Quitting remained elevated, but the “Great Resignation” isn’t getting worse (for now). Let’s take a tour through the latest April release of the Job Openings and Labor Turnover Survey (JOLTS) report.

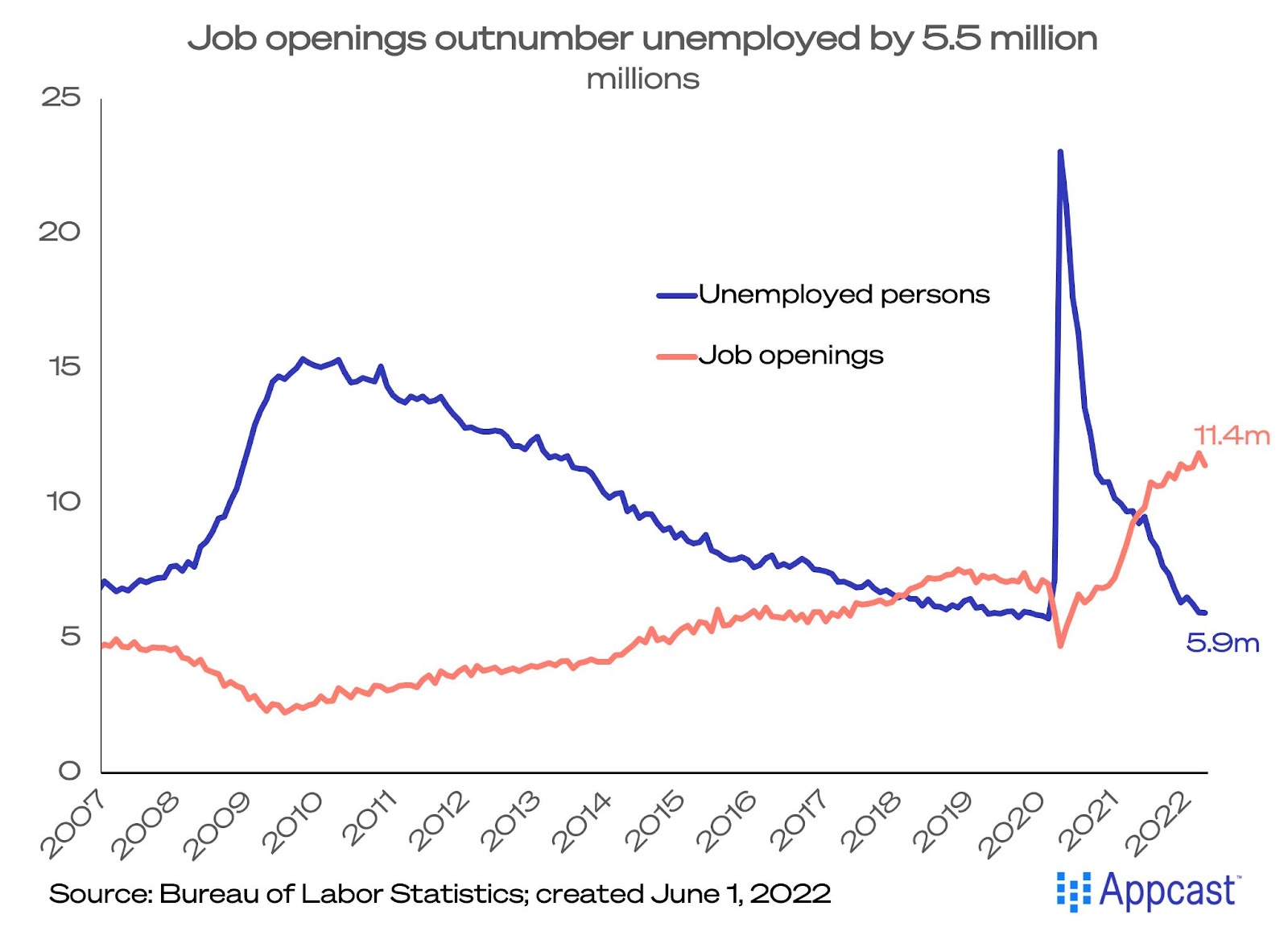

Job openings declined in April to 11.4 million from an all-time high of 11.9 million in March. This level is about 60% above the pre-pandemic number of job openings. And while the gap between unemployed persons (5.9 million) and openings closed a bit, it’s still very wide at 5.5 million. There is a fundamental imbalance in this ‘tight’ labor market: more demand for workers than the supply of hireable candidates.

