Is the fabled “soft landing” really happening? So far, yes, it seems that it is. While not a sure thing, it looks promising. Let’s review what a soft landing means, tour the latest Fed forecasts for the economy, and assess four layers of risks to the outlook.

What is a “soft landing”?

A soft landing means disinflation without a recession. It has happened before, in 1995, but it’s not easy to pull off. When the Fed embarks on a sustained series of interest rate hikes to combat high inflation, more often than not a recession follows. However, in recent months, inflation has fallen, while the unemployment rate is below 4% and GDP growth is exceeding forecasts.

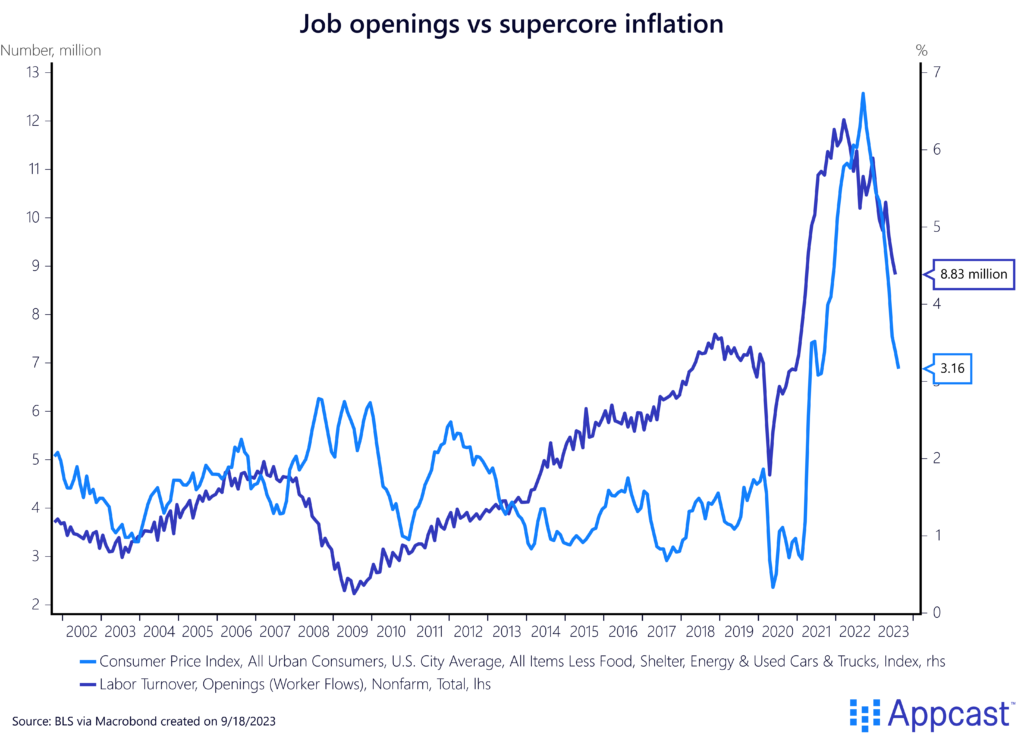

To see the soft landing, just look at the chart below. It shows the labor market cooling and underlying inflation declining hand-in-hand. On one axis, job openings have materially declined, from nearly 12 million to 8.8 million. And at the same time, “supercore” inflation is coming down from over 6% to just above 3% on a year-over-year basis. Supercore inflation excludes not just volatile food and energy prices but also housing and vehicle prices, which move with long lags.

