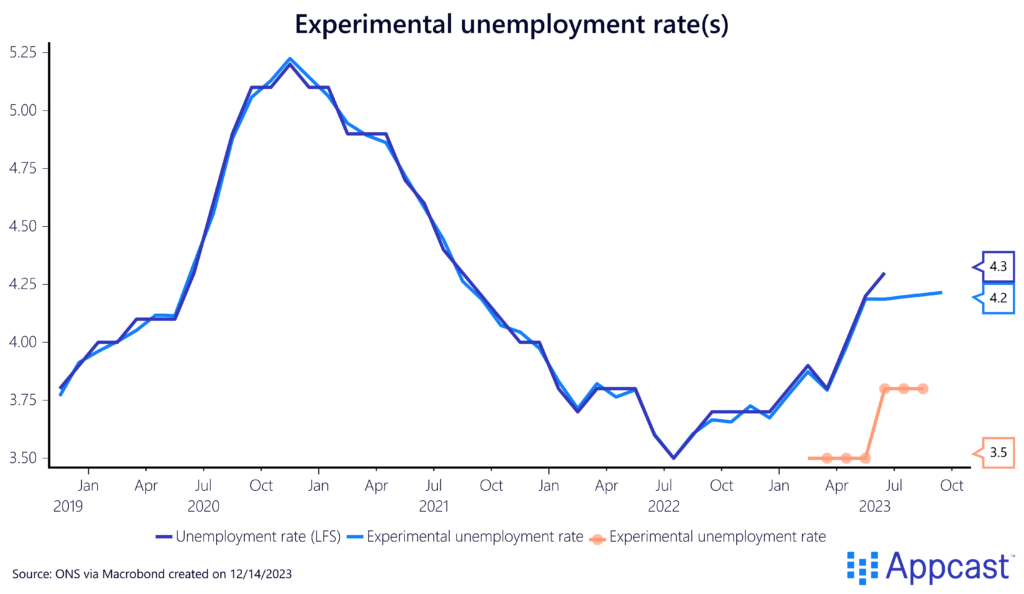

There is considerable uncertainty about the unemployment data

As I explained earlier this year, the Office for National Statistics (ONS) has ceased to publish unemployment data based on the U.K. Labour Force Survey. The responses to the survey have fallen so much that the ONS cannot accurately calculate the unemployment rate.

Instead, the ONS is currently releasing an “experimental unemployment rate” based on claimant counts, which currently stands at 4.2%.

However, in a stealth move, the ONS also released some preliminary data from their Transformed Labour Force Survey (TLFS) a few weeks ago. The TLFS was supposed to be released next spring as a replacement for the now obsolete U.K. Labour Force Survey.

The data from the TLFS shows that the unemployment rate in Q2 and Q3 might have been up to 0.5 percentage points lower than what the experimental statistics suggest.

Long story short, the U.K. labor market data is currently a bit of a mess, and we do not quite know where we stand. The unemployment rate might be at 4.2%, as the experimental data shows, or below 4% per the TLFS, or it could be higher than either measure shows.

The uncertainty about the labor market data is particularly hazardous right now because policy makers rely on it. The Bank of England (BoE) is leaving interest rates at elevated levels to stoke off inflationary pressures in the economy. Therefore, there is a risk that monetary policy makers will slow down the economy too much and put the labor market in peril without even knowing it.

