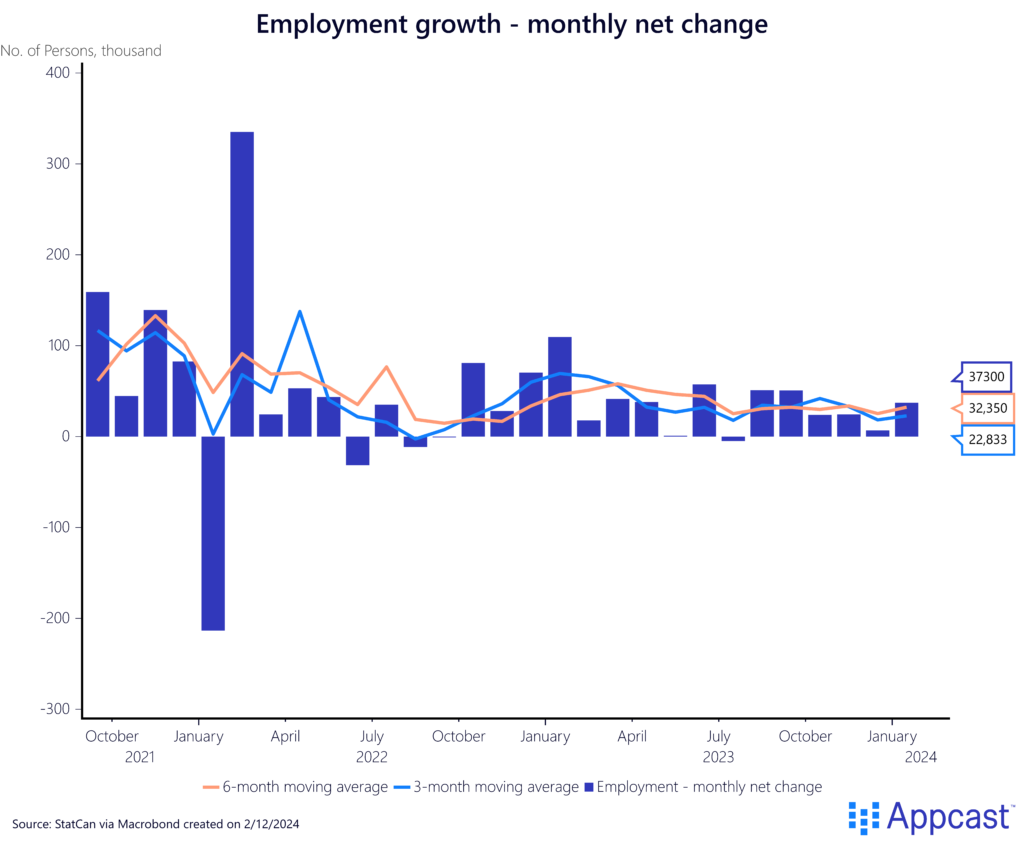

After a poor start to the year, the labor market in Canada surprisingly bounced back, adding 37,300 new jobs in January. The headline number is assuredly a good sign after several months of weak employment growth – however there are some details that are potentially concerning.

First, the majority of growth in the headline number was from an increase in part-time employment (+49k). Full-time employment fell by nearly 12,000 jobs (-11.6k), a concerning signal about the demand for hiring. This could potentially suggest a shift towards less-stable employment conditions, undoing several years’ worth of gains of full-time work.

