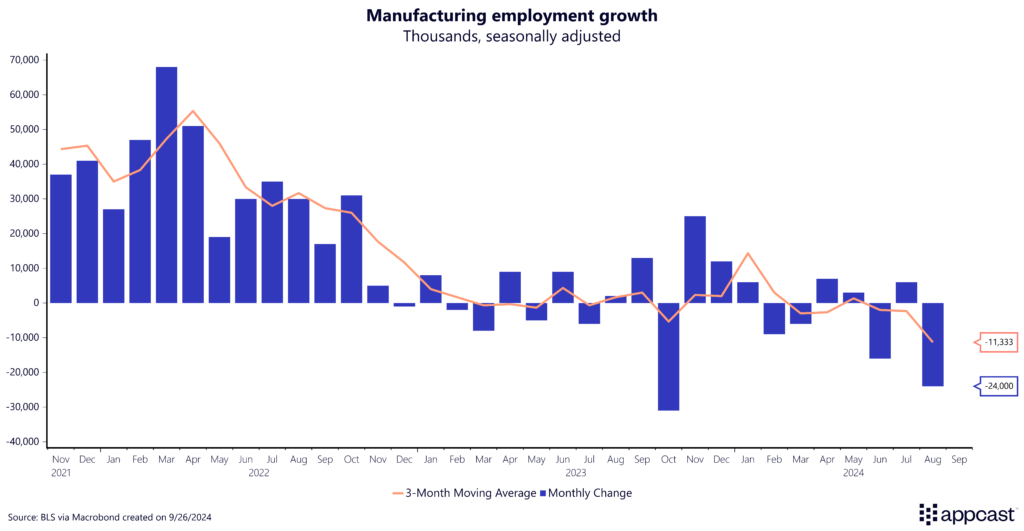

It’s no secret that the manufacturing sector is facing a slowdown in the U.S. Coming out of the pandemic, employment growth was strong, thanks to global supply chain issues that prompted a push to reshore production domestically. For nearly two years, this surge in activity drove robust job growth. However, the momentum began to falter when the Federal Reserve started raising interest rates to curb inflation.

The Federal Funds Rate, which saw its first signs of easing as of September 17th, has played a critical role in this slowdown. Manufacturing, as a capital-intensive sector, is particularly sensitive to changes in borrowing costs. When interest rates rise, the expense of financing major projects—such as building new facilities or purchasing advanced equipment—skyrockets. This, in turn, discourages companies from pursuing large-scale expansions or investments.

As a result of these higher borrowing costs, job growth in the manufacturing sector has remained flat—or even negative. Since October 2022, the industry has seen no net new employment gained, a clear indicator of the strain higher interest rates are placing on the sector’s growth potential.

The question is now whether the recent easing of interest rates will be enough to reinvigorate the manufacturing sector or if more economic headwinds will keep growth stalled. As we look toward 2025, this will be a critical area to watch for recruiters looking to hire the skilled talent necessary to expand their operations.

