We recently noted the divergence between soft economic indicators and hard economic data for the U.S. and Germany. For both countries, surveys and other soft data have hinted at a severe economic recession. Actual hard economic data like employment and GDP growth, on the other hand, have performed better than expected by forecasters and surprised on the upside.

In what follows, we will have a look at whether the same can be said for the UK economy.

Soft data worse than ever before

The business and consumer outlook has deteriorated significantly in the U.K. The economy was hit by a double whammy in 2022: the highest inflation rate since the 1970s due to the energy crisis and a severe economic growth slowdown as the negative effects of Brexit started to materialize.

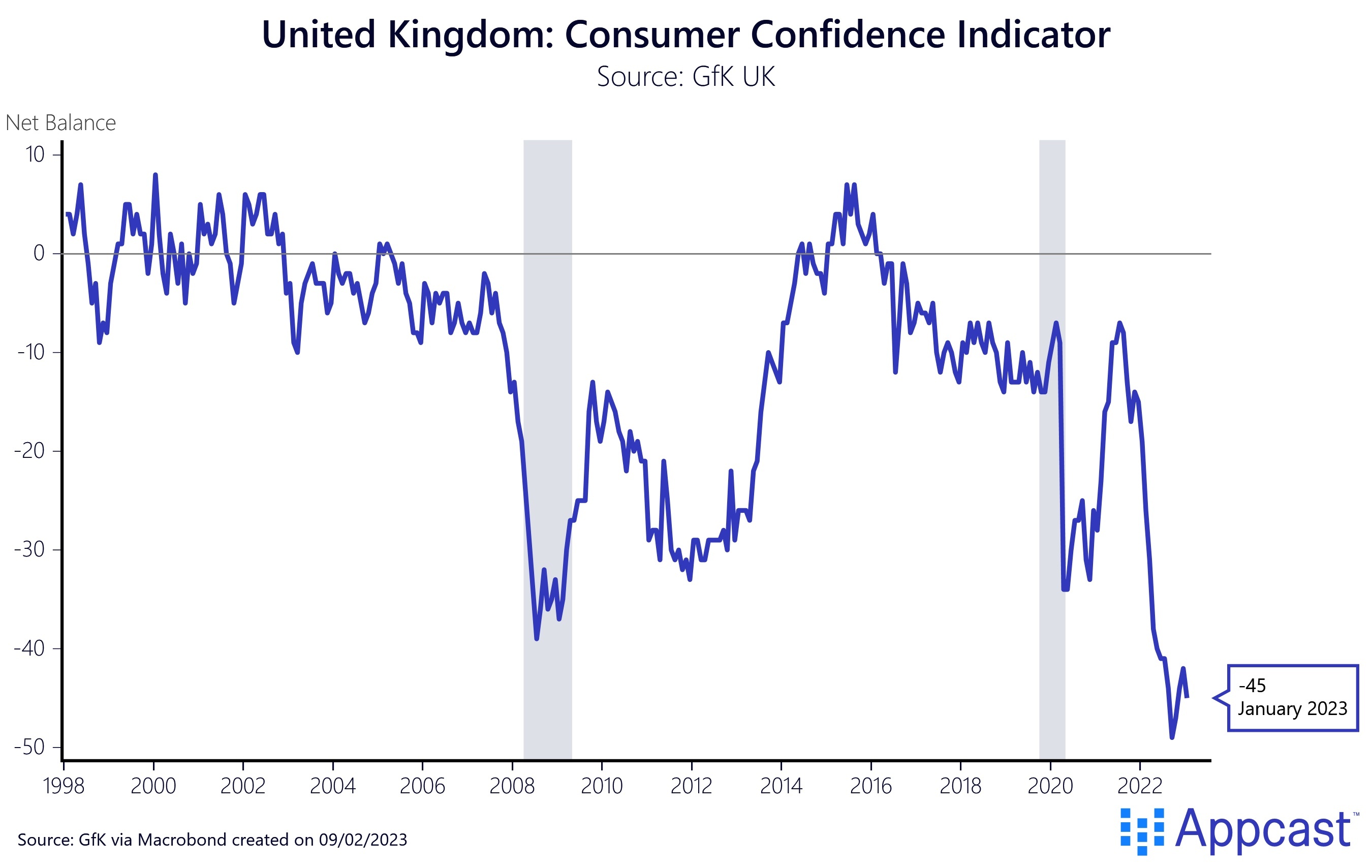

Consumer confidence thus plunged to a record low at the end of 2022 and remains significantly lower than at any point during the Great Recession or the 2020 COVID crash. U.K. consumers are horribly depressed and aware that economic times are terrible as real wages have plunged, unable to keep up with inflation over 10%.