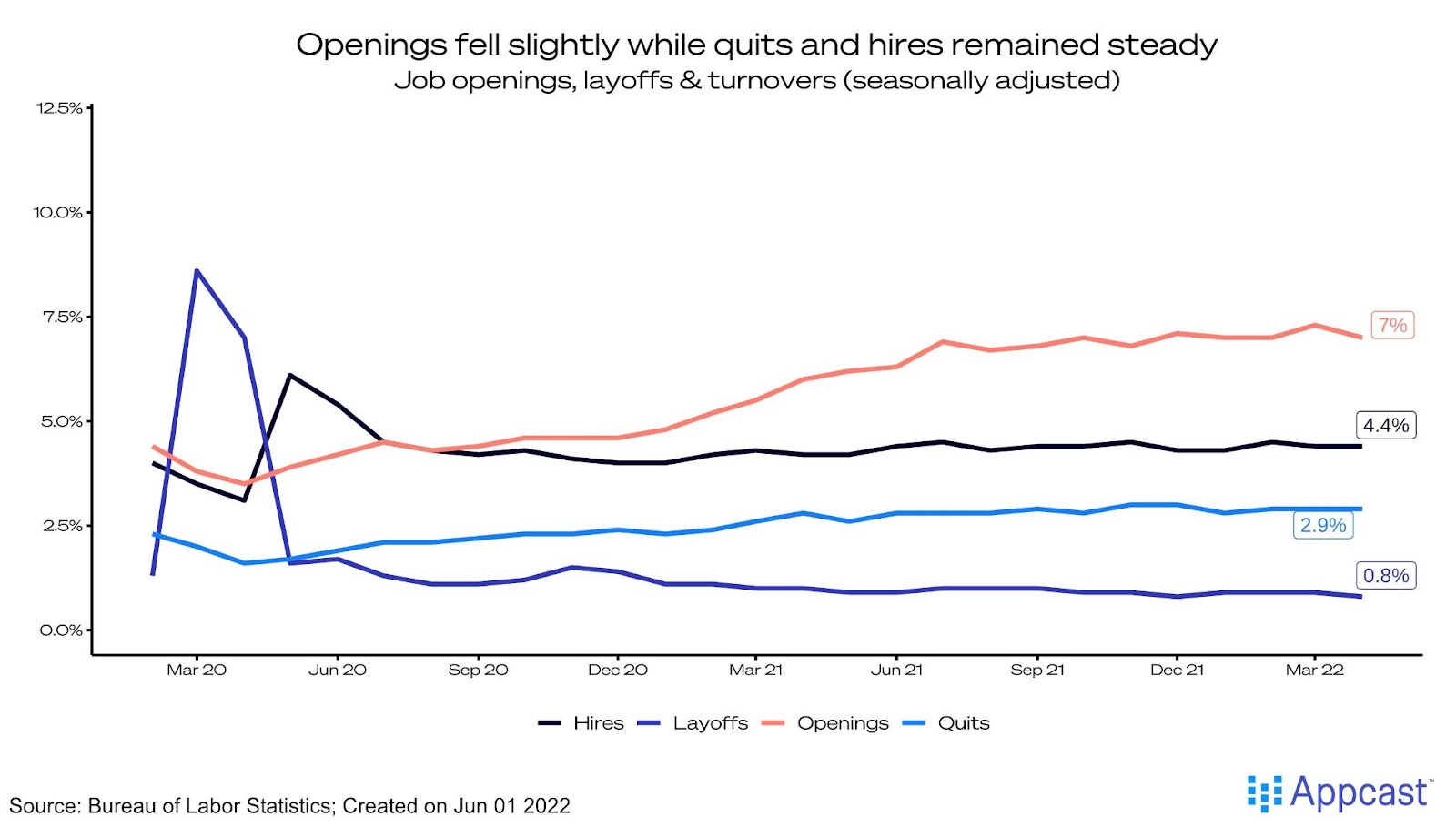

A higher job openings rate (which is calculated by dividing the number of job openings by the sum of total employment and job openings) signals a stronger demand for workers. How employers actually translate openings into hires – that’s the hires rate. A more challenging recruiting environment emerges when the gap between the opening rate and hiring rate grows (holding retention constant). However, retention is not constant: the quits rate measures the willingness of workers to leave their job, often because they got a better offer elsewhere. So, a high quits rate is a sign of a strong labor market. The layoffs rate is the inverse: the lower it is, the stronger the labor market, but in recessions, layoffs rise.