Employment gains by subsector

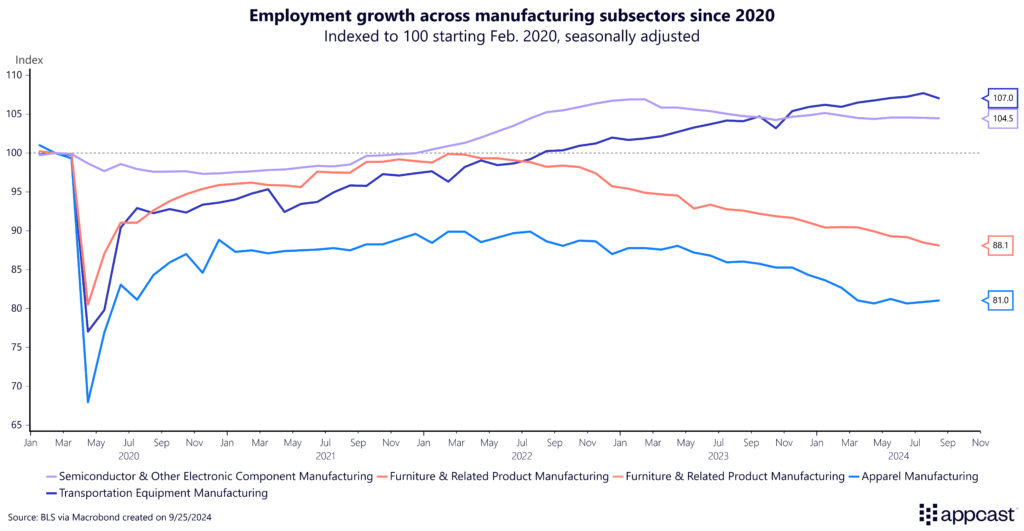

While the broader manufacturing industry has been shedding jobs recently, certain subindustries are bucking the trend and thriving. Since the pandemic, employment in transportation equipment manufacturing has surged by 7% and semiconductor manufacturing has seen a solid 4.5% increase. These sectors have benefited from growing demand for high-tech durable goods, along with significant investment.

In contrast, other segments like apparel and furniture manufacturing have struggled to keep pace. Demand for workers in these industries has plummeted, with employment falling by 11.9% in apparel and by a staggering 19% in furniture manufacturing. These declines reflect shifting consumer preferences and broader structural changes, as automation and global competition weigh heavily on labor demand in these traditional manufacturing sectors.

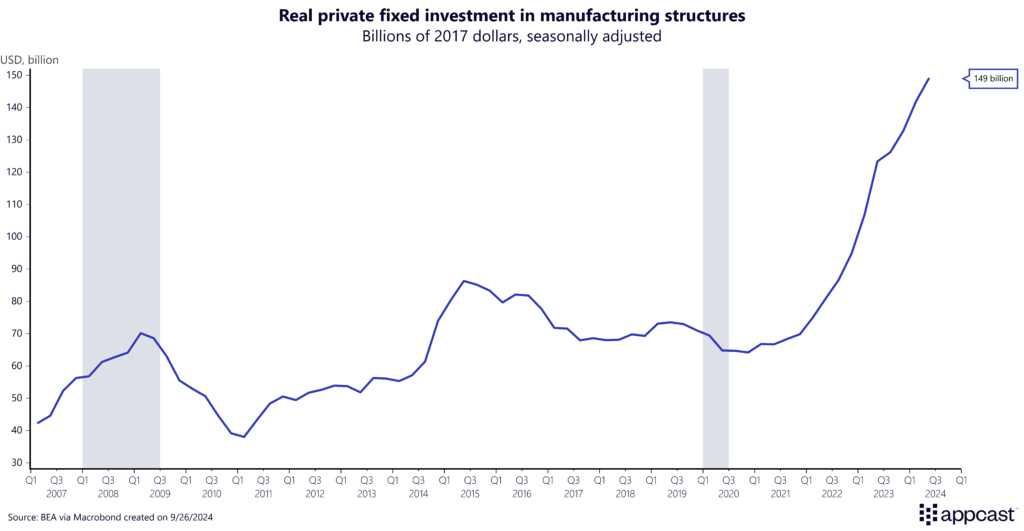

Federal & private investment

The semiconductor industry’s growth isn’t just driven by consumer and business demand—it’s also a direct result of the federal government’s strategic investment. The passage of the CHIPS and Science Act has unleashed a wave of federal funding aimed at making the U.S. a leader in semiconductor production, positioning chip manufacturing as critical infrastructure for the 21st century.

This investment is not only boosting domestic production but also streamlining the permitting process for building new plants. Federal, state, and local governments are working hand-in-hand with private manufacturers to expedite approvals, ensuring that these crucial projects move forward without unnecessary delays.

