International migration is a complex phenomenon caused by many push and pull factors. Push factors, such as economic hardship, political instability, environmental disasters, and lack of opportunities, compel individuals to leave their home countries. On the other hand, pull factors, including better job prospects, higher wages, political stability, and improved living conditions, attract immigrants to new destinations.

Among these pull factors, the state of the domestic labor market plays a pivotal role. A tight labor market—where demand for workers outpaces supply—can significantly draw immigrants seeking employment opportunities. In this blog, we will explore how domestic labor market conditions serve as a powerful magnet, shaping the patterns and dynamics of global migration. We will focus mainly on the economies of the U.S., the U.K., and Spain, all of which have seen soaring immigration in recent years during periods of labor market tightness.

Illegal immigration into U.S. soared during the tightest labor market in decades

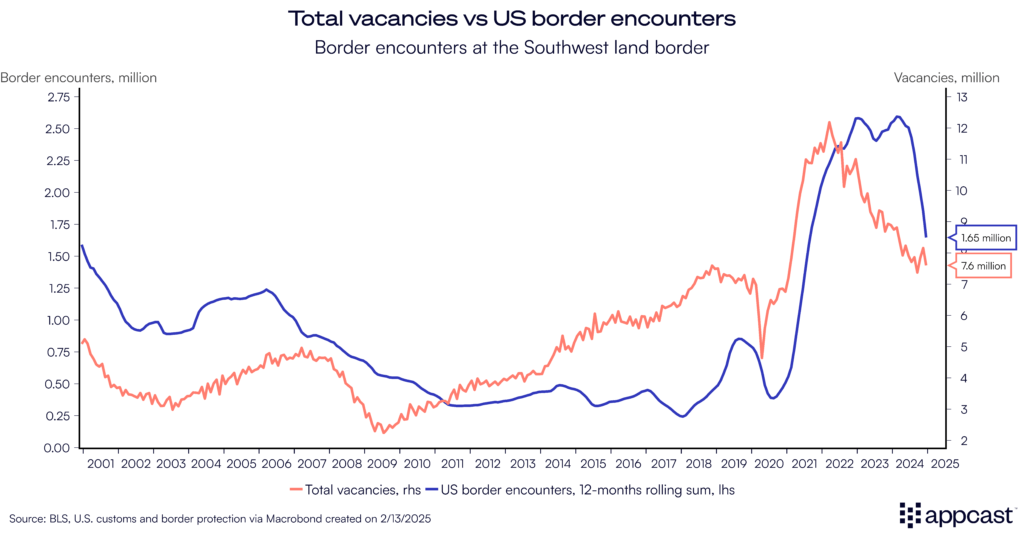

The U.S. saw immigration soar to its highest level in decades throughout 2022 to 2024, a majority of whom were illegal arrivals. It is estimated by the Congressional Budget Office (CBO) and others that net migration reached a peak of more than three million per year recently.

These estimates are backed up by border control encounters, which has recorded millions of illegal crossings during that time period.

It is no coincidence that the number of arrivals surged at the same time as the U.S. labor market became increasingly tight. During the economic recovery from the pandemic, job openings increased sharply to a record of about 12 million in 2022 before slowly starting to normalize.

The correlation between illegal immigration into the U.S. and the number of vacancies is strikingly high. Undoubtedly, international migrants are aware of economic conditions in the U.S. via word of mouth and the media. High economic growth paired with a surge in the demand for workers in the world’s largest economy served as a strong pull factor attracting immigrants from Latin America and elsewhere. As the labor market has normalized over the last two years (with vacancies falling by several million), net migration has come down as well.

Obviously, there are also many other factors at play that influence immigration decisions. The deportations and general sense of unease put in place by the Trump administration are surely a deterring force. Push factors at home like climate change, political upheaval and weak domestic economies are all important contributors. However, the simple correlation between the strength of the U.S. labor market and illegal border crossings shows how labor market tightness is powerful force of attraction for international migrants.

