U.K. economic data has come in better than expected in 2023. Even the housing market has held up well, though it remains vulnerable. A significant portion of mortgages will see their rates increase substantially later this year, which could lead to a credit crunch and correction in the housing market.

The U.K. has an inflation problem

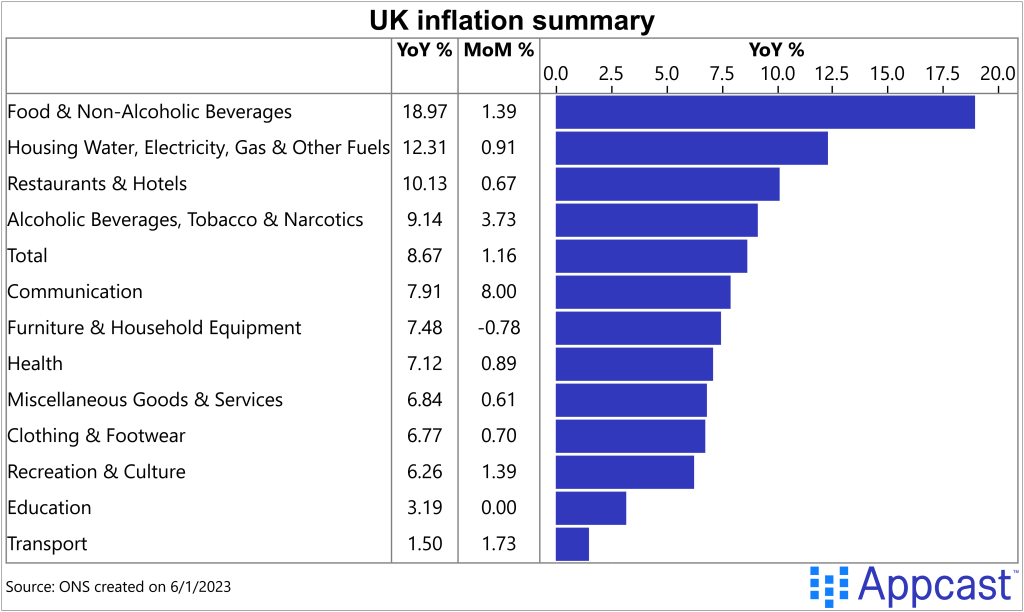

It is abundantly clear that the U.K. has an inflation problem – the CPI increased by more than 10% last year. Even more worrying, the latest inflation print was unexpectedly high and showed CPI inflation close to 9% and service inflation running at about 6%.