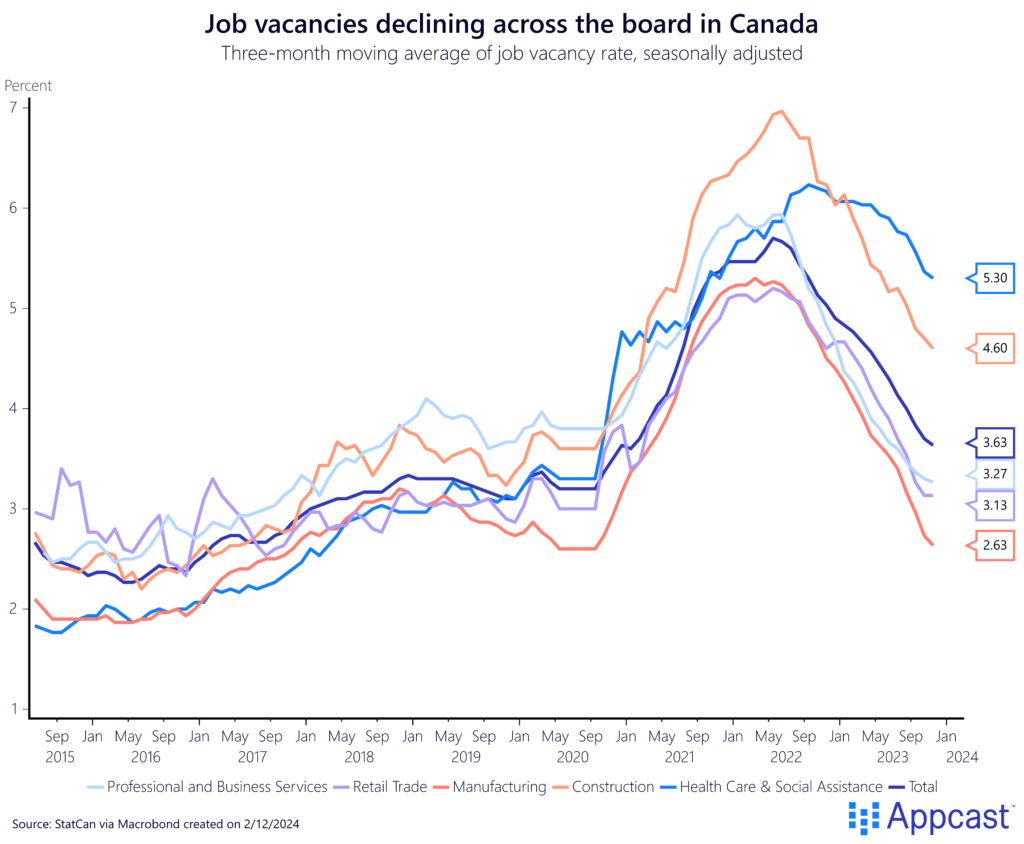

The overall demand for workers in Canada has notably decreased across all major sectors. For instance, in the construction industry, the job vacancy rate has sharply fallen from nearly 7% in 2022 to just 4.6% in the last winter.

Similarly, other key sectors, such as manufacturing, professional and business services, and retail, have seen a significant reduction in job openings, with rates now at or below their pre-pandemic levels. This shift highlights a critical point: while hiring demand has cooled, it remains in line with or just slightly below the job opening trends observed in 2019.

