Texas growth miracle

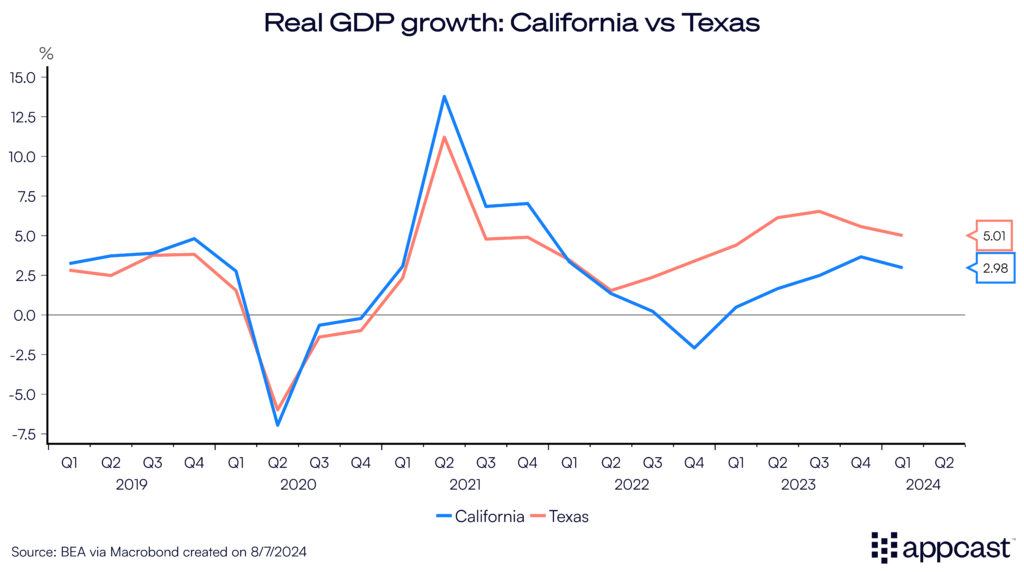

Texas is expanding rapidly. Its economy has been growing at a rate of more than 5% in recent years, which are growth rates akin to an emerging market. The state has also accounted for more than 20% of U.S. economic growth in the past two years even as it’s accounting for less than 10% U.S. GDP.

The state’s economy is fueled by several factors, including access to cheap energy sources and the domestic manufacturing boom, which has been favoring the South. Friendshoring to Mexico is also playing a role. It has led to a construction boom and employment surge in the transportation and warehousing sector as global supply chains are being recalibrated due to the geopolitical tensions with China.

But it’s not just the more traditional sectors that are growing, Texas is now also experiencing the fastest expansion in renewable energies. And Austin has become a hub for Tech companies, many of which have relocated from California.

The state has seen a population boom, thanks to affordable housing

The pro-business environment, cheap housing, and affordable living costs have led to a population surge in the state. The robust job market is supporting the rapid economic expansion.