Business surveys suggested confidence in the economy until early 2022 as the recovery from the COVID economic shock was much faster than widely anticipated. While British businesses are not quite as depressed as consumers, the outlook isn’t exactly great either.

The Confederation of British Industries (CBI) surveys businesses regarding the general outlook with respect to orders, investment, employment, and so on.

The composite growth indicators on the upper pane show that output volumes over the past three month and expected output volumes over the next three month have been falling sharply since mid-2022 are currently quite depressed.

Moreover, total order books have also declined rapidly since the end of last year, pointing at a broader-based economic slowdown.

Last but not least, as the BoE’s rapid rate hikes combined with a commitment to leave the policy rate higher for longer has led to a battering of the housing market. House prices have already started to decline as mortgage rates surged to the highest levels in decades.

The house price sentiment index shows that homeowners are now fully expecting a correction in the housing market too. This will potentially create a negative wealth effect that might further depress consumer spending.

What about the hard data?

In contrast to the U.S. and Germany, hard economic data in the U.K. has also been quite abysmal. The economic outlook for 2023 and beyond is mediocre as well.

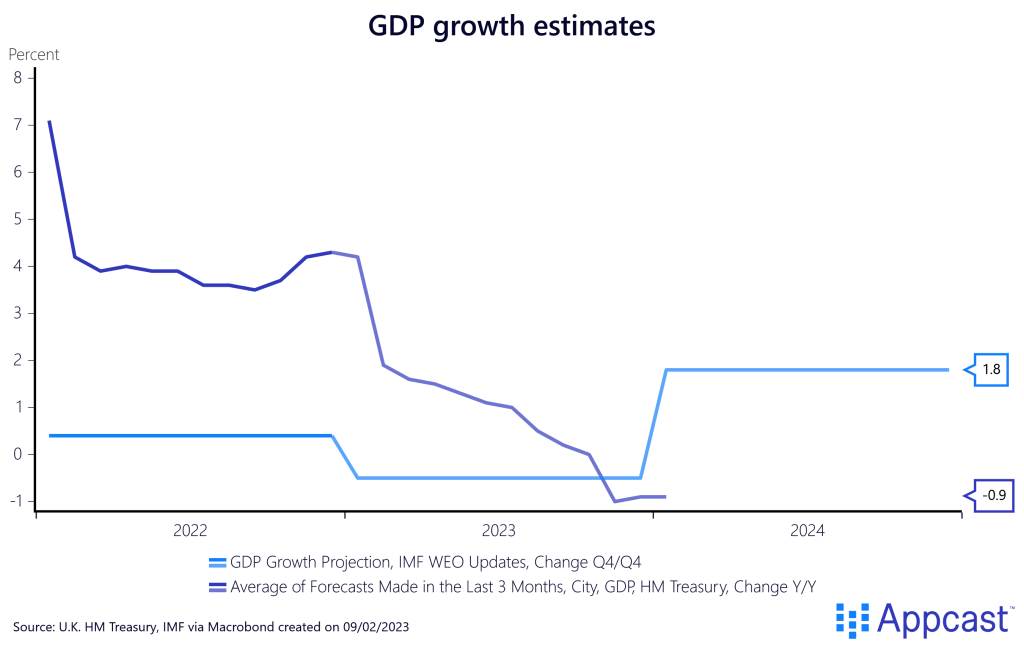

While the BoE has recently revised their outlook, they are still forecasting a shallow recession for 2023 with another year of economic stagnation thereafter.

Average forecasts made over the last three months suggest a contraction of a little less than 1% year-on-year by the end of 2023. The IMF is a tad more optimistic but still forecasting negative growth of -0.6% with an economic recovery resuming in 2024.