So far, this public-private partnership has been highly effective. Over the past two years, total private investment into manufacturing plants and infrastructure has surged to an astounding $156 billion (adjusted for inflation). This figure is more than double the investment levels seen before the pandemic, signaling a strong shift back toward expanding production capacity in the U.S. With such robust investment, the future of semiconductor manufacturing—and the broader manufacturing landscape—looks brighter than it has in decades.

Impact on job seekers

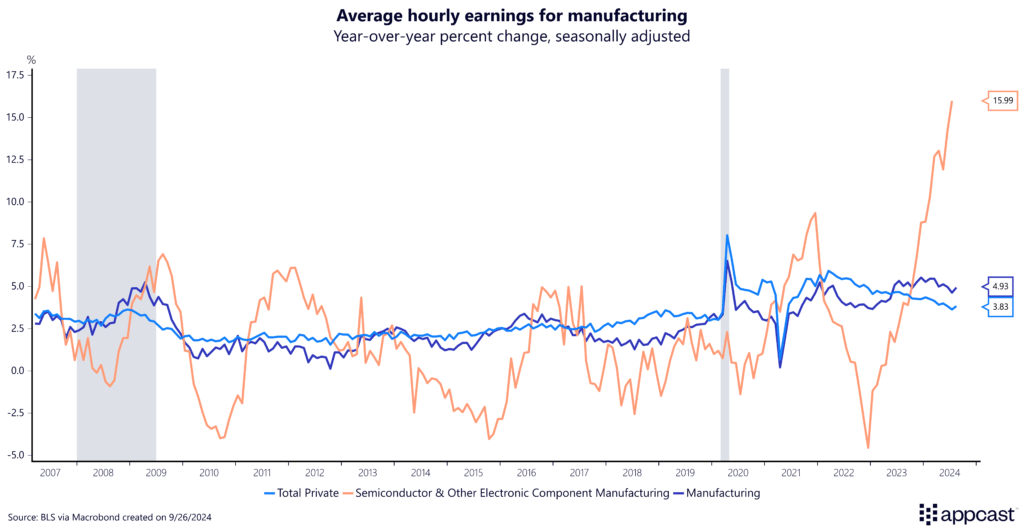

The combination of federal and private sector investment in specialized chip manufacturing has been a significant win for workers, driving impressive wage growth. For non-managerial workers in semiconductor manufacturing, hourly earnings have surged by nearly 16% over the past year, now exceeding $40 per hour. This rapid wage growth reflects the high demand for skilled labor in this industry.

Even when considering the broader manufacturing sector, wages are still performing well, growing at 4.9%—notably above the national average. This highlights the ongoing strength in the manufacturing labor market, with specialized sectors like semiconductors leading the way in both job creation and wage gains.