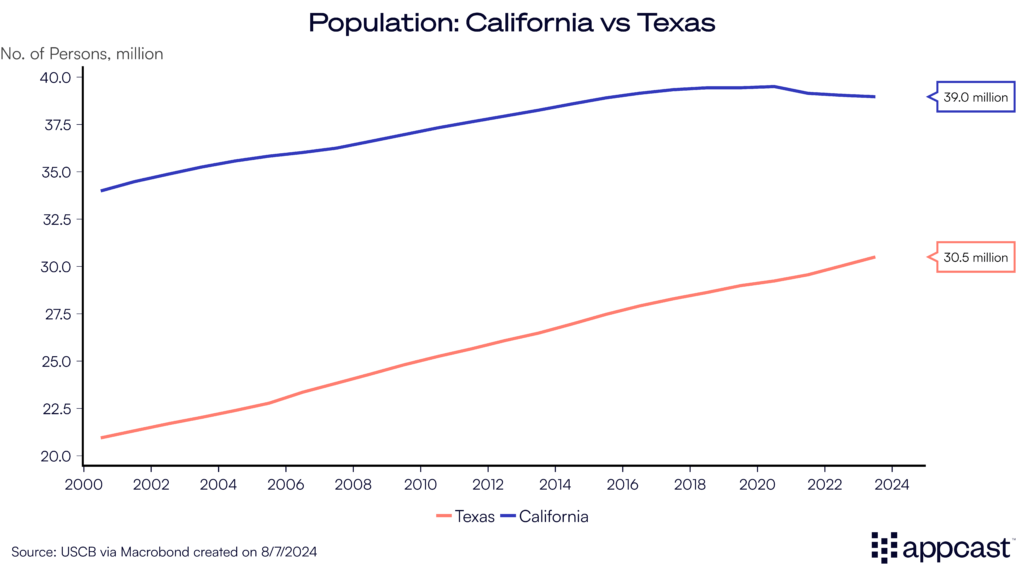

Texas’ population has increased by about 10 million since 2000 and now exceeds 30 million. This rapid growth contrasts sharply with that of California, which has only added five million people since then despite having a higher population.

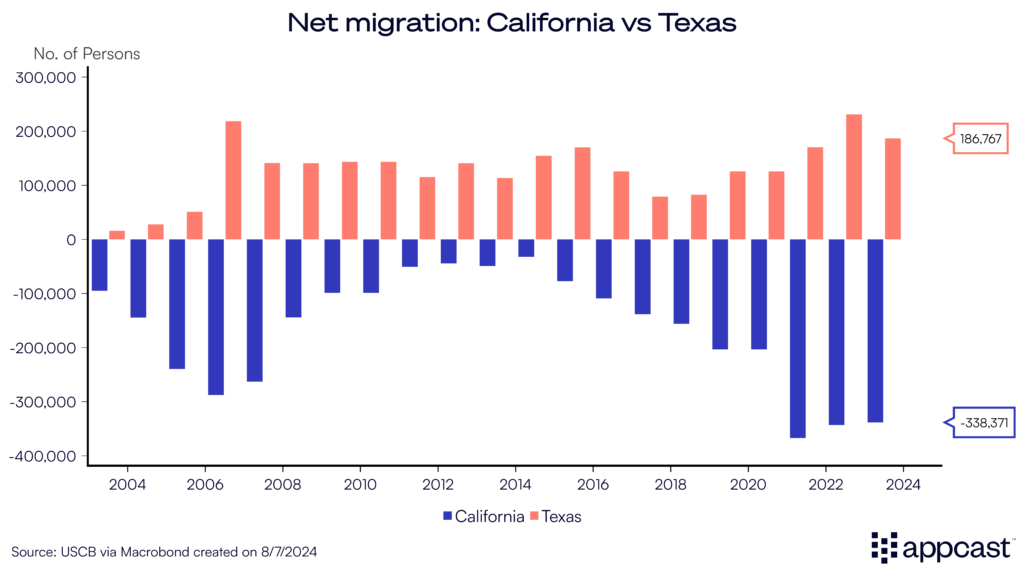

While Texas cities like Austin, Houston, and Dallas are expanding rapidly, drawing in new residents and businesses, while California has seen a slowdown, with some areas even experiencing a decline in population as residents seek more affordable living conditions and economic opportunities elsewhere. This divergence highlights the differing economic landscapes and policy environments of the two states, making Texas a magnet for growth while California grapples with retaining its population.

While Texas has added some 200,000 people on net in recent years – and more if you add illegal migrants – California has had a negative migration balance for almost two decades now.

