The labor market is rapidly shifting from tight to balanced as businesses have scaled back their appetite for hiring. As the Federal Reserve decided on Wednesday to keep interest rates at their current level, pressure will continue to mount to reduce rates in September to ease this softening labor market. The question is no longer when they will cut rates, but by how much.

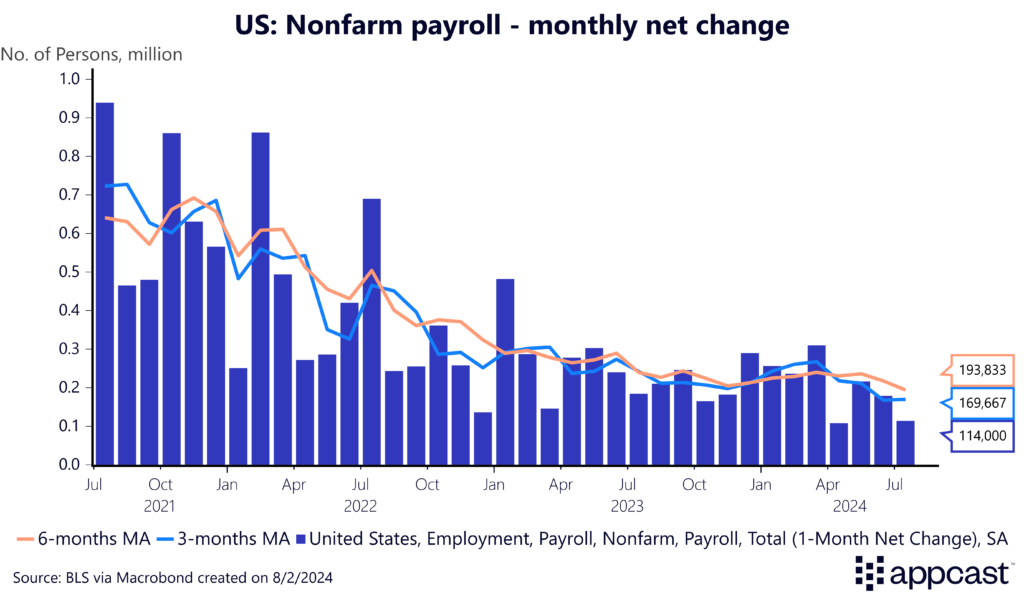

The U.S. economy added just 114,000 new jobs last month, with a net negative revision of 29,000 combined for May and June’s data. The three-month average for job growth is now below 170,000, the lowest in the post-pandemic recovery. Not only has the pace of job growth cooled, but the unemployment rate has steadily risen – now at 4.3%.

Average hourly earnings continue to decelerate, now at 3.82% from the year prior. Concerns about a reversal in wage growth earlier this year have completely disappeared.

Industry insights

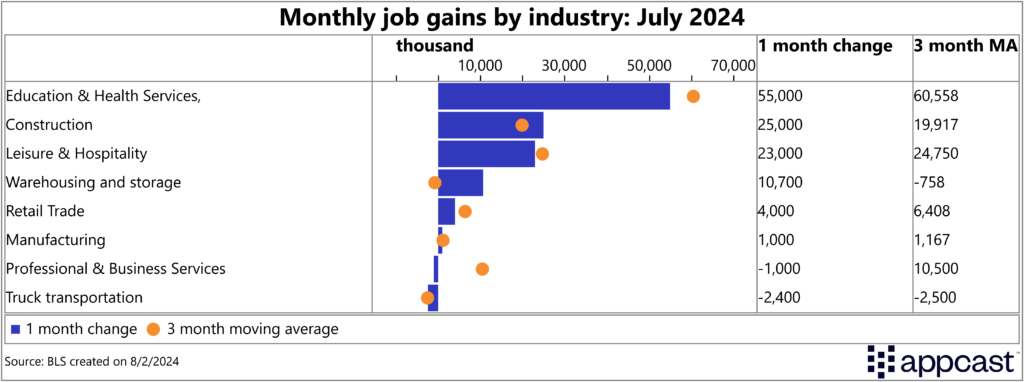

Healthcare and education have kept the labor market afloat for many months now, and that trend continued today as the industry added 55,000 new jobs. Outside of healthcare, construction is a surprising growth industry, adding 25,000 new jobs and weathering the storm of elevated interest rates.

Ongoing weakness in “sitting down” jobs (those typically done on a computer) has persisted throughout the year as the information industry lost 20,000 jobs and professional and business services changed little.

