Edit (Wednesday, October 30th): A previous chart on residential building permits in Arizona vs the U.S. has been changed to reflect population.

Thanks to the electoral college, the outcome of the U.S. presidential election will very likely be determined by a few key swing states, divided into two distinct groups based on their demographic and economic characteristics.

In the Rust Belt, three predominantly white and historically manufacturing-based states – Michigan, Pennsylvania, and Wisconsin – play a crucial role. These states, characterized by their industrial economies and blue-collar workforce, are showing relatively stronger support for Kamala Harris, reflecting her appeal to traditional Democratic voters and her policies aimed at revitalizing American manufacturing, a policy goal of the previous administration. Joe Biden won all of these states in 2020, and Harris is expected to carry them as well.

Conversely, in the Sunbelt, three rapidly growing states – Arizona, Georgia, and North Carolina – are more business-friendly and focused on construction and economic expansion (Nevada is potentially a fourth Sunbelt swing state). Residents have been unhappy with Bidenomics, which might by extension hurt Harris since voters will associate her with the previous administration. With their diverse, suburban, and significantly non-white populations, these states are now leaning more towards Donald Trump, who has championed deregulation and other pro-business sentiments.

This dichotomy highlights the varied economic and demographic landscapes that influence voter preferences and ultimately shape the electoral map.

Swing State Battlecard: Arizona

In this blog post, we cover the state of Arizona and provide some demographic, economic and labor market context. Every single one of these factors will influence which candidate will carry the state in this year’s election, but one may have an outsized influence in which way Arizonans decide to vote. The buzzing local economy would usually favor the incumbent candidate. However, severe discontent about recent inflation together with a sentiment of Trump being more pro-business seem to have swayed voters away from the Democrats.

Population dynamics

Demographic trends are one of the most important factors shaping how regional economies perform in the long run. Both local economic development and the demographic composition within states influence how people vote.

Demographic trends are one of the most important factors shaping how regional economies perform in the long run. Both local economic development and the demographic composition within states influence how people vote.

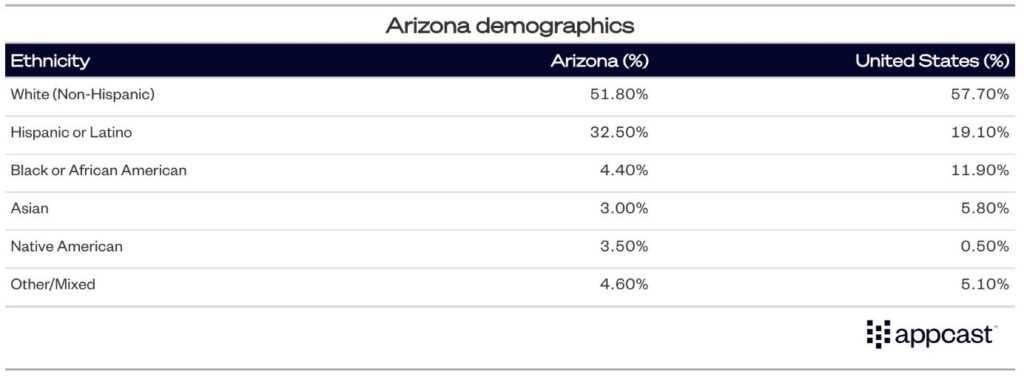

However, Arizona’s ethnic composition is strikingly different. Only 58% of Arizonans are non-Hispanic White (compared to about 60% for the U.S.). Given its geographic proximity to Mexico, Arizona has a much higher share of Hispanics and Latinos (32% compared to less than 20% in the U.S.). Latinos have turned away from Biden because of economic issues – dissatisfaction with the current economy – as well as a sense of political neglect from the Democratic party. But they are the key group that Harris will have to win over in the state to win it.