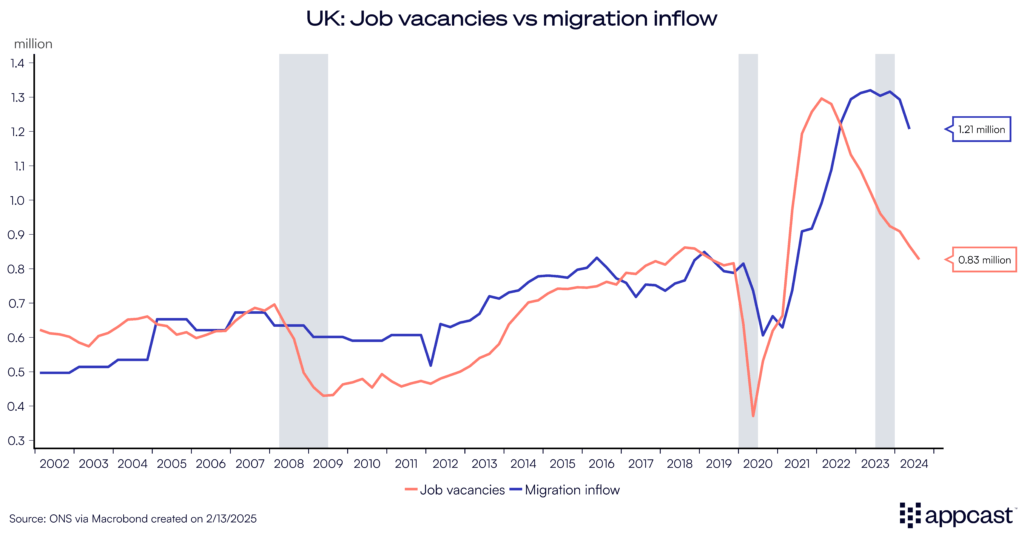

Net migration soared after Brexit as domestic vacancies surged

Immigration into the U.K soared in the early 2000s before the financial crisis as both push and pull factors were at work. First, the U.K. economy was performing well at the time, growing at a faster pace than most of continental Europe. Second, Eastern European countries joined the European Union (EU) in 2004.

While Germany and other countries opted for a transitory period of seven years that did not allow Eastern European workers to work without a permit, the U.K. immediately allowed Eastern Europeans to work in the local labor market without restrictions despite concerns. This led to soaring net migration in the years before 2008. The strong local economy attracted hundreds of thousands Eastern European workers, many of them Polish, to move to the U.K. in the early 2000s.

Following the Global Financial Crisis, the job vacancy rate remained depressed for several years due to a weak economy. Net migration fell and only started to pick up again in 2014, which coincided with a pickup in the vacancy rate. Therefore, even before the pandemic, net migration was already correlated with local economic conditions.

Vacancies surged to a record of more than 1.3 million during the pandemic recovery, specifically in 2022. The vacancy rate increased to about 4%, about 1.5 percentage points higher than before the pandemic.

Revised statistics show that net migration to the U.K. exceeded 1.8 million between the summer of 2022 and the summer of 2024. We know that a large number of recent arrivals are international students, many of whom are expecting to stay in the U.K. to find work after graduation. There has also been a surge in work-related visas and dependent visas (family members).

While it is surely not the only factor, the unprecedented labor market tightness in the U.K. throughout 2021 and 2022 attracted a lot of international workers as well as students and acted as a pull factor for immigration.

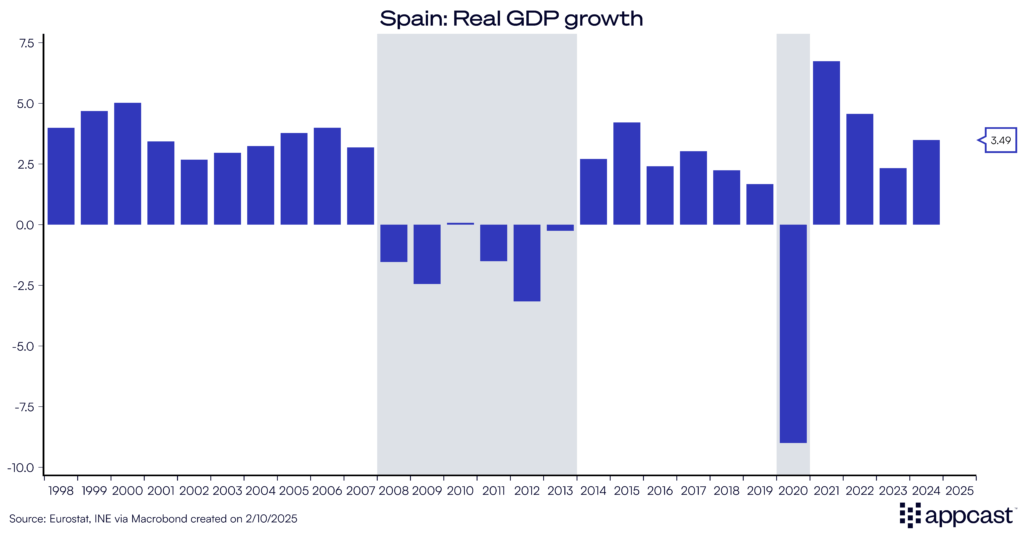

Spain is experiencing record net migration again as the economy soars

Similar to the U.K., Spain experienced a strong economy in the run-up to the financial crisis. Annual GDP growth exceeded 3% from the late 1990s until 2007 as Spanish income levels started to converge with Northern Europe.