Labor Force Insights

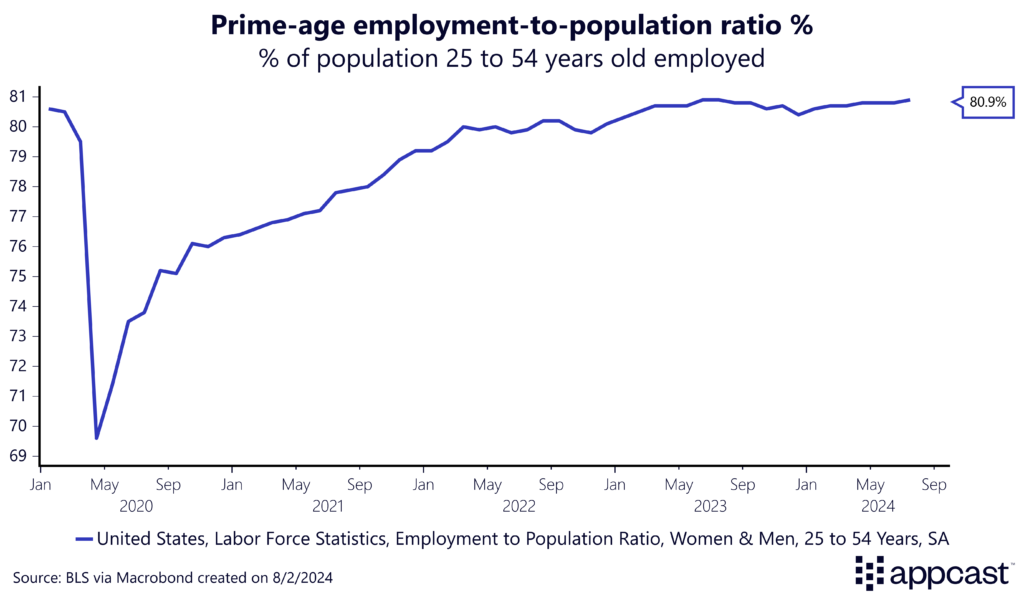

While employer demand has subsided, we have not witnessed extensive weakness in the labor force. The prime-age employment-to-population ratio is still above its pre-pandemic level and, if adjusted for changes in demographics, it is at an all-time high.

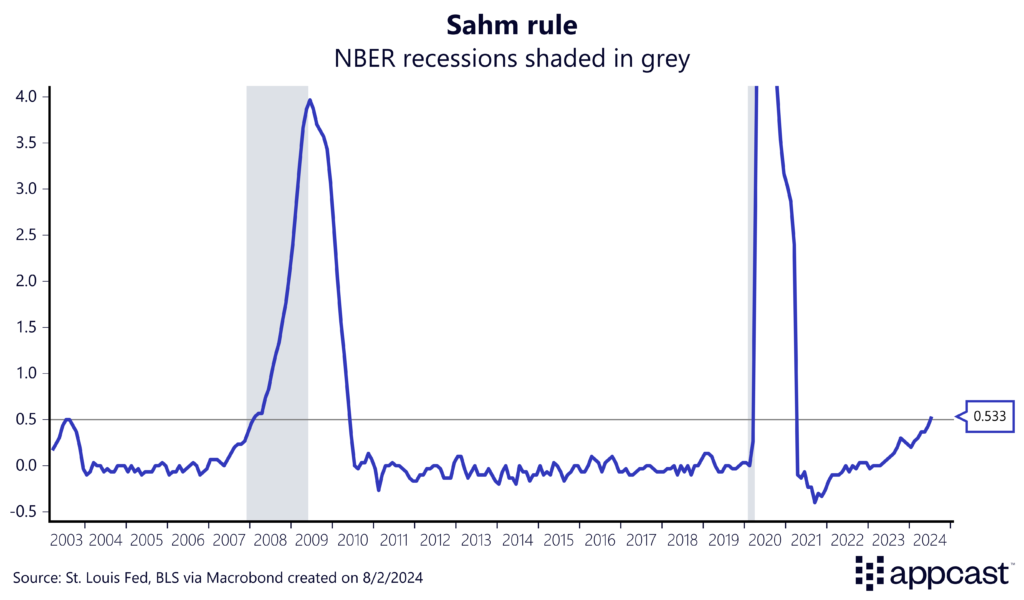

What will grab the most oxygen in the room today is certainly the triggering of the Sahm rule. The recession indicator tracks the movement of the unemployment rate compared to its twelve-month low. Claudia Sahm (the author of the calculation) has rightfully pointed out that even though the rule has triggered, the underlying components of economy don’t necessarily point towards a recession.

While the unemployment rate has been gradually rising, a typical recession is determined by a widespread economic downturn. We’re far from that: U.S. GDP growth far exceeded expectations this quarter, growing at a rate of 2.8% as consumer spending remains robust.

So, what’s going on? A combination of people returning to the workforce and elevated immigration levels create a larger supply of workers, who are all facing a weaker hiring environment and thus taking longer to find jobs.

Elevated Risks

As more people loudly call for the Fed to cut rates, this situation eerily calls to mind early 2022. Inflation began to climb in 2021 when interest rates were at nearly zero. Economists like Larry Summers correctly predicted the largest risk to the U.S. economy was overheating – too much growth, too rapidly with supply constraints driving up prices.

Now more than three years later, the opposite is true. The Fed did not lower interest rates in July, continuing to hold out for their goal of 2% inflation. Inflation has come down, but not enough for policy makers, despite the weakening labor market. All signs point towards a rate cut in September, with several more to potentially follow in the fall and winter.

What Does This Mean for Recruiters?

For recruiters, the shift from a tight to a balanced labor market means adapting strategies to an evolving hiring environment. With fewer new jobs being created and a rising unemployment rate, the available talent pool is expanding, offering more options but also necessitating more effort to attract top candidates.

Although the rest of 2024 may look far different than the tight markets of 2021 and 2022, easing financial conditions from the Fed suggest that 2025 may bring a more normalized hiring environment.