Economic growth in the U.K. has surprised on the upside

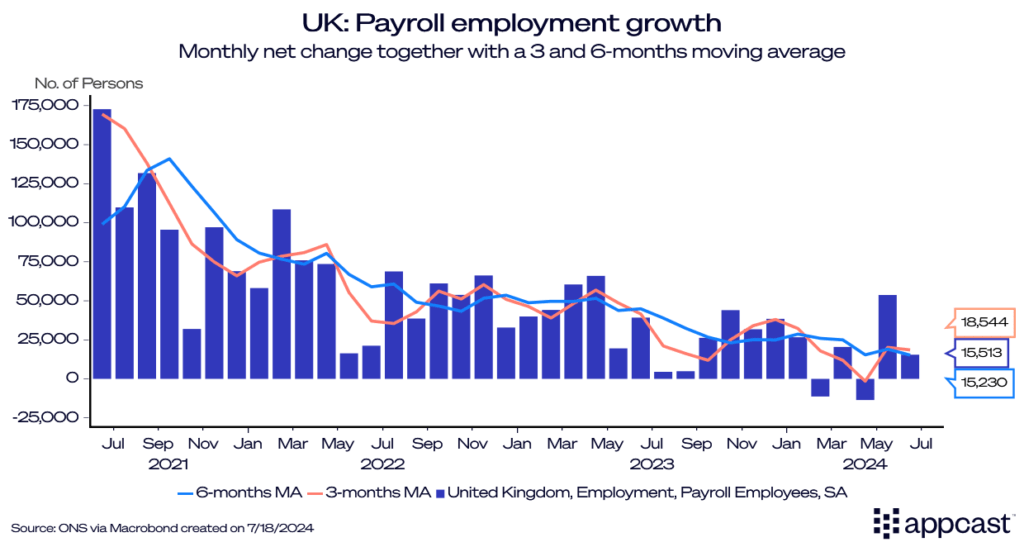

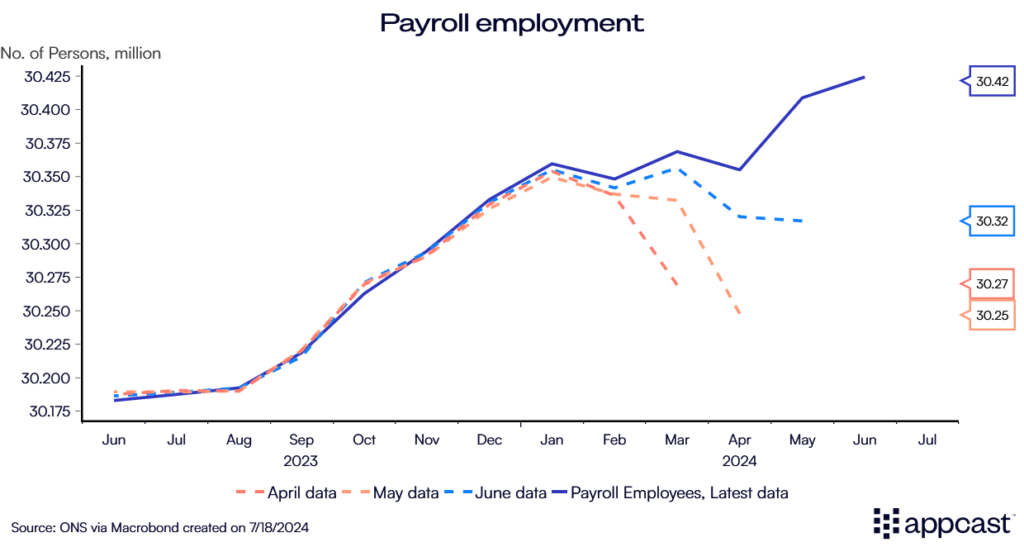

This week’s employment report showed some good news on the jobs front. The U.K. labor market added some 15,000 payroll jobs in June and close to 54,000 jobs in May, much higher than previously estimated (the May number was initially negative). While the pace of job creation has slowed compared to a couple of years ago, it has remained positive.