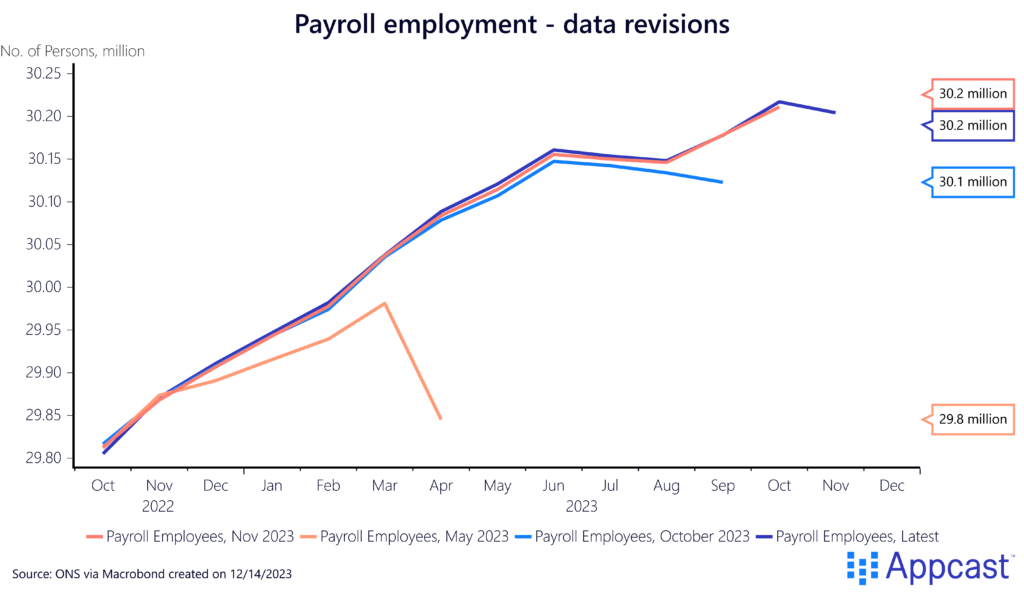

Payroll employment has slowed down but remains positive

Payroll employment continued to grow this year, especially in the first half. While some preliminary data releases displayed some decline earlier this year, subsequent revisions of the data showed that payroll employment continued to grow throughout 2023.

However, job growth has slowed down since the summer and was slightly negative in November. It is becoming very evident that the U.K. labor market is easing compared to last year.

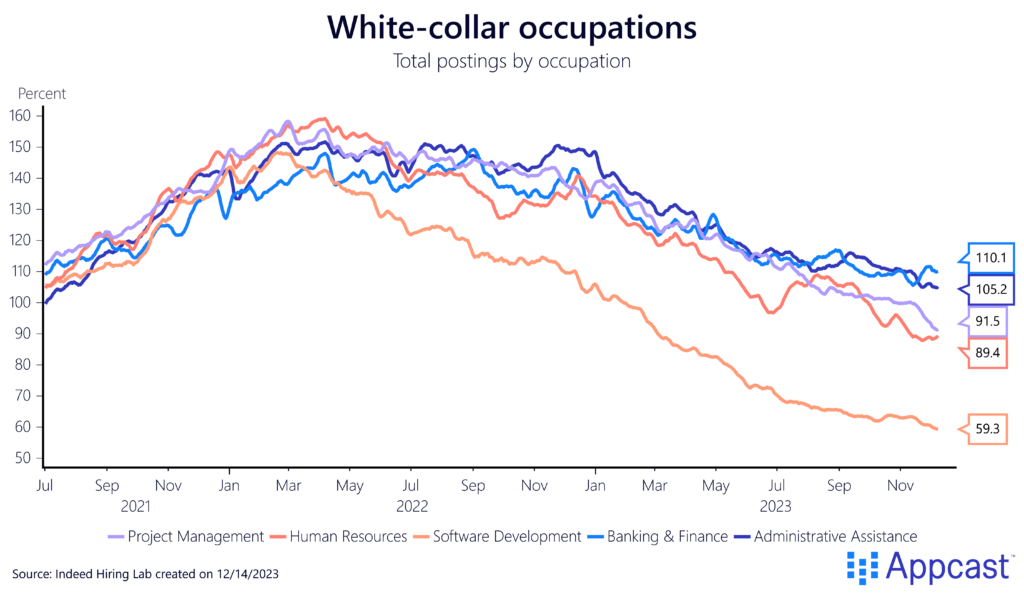

After a somewhat manic 2022, when open vacancies reached 1.3 million, hiring and pay freezes have become more common in 2023.

It is especially job postings in white-collar occupations that have slowed down significantly. This has been affecting tech, finance, marketing and media roles.

