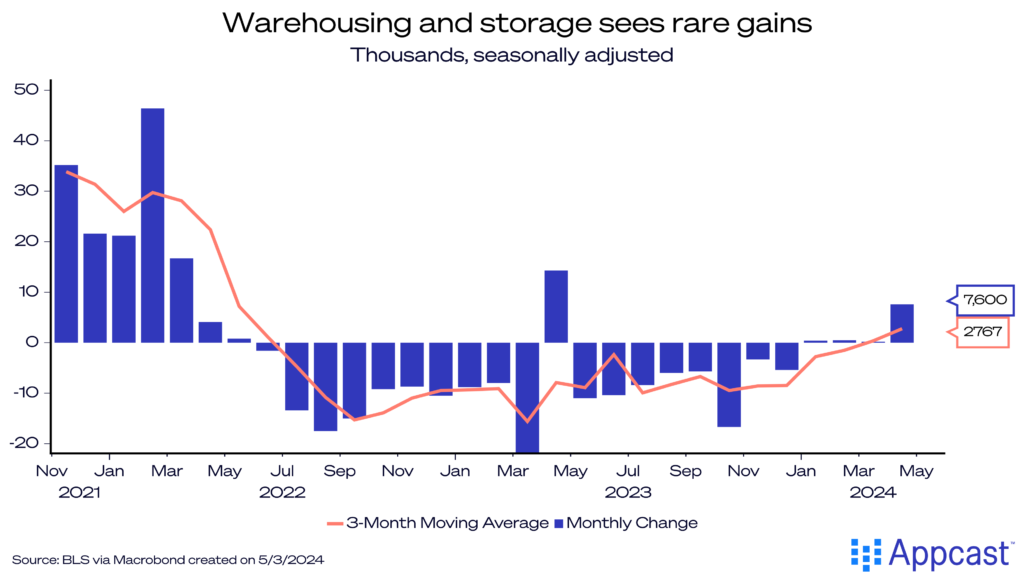

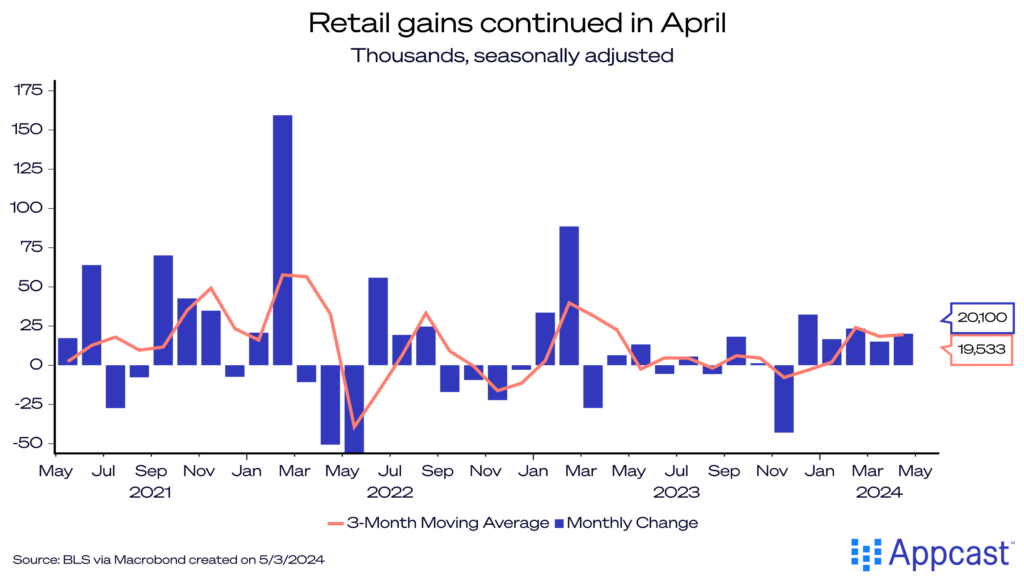

Secondly, some laggards pushed ahead last month. Transportation and warehousing added 22,000 jobs, strengthened by the warehousing sector, which has spent much of the past two years shedding jobs. Retail trade continued to trend higher, adding 20,000 net new jobs in April. This is a starkly different industry breakdown than we’ve seen in recent months, something to watch in the reports to come.

What does this mean for recruiters?

In short, recruiters’ jobs are getting easier as a whole. Of course, there is no one labor market – depending on the sector, recruiting can still be very difficult (like healthcare). The return to balance in supply and demand for labor will translate to lower recruiting costs, higher apply rates, and more viable candidates. Additionally, this is still a strong market – hiring may be slow in specific sectors (see: tech), but gains continue to be strong in healthcare and other key sectors. There was even some strength in unexpected places last month, like warehousing and retail. Plus, by coming in below expectations (especially in wage growth), this report will ease Federal Reserve fears slightly, perhaps teeing up a rate cut in the future if inflation slows as well.