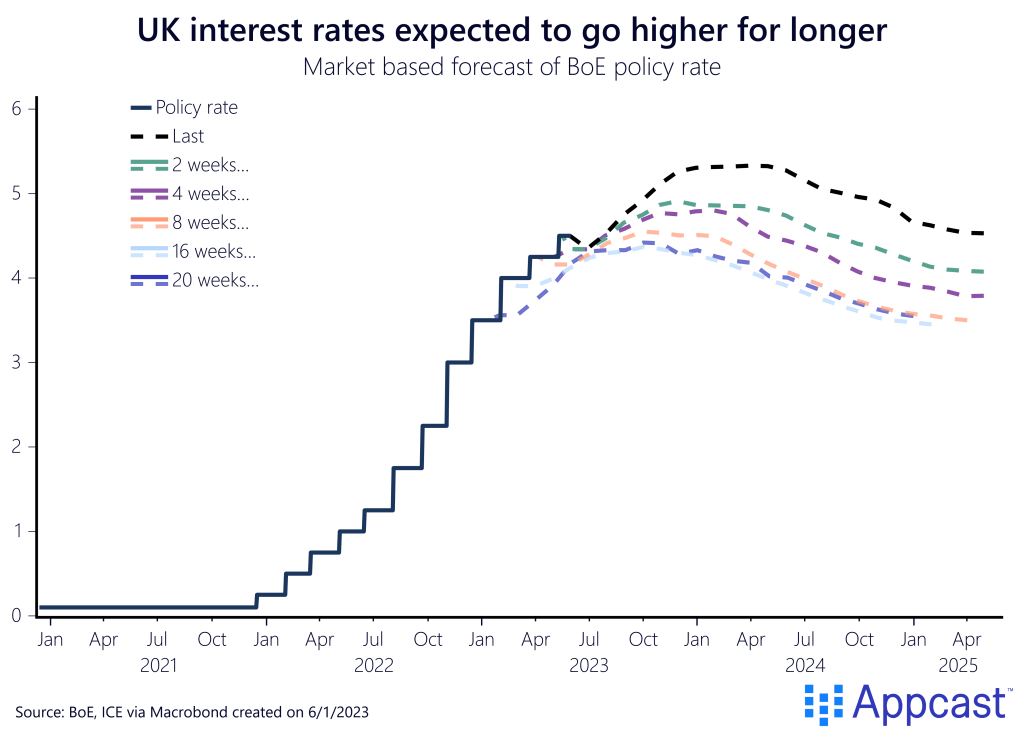

Nominal wage growth is still exceeding 7% in the private sector even as the Bank of England (BoE) increased its policy rate from 0% in January 2022 to 4.5%, the fastest tightening cycle since the 1980s. And markets are now pricing in an even higher peak policy rate of 5.5% and expect the policy rate to remain above 5% throughout 2024, which will put additional pressure on mortgage rates in the U.K.

Both the inflation and wage growth have come in higher than expected this spring and are completely inconsistent with the BoE’s inflation target, fueling fears that the country is edging towards a wage-price spiral. And in recent remarks, BoE governor Andrew Bailey even admitted as much. He stated that the initial massive surge in food and energy prices in the U.K. has led to second-round effects that are keeping core inflation elevated.

With food prices increasing by nearly 20% year-over-year, it is no wonder that workers have been demanding higher wages to keep up with the cost-of-living crisis.

The U.K. has a mortgage crunch problem

A lot of buyers in the U.S. took advantage of very low rates during the beginning of the pandemic and many existing borrowers refinanced their mortgage as well to lock in those low rates for many years to come. However, the U.K. market functions differently since long-term fixed rates for mortgages, like they exist in the U.S. and Germany, are uncommon.

Usually, U.K. mortgages are only fixed between two to five years and the mortgage rate adjusts at the end of the term according to prevailing interest rates in financial markets.

This means that that a lot of people who bought their homes early in the pandemic – incentivized by the reduction in stamp duty at the time (tax being paid on purchases of residential property) – will now be facing substantially higher mortgage costs when their interest rates adjust.