So what happened in April? The job openings rate ticked down slightly, to 7%. That is far above the rate seen pre-pandemic, which was below 5%. And, crucially, it’s far above the hires rate (4.4%). The quits rate was flat at 2.9%, near an all-time high. The layoffs rate dipped to a series low of 0.8%.

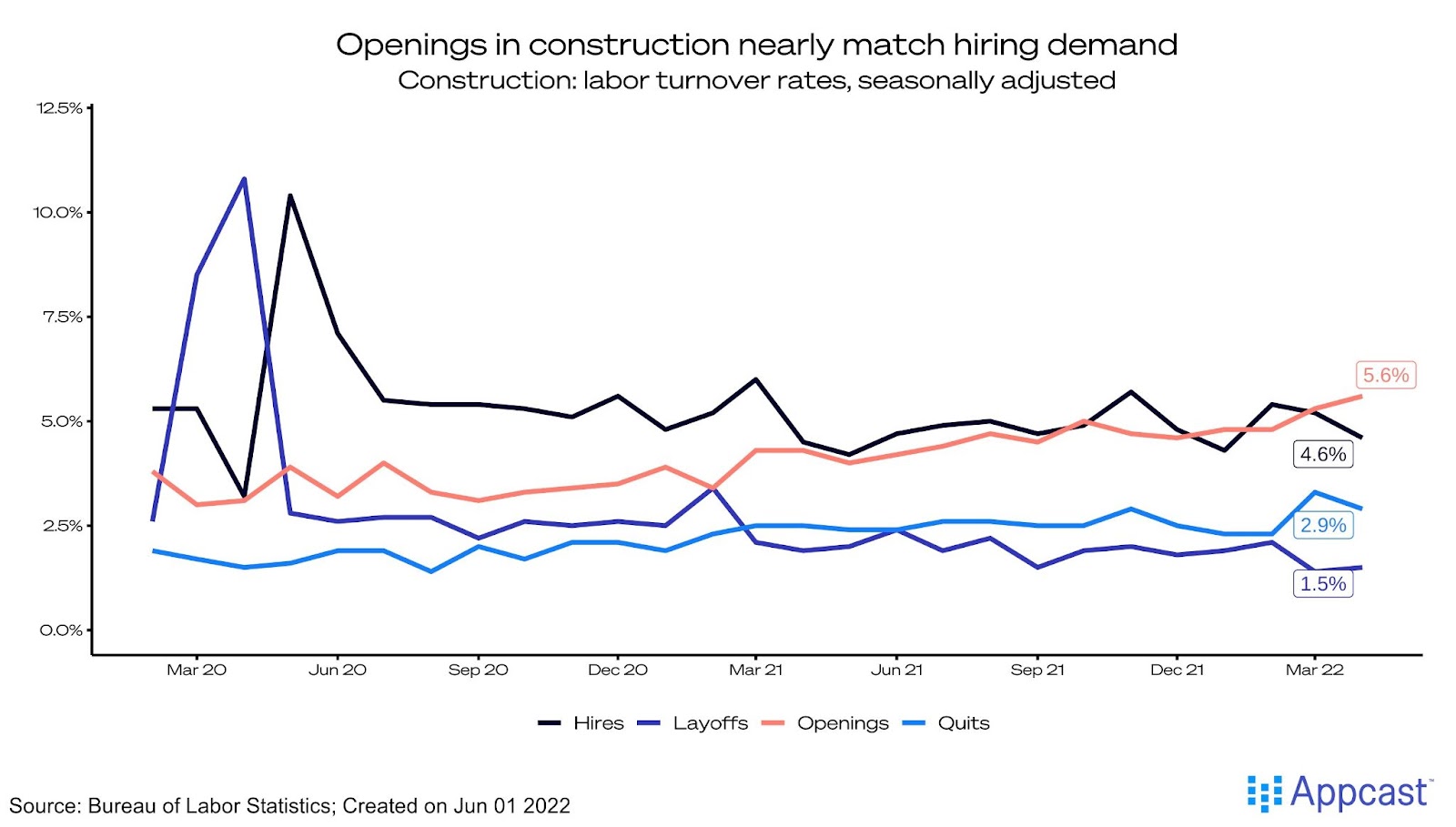

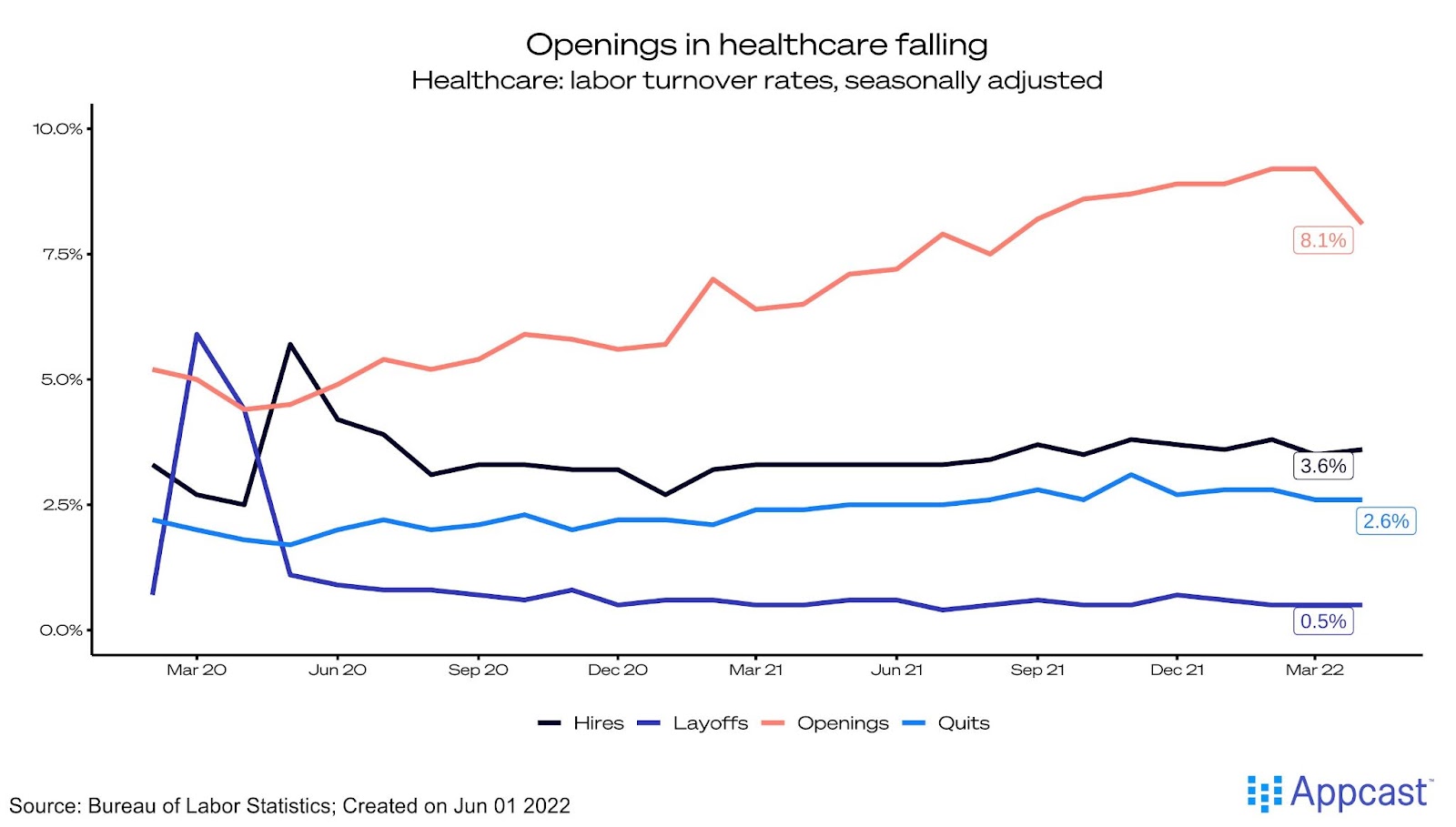

Below the same chart is replicated for six key industries: construction, manufacturing, transportation & warehousing, finance & insurance, retail, and healthcare.