Texas, the big job creator

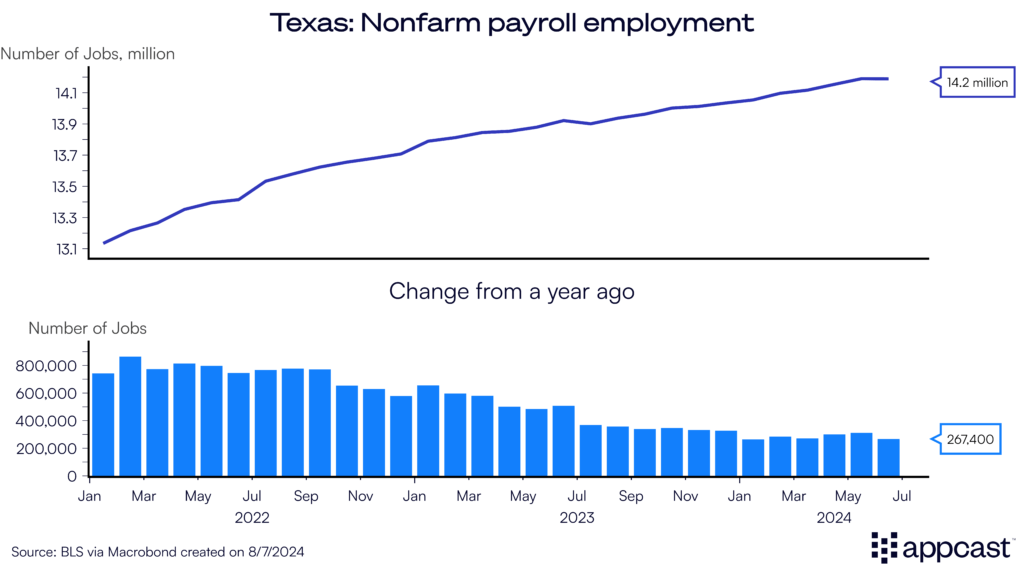

Since 2022, Texas has added more than a million payroll jobs. While job creation inadvertently came down following the recovery from the pandemic, Texas has still created more than 260,000 jobs over the last year. As a point of comparison, this is slightly more than the pace of job creation in Germany or the U.K., which have some 83 and 67 million inhabitants, respectively, compared to Texas’ 30 million.

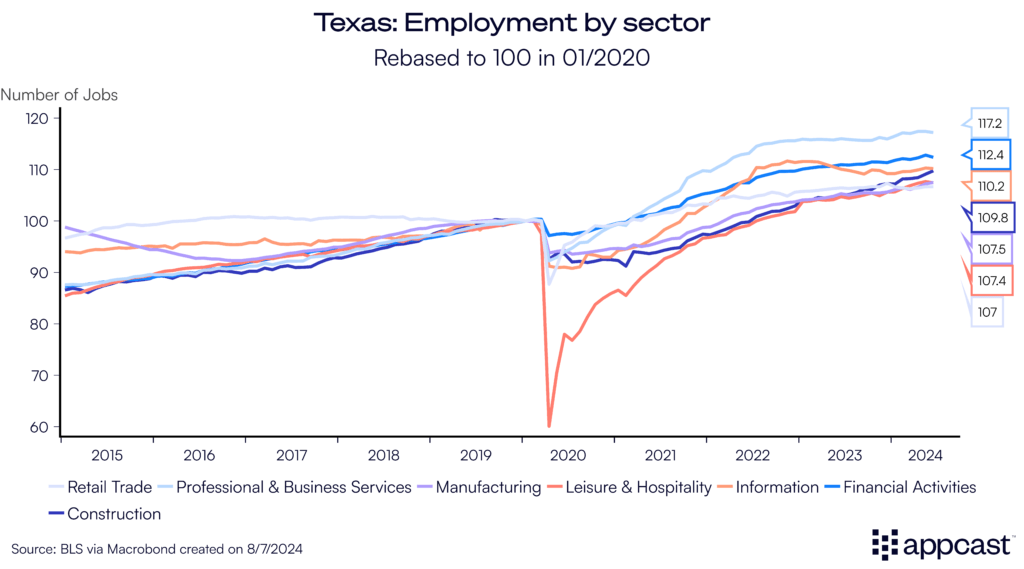

As the chart below shows, Texas is not just adding jobs in manufacturing and construction, which are up by 7% and 9%, respectively since early 2020. White-collar occupations have also thrived. Professional and business services have seen an employment surge of 17% since before the pandemic. Employment in information suffered a little during the “Tech-cession” of 2022 and 2023 but is still up by more than 10%. Ditto for financial activities. Overall, Texas is seeing broad employment gains across all sectors.