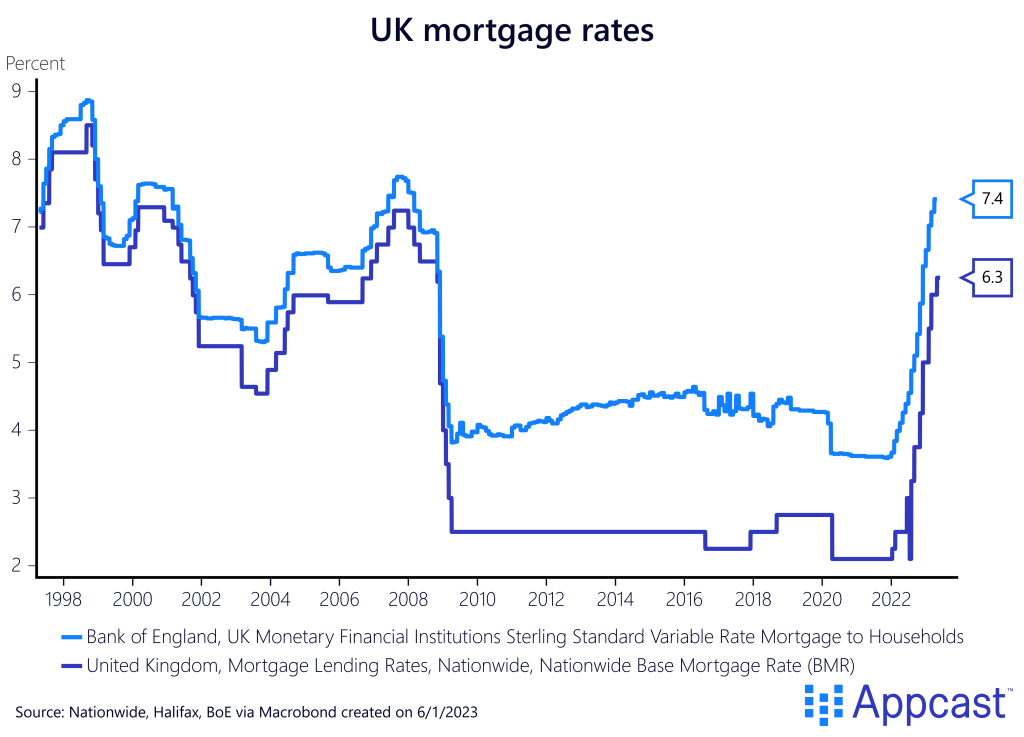

Nationwide, a U.K. building association, has seen its base mortgage rate increase from below 3% in late 2021 to more than 6% right now. The standard variable rate for households is even higher at just under 7.5% right now.

This unprecedented surge in mortgage rates at a time when U.K. house prices are at a record-high means that a lot of borrowers are going to see their mortgage costs blow up as soon as they move from the fixed to the flexible rate.

According to Bloomberg, some 1.4 million borrowers in the U.K. will have to refinance their mortgage this year. Most of them were on an interest rate under 2.5% and will now face borrowing costs twice as high or more. Borrowers moving on to new fixed-rate deals can see their annual mortgage payment increase by about 2,300 GBP, according to the Resolution Foundation. This represents a significant burden and decline in living standards, given that the median salary in the U.K. is only at about £33,000 (and around £42,000 for the London area).

The upcoming mortgage cost shock will only aggravate the current cost-of-living crisis in the U.K. and has also the potential to cause further distress in the housing market. For the first time in decades, it might now potentially be cheaper to rent than to own. Even though house prices have turned out to quite resilient to the BoE’s rate hikes so far, this might be about to change.

