It’s been a turbulent week for the United Kingdom. Puzzling financial policy and political drama latched onto an ongoing energy crisis and a tight labour market, triggering volatility not seen in at least 20 years.

Frighteningly Tight Labour Market:

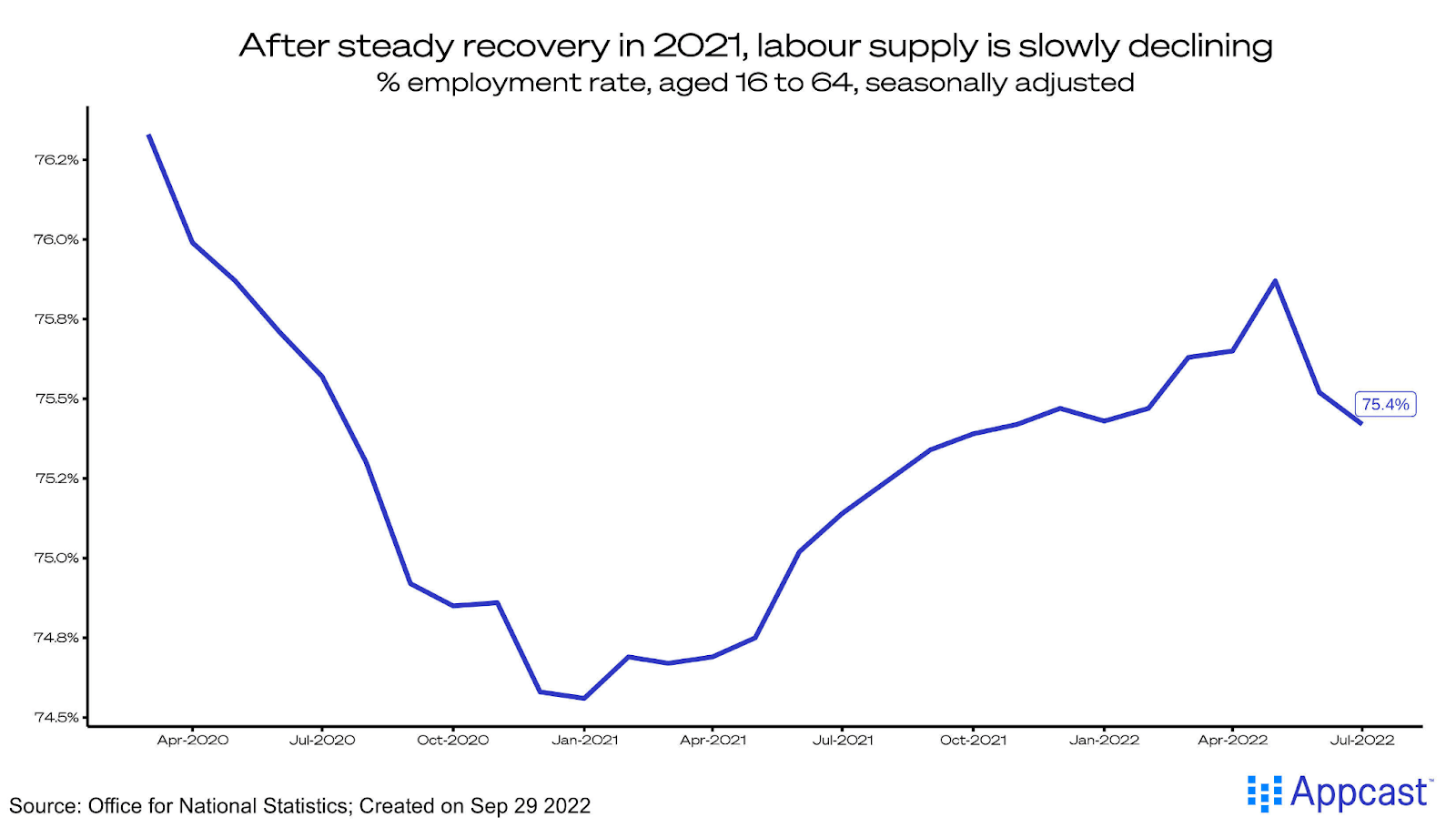

Demand for labour is way up in the U.K. – but job seekers are missing. The post-pandemic jobs recovery faltered as labour supply slipped steadily in 2022. The employment rate has dropped to just 75.4% – way down from pre-pandemic levels and even from earlier this year.