Recruitment remains a challenge

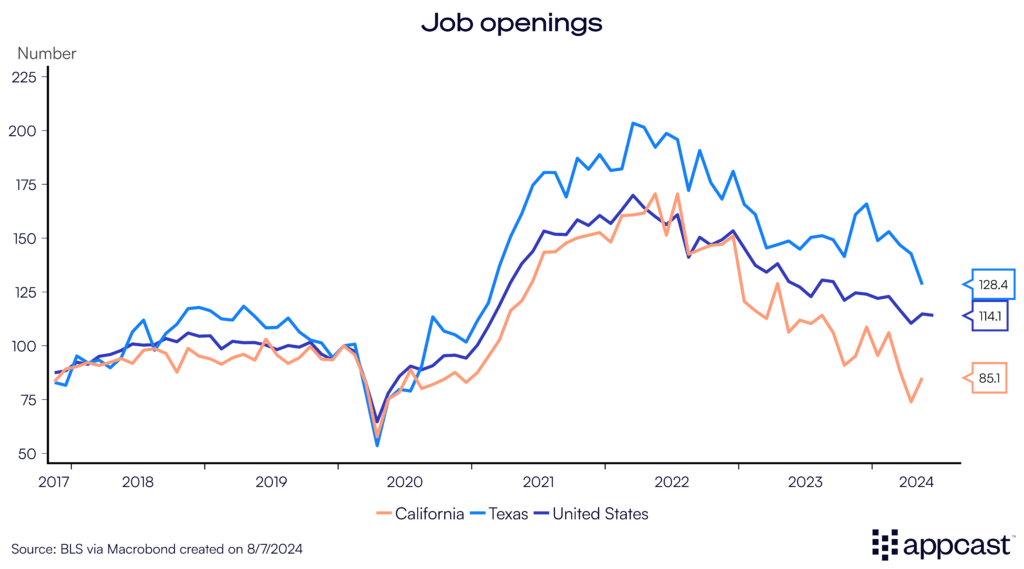

Given the strong local labor market, recruitment remains a challenge. Job openings continue to be highly elevated In Texas. They are some 45% higher than during the pre-pandemic period, a stark contrast to the U.S. as a whole (13% above), or California for that matter (23% below pre-pandemic levels now). Texas’ job market therefore remains tighter than the national labor market.

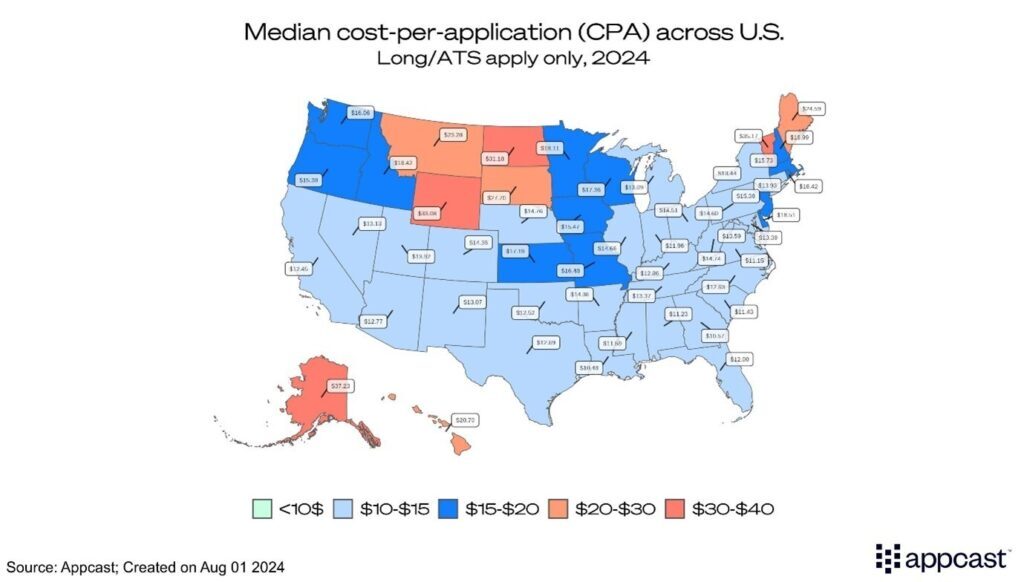

However, even as vacancies remain elevated in Texas, the cost-per-application (CPAs) is reasonably low. The median CPA across sectors stands at around 13 USD, which is slightly below the national average. Texas is therefore currently one of the lower-cost geographies for recruiters even though vacancies remain elevated compared to the nation as a whole. We know from our own data that apply rates in Texas are above average, driving down CPAs. The massive surge in net migration into the state is creating additional labor supply that is contributing to the easing of CPAs over time. The weakening national labor market is also an important factor.