Healthcare openings declined sharply, but with the openings rate at 8.1%, the gap between openings and hiring remains very wide. Otherwise, quits are flat and layoffs are nearly nonexistent. (“Quits” being shorthand for the quits rate – the percentage of workers who quit in a given month.)

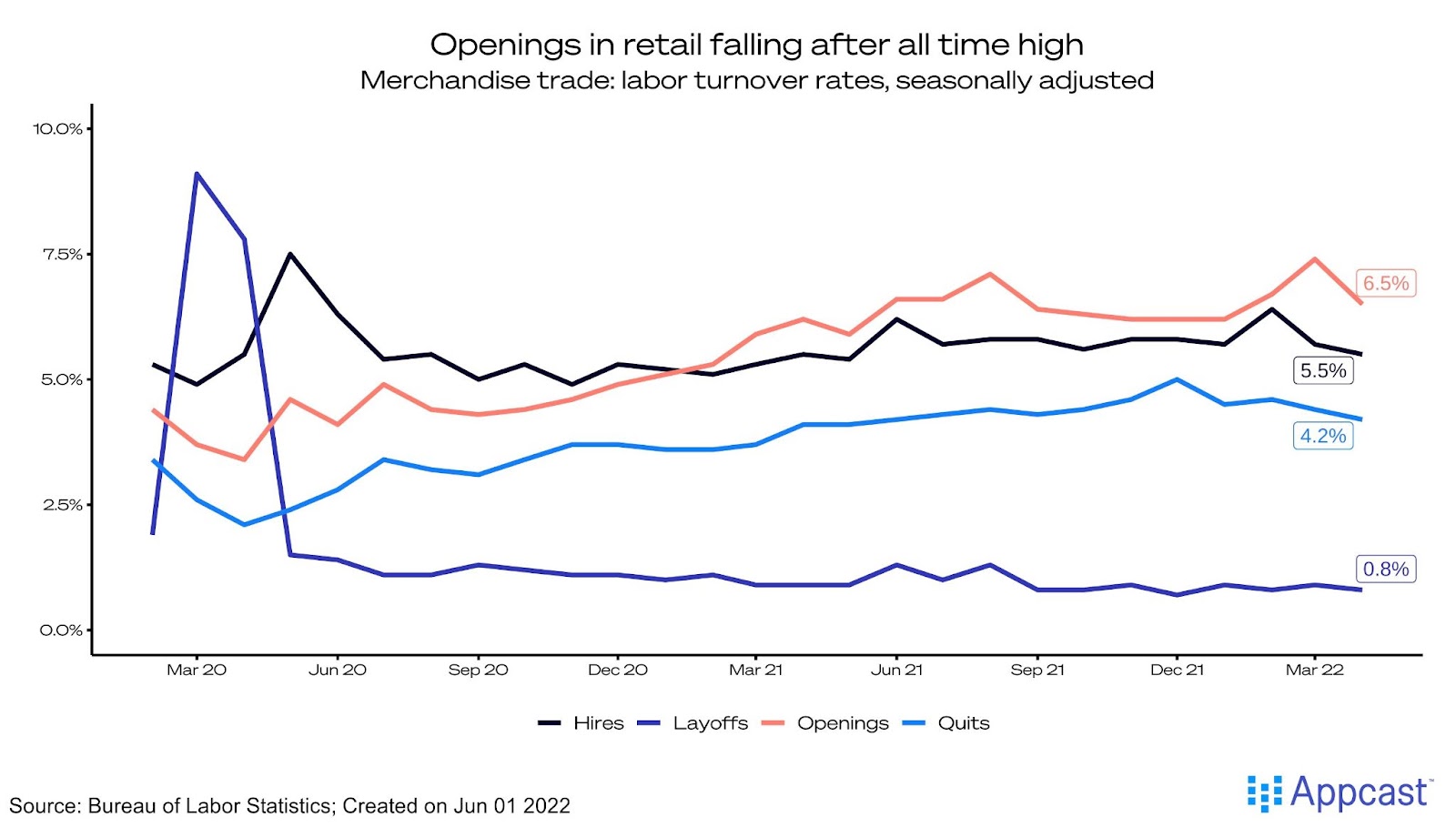

Retail, comparatively, has a much smaller gap between its openings and hires rates. Quits are much higher (no surprise).

