May’s job numbers showed a rapid deterioration of the U.K. labor market following the dramatic surge in employer costs due to the rise in the minimum wage and National Insurance Contribution (NIC). While these preliminary job numbers will most likely see some upward revisions in the coming months, the current trend is quite clear. From falling vacancies, frozen hiring, an increasing unemployment rate, and decreased payroll jobs, it’s clear to see that the U.K. labor market is now in a downturn. The Bank of England must act swiftly to cushion the blow.

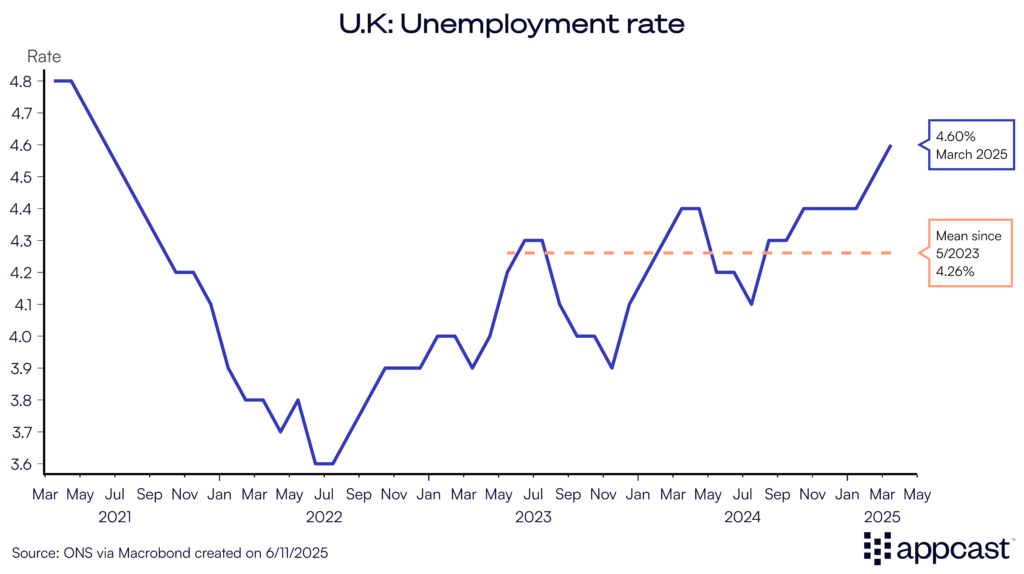

The unemployment rate rises yet again, vacancies continue to fall

The unemployment rate in the U.K. now stands at 4.6%. While this is a mere 0.6 percentage point increase since early 2023, the trend is concerning. The U.K. labor market is clearly weakening. Younger people are struggling particularly hard to find employment with economic inactivity rising quickly among that age group.

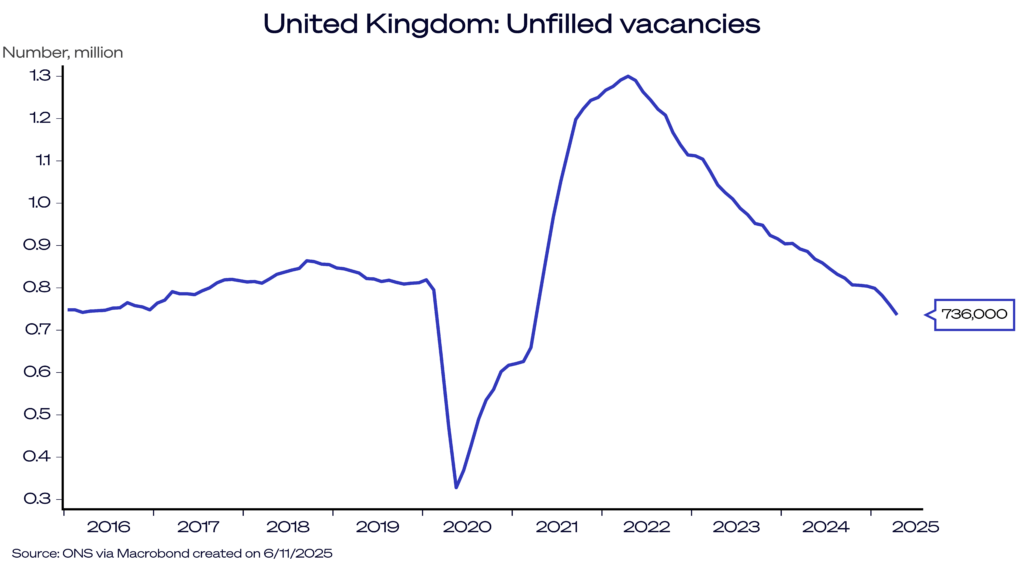

Vacancies have now declined for about three consecutive years, falling towards 735,000 in May—about 100,000 below the pre-pandemic level. It is now a significantly weaker labor market than in 2019; it’s also completely static. Employers have significantly reduced hiring and worker churn has frozen. People are less willing to take risks and change employment during times of high economic uncertainty.