The Biden manufacturing boom and friendshoring

The U.S. has experienced a manufacturing renaissance thanks to the Biden administration and recent legislation. Several legislations passed by the administration have been successful in supporting domestic jobs and key industries. The CHIPS Act with its particular focus on domestic semiconductor production, has reduced dependency on foreign sources and enhanced the competitiveness of the U.S. tech industry. The Infrastructure Investment and Jobs Act has allocated significant funds for infrastructure projects, which boosted demand for manufacturing materials and products.

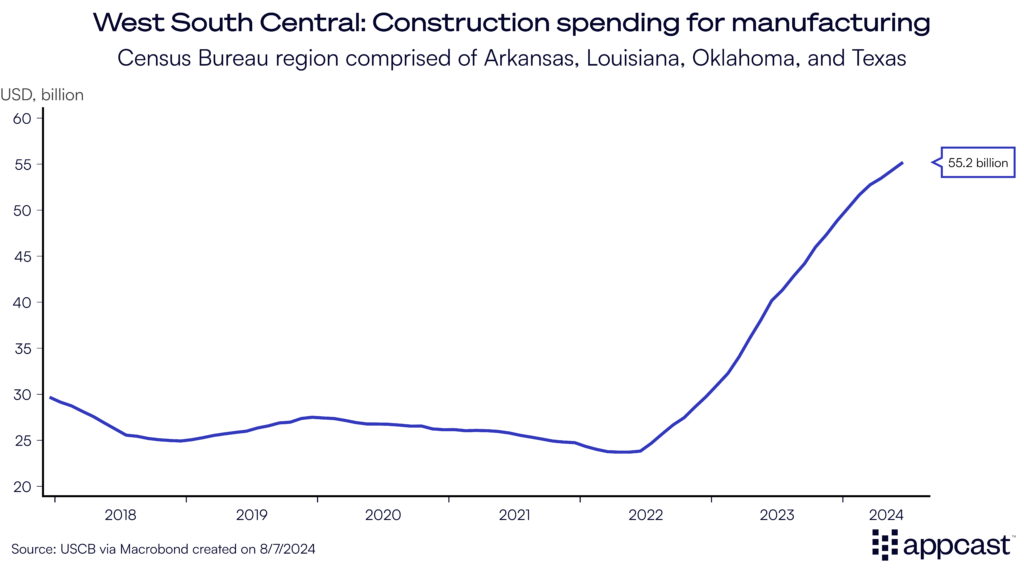

Data from the U.S. Census Bureau shows how construction spending for manufacturing plants has surged nationwide, especially in the Southern part of the U.S., with Texas seeing a good chunk of the boom.

Another factor that has positively affected the state’s economy is related to friendshoring. As geopolitical tensions with China have been rising, more and more companies have started to relocate production to Mexico. For the first time in decades, the U.S. is importing more goods from its neighbor than from China.