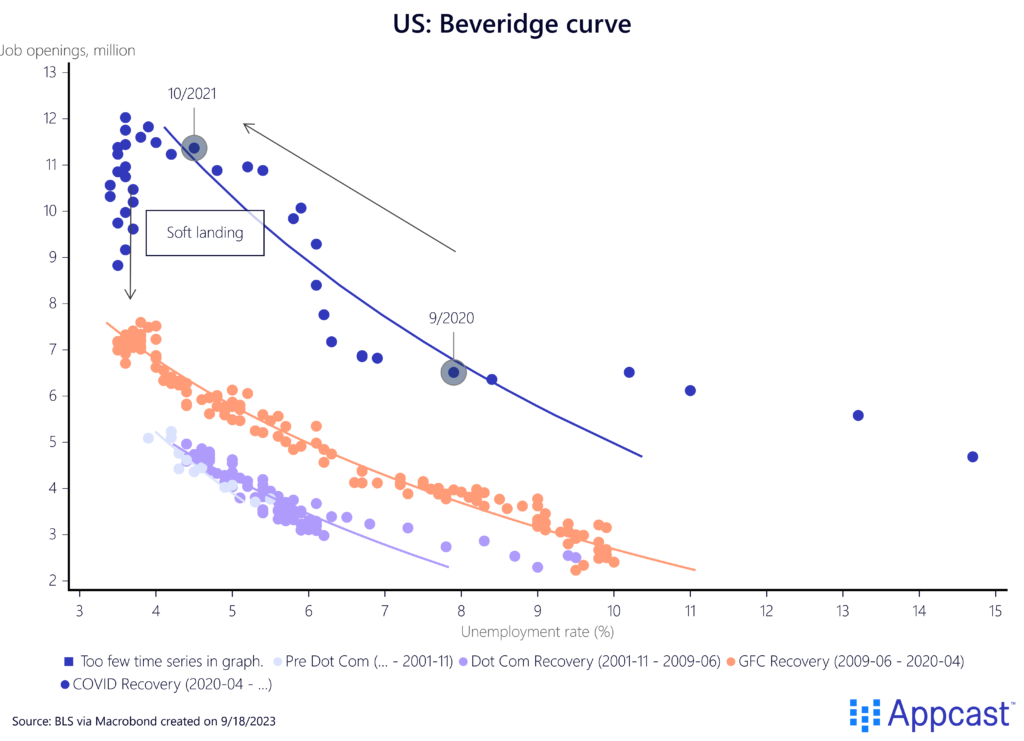

Disinflation happening alongside a so-far immaculate cooling of the labor market is evidenced by the Beveridge Curve, named after the economist William Beveridge. It shows the consistent inverse relationship between job openings and the unemployment rate: when labor demand falls, usually the unemployment rate rises. But this time is different! As you see, the blue dots of recent months have fallen (job openings have declined) but the unemployment rate hasn’t risen significantly.