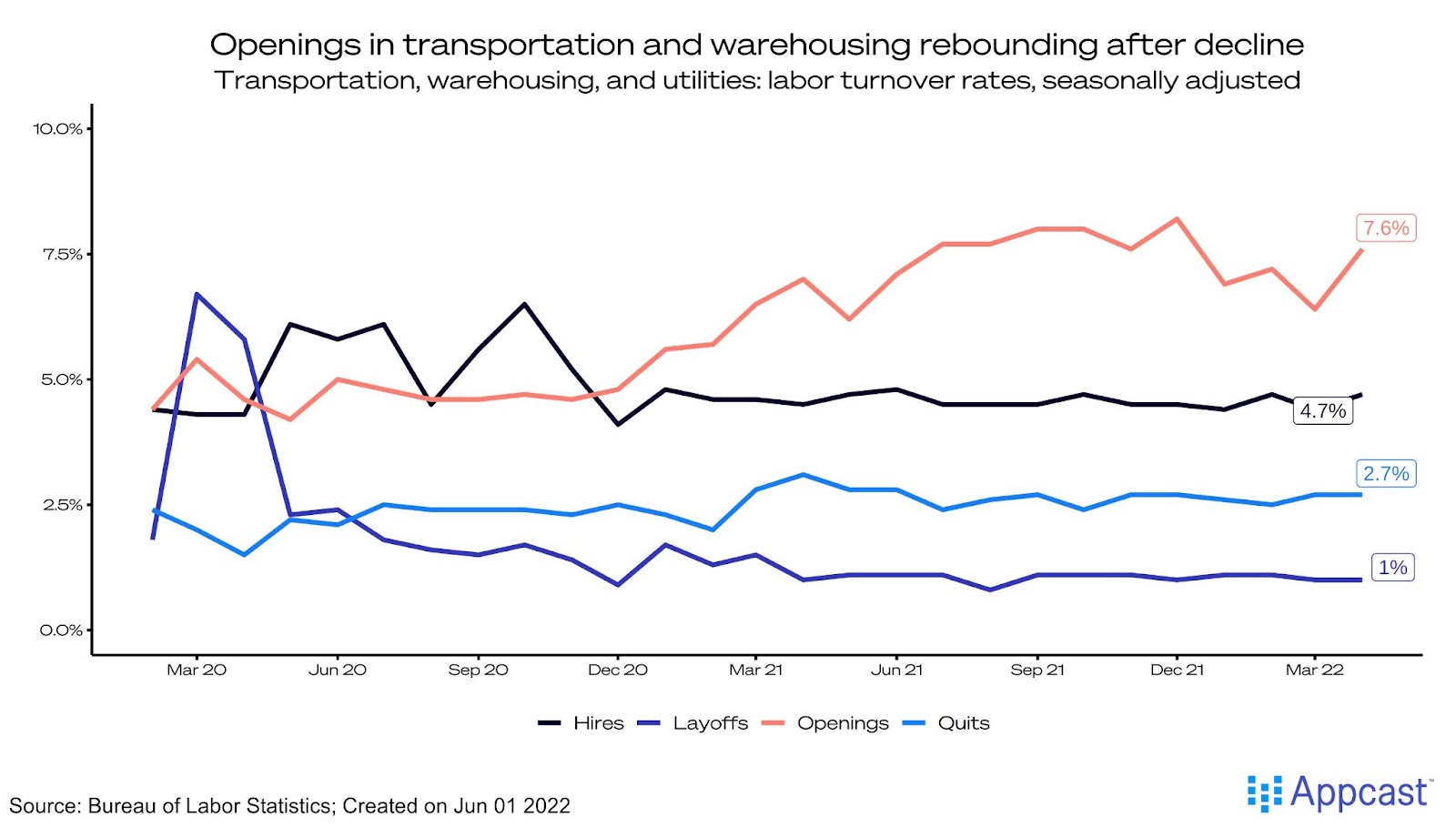

Transportation & warehousing openings rebounded after a decline over the last few months. However, hiring did not pick up much.