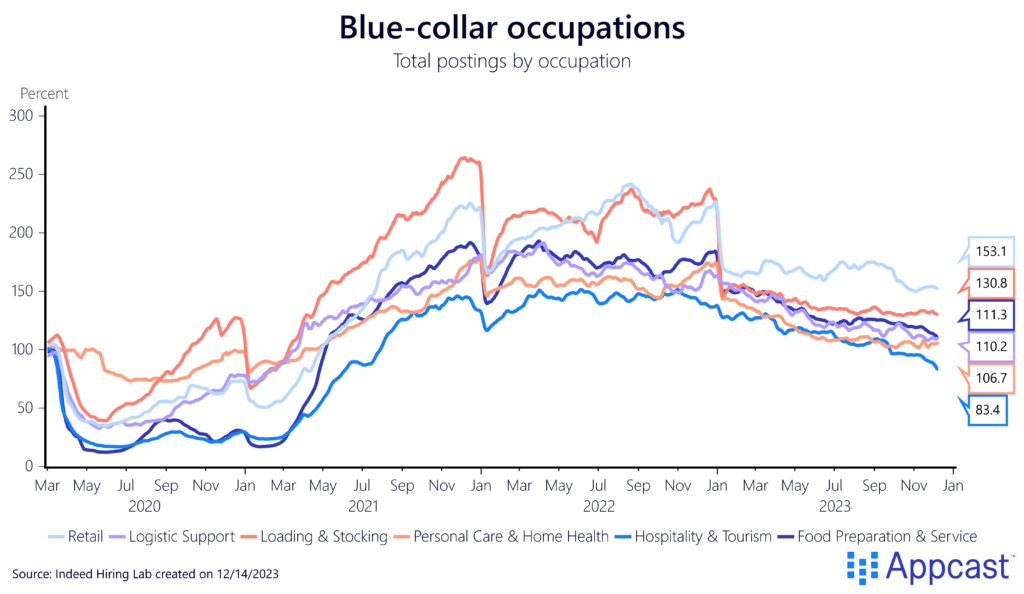

Blue-collar postings, on the other hand, remain elevated. With Brexit, the supply of blue-collar workers coming from Europe has dried up, leading to shortages in many occupations. Older workers and the long-term sick have also left the labor force, aggravating the problem. Therefore, demand for blue-collar workers remains elevated in industries like hospitality.

GDP growth has stalled but defied expectations

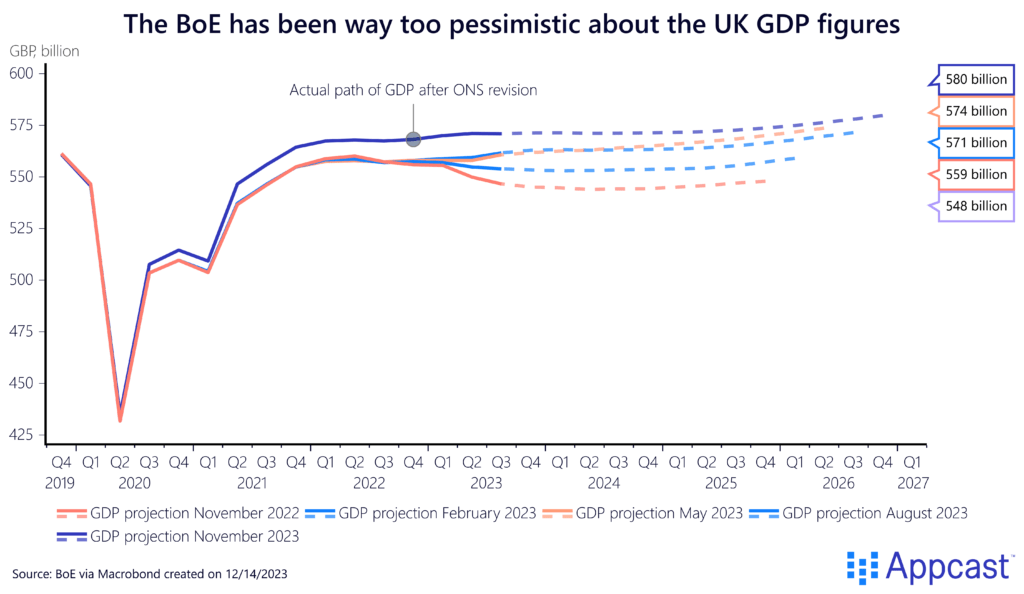

Thanks to subsequent data revisions, the ONS discovered earlier this year that the U.K. is not actually the big underperformer it was thought to be but is more or less growing in line with other Eurozone economies like Spain and France.

The BoE forecasted a recession at the beginning of this year that has failed to materialize. While the U.K. economy is expanding at a glacial pace, it has continued to grow and defy expectations of an economic contraction.

While forecasters are equally pessimistic about next year and simply pushed their recession calls forward, it is possible that the U.K. economy might not contract in this cycle after all and simply continue to grow, even at a mediocre pace.