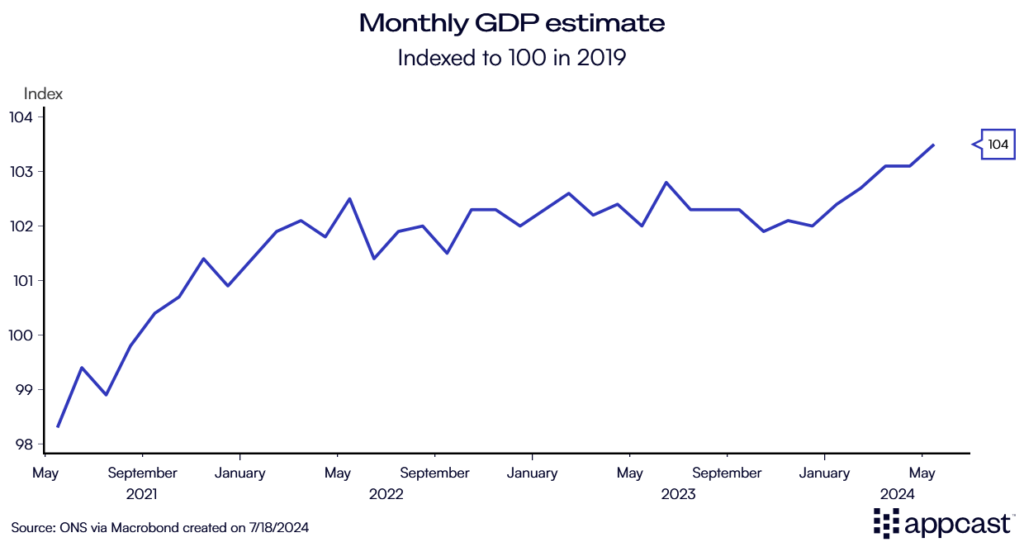

Economic projections for the U.K. economy have consistently been too pessimistic. At the beginning of the year, most forecasters assumed that the economy would be stagnant throughout 2024. Growth estimates from the International Monetary Fund (IMF) and Bank of England (BoE) were below 0.5%. The assessment back then was that high interest rates would be a major constraint and hold back economic growth.

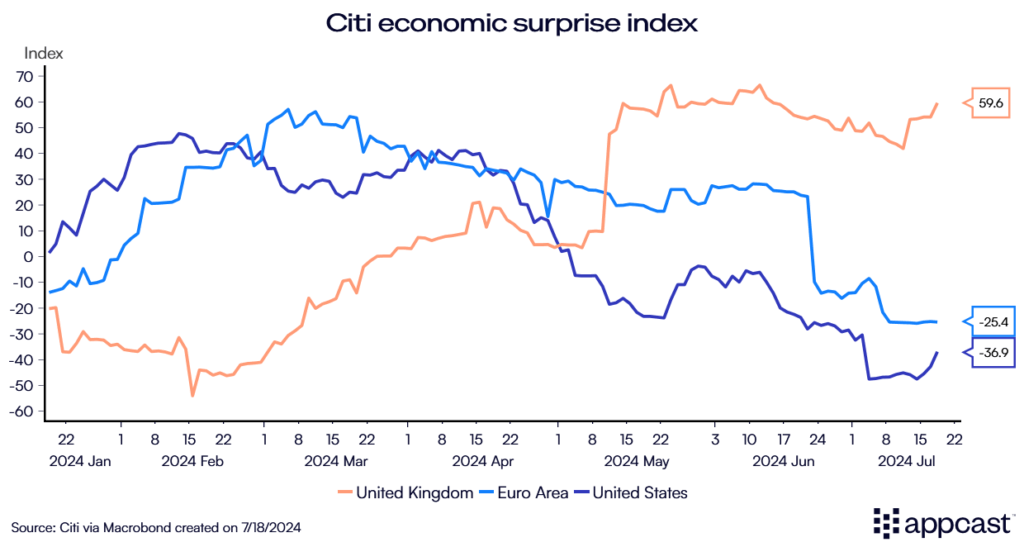

Luckily, economic data in the U.K. has continuously surprised on the upside in recent months, contrary to what we have seen for the economies of the U.S. and Eurozone.

The Citi economic surprise index – an indicator that shows to what extent economic data is beating or missing forecasts – surged in May when the Q1 GDP number for the U.K was released, showing that the economy was coming out of the 2023 recession with much faster growth than anticipated.

The latest data shows a rate GDP growth of 0.7% for Q1 (approximately 2.8% annualized growth), a significantly faster expansion than in the Eurozone or the United States.

And monthly GDP figures for the U.K. show that the good news is likely to continue in Q2, as flash estimates indicate positive growth numbers for April and May.

As a result of the positive economic data surprises in the first half, 2024 growth forecasts for the U.K have been revised upwards several times, reaching 0.7% more recently.

This is still only half the pace of the U.K.’s trend growth rate, the speed at which the economy should grow in the long run without being hold back by insufficient demand.

