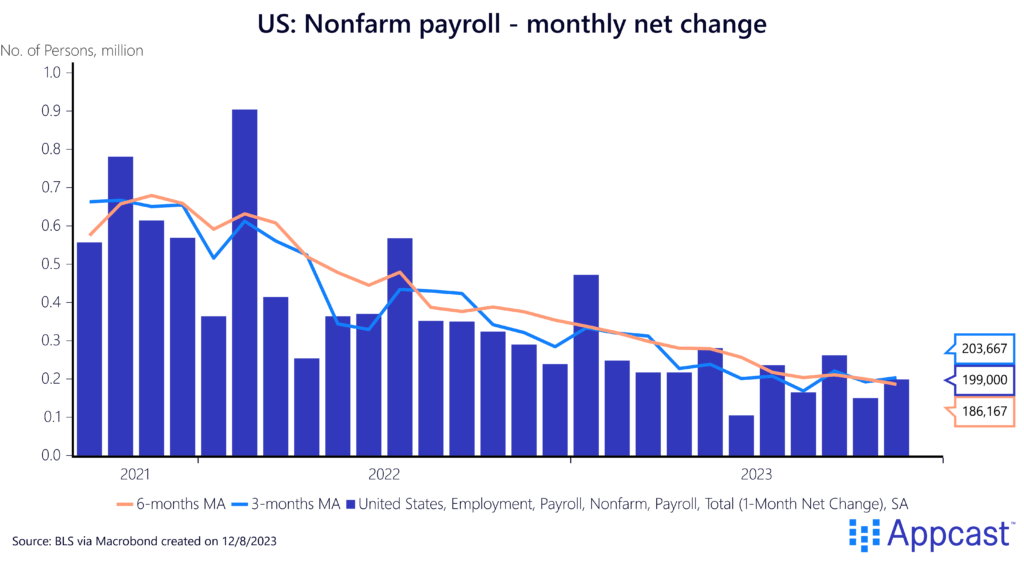

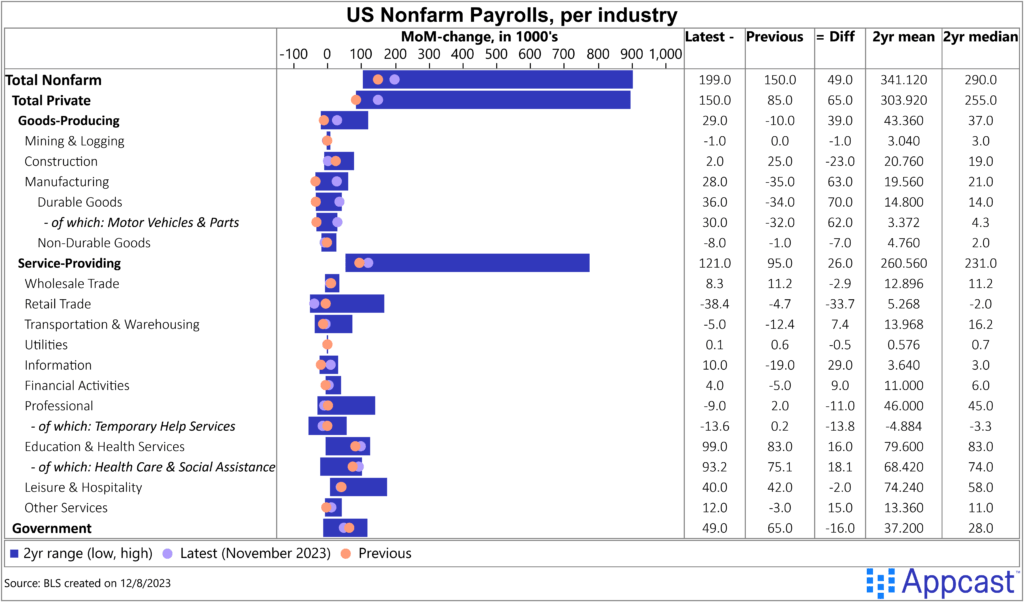

In November, the U.S. labor market added 199,000 net new jobs. The unemployment rate dipped slightly to 3.7%. Healthcare was once again an industry leader in job gains, but the return of striking workers in auto manufacturing also contributed to this past month’s gains.