The U.K. has a housing problem

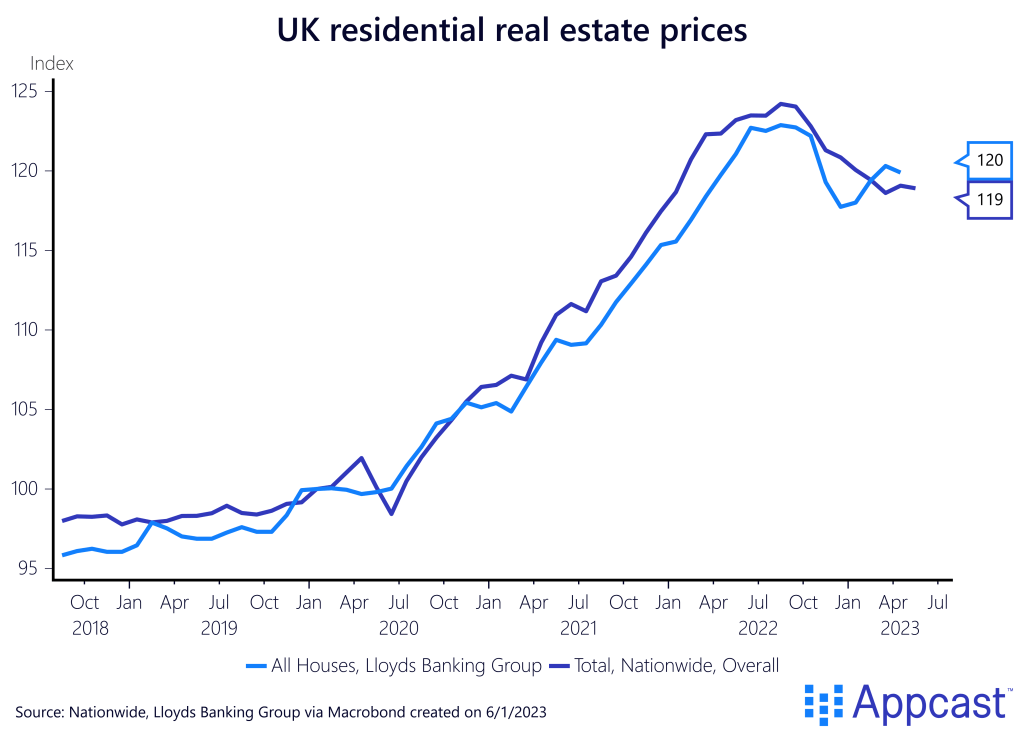

Residential house prices in the U.K. peaked in last fall and have fallen by about 4% so far. Given that the BoE policy rate increased from 0% in early 2022 to 4.5% today, it is almost surprising that prices didn’t decline more. But there are reasons to believe that a further contraction is coming and Nationwide expects house prices to fall by about 5% in 2023.

First, with mortgage costs surging to the extent indicated above, there could be some distressed sellers that might have to let go of their property. Second, with mortgage rates as high as they are right now, many new buyers will simply not be able to afford to enter the housing market at current prices unless a significant correction takes place.

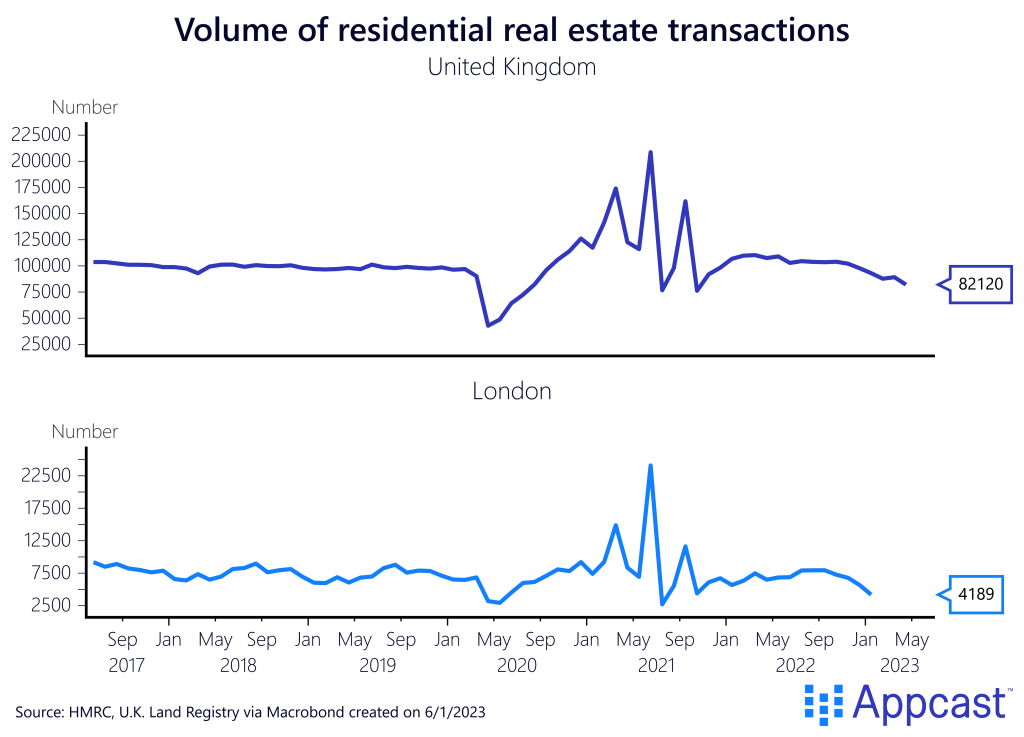

While the number of transactions surged by an unprecedented amount early on during the pandemic – also thanks to the moratorium on the stamp duty – real estate transactions have now fallen below pre-COVID levels.