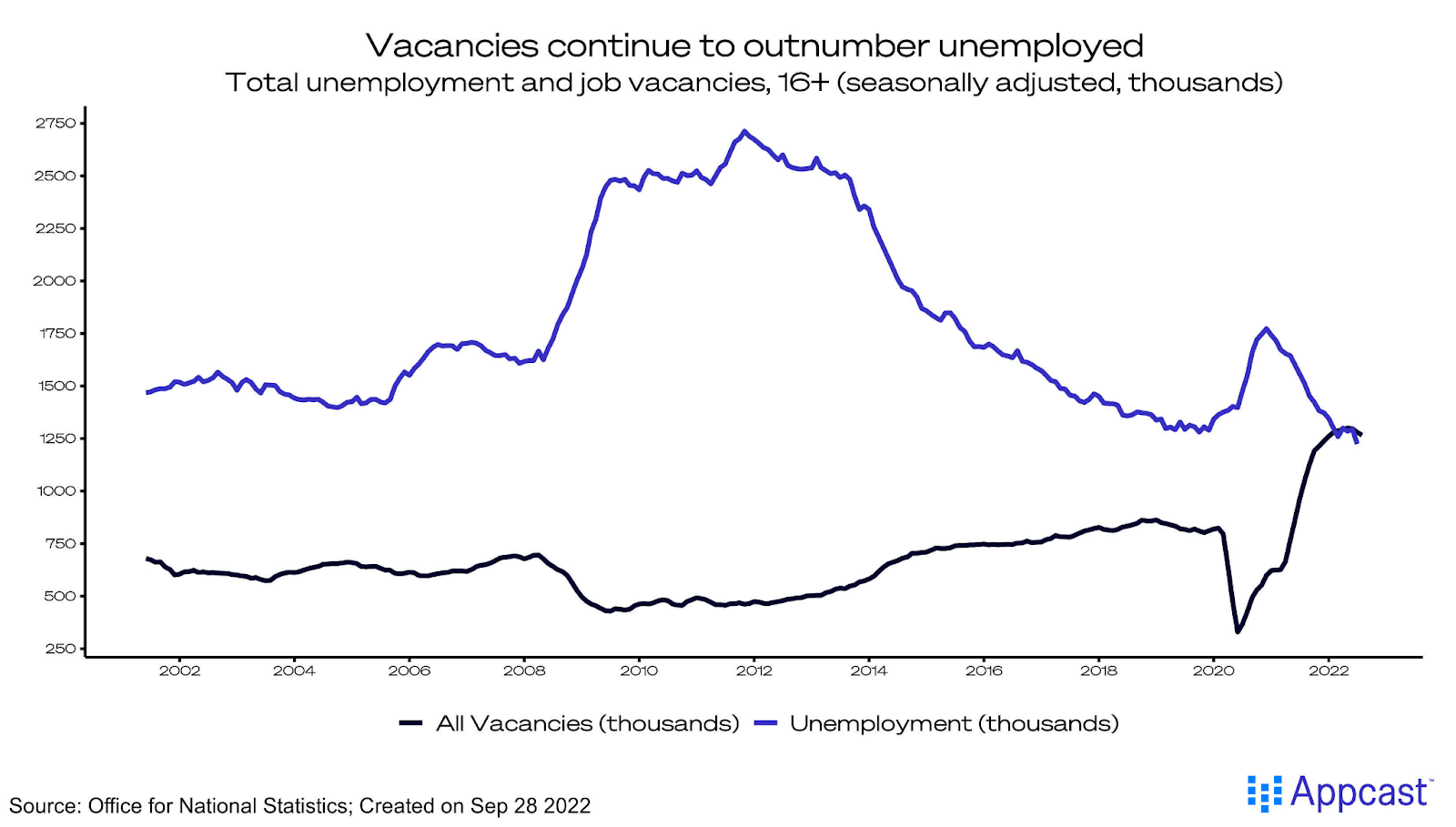

The labour market is very tight: job vacancies outpace the number of unemployed people for the first time in over 20 years. The current recruitment landscape is very challenging to navigate.