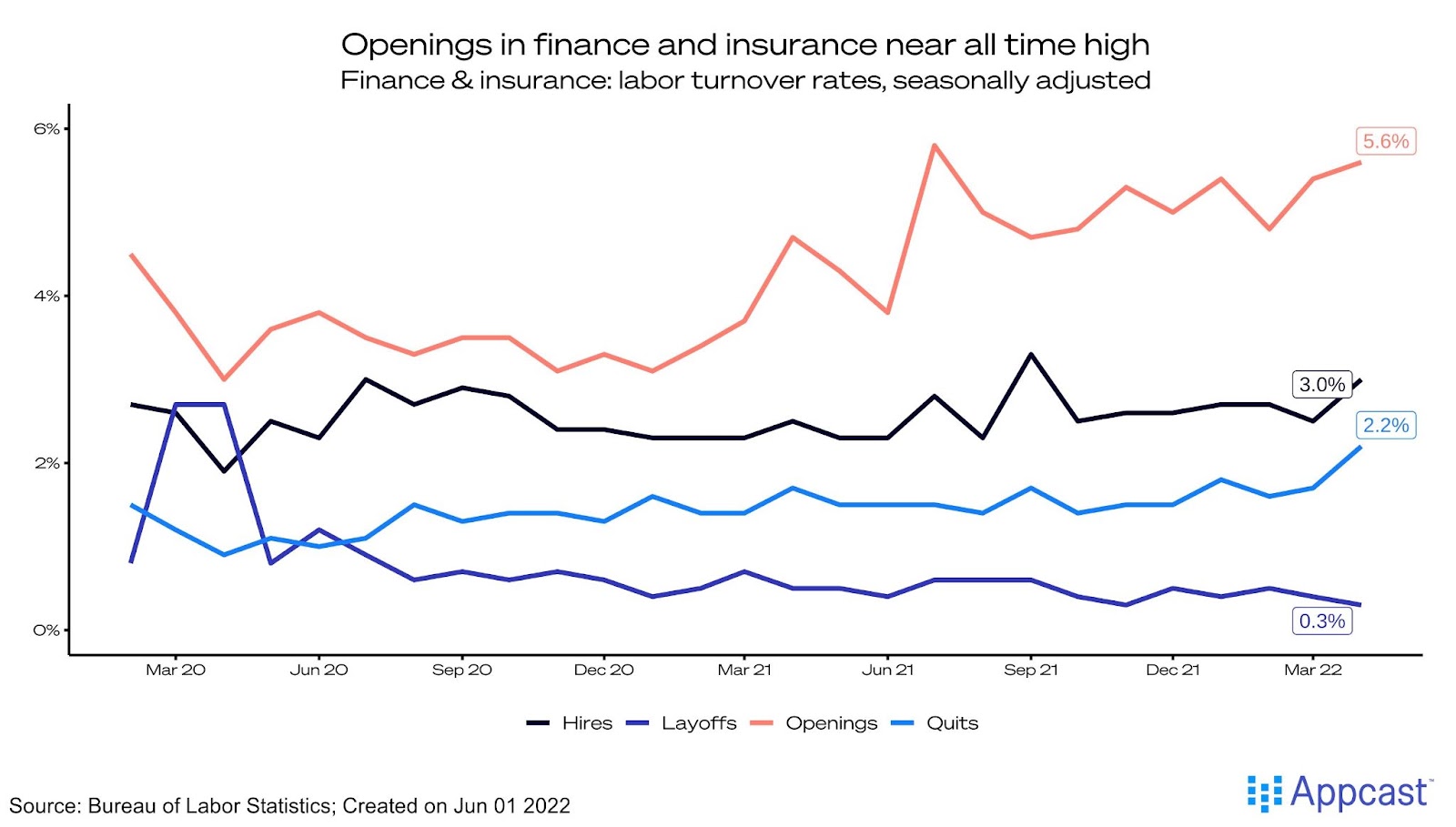

Finance & insurance job openings are near an all-time high, while quits have been rising (the “Great White Collar Resignation”?). Layoffs are not happening.