Labor force trends

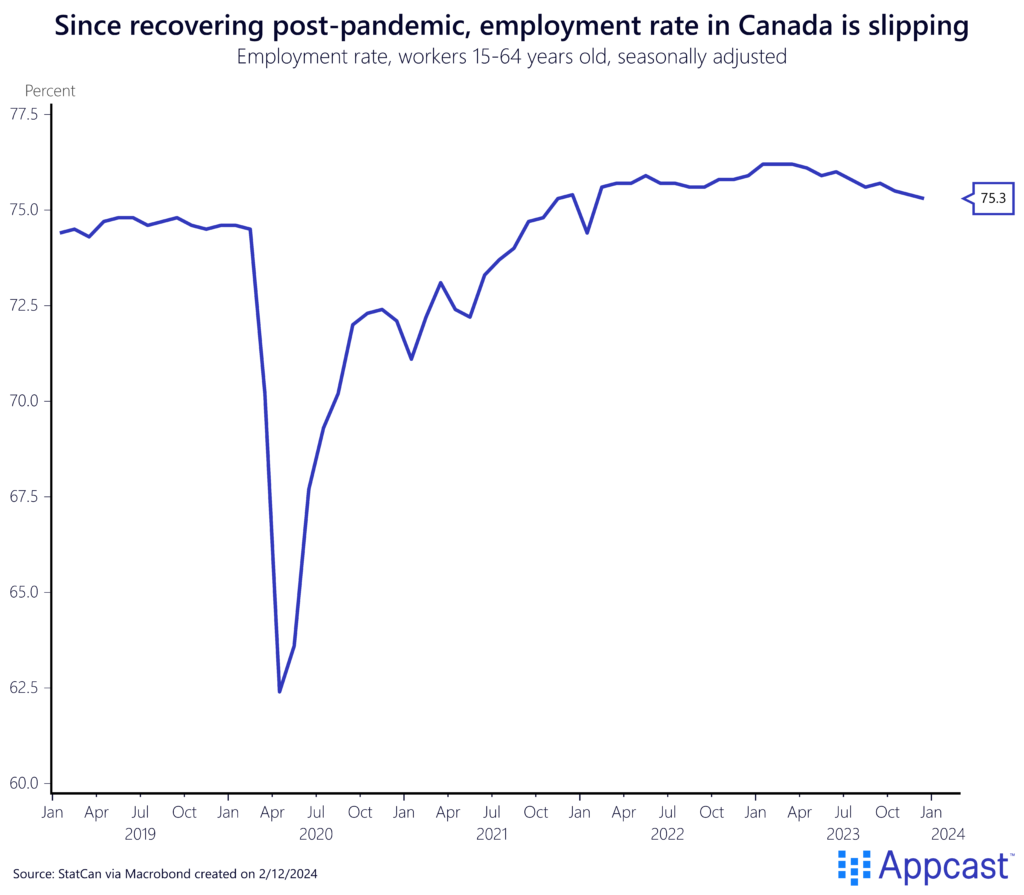

For the fourth consecutive month, Canada’s employment rate – the percentage of the working-age population that is employed – has fallen slightly by 0.1 percentage points. This ongoing decrease in labor supply is a growing concern for the country’s economy, indicating that a larger portion of the workforce is not working or earning an income.

The decline is more pronounced in the prime-age employment rate for both men and women, which dropped by 0.3 percentage points in January. This decline among workers in their prime years is particularly worrisome, as it suggests that key segments of the labor market are facing challenges, potentially affecting Canada’s economic stability.