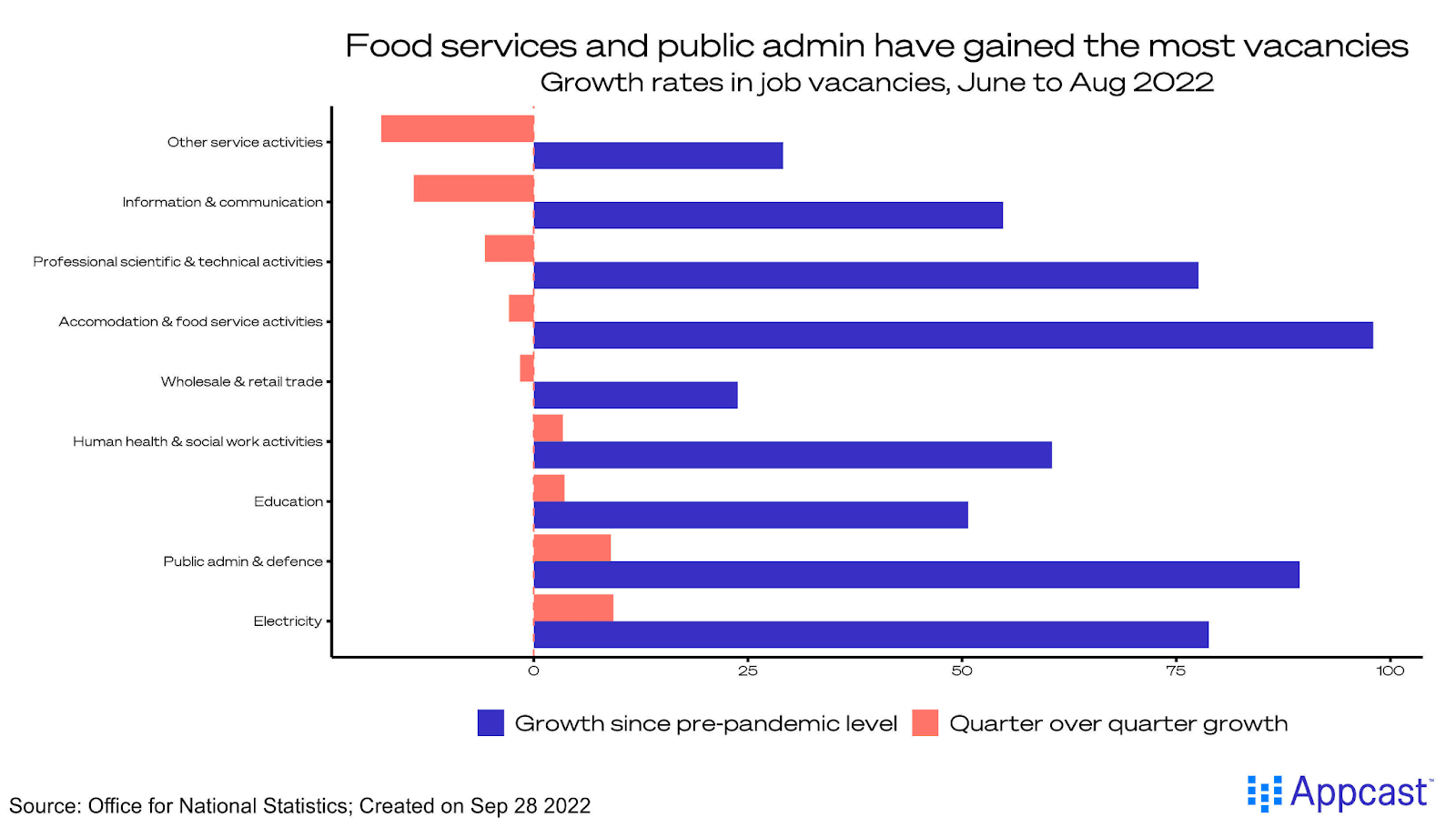

However, signs of easing are starting to show. Job vacancies are falling across the board, especially in the services, tech, and food and accommodation sectors. Recruiters may soon be feeling a cooldown in these challenging conditions.

Devastating Cost-of-Living Crisis:

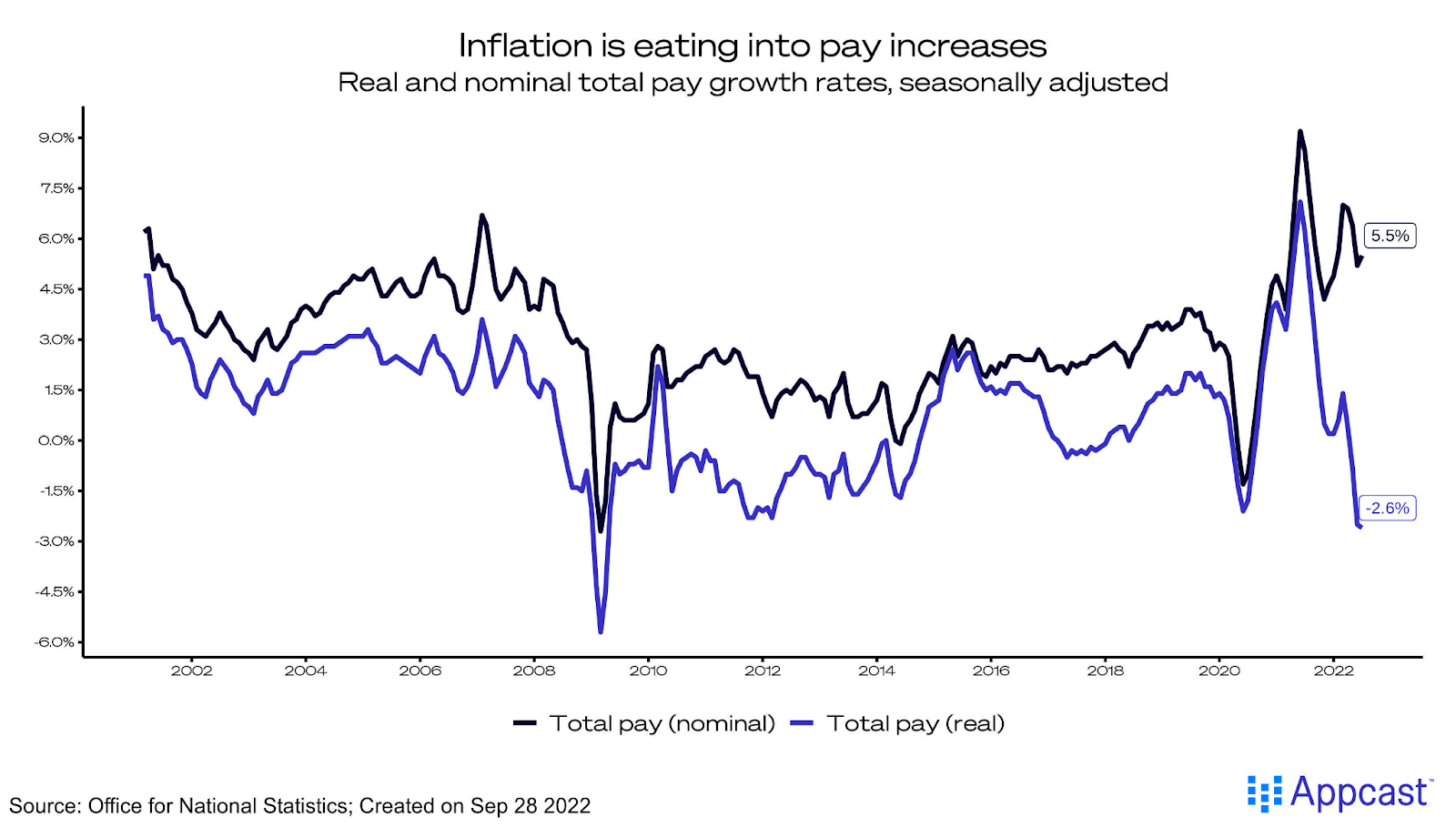

A devastating energy crisis has spurred decades-high inflation in the U.K. The country’s inflation rate is the highest among rich countries: prices were up 9.9% from the year before in August. While the cost of living rises, workers across the U.K. are experiencing eroding real incomes.

In order to fight inflation, the Bank of England is hiking interest rates. The side effects of a tightening policy may be painful – the U.K. is projected to enter a long (but mild) recession during the fourth quarter of this year.

Financial (and Political) Turbulence:

Against this bleak backdrop, new prime minister Liz Truss and her Chancellor of the Exchequer Kwasi Kwarteng took center stage over the last week. On Friday, a mini-budget from hell was announced, featuring energy subsidies and unfunded tax cuts. It had massive consequences.

In less than a week, government debt yield soared to levels not seen in 20 years, putting the pension funds backed by these gilts at risk of a serious meltdown. The Bank of England was forced to step in, pledging to buy 65 billion pounds worth of long-term bonds to avoid devastation.

Pumping pounds into an inflationary environment is certainly not what the Bank of England hoped to do this week (or anytime soon). They had promised a continued hawkish stance – including confirming a plan to sell gilts – just days before.