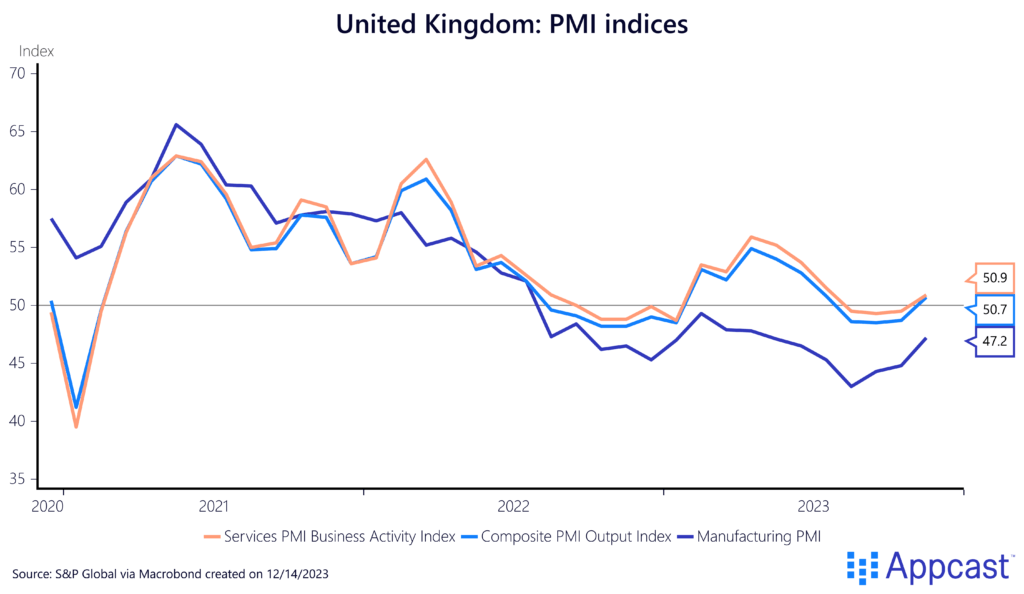

The most recent data from the Purchasing Managers Index (PMI) should also make us more optimistic on the U.K.’s growth prospects. Both the manufacturing and services PMI numbers have recently improved. The composite PMI for all sectors has risen above 50 again, indicating that the economy is in expansion territory again, very much contradicting pessimistic forecasts.

High rates might not choke growth, but wages pose a concern

The BoE’s hiking cycle has so far not led to the widely anticipated economic recession. While high interest rates have slowed down the economy, they have not completely choked economic growth just yet. And rates in the U.K. have peaked as policy makers decided this week to leave them unchanged at 5.25% for the third consecutive meeting.

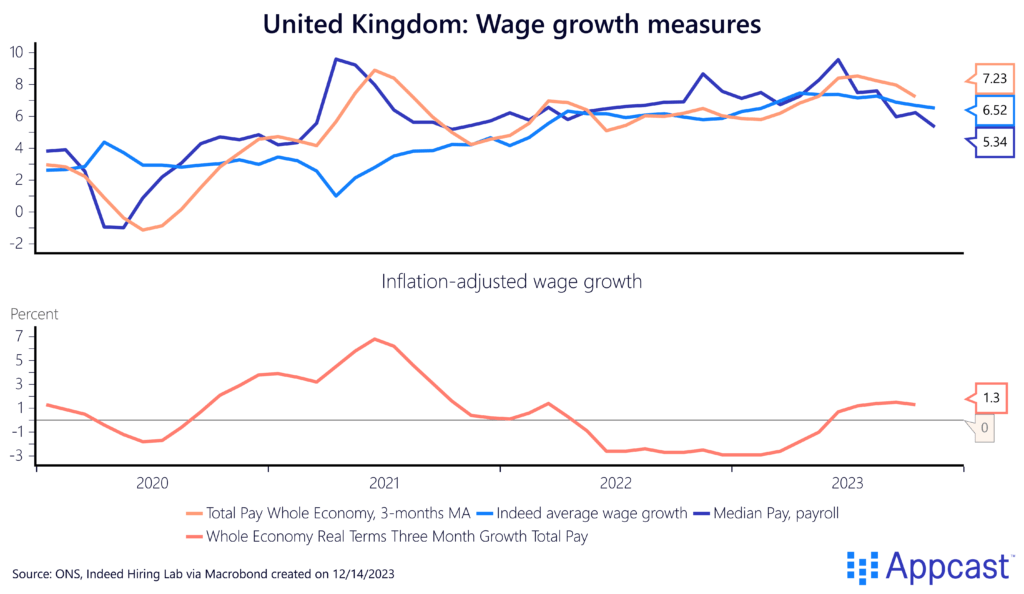

After almost two years of inflation close to double digits, price pressures are finally easing in the economy. One major point of concern for the BoE though is that nominal wage growth continues to run above 6% – depending on the measure you use – which is far too high to be consistent with the central bank’s inflation target.