“Proceeding carefully” with a soft landing

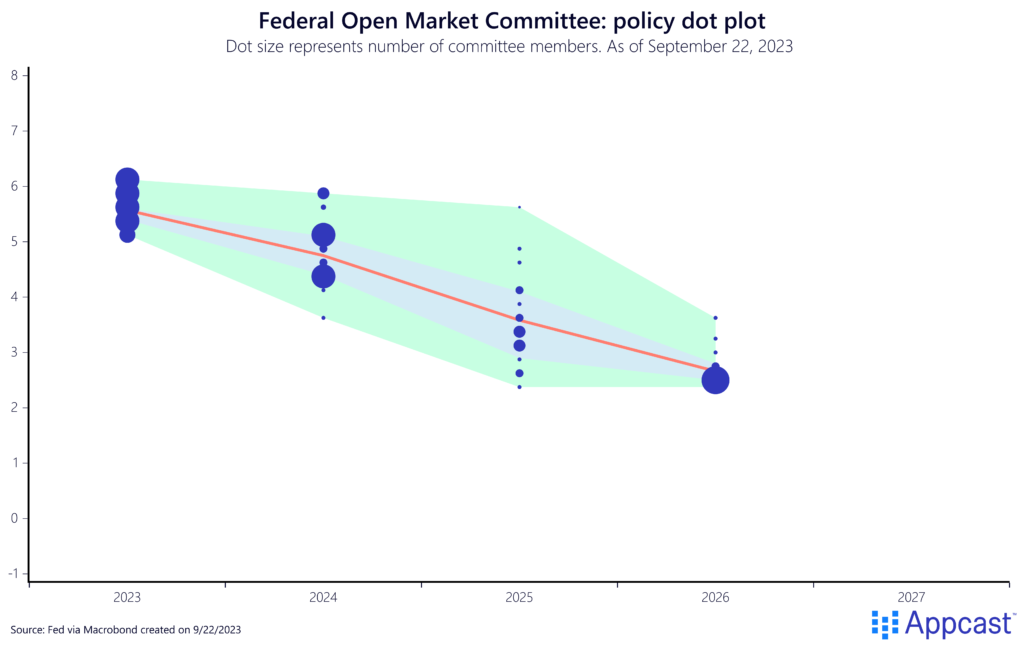

This week the Federal Reserve acknowledged that the fabled “soft landing” was inching closer to reality. As the Federal Open Market Committee (FOMC) decided not to raise short-term interest rates, it also was signaling that it could do so later this year. The so-called “dot plot” (show below) should be interpreted as an insurance policy – should inflation not come down as it has in recent months, the Fed may do another hike. But futures markets bet that the Fed is done tightening. Jay Powell, the Fed Chair, repeatedly said they were “proceeding carefully” by not raising interest rates and assessing the incoming data.

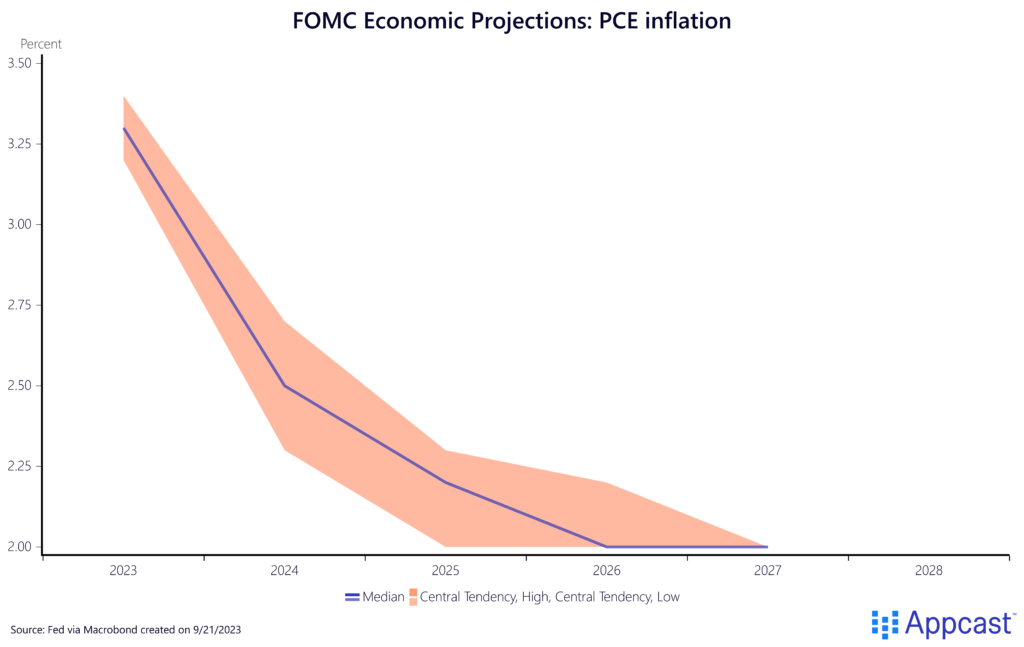

Yet this outlook entirely depends on continued disinflation. The FOMC lowered the 2023 forecast of its preferred gauge of inflation – the Personal Consumption Expenditures (PCE) price index – to 3.25%, and to 2.5% next year. So, still above its 2% target but it’s getting there.