But for 2025, the IMF is now estimating growth of 1.5%, implying that monetary policy should not have any big negative effects on the economy and labor market by then.

Meanwhile, high interest rates and tight money remain a major constraint for the economy this year, especially as some households have yet to experience the inevitable mortgage shock when their fixed rate adjusts to a higher flexible rate.

But the assessment is that these headwinds will fade next year as interest rates will slowly start falling again.

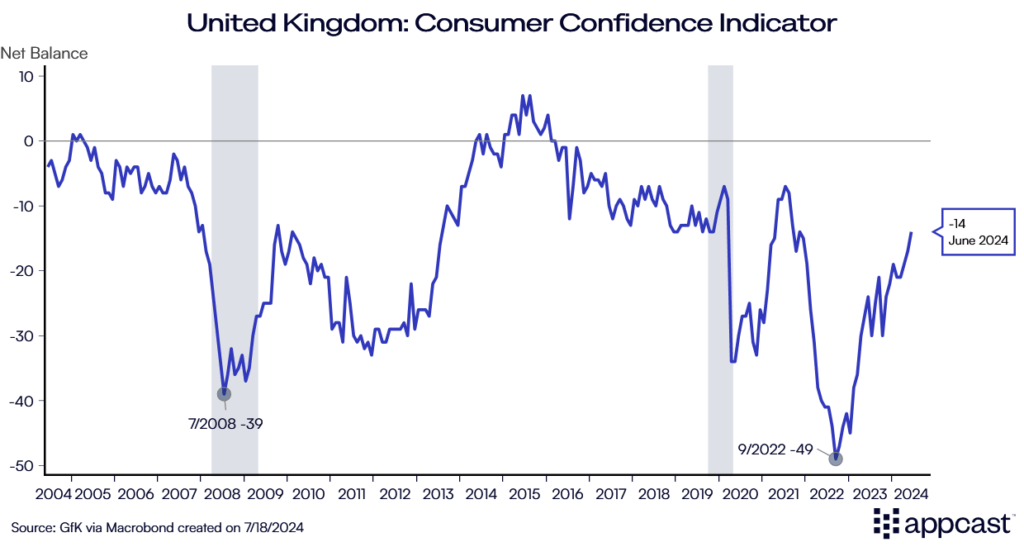

Consumer confidence has increased as real wages are rising again

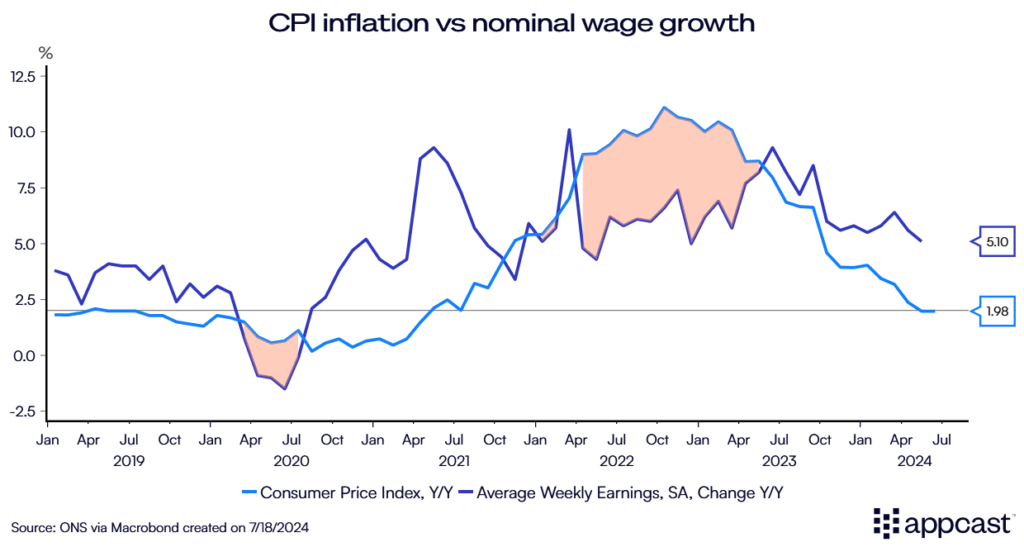

Consumer confidence was historically depressed coming out of the pandemic as inflation surged and interest rates rose rapidly. With inflation coming down from more than 10% at the end of 2022 to 2% more recently and interest rate cuts on the horizon, consumer confidence has started to recover and continues to improve throughout the year.