The U.K. has a residential investment problem

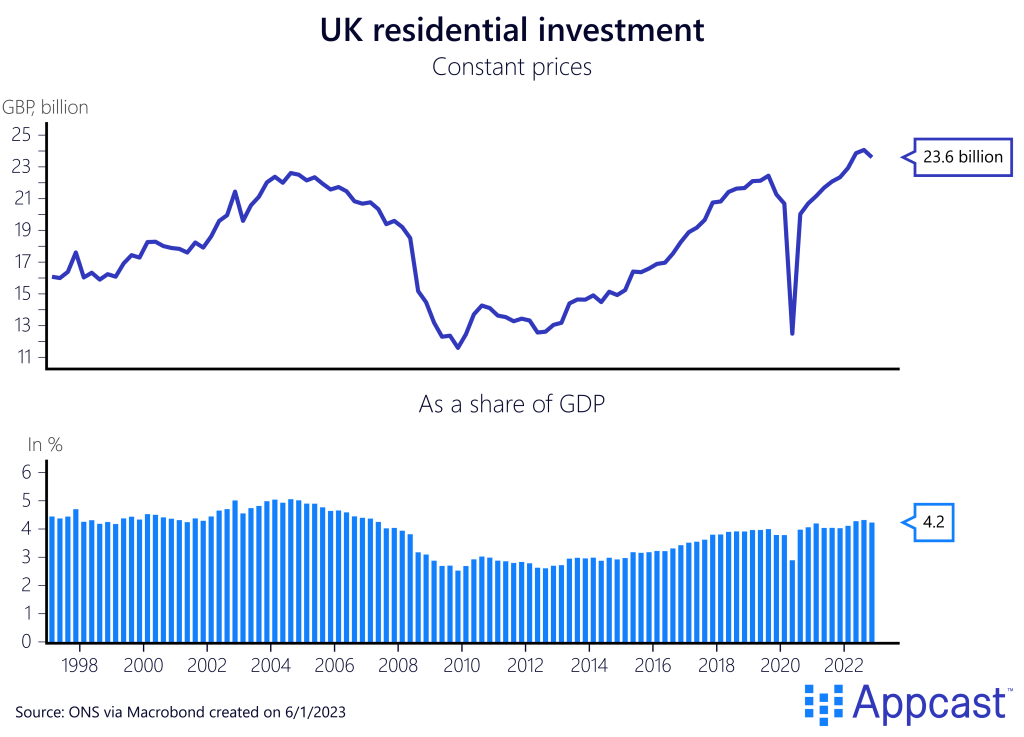

The current rate hike cycle will also affect residential investment and construction starts. While residential investment has recently exceeded its pre-pandemic level, it is still lower as a share of GDP than before the financial crisis of 2008.