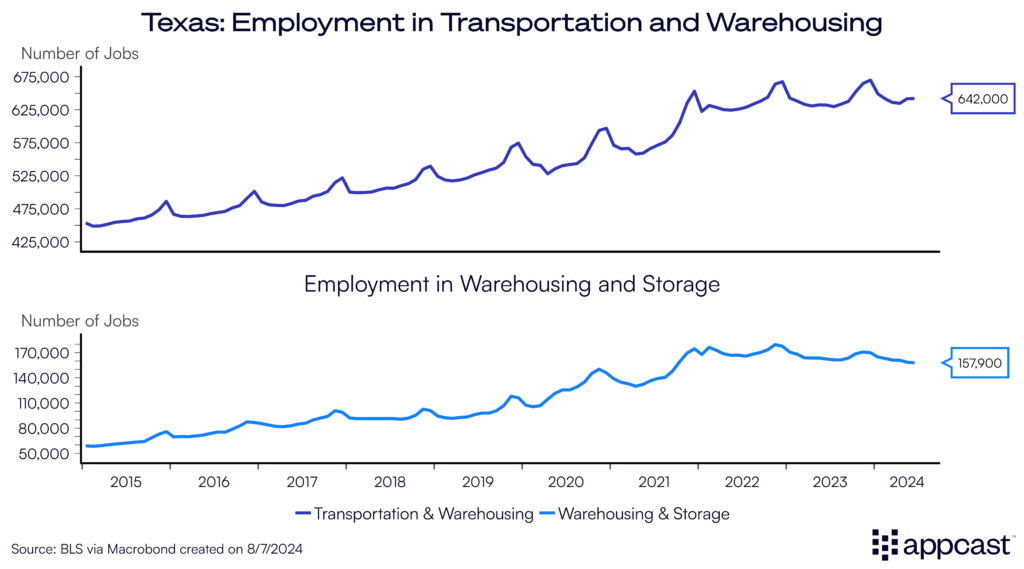

This trend also required a significant recalibration of global supply chains. Warehousing and storage capacity had to expand massively in Texas to accommodate the increasing trade flow between Mexico and the U.S. Employment in transportation and warehousing increased from less than half a million before the pandemic to more than 640,000 in 2024. Warehousing alone added some more than 50,000 workers to a total of more than 150,000 over the same period.

There is no doubt that Texas’ labor market is hot, not just for white-collar professionals but especially for blue-collar roles that are benefiting from the boom in transportation and warehousing due to friendshoring as well as the national manufacturing renaissance.

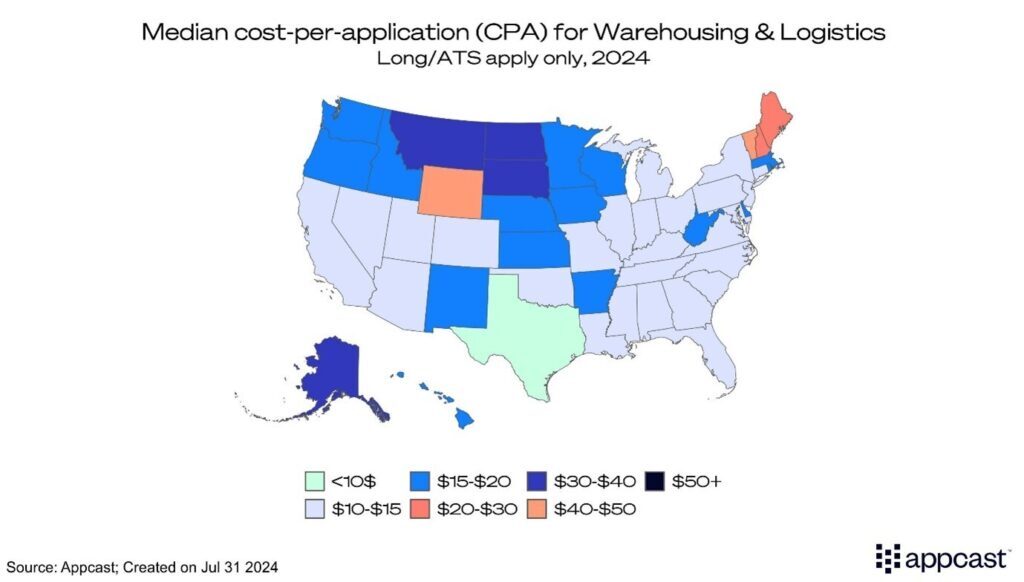

But even as employment in warehousing has risen substantially in the state, Texas remains a low-cost recruitment geography. CPAs in warehousing and logistics are among the very lowest in the nation!

What does that mean for recruiters?

Texas’ labor market is tighter than that in many other parts of the U.S. But the state has one massive advantage. Its YIMBY policies have delivered spectacular growth rates. The state is not just producing oil and gas anymore, but it is expanding renewables at a faster pace than anywhere else. Texas is also increasingly attracting white-collar professionals, especially with Austin being a rapidly expanding hub for tech companies.

Employers can attract workers from other states thanks to the state’s pro-housing policies that are creating more affordable housing than in other parts of the country. General living costs are lower while employment opportunities are expanding and wages are going up, making the state an attractive place to live in.

While the hot labor market might create some challenges for recruiters, Texas is currently a low-cost recruitment geography. CPAs are lower than the national average. The local labor market supply boom thanks to surging migration is most likely a contributing factor.

Recruiters will probably find it relatively easy to lure prospective candidates to Texas if they point to the various benefits that such a relocation can entail, including the relatively low cost-of-living in the state combined with attractive salaries in tech hubs like Austin. Some big employers have already made the move from California to the red state, Chevron being the latest example. It probably won’t be the last.