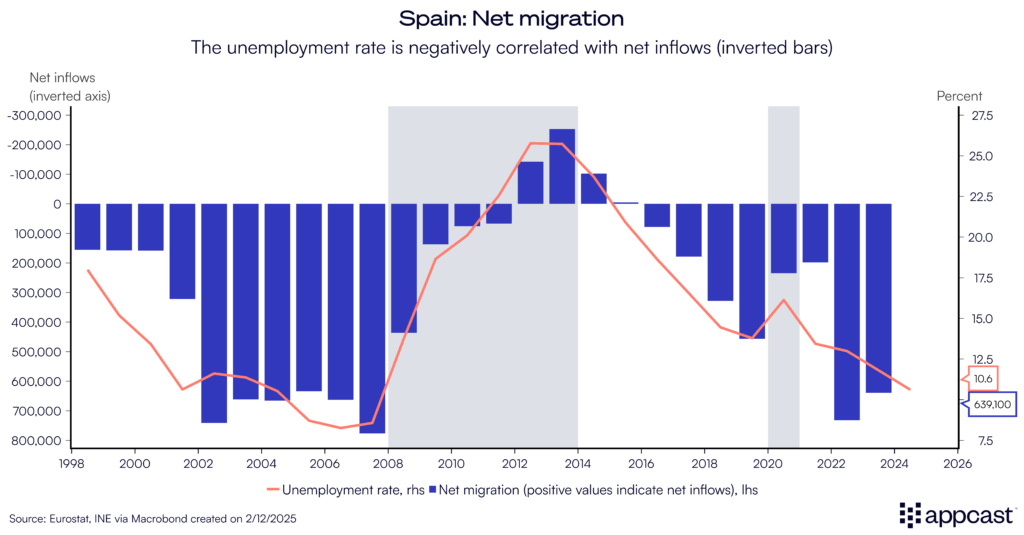

Annual net migration exceeded 600,000 (more than 1.5% of the domestic population) during the early 2000s. As a result, the foreign-born population grew from about 924,000 to over 5 million between 2000 and 2007, making Spain one of the top destinations for immigrants in Europe. The inflows were driven by an economic boom at the time, particularly in construction, agriculture, and services, which created a high demand for labor.

A significant portion of migrants came from Latin American countries, especially Ecuador, Colombia, and Bolivia. Shared language and cultural ties made Spain an attractive destination. Many immigrants also came from Morocco and Algeria, driven by geographical proximity and historical ties.

Following the collapse of the real estate market, unemployment soared from less than 10% to about 25% as the economy contracted between 2008 and 2013. Not only did inward migration collapse, but Spain started to experience net outflows at the time as many young and skilled Spanish workers fled their home country for better economic opportunities in Northern Europe (Germany and the U.K. being prime destinations).

With the continued decline in unemployment during late 2010s as the Spanish economy revived, net migration turned positive again. Since the pandemic, Spain’s economy has completely outperformed the rest of the Eurozone. Boasting growth rates of close to 3% right now, Spain is performing on par with the U.S.

The strong labor market has become a magnet for foreign workers again. As of 2024, Spain’s foreign-born population was approximately 8.9 million, with the largest groups originating from the Americas, followed by Europe.

There is also a significant increase in immigrants from West Africa due to ongoing conflicts and economic challenges in the region. The Canary Islands have seen a surge in arrivals, with 46,843 arrivals in 2024.

Conclusion

International migration is the result of many forces interacting with each other. Push factors in the origin country, such as conflicts, famines, and weak economic opportunities often play a prominent role. But labor market conditions in the destination country should not be overlooked. The U.S., the U.K., and Spain are three countries where the correlation between migration and labor market tightness is quite strong.

For recruiters, this correlation is encouraging. Undoubtedly, the large inflow of migration during tight labor markets is an employment boost and helps companies fill positions that might potentially be left unfilled.

However, there are some risks going forward that times might be changing. We are currently seeing a global backlash to migration policies with the Trump administration leading the charge. If migration inflows are being curbed significantly, industries that typically have a high share of foreign workers – think agriculture, construction, hospitality, etc. – might start experience labor shortages rather sooner than later. And this, of course, will mean longer vacancy durations, elevated times to higher, and therefore rising recruitment costs for the job categories that are affected the most.