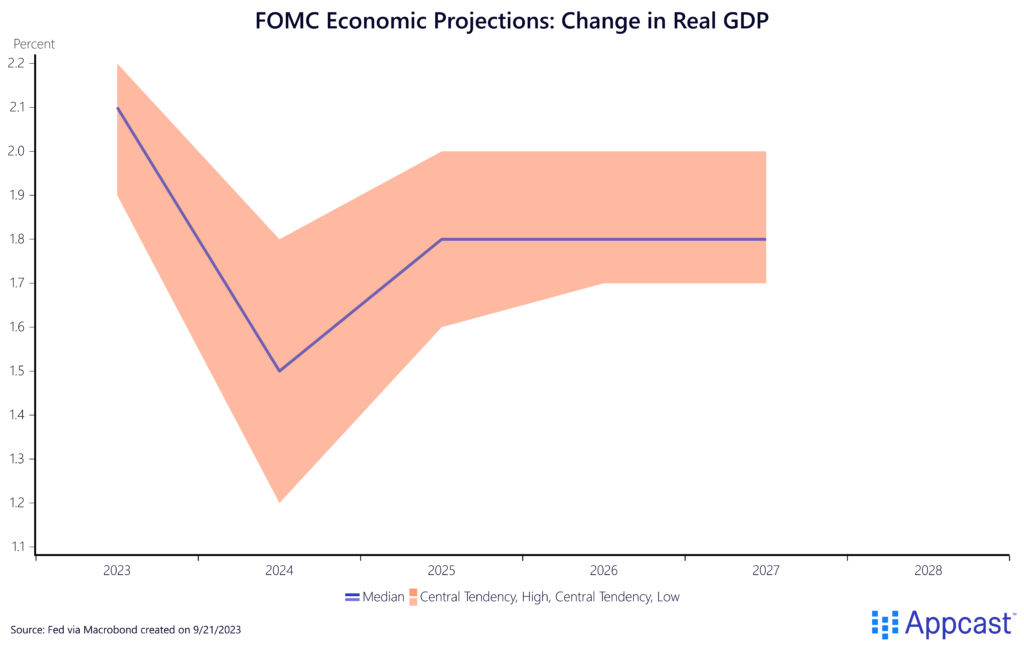

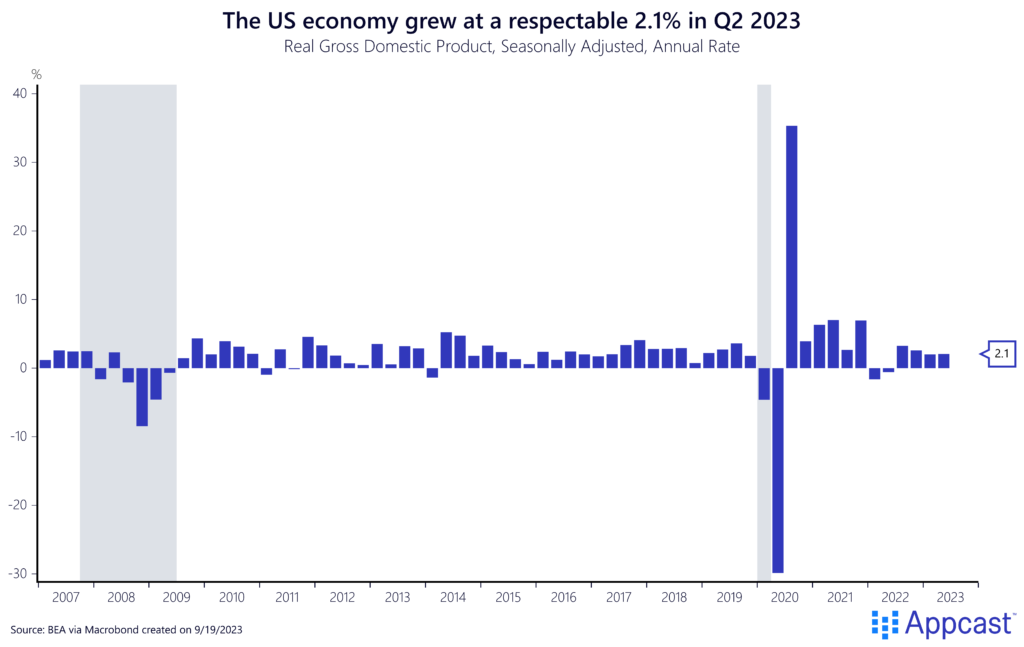

Where the Fed really tipped its hat that a soft landing was becoming a reality was through its real GDP forecast, which doubled for 2023 from 1% to 2.1%. This is mostly a matter of arithmetic, as consumer spending has powered growth well above most forecasts this year.