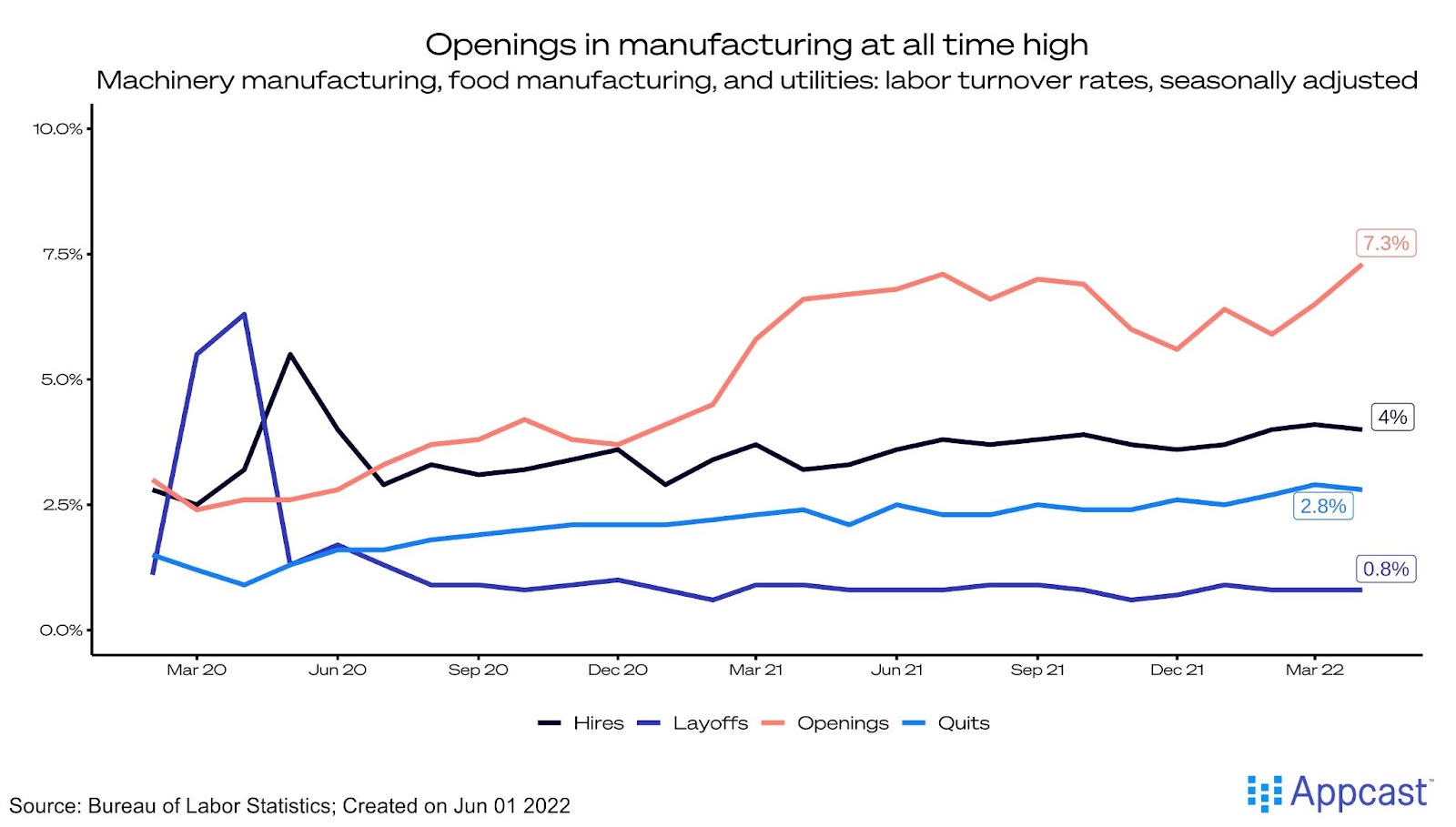

Manufacturing job openings have never been higher – more than double the level pre-pandemic and growing. The hiring rate (4%) just can’t keep up. Quits are average in this sector.

Construction, funnily enough, has had a good balance between openings and hires over the last year, with quits typical. Now a slight increase in openings over hires has emerged.