Housing market and rental prices

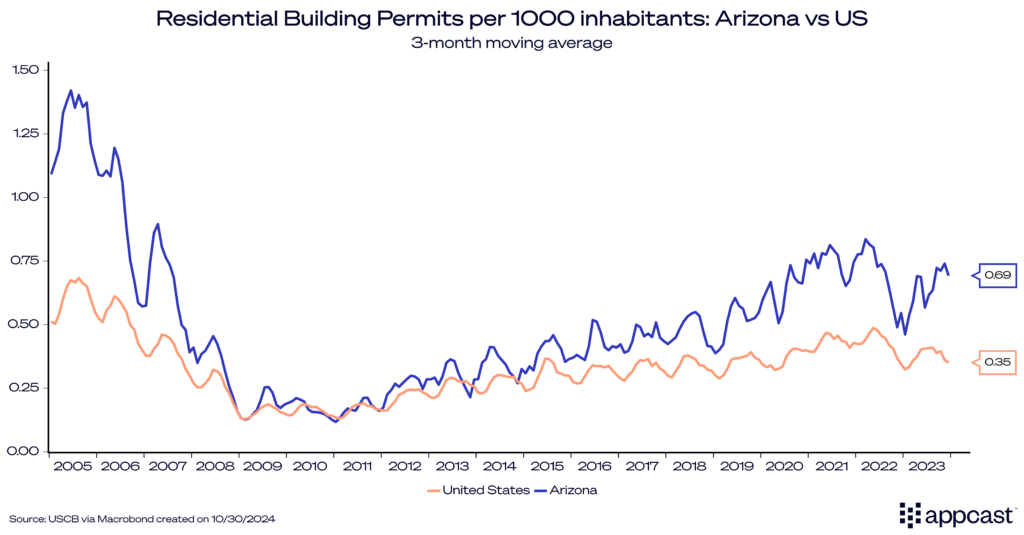

Following depressed growth in the decade after the Great Recession, housing construction has recovered well more recently. Arizona has built significantly more housing units recently than in the years before the pandemic. In fact, the state is building at almost twice the rate of the national average!

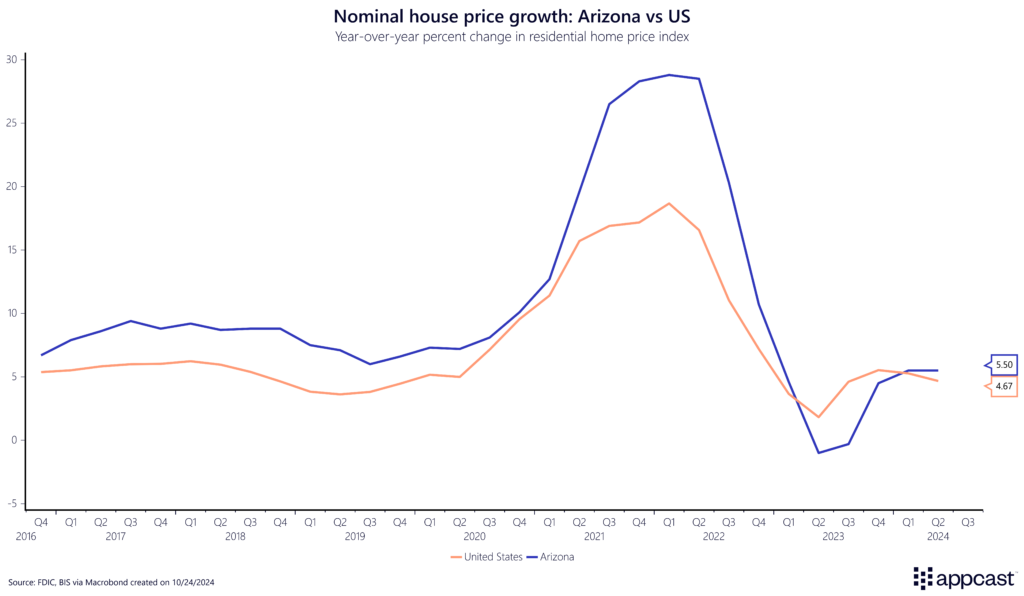

Nevertheless, house price growth has significantly outpaced the rest of the U.S., especially in 2021 and 2022. The main reason is that Arizona’s economy has outperformed the United States overall, therefore attracting a continuous inflow of workers from the rest of the country.