Payroll job growth cratered in May…

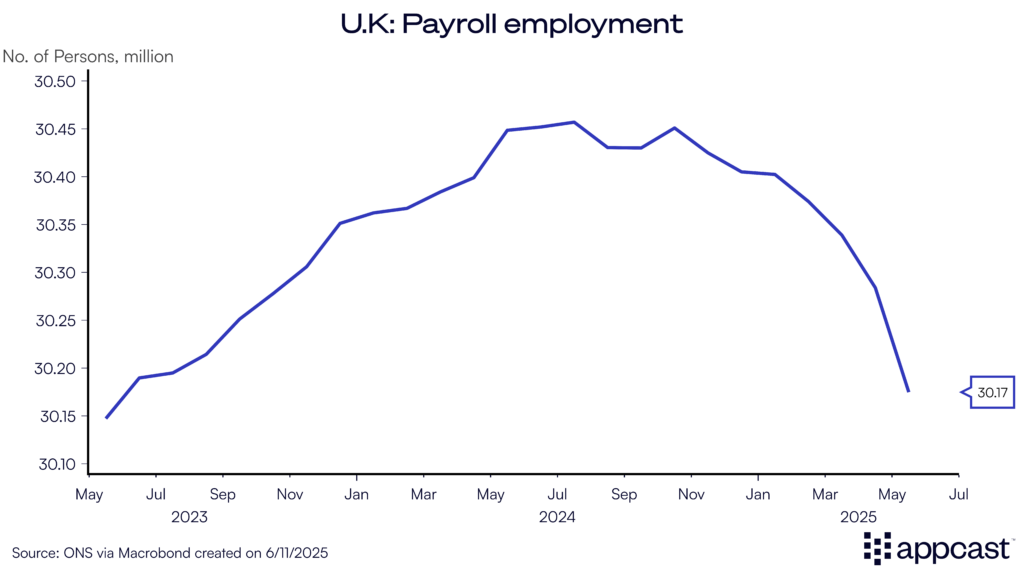

Payroll job growth in May cratered, following several months of minor job losses since last fall. The official figures showed a decline of close to 110,000 in May alone. Over the last year, payroll employment is now down by about 270,000. A significant chunk of the employment losses are due to Labour’s policy of increasing the NIC and the minimum wage by another 7%. As both measures came into effect in April, employment costs have surged. Businesses with large staffing costs and low profitability have been forced to make adjustments by laying off workers.

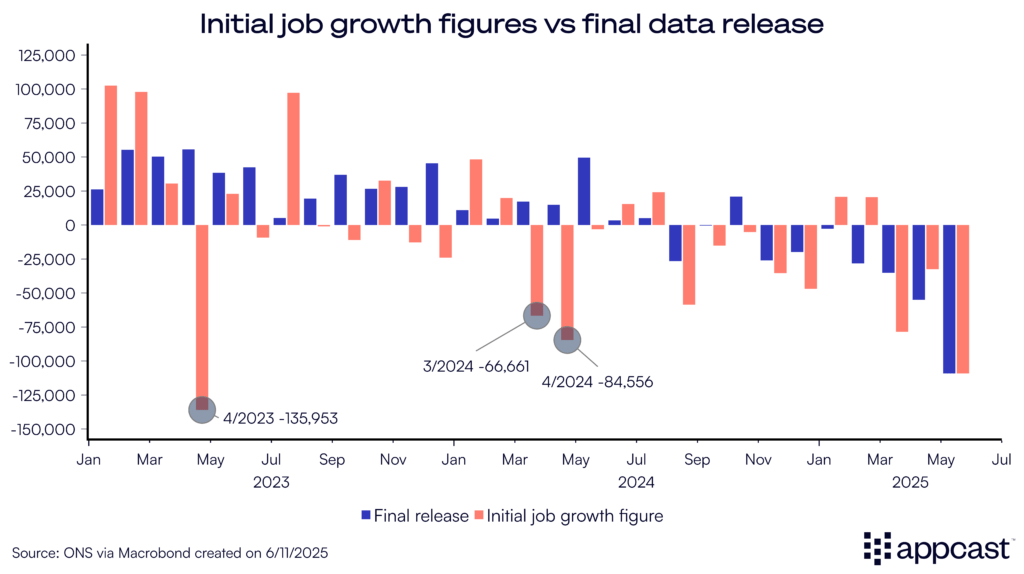

…but the extent of the decline was probably overstated

However, the extent of the job losses in May were most likely overstated, potentially quite a bit. The first release of the payroll numbers is often subject to relatively large revisions. This is particularly true for cases when the initial number shows large jobs losses. As the figure below shows, there are several instances throughout 2023 and 2024 when the initial data showed very large losses, such as 66,000 in March 2024, 84,000 in April 2024, and even 135,000 in April 2023, but subsequent revised data actually showed employment gains for these months!