The labor market remains strong, despite its gradual slowing. The resilience of this labor market should be commended, especially considering the cooling forecasts seen in late 2022 and early 2023. This report has “soft landing” written all over it.

Steady labor force participation

Nonfarm payroll gains have slowed in 2023, but the gains this month show the labor market is still relatively strong. Gains of 199,000 jobs is nothing to scoff at – in fact, it’s a more sustainable pace of growth than the robustness of 2022.

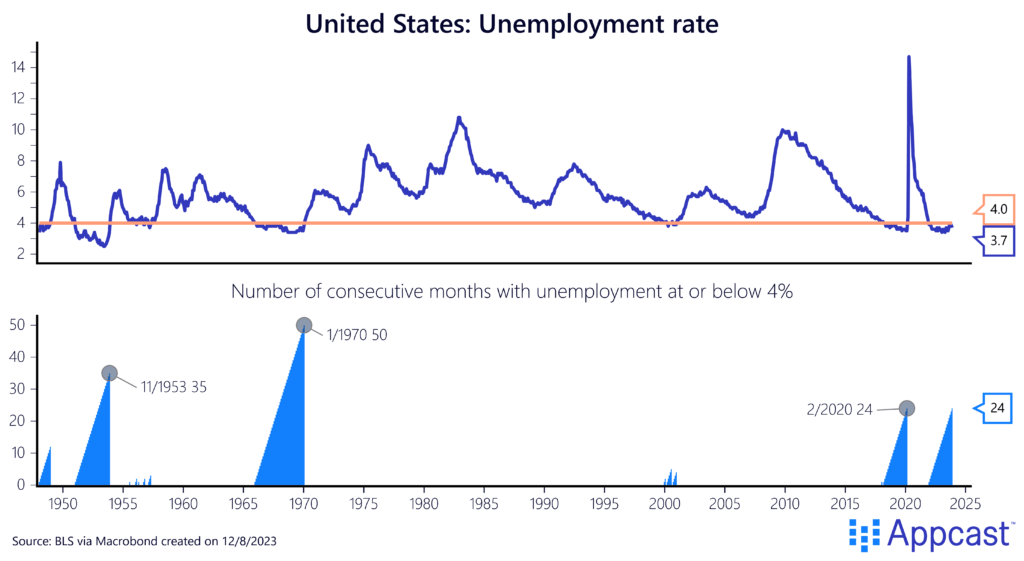

The unemployment rate fell by 0.2% down to 3.7%. Historically low, this rate continues a streak of 4% or under employment, going on its 24th month. The labor market remains tighter than many predictions from a year ago, despite its gradual cooling.

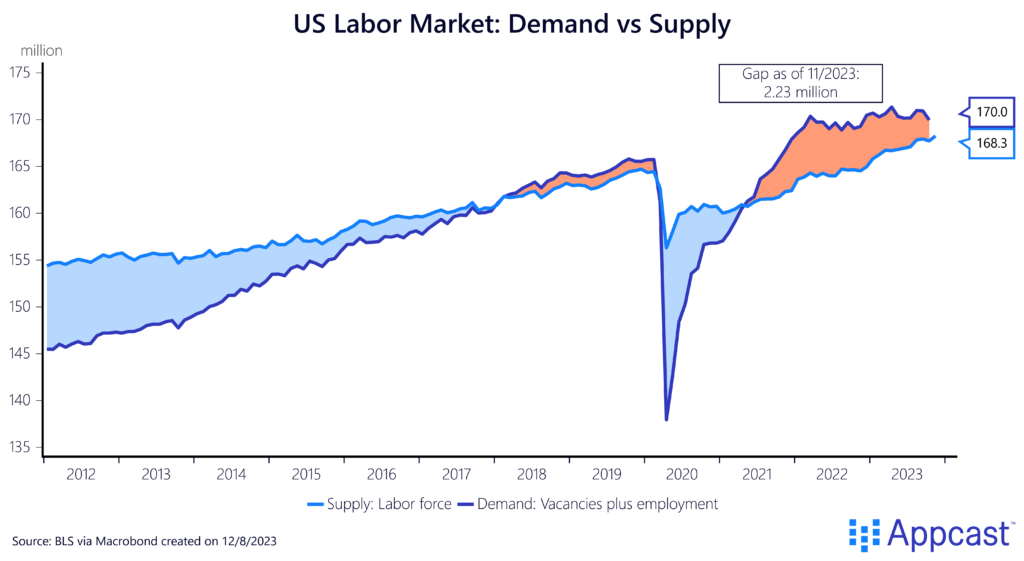

As the labor market cools, demand and supply are converging – exactly what the Federal Reserve would like to see. We’re slowly moving from an imbalanced labor market (demonstrated most extremely in mid-2021) to balanced. That more balanced labor market will lead to more sustainable wage growth, leading to softer inflation, but with resilient hiring.

Steady labor force participation

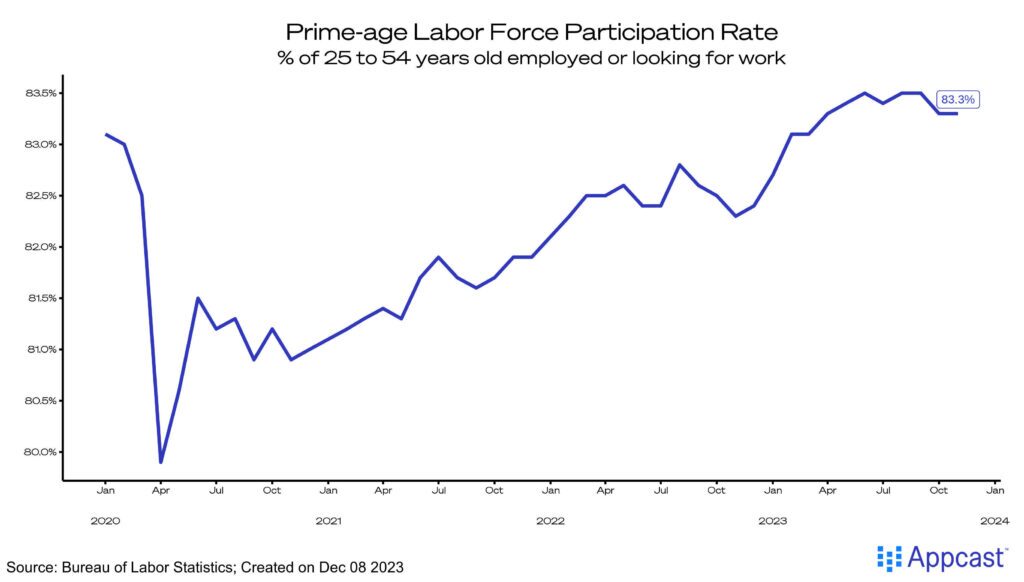

The rebound in labor supply in 2023 has been fairly remarkable. The prime-age labor force participation rate, which includes the 25-54 year old cohort, was flat at 83.3% this month. There was also a slight increase in the prime-age employment-to-population ratio to 80.7%. These data points show that we’re near full-employment, which is how hiring has remained so strong throughout the year.

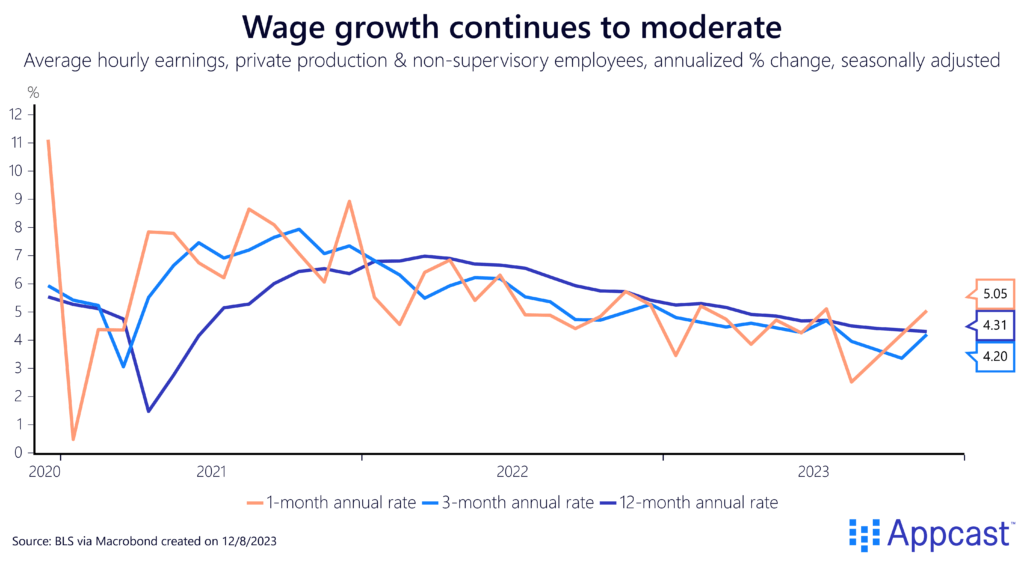

Wage growth catches Fed’s eyes

Wage growth – average hourly earnings (for private sector non-managers) – has had a noticeable increase the past two months, after several months of consistent cooling. The one-month annual change is now up to 5.05%, and the three-month change increased slightly to 4.2%.

While strong wage growth is obviously a positive for workers, the Federal Reserve watches it closely, as it directly impacts the rate of inflation. The long-term, 12-month trend is still on a glidepath downward, headed towards normal wage growth. The Fed will keep a close eye on this as it moves forward, especially because the long-term trend is still running a bit hot.

Sector-specific growth

Dialing in on sector-specific growth, industries behaved as expected. Once again, healthcare won the month. In fact, at this point in the year, it may be safe to say that healthcare won the year. The powerhouse sector added 77,000 jobs in November, even higher than the average of 54,000 per month throughout the year. The sector has the real potential to keep growing as the population ages and healthcare labor demand remains steadily high.

Manufacturing had a remarkable month after a slow October. The strikes in the auto industry impacted gains last month but as those workers returned to work, employment rose by 28,000.

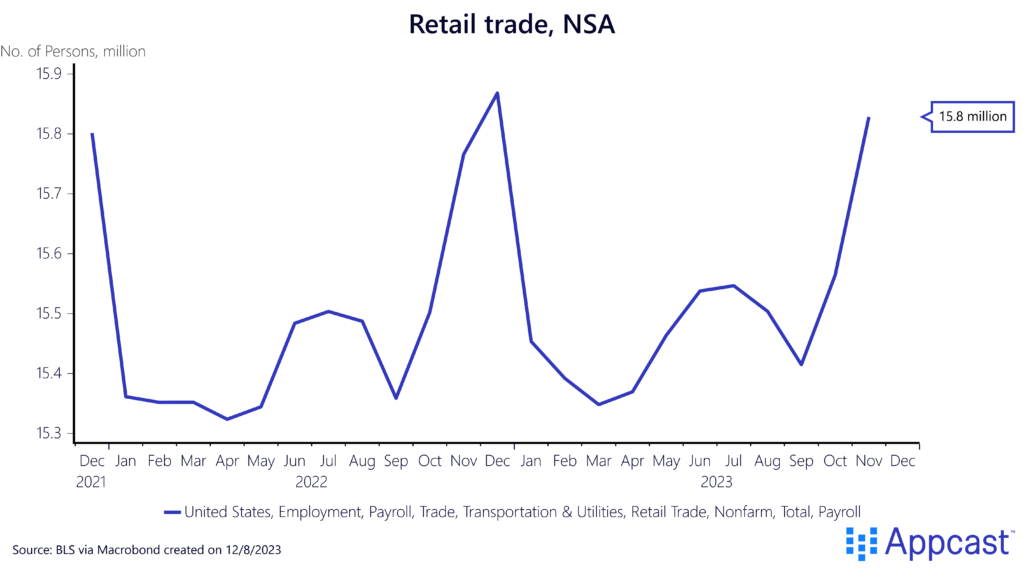

Retail lost a (seasonally-adjusted) 38,000 jobs in the lead-up to the holiday season. Without seasonal adjustment, the data shows an increase of several hundred thousand. What this means is that retail rose less than what was expected, compared to the past year’s trend. Perhaps COVID-era disruptions are distorting the seasonally-adjusted figures.

One surprise might be the information sector, which had a robust month. This industry, which includes many tech jobs, suffered early in the year as companies adjusted to higher interest rates and constrained growth. However, in November, the sector added 10,000 net new jobs – perhaps something to watch moving forward.

What does this mean for recruiters?

Employers may be feeling like the economy is doing poorly – the “vibecession” narrative is certainly real. However, as this latest jobs report shows, the labor market remains strong. Recruiters may still be feeling the sting of a tight labor market, especially in sectors like healthcare, but the growth in the labor force should ease those troubles.

Despite the vibes being off, the U.S. labor market just won’t quit.