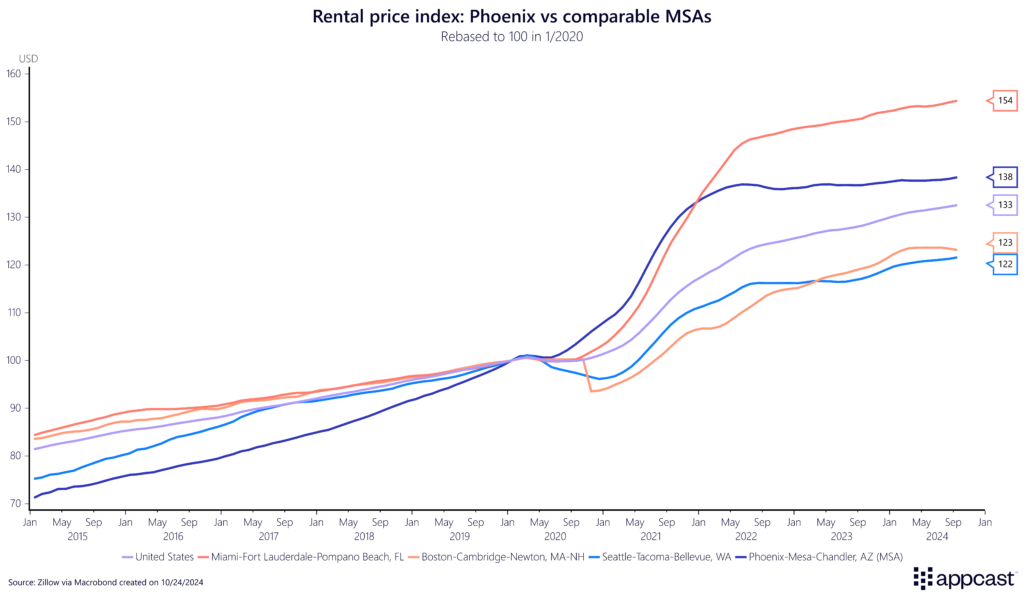

Rental prices in the Phoenix metropolitan statistical area (MSA) surged significantly faster between 2020 and early 2022 compared to many other MSAs of similar size like Greater Boston or Seattle.

However, since 2022, rental prices in Phoenix have stagnated while they continue to edge up elsewhere. Generally speaking, Arizona remains a place filled with cheaper housing compared to other parts of the country, especially the West Coast and the Northeast, which is precisely why the state continues to attract people.

Labor market outcomes

Arizona’s labor market was generally weak following the Great Recession, as the regional housing bust depressed the local economy for several years.