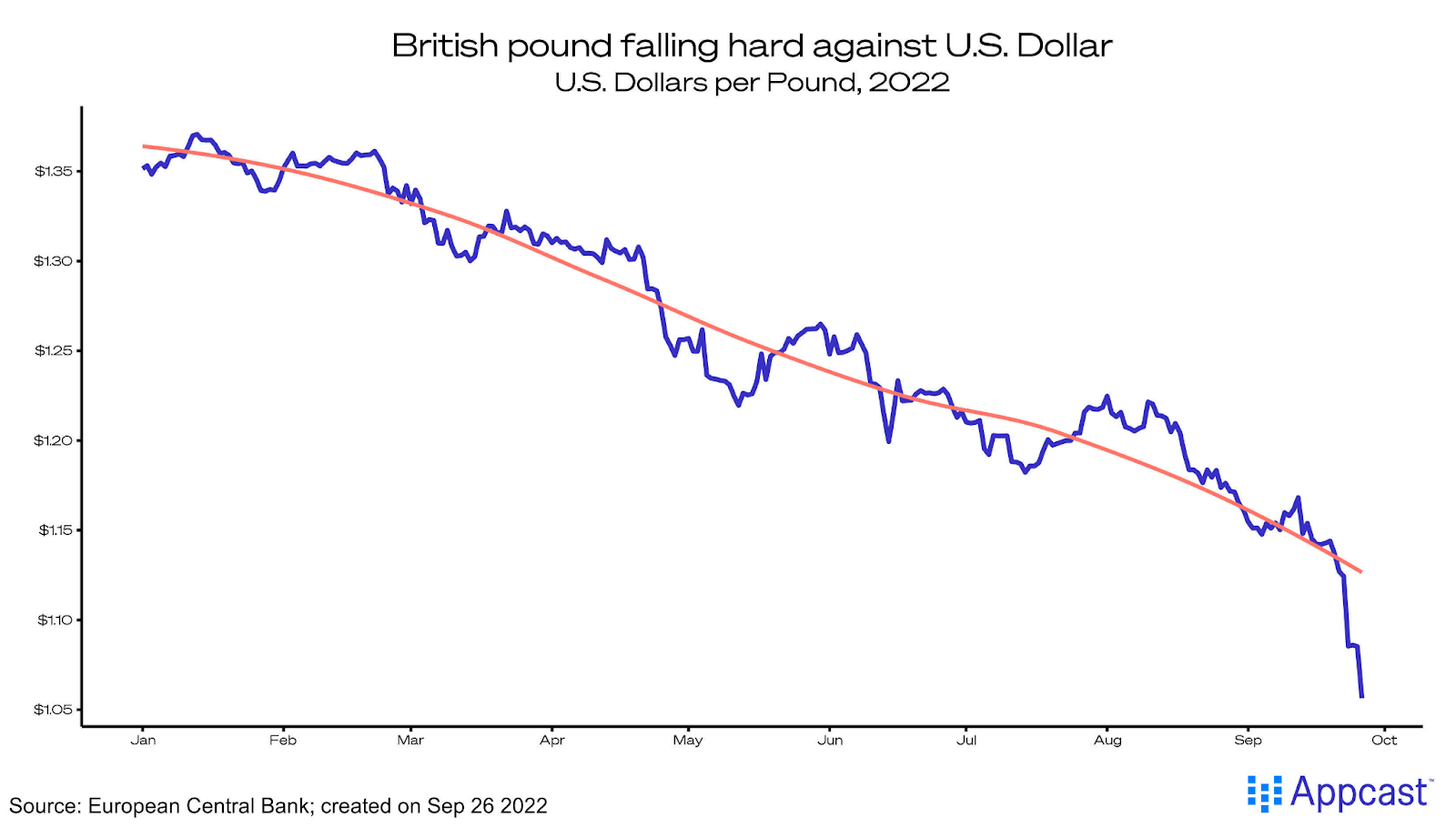

Also impacted by the confidence crisis the mini-budget created: the British pound. The currency depreciated rapidly this week – nearly falling to parity against the U.S. dollar. Now, U.K. workers are facing inflation with a weaker pound, exacerbating the cost-of-living crisis.

Looking Ahead:

The battle against inflation will wage on.

To recap: last week, inflation encountered an unexpected ally in the form of a misinformed mini-budget. But, after a forced ceasefire, the Bank of England will continue the fight: expect more interest rate hikes.

As for the labour market, initial impacts of an upcoming recession will be painful. But, in the medium-run recruiting challenges will ease as slack is introduced into the frighteningly tight labour market.

The curtain will not close on this week’s financial drama anytime soon. The long-term impacts of the BoE’s bold decision to save pension plans and the mini-budget saga are yet to be seen. The only guarantee is that far more uncertainty is in store for the United Kingdom.