Canada’s labor market and broader economy have been teetering on the edge of recession for several months. However, the latest job numbers provide a glimmer of hope. In February, Canada added 40,700 new jobs, a respectable gain given the high interest rate environment.

For the past several months, we have closely tracked the gradual rise in the unemployment rate, along with slipping labor demand, as indicators of a potential downturn in the labor market. This month, however, offers another much-needed boost of optimism, suggesting that employer demand for hiring may continue to chug along.

Labor Force Trends

Nominal wage growth remains elevated, with average hourly earnings up over 5% year-over-year. However, they have been gradually cooling over the past six months. Total hours worked have managed to stay positive, increasing by 0.3% from the previous month.

The unemployment rate increased 0.1 percentage points to 5.8%, with a noticeable jump to 6.1% for men compared to 5.5% for women. This gender divergence has historical precedence – during the height of the Great Recession the unemployment rate for males reached a peak of 10%, compared to just above 7% for women.

The silver lining is that the latest figures are still near historical lows, indicating that despite a weakening labor market, the long-term trend remains positive.

One trend we’ve been watching is the share of part-time employment growth compared to full-time. For prime-aged workers (25-to-54 years old), full-time employment growth has gradually been slipping, down from around 6% year-over-year in early 2022 to below 3% last month.

However, part-time employment has been rapidly growing after significant losses in 2021. Extrapolating away from the month-to-month volatility of part-time employment changes, the trend line is clear – hiring demand is now favoring this employment arrangement.

Sector Trends

The “growth gap” between goods-producing and service-producing industries continues to widen, as the former lost a total of 6,700 jobs last month, while the latter gained just under 47,000 jobs.

Employment gains were generally broad-based last month, with large increases in accommodation & food services (+26,000), professional and technical services (+17,900) and construction (+10,500) leading the way.

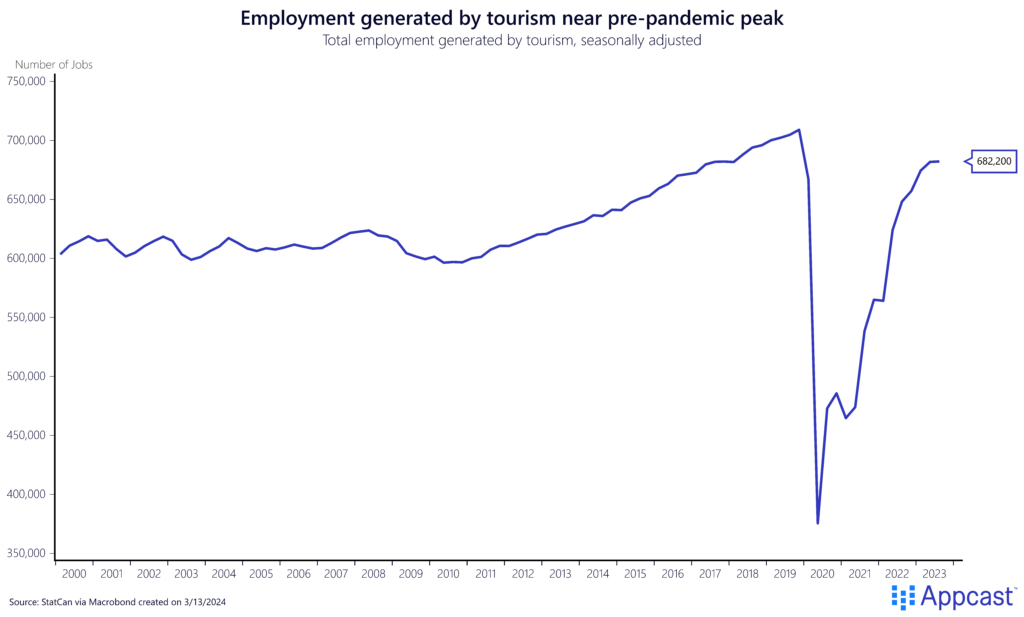

Honing in on the robust growth for accommodation & food services – one series to track is the total employment generated by tourism. Following a severe drop due to COVID, jobs created due to tourism have rebounded rapidly and are nearly back to their pre-pandemic peak.

What does this mean for recruiters?

The Canadian labor market has been flirting with a downturn for several months, but the most recent job report offers a glimmer of hope. Recruiters looking to hire in customer-facing industries such as restaurants can remain optimistic. However, those in sectors focused on producing consumer and industrial goods, like manufacturing, are encountering a slower environment.

The Bank of Canada has ruled out a rate cut this quarter, indicating inflation is still top-of-mind for policymakers. As the labor market continues to teeter on the edge of recession, the balance between inflation and economic growth will have tremendous impact on the hiring outlook for the remainder of 2024.