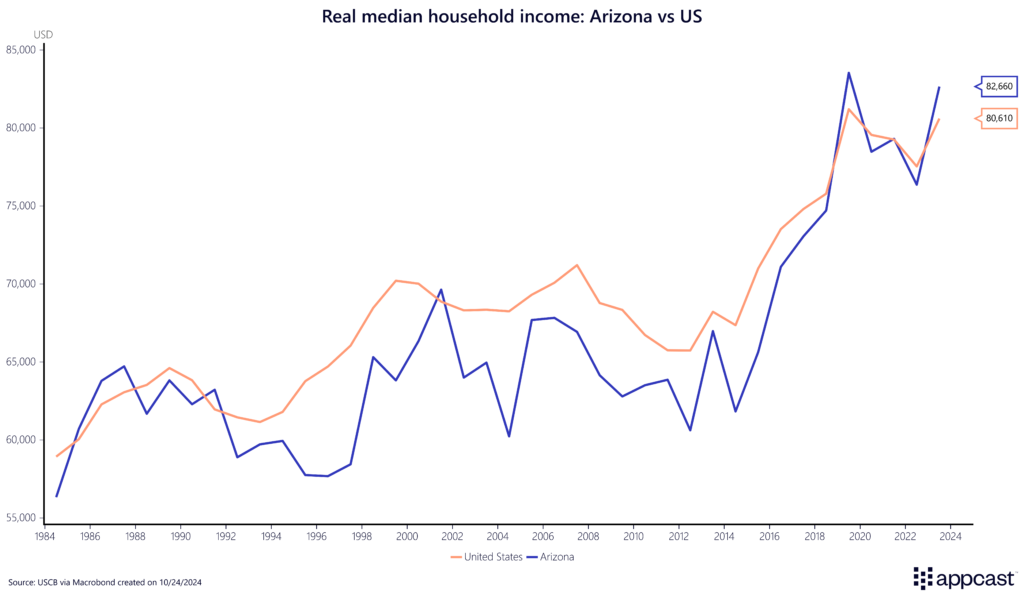

More recently, though, the state’s economy has outperformed. Some of the difference can be explained by the significant population growth Arizona has experienced thanks to its positive migration balance. Median household income has caught up and is now slightly exceeding the U.S. average.

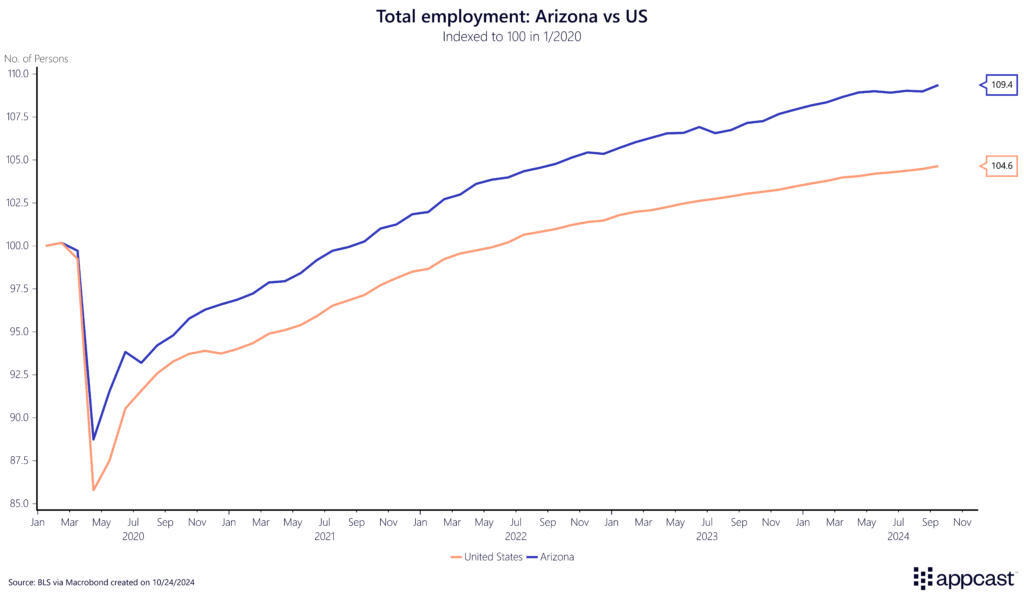

Arizona is also currently enjoying one of the strongest labor markets in the country. Since early 2020, job growth has increased by about 9% compared to only 4.4% for the U.S.