Moreover, as inflation has fallen much more quickly than nominal wage growth, real wage growth has turned positive again last year and now stands comfortably at close to 3% (depending on the precise measure you use). This is, of course, a much-needed relief for consumers and workers, who are finally clawing back some of the lost purchasing power they experienced during the inflationary surge.

On the other hand, it is also a thorn in the eye for monetary policy makers since more than 5% nominal wage growth is inconsistent with the 2% inflation target in the long run. The BoE will therefore only start normalizing interest rates if nominal wage growth, especially in the service sector, continues to come down a notch.

Previous payroll employment losses have been revised away

As mentioned above, payroll job growth has been underestimated in recent months. In fact, previous employment reports showed some minor job losses with payroll employment slightly contracting between January and May.

These job losses have now been revised away though. The new data estimates that payroll employment has grown by roughly 90,000 since the beginning of the year, which is more consistent with the good news we have seen for other economic data, such as GDP figures, consumer sentiment, and real wage growth.

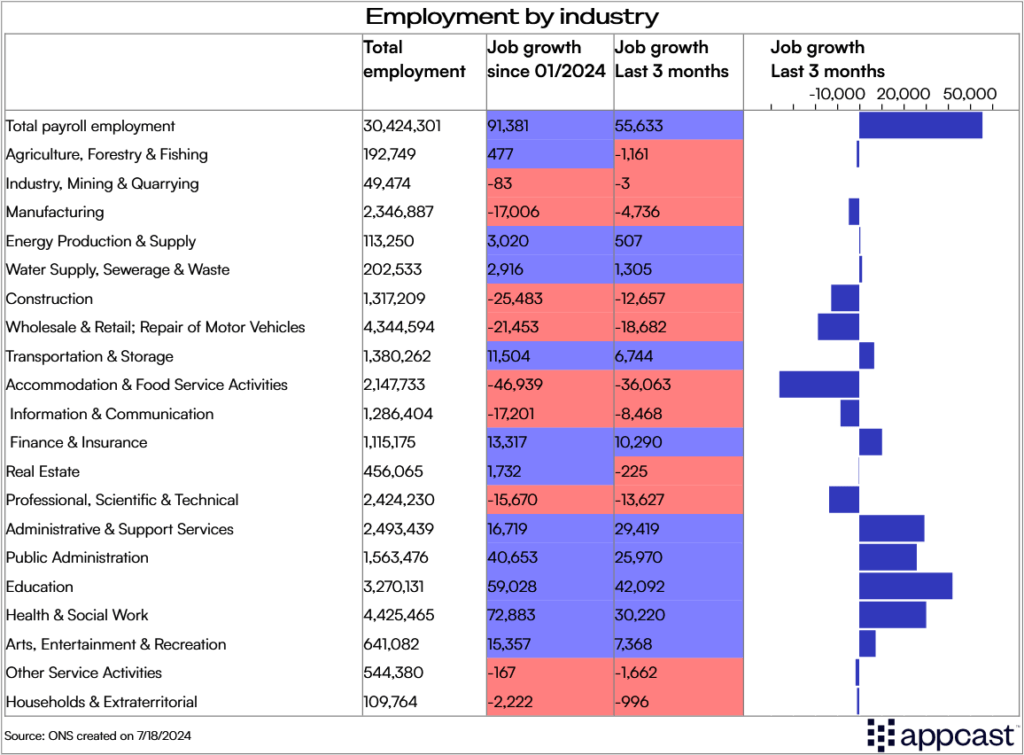

There are some sectoral divergences though. Even with the most recent revisions some sectors have seen some minor job losses since January. Education, healthcare, and public administration are the three sectors that have contributed the most to the positive job numbers.

Retail, hospitality, and construction, on the other hand, have seen the highest job losses. As we have previously explained, these sectors have been affected by record precipitation that the U.K. has experienced since the beginning of the year. The continuous rainfall has deterred consumers from going to the stores and pubs. And it has also negatively affected construction.

What does that mean for recruiters?

The most recent jobs reports shows that the U.K. labor market continues to add jobs, even if at a slower pace than in previous years. The minor job losses from previous months have been revised away. The most recent data shows that some 90,000 payroll jobs have been added since January, which is more consistent with the other positive economic data surprises for the U.K. economy.

Recruiters should be aware that economic data can be volatile and subject to large revisions in later releases. This is particularly true with labor market data. In fact, every single employment report between April and June showed minor job losses compared to January 2024. And only with July’s data, these negative employment numbers have been revised away.

Recruiters should therefore not put too much weight on the latest data release when informing themselves about the labor market but rather take a more holistic approach that takes medium and long run trends into account.