As the following chart shows, among advanced economies, the OECD expects the U.K. to be the worst performer in 2023. The U.K.’s poor performance is a combination of several factors coming together: scarring effects from Brexit, high inflation due to the commodity price shock, higher expected rates from the BoE, and a more fragile housing market.

While service trade is still up from a year ago, retail trade in constant prices is now down by more than 5% compared to a year ago, showing how weak domestic demand already is as the U.K.’s cost-of-living crisis is hurting households.

Another huge point of concern is the surge in bankruptcies last year, which have risen to a near-all-time high and are definitely pointing towards a potentially nasty economic downturn.

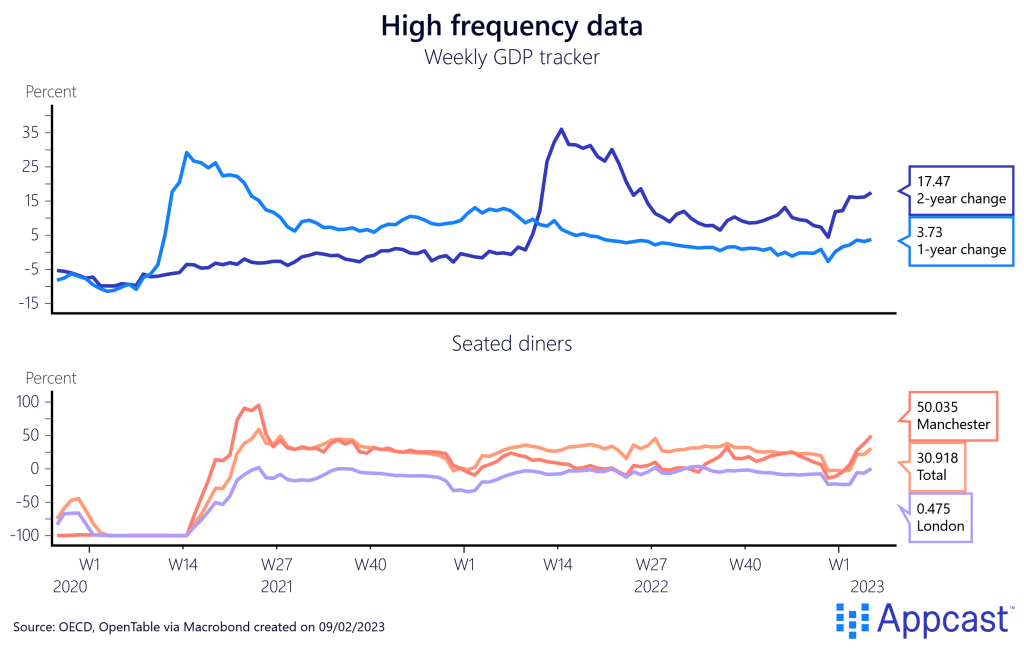

High frequency data, on the other hand, is showing that some sectors of the economy are still doing relatively well. The OECD’s weekly economic indicator uses Google trends data to get an estimate of economic performance in real time. Compared to a year ago, the measure is up by 3%.

Similarly, reservations from seated diners are also higher compared to the pre-pandemic period and significantly higher than just a year ago when the economy was back in lockdown last winter – consumers are still going out.

The world has seen quite a significant rebound in travel and tourism spending after two years of pandemic depression. Both overseas visits to the U.K. as well as tourism spending are finally back at their pre-pandemic level. It is thus entirely feasible that the U.K. economy will get a boost from abroad in 2023, especially as China is finally opening up again, which could compensate for the lack of domestic spending this year.

Conclusion:

Soft data in the U.K. has been foreshadowing a severe economic contraction. In contrast to the U.S. and Germany, economic pessimism is more warranted as the U.K.’s economy is much more vulnerable right now. The cost-of-living crisis is hitting the country harder and domestic spending is already contracting significantly. The BoE will maintain a high policy rate for the year to come to bring inflation down, which will also depress the housing market. The only bright spot is increased global tourism spending with China opening up, which may give the U.K. economy a necessary lift.