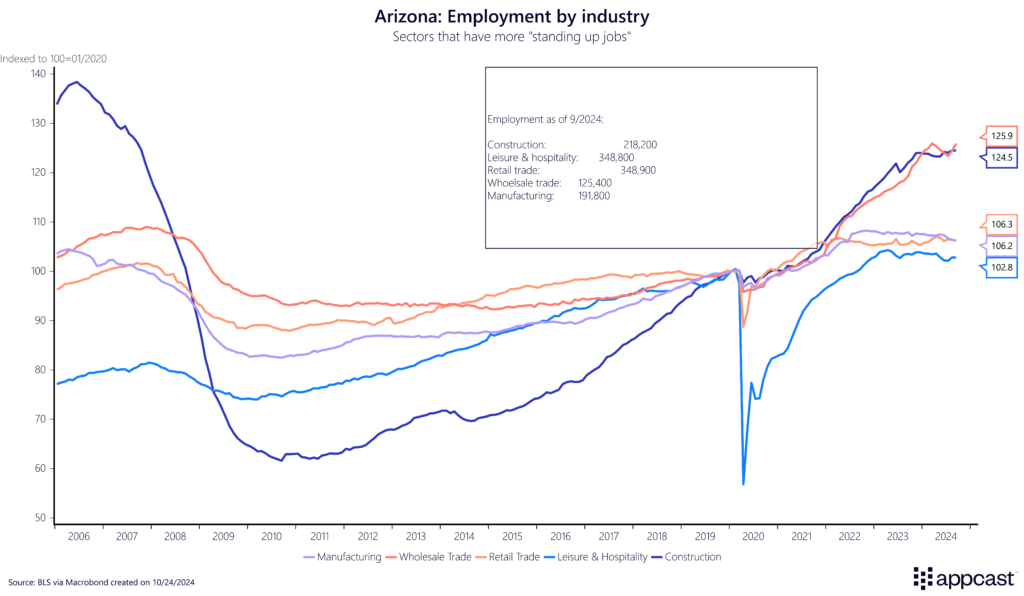

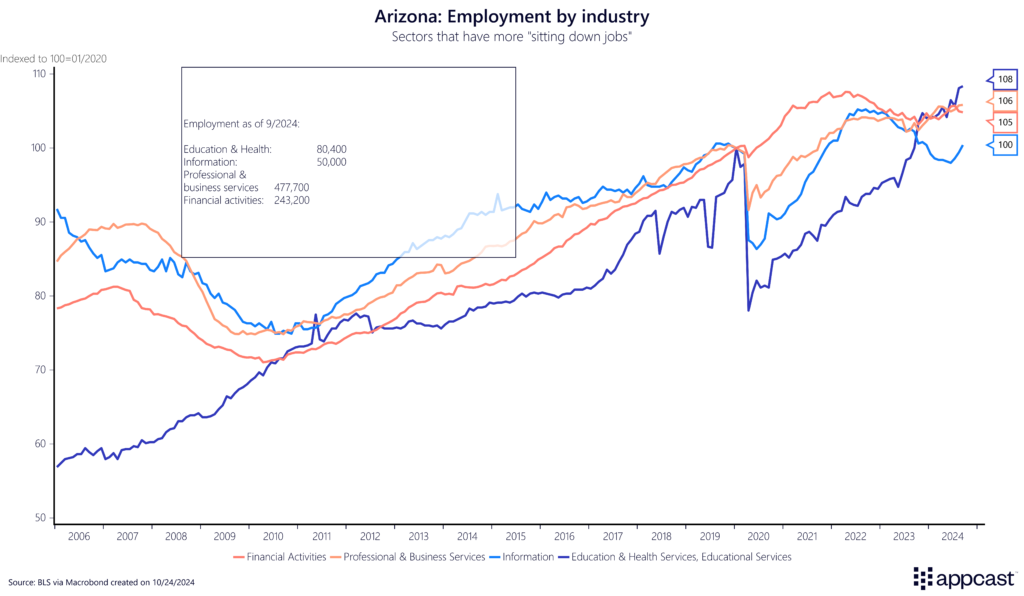

Employment across most industries has been steadily increasing in recent years, as one would expect in a growing state. However, there are some key sectoral differences. Sectors that have more “standing up” jobs (think, blue-collar) are thriving, while sectors with more “sitting down” jobs (think, white-collar) are seeing smaller gains.

This is very much mirroring national labor market trends with blue-collar doing reasonably well while professionals are struggling, some even speak of a white-collar recession.

Inflation Paradox

The local economy and labor market are strong, which would normally lead to support for the incumbent. So why the switch to the right?