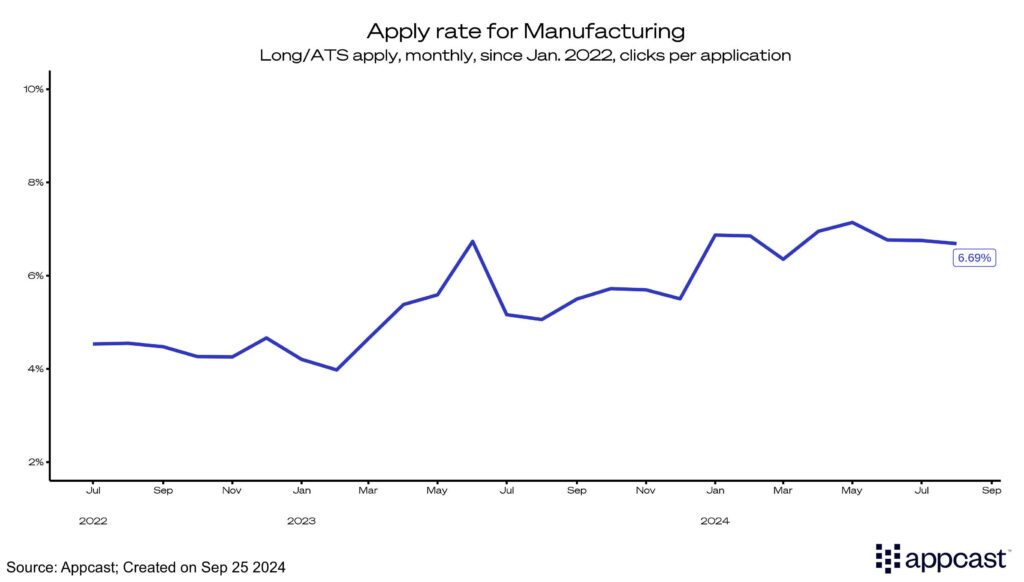

This substantial wage growth has reignited interest among job seekers in the manufacturing sector. According to Appcast’s data, application rates (measured as clicks-per-application) for manufacturing jobs have steadily increased over the past two years, climbing from just over 4% to nearly 7%. This is welcome news for recruiters who have been grappling with the challenge of filling positions for skilled trades.

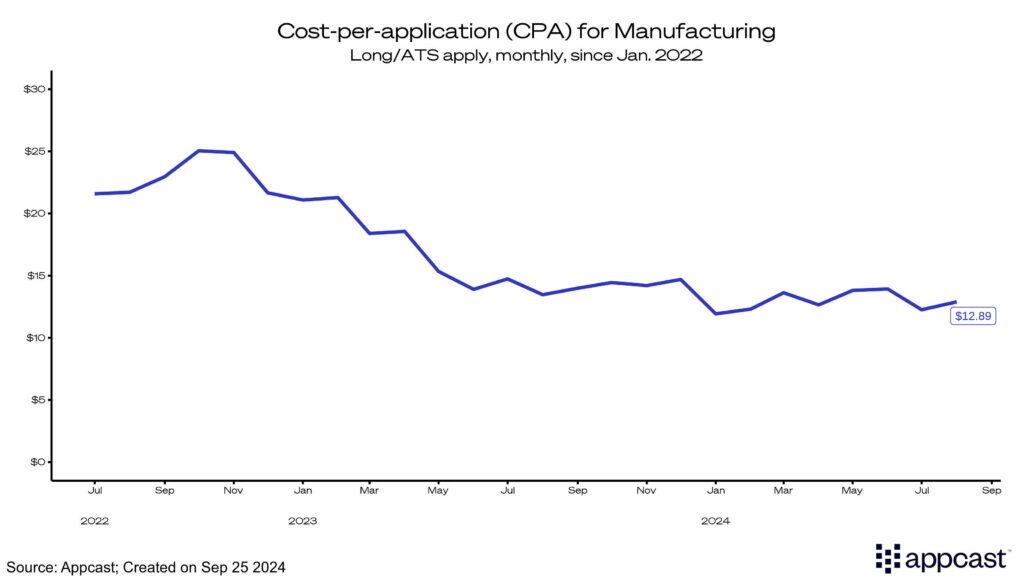

Not only are more job seekers showing interest in manufacturing roles, but recruitment costs have leveled off as well. The median cost-per-application has nearly halved, dropping from $25 to $12.89. This decline is largely due to reduced competition as higher interest rates have curbed expansion efforts across the sector. The broader labor market weakening has impacted competition, dragging down costs across all industries. However, with borrowing costs expected to ease in 2025, this cost advantage may be short-lived.

As interest rates come down, we could see a resurgence in competition for talent, potentially driving recruitment costs back up. For now, though, recruiters are benefiting from both increased applicant interest and more manageable costs—an ideal combination as the industry seeks to rebuild and expand its workforce.

What does this mean for recruiters?

For recruiters in the manufacturing sector, the past four years have been a rollercoaster. The initial hiring boom of 2020 and 2021 sparked intense competition for talent, prompting a level of openings unseen in decades. However, the rise in interest rates over the past two years has cooled hiring activity significantly. As borrowing costs begin to decline, the industry could see a resurgence in demand, potentially returning to a more balanced hiring environment—neither too hot nor too cold.