We will most likely see another significant data revision in May, with actual job losses being much smaller than the provisional figures initially showed. However, this will not negate the fact that job growth has been negative since the Labour Budget last October.

The trend is not your friend as the labor market is edging closer to recession

With the provisional May figures, payroll employment has now contracted by about 276,000 since its peak last summer. Even with some positive revisions to come, we are likely looking at job losses exceeding 200,000, a 0.7% contraction, with further job losses potentially being in store this summer.

While this employment contraction is still significantly smaller than what one typically observes during a recession, we are now clearly in a labor market downturn.

Even as some laid off workers might successfully transition into self-employment (which would not be captured by the payroll data), gig work is typically associated with higher economic uncertainty and potentially lower compensation.

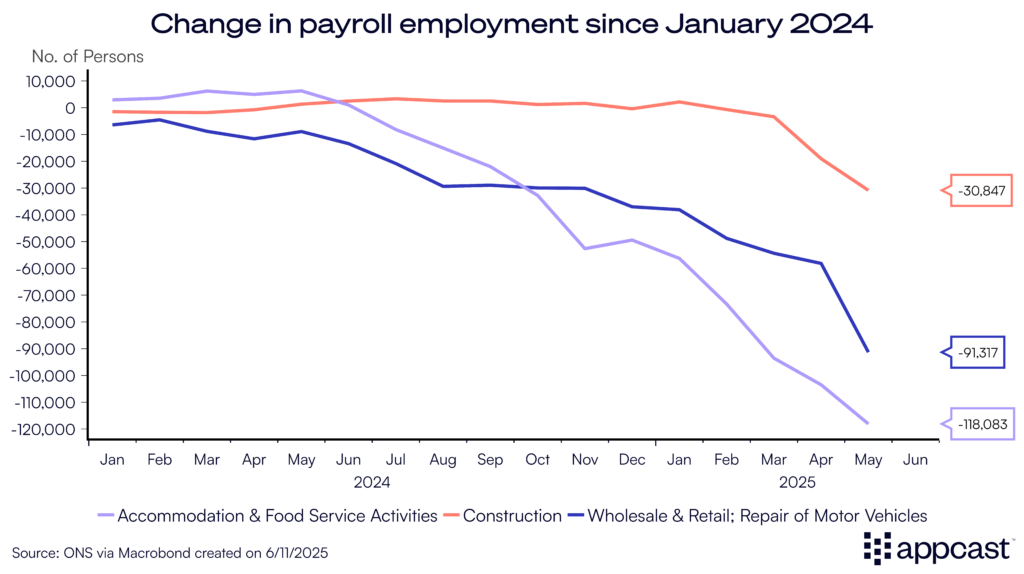

Retail and hospitality are suffering

As we wrote last month, the sectors most affected by the current labor market downturn are low-margin industries where employers have large wage bills. The hospitality sector, retail, and construction definitely fit into that category. Employers have been hit by the double whammy of NIC increase and the minimum wage hike, given that many of their workers are in the lower part of the wage distribution. Accommodation and food services have thus shed close to 120,000 jobs so far, and retail has lost more than 90,000, according to the latest data.