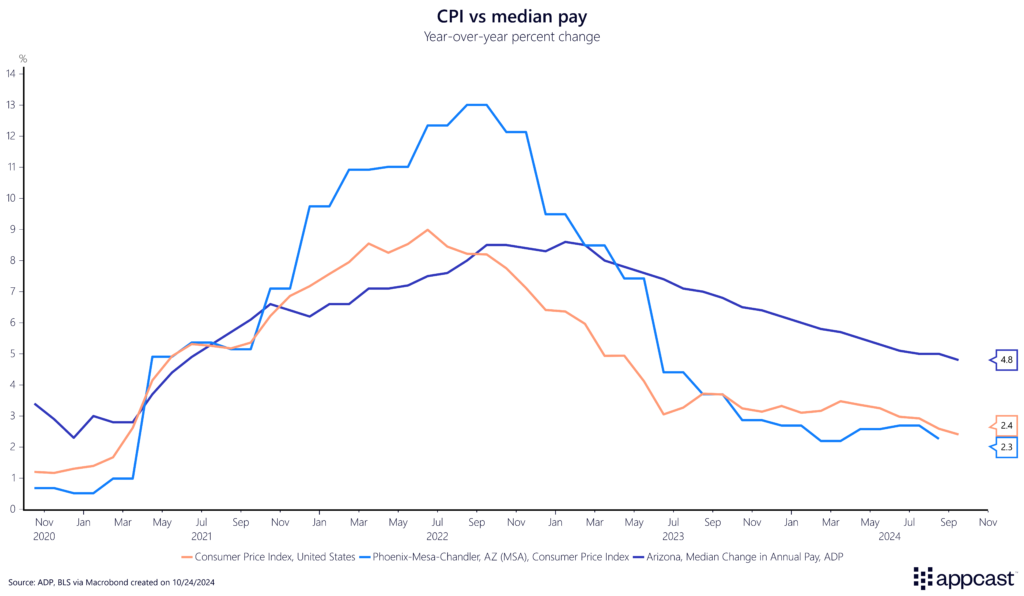

Inflation can probably resolve the puzzle. Wages have generally kept up with the rapidly rising price level since 2020. However, most people generally feel that they “deserve” higher compensation while price increases are regarded as “unfair.”

The price surges following the pandemic have come as an extreme shock to many after two decades of extremely low and stable inflation, depressing consumer sentiment ever since.

Inflation in large MSAs like Phoenix has exceeded the national average by a significant amount. And after roughly two years of declining purchasing power, real wage growth only turned positive about a year ago.

What does that mean for recruiters?