While workers will love that real wages have now started to rise thanks to falling inflation, monetary policy makers will be desperate to bring nominal wage growth further down, even if it comes at the expense of the labor market.

The housing market remains the biggest downside risk

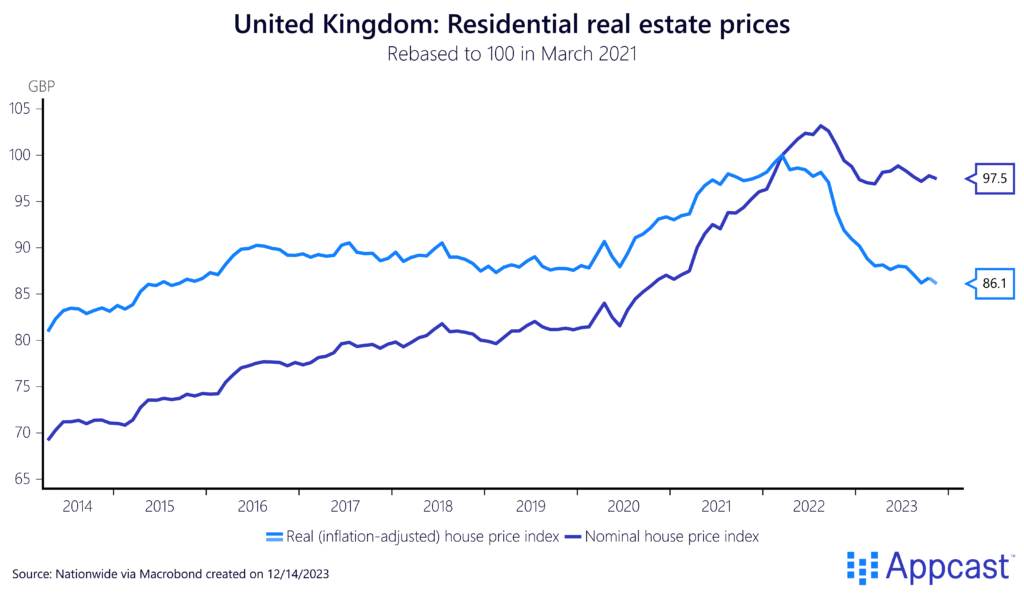

The housing market remains by far one of the largest downside risks for the U.K. economy. While house prices have not gone down significantly in nominal terms, they are down by some 15% in real terms (adjusted for inflation), roughly back at 2019 levels, according to Nationwide figures.

With mortgages rates being close to 7% or above, new buyers have been pushed out of the market. Housing transactions have fallen but less than what one might expect, given the surge in interest rates.

While it is fair to say that the housing market has suffered, we are a far cry from the housing crisis in 2008 when the market froze and valuations plunged. House prices have ticked up again slightly this fall.

It remains to be seen whether the market can cope with elevated interest rates above 4% for another two years, which financial markets currently anticipate.

A significant house price correction, while unlikely, is a possible scenario. A plunging housing market could easily throw the economy into recession and lead to a significant short-term rise in unemployment amidst falling demand in the economy.

What does that mean for recruiters?

The bad news for recruiters is that there is considerable uncertainty about where the U.K. economy and labor market stand right now. Not only is the outlook uncertain but because of data issues, today is too. We do not even know exactly where the unemployment rate is right now!

Alternative data sources like payroll employment and job postings do suggest though that the labor market is easing quite significantly, much more for white-collar workers than blue-collar workers, who are still in short supply.

The good news is that the U.K. economy has defied expectations of recession throughout the year. Economic growth and job growth has been much higher than anticipated and the housing market did not crash. There is good reason to believe that the postponed recession calls for 2024 might be wrong again. I expect that the U.K. economy will continue to stagnate in the first half of next year, but no recession, before picking up again by the end of 2024.

This means that the labor market will continue to be tight by historical standards with an unemployment rate well-below 5%. There are some strong sectoral differences though. White-collar job postings might continue to underperform even as the economy stagnates whereas blue-collar job postings will remain elevated due to labor shortages.