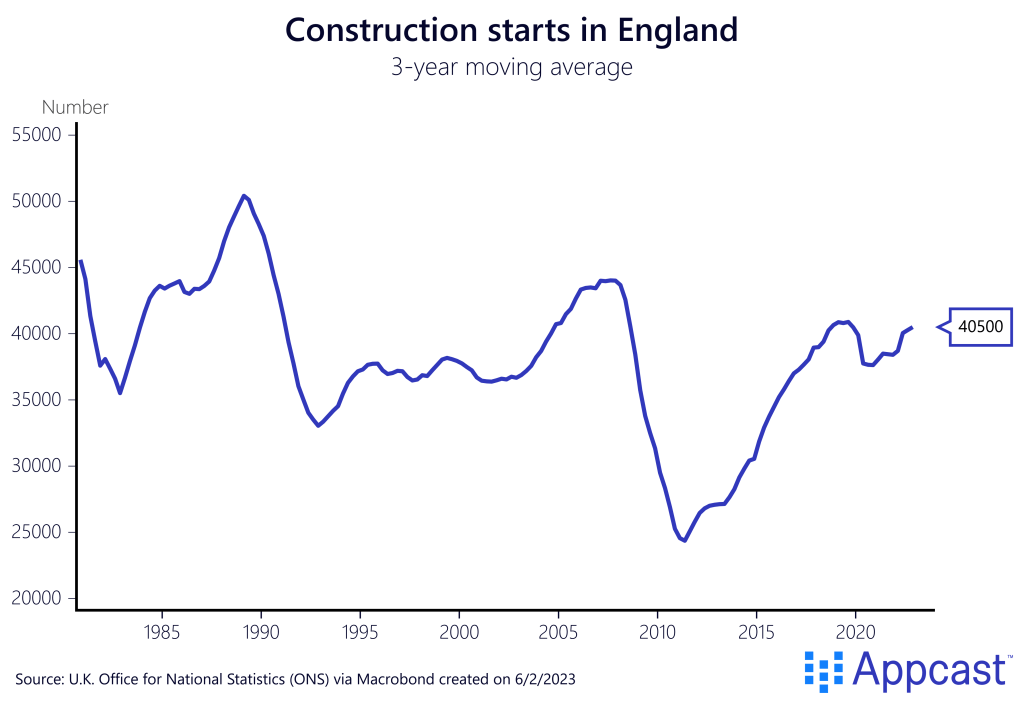

The latest number shows that housing starts in England have been recently higher than just before the pandemic. At the same time, starts are still lower than they were in the 1980s when the population was significantly lower. On a per capita basis, the U.K. has not been building enough housing for decades, and this has driven up real estate prices across the board.

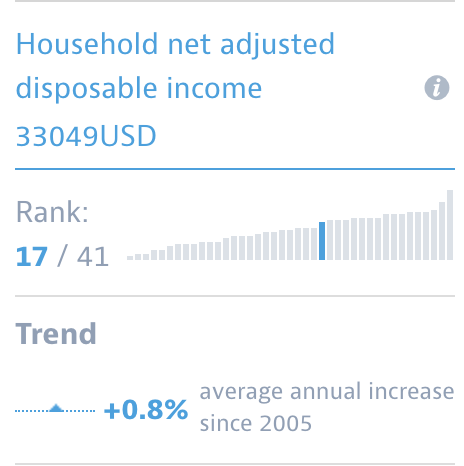

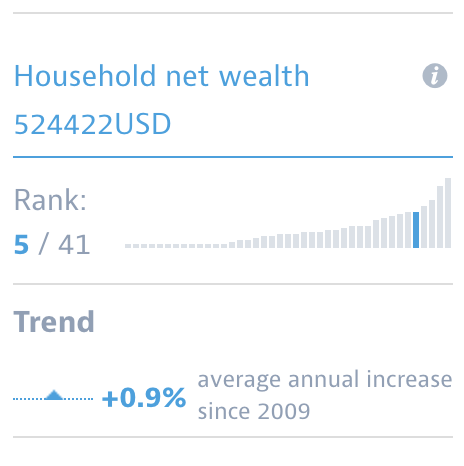

It is very telling that the U.K. now only ranks in the middle of the income distribution countries but at the top of the wealth distribution across OECD countries.

Massively inflated house prices have created a significant amount of wealth for homeowners while coming at the expense of economic growth, preventing workers to relocate to the cities where wages and productivity are higher.

Source: OECD Better Life Index

One big concern is that the recent rate hike cycle might not just put a dent into house prices, but also kill off residential investment for a while, which would lead to even less supply in the medium-run and could thus aggravate the U.K.’s unaffordable housing crisis.

Moreover, a significant house price crash would also plunge the economy into a downturn and negatively affect the labor market. With trend growth being below 1% right now, it doesn’t take much of a shock to tip the economy closer to recession.

Conclusion

The U.K. housing market has held up surprisingly well over the last year as interest rates have surged. However, things are about to change now, given how mortgages are structured in the U.K. The country has one of the most exposed housing markets across OECD countries because most mortgages are only fixed for a short time span. Sweden’s house price correction with forecasts of more than a 20% peak-to-trough decline could be a harbinger of things to come in the U.K.

This year, about 1.4 million British households will need to refinance and many households will see their mortgage costs explode. This could lead to forced selling and put further pressure on the housing market, which is already seeing declining transactions and slightly falling house prices. A significant price correction would plunge the U.K. economy into a recession and lead to higher unemployment.