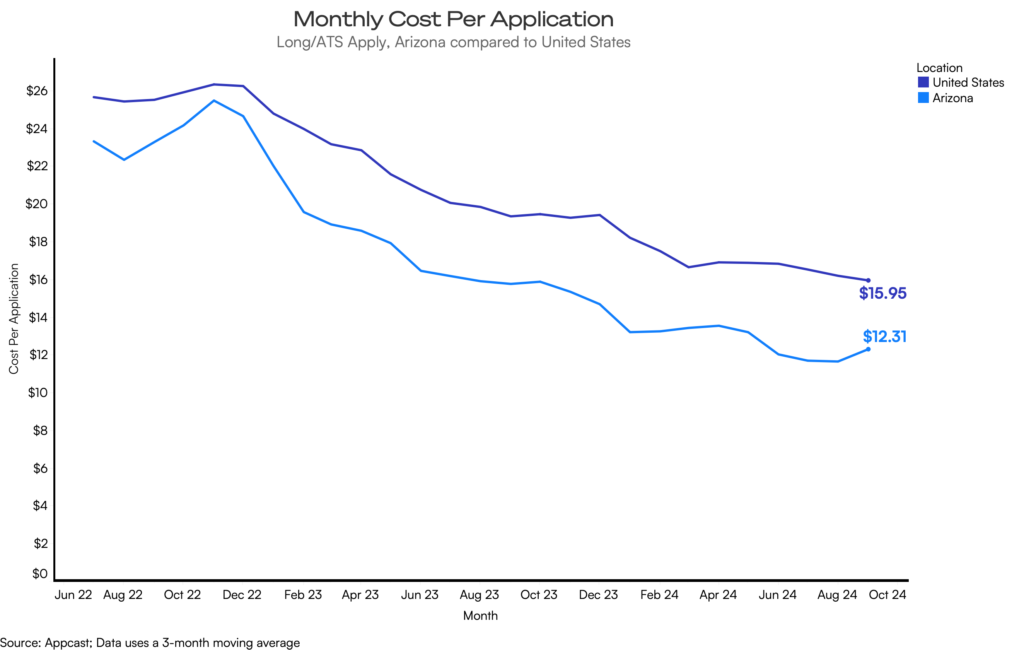

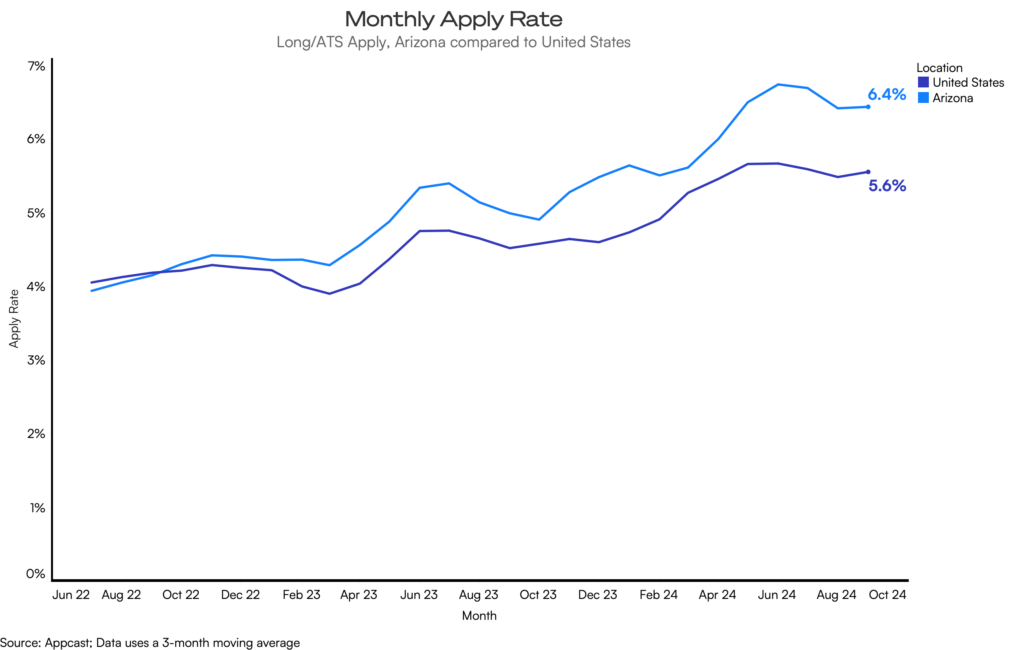

Arizona offers strong potential for recruitment, thanks to its lower cost-per-application and higher job seeker activity (apply rates). Recruiters in fast-growing sectors like construction and retail can leverage a larger talent pool, though they may encounter increased competition as the state’s labor market continues to expand.

The state’s growing diversity, particularly with a higher share of non-white Hispanic workers, provides a valuable opportunity for recruiters to enhance diversity hiring efforts and tap into a broader candidate base.

However, the biggest recruitment challenge in Arizona is the recent rise in the cost of living, particularly housing and everyday essentials. This could impact both attracting new talent and retaining workers, as affordability becomes a growing concern for many job seekers.

What’s the outlook?

Arizona’s economy is buzzing. The state continues to attract a significant inflow of people from other states. House and rental prices have increased but Arizona still offers relatively cheap housing. The labor market is doing well, and employment gains are broad across sectors.

Despite that economic strength, it looks like the incumbent is unlikely to win in the state, contrary to historical norms. Many polls indicate that Latino voters seem less inclined to support Harris than they did Biden four years ago, which will make it extremely difficult for her to win Arizona this fall. What explains this vibe paradox? Well, inflation has been a drag on consumer sentiment for some time. Most consumers had fairly anchored prices in their mind before the pandemic hit. The inflation shock therefore upset many even if wages have kept up. Biden, and Harris by association, is being blamed for the poor aspects of the economy while not being credited with the boom.