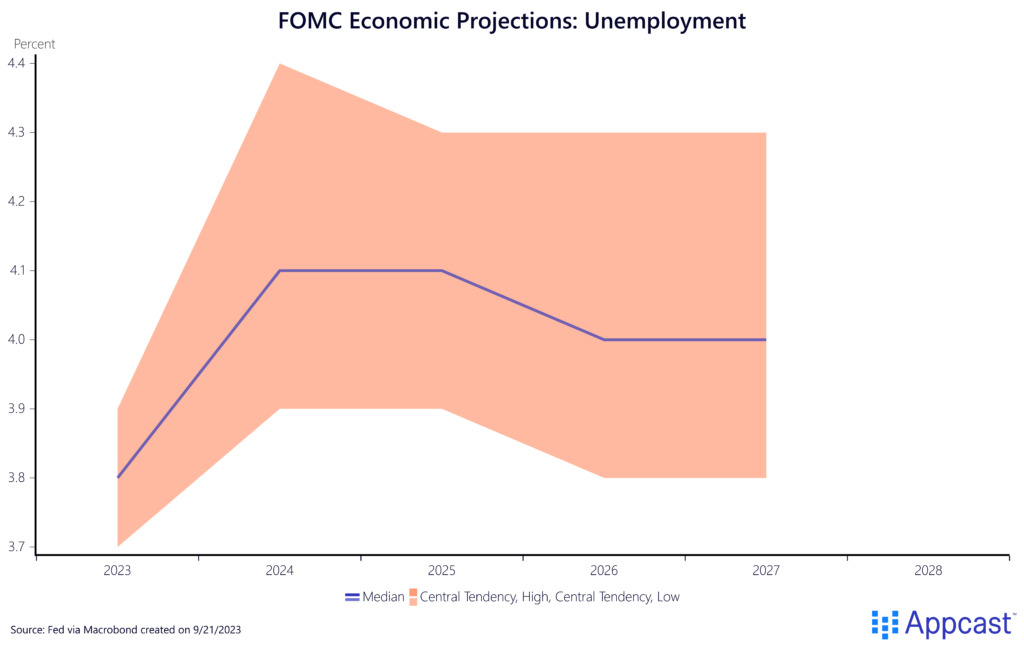

Finally, the FOMC’s unemployment rate forecasts recognize that the historically tight labor market, while cooling somewhat this year, needs to “soften” further. The current 3.8% rate is expected to rise just above 4% next year and into 2025. This is still pretty good!

Layered risks to the outlook

That said, all the optimism of the Fed’s forecasts this week come with a layer cake of risks. On their own, none of these risks are likely to push the economy into recession, but if they all hit, the cumulative impact could be death by a thousand cuts.

What are those risks? Let’s review:

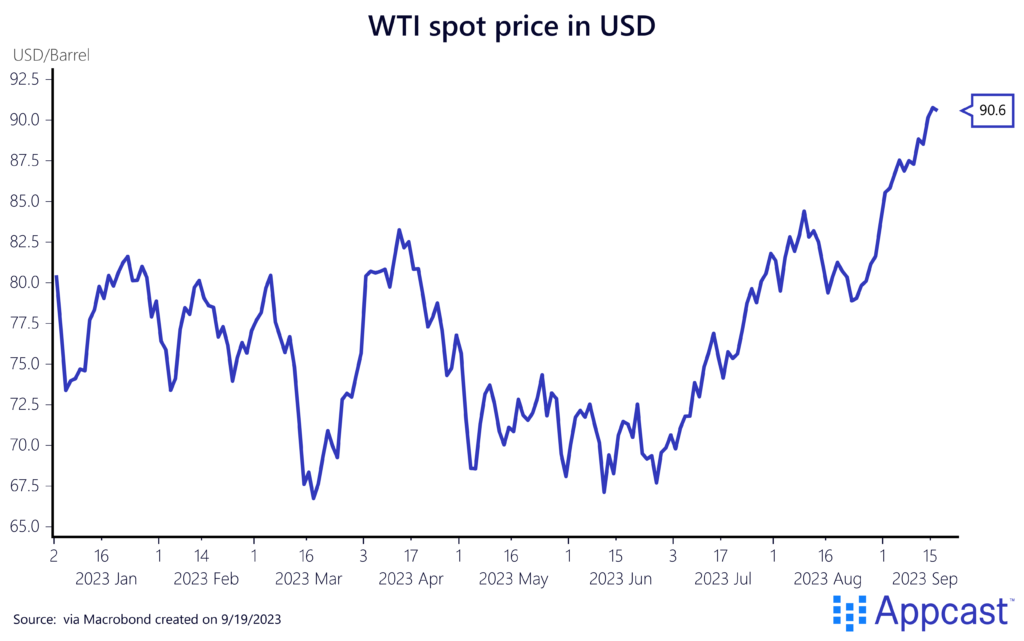

- Oil shock

First, oil prices began to move higher in August after OPEC+, notably Saudi Arabia, cut production. The West Texas Intermediate (WTI) price per barrel rising above $90 signals the average gallon of gas in the U.S. is well above $4, driving up headline inflation.

- Labor pains

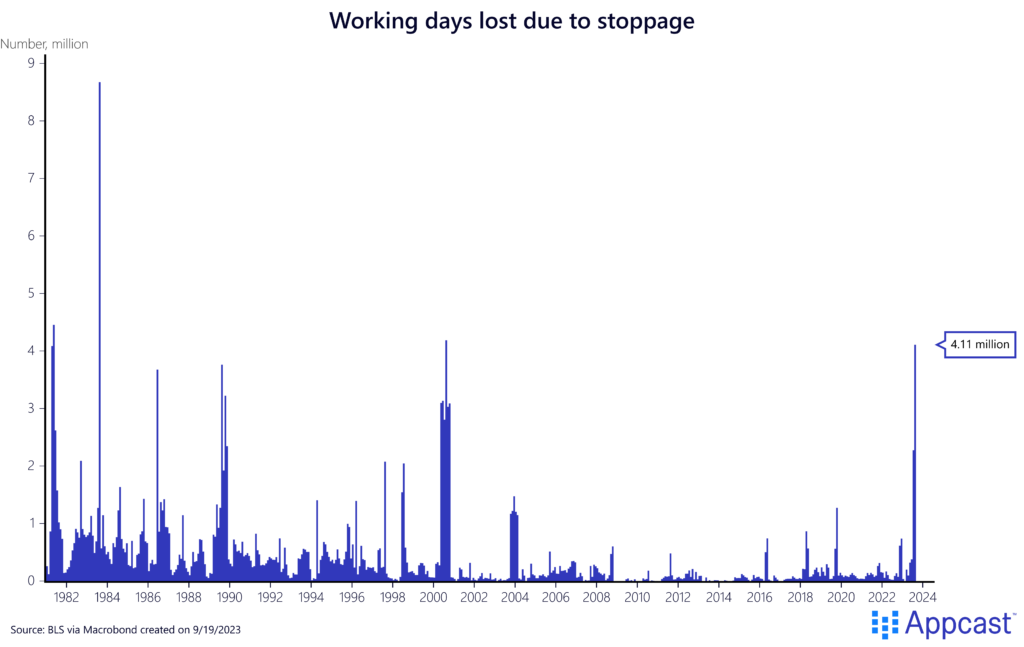

Second, the United Auto Workers strike that began last week is emblematic of a “hot labor summer” that has continued into the fall. This strike could disrupt production and potentially reverse a cooling labor market. Auto workers are not alone: Hollywood actors and writers are striking as well, plus various smaller strikes across the country. The cumulative number of days lost to work stoppages is over 4 million, putting the U.S. on track to have the most intense period of labor action in nearly 40 years.