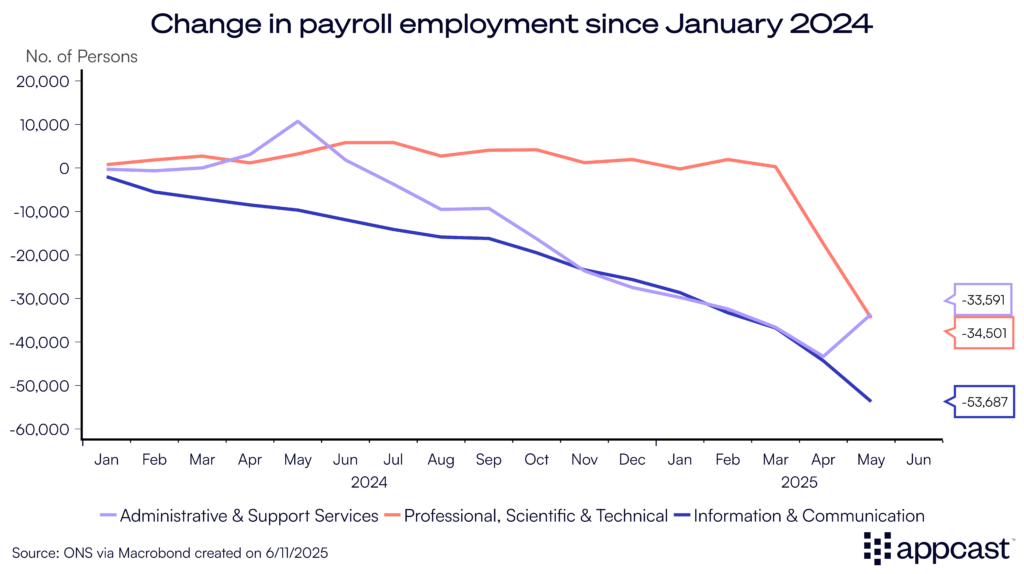

But tech and professional service jobs are struggling too

But even more concerning is that the latest data also shows some job losses in some highly paid white-collar sectors like tech and professional services. Information and communication is now down by more than 50,000. Professional, scientific and technical jobs are down about 35,000, and administrative and support services have lost some 33,000 jobs, according to the latest data.

Employment losses are therefore not contained to just the three sectors that we singled out last month. The labor market slowdown is broadening. Furthermore, job losses in the white-collar tend to have a broader impact, as it impacts high-income workers who are often strong consumers. Altogether, today’s environment should cause a bit more concern than just a few months ago, when job losses were more contained.

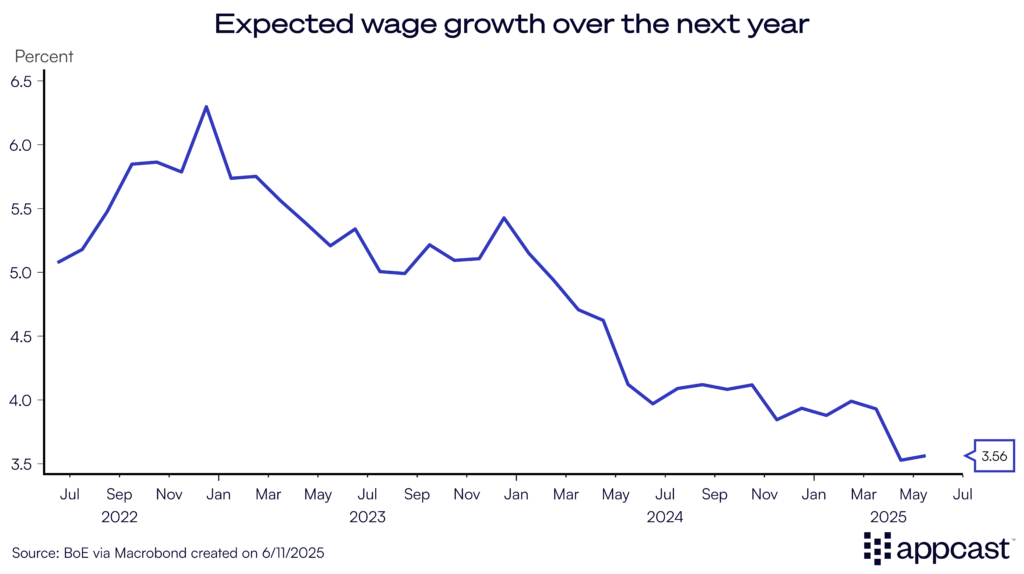

Financial markets believe the Bank of England will help cushion the blow

So, with the market obviously suffering, why have monetary policy makers not supported the labor market more by cutting rates in recent months? The answer is that wage growth in the U.K. has remained stubbornly high so far. Throughout 2023 and 2024, nominal wage growth well exceeded 6%, a number that is completely inconsistent with the Bank of England’s inflation target.

However, with the labor market slowdown, the latest figures suggest that wage growth is now closer to 5%. More importantly, expected wage growth over the next year is now below 3.6%. The BoE is finally seeing the light at the end of tunnel when it comes to sticky wages and sticky inflation.

Given the pretty abysmal job numbers combined with the prospect of moderating wage demands, BoE policy makers are now in a good place to ease monetary policy. The pound depreciated as financial markets now fully price in two more rate cuts this year following the labor market data release. Lower interest rates would help support the economy and labor market in the coming months and hopefully