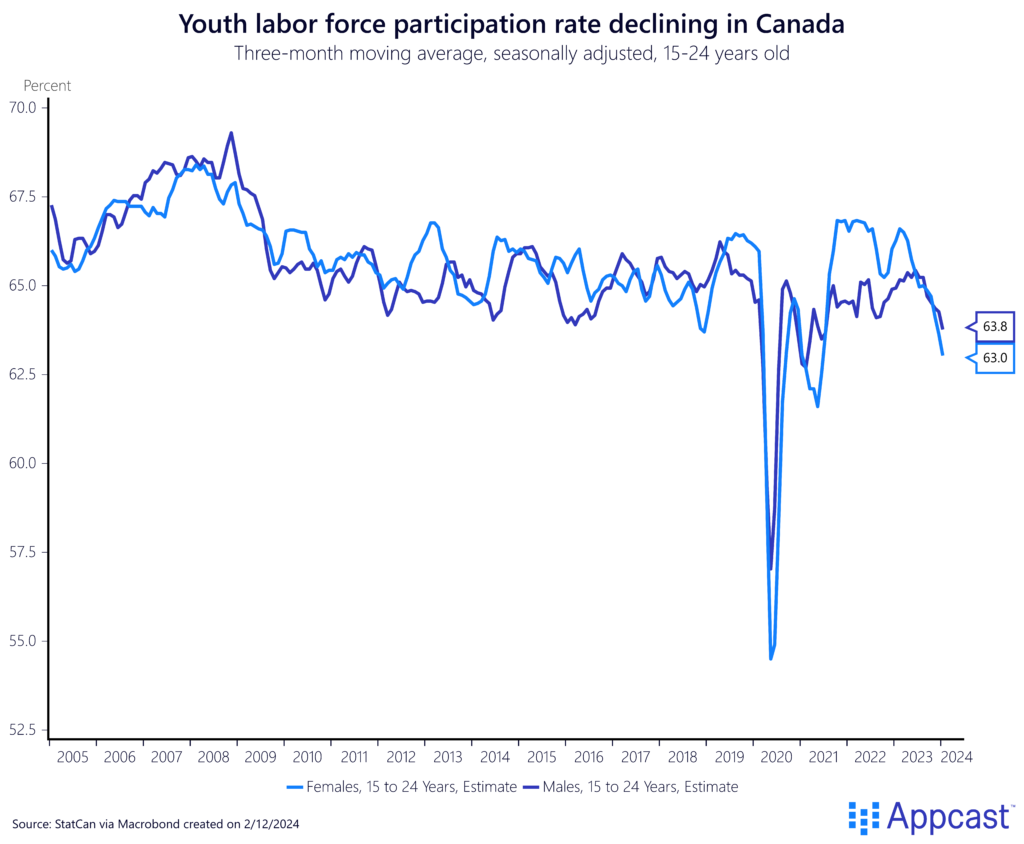

For younger Canadians, the labor market situation appears particularly bleak. After hitting a peak in late 2021, the labor force participation rate among the youth (aged 15-24) has seen a significant decline. Within a year, the participation rate for young women plummeted by three percentage points, reaching its lowest level in several decades. Similarly, the participation rate for young men has also fallen, approaching near-historical lows.

This downturn in youth participation in the labor force underscores a growing concern about the engagement and employment prospects of younger Canadians in the economy.

Despite the downturn in labor supply, wage growth in Canada has maintained a notable pace, remaining elevated against the backdrop of rising prices. Wages have increased by just under 5.3% from the year prior, indicating that incomes are, to some extent, keeping up with inflationary pressures.

Sector trends

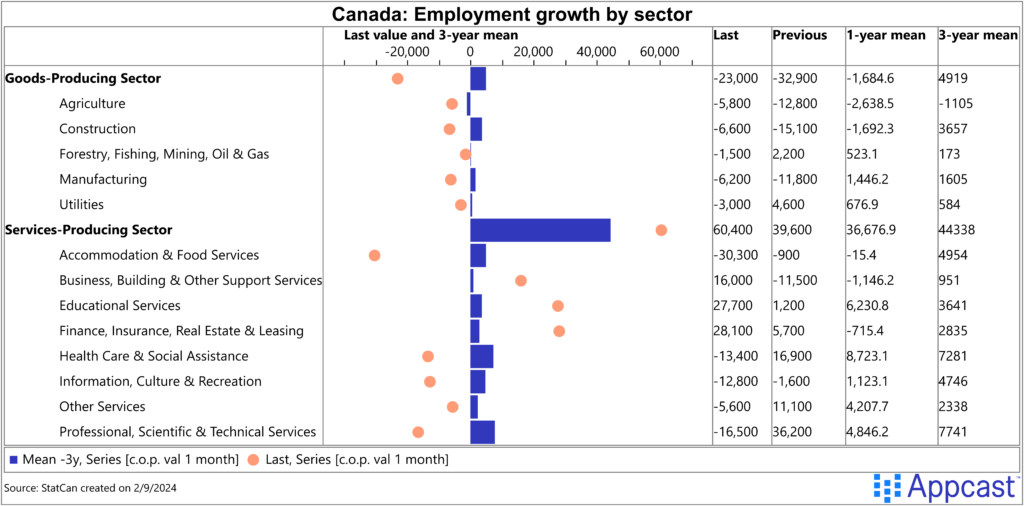

Over the past six months, a discernible trend has emerged in the Canadian labor market, distinguishing the employment growth patterns between goods-producing and services-producing sectors. This trend persisted in the latest data, with services-producing industries continuing to outpace their goods-producing counterparts in job creation.

A notable development was observed in the wholesale and retail trade sector, which added a significant 31,000 new jobs, marking a robust recovery after a period of sluggish growth at the beginning of the winter. On the other hand, the accommodation and food services sector experienced a substantial contraction, shedding 30,300 jobs, a downturn that followed closely on the heels of seasonal hiring peaks.

Overall, growth remains concentrated in industries that require interaction with another person, whether that’s a registered nurse, financial planner, or fast food worker. All of these industries are outgrowing sectors that produce finished goods.

What does this mean for recruiters?

The early 2024 Canadian labor market rebound, with a significant addition of part-time jobs overshadowing a decline in full-time positions, presents a mixed outlook for recruiters. A general decrease in worker demand across major sectors, alongside falling employment rates, especially among young and prime-age workers, signals a challenging environment.

Despite these hurdles, wage growth remains strong, and service sectors, especially those requiring direct human interaction, continue to see job growth. Recruiters should note the shifting job market dynamics, recognizing the need for strategic hiring goals in 2024.