- Washington’s own goal

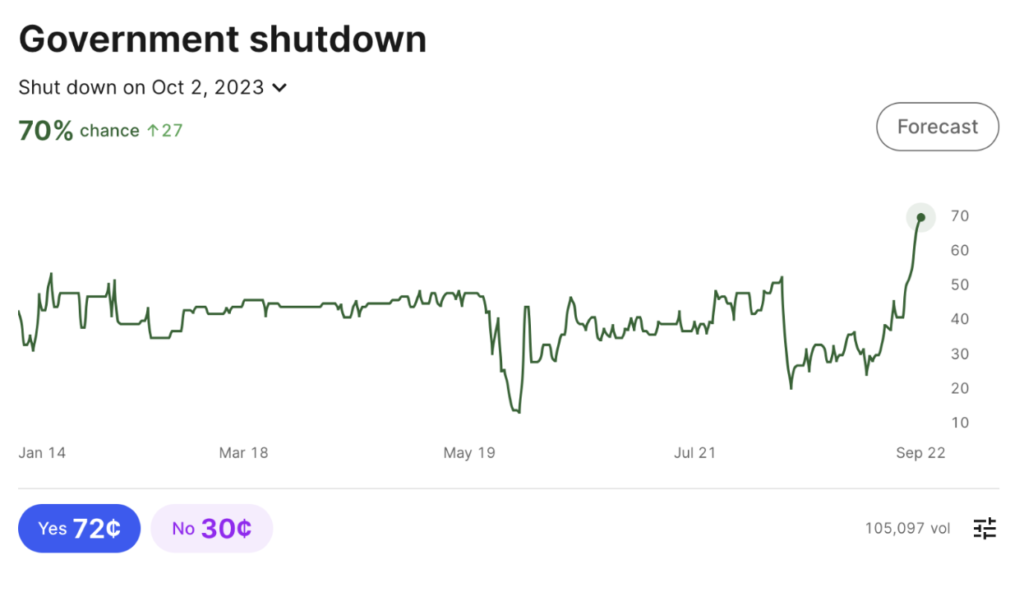

Third, polarized politics. It not only distorts economic statistics but could cause real damage too. Another government shutdown seems likely, according to the prediction market Kalshi.com

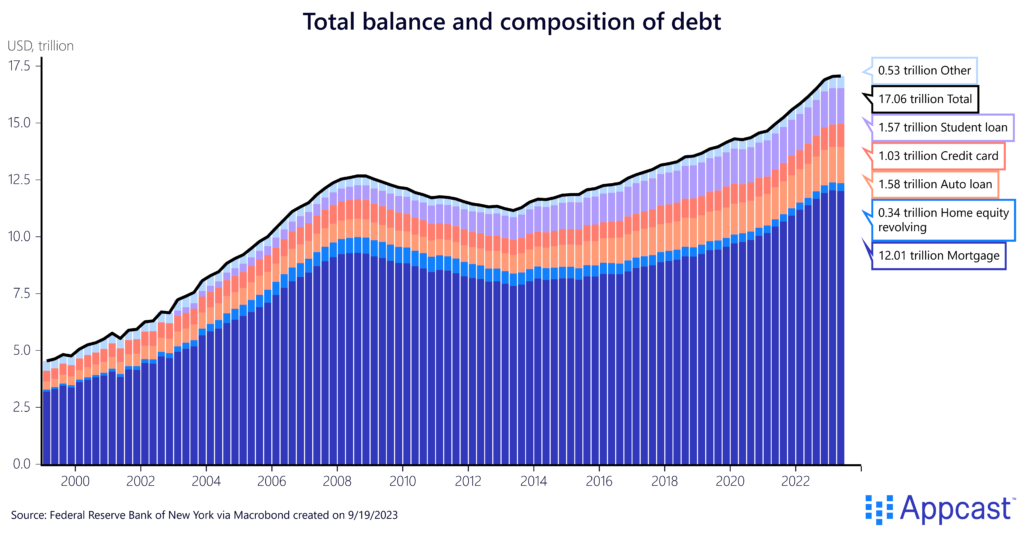

In tandem with a probable shutdown, payments resume this fall on $1.6 trillion of federal student loans, after a multi-year pause. Again, on their own, no single factor here could push the U.S. economy into recession. But as these risks add up, it could be significant.

- Too much of a good thing

Fourth and finally, there is the risk that the economy could be too good. If the economy fails to slow enough, inflation could bounce back, and the would-be soft landing could turn very hard. In Q1, real GDP growth was 2% and in Q2 it was 2.1%. This is slightly above trend.

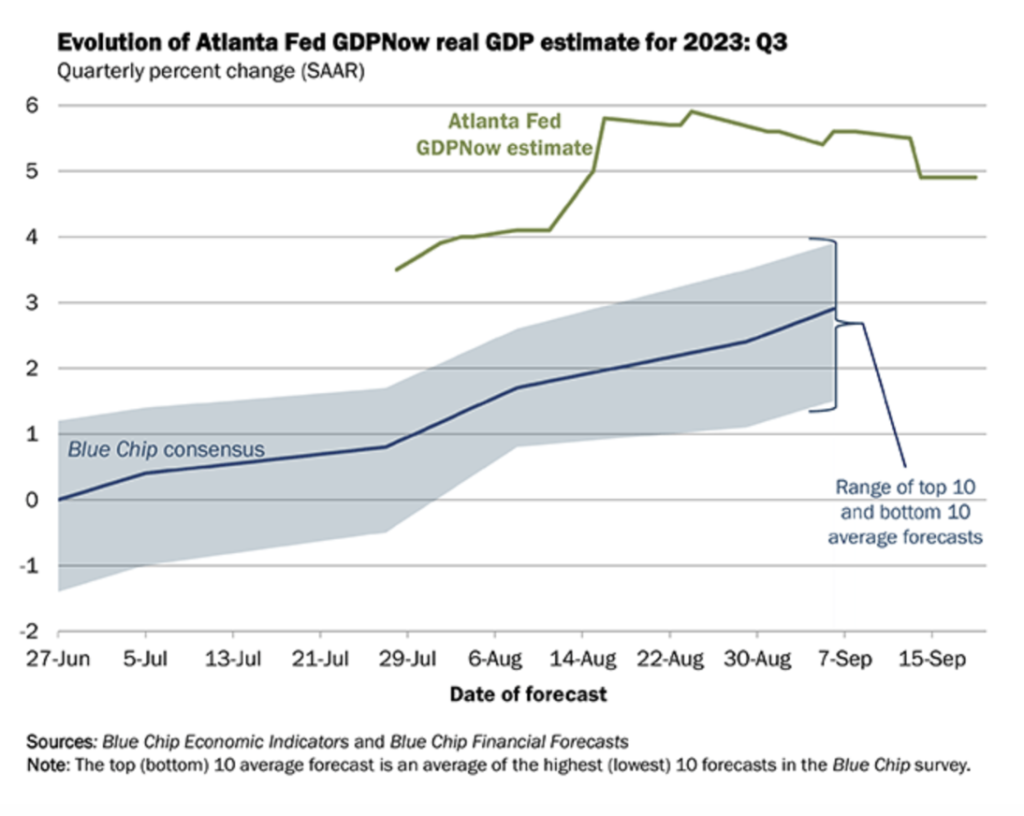

Tracking forecasts for Q3 real GDP growth are surprisingly strong, with the Atlanta Fed’s GDPNow forecast at 5%! If consumer spending continues to drive growth higher, the Fed could worry that interest rates aren’t sufficiently restrictive.

Conclusion: Cautious optimism is warranted

The economy is doing better than sour consumer sentiment reflects. Rule-of-thumb recession predictions (like the inverted yield curve) may not apply. But the variety of risks to this outlook make 2024 predictions highly uncertain. No single factor seems significant enough to move the needle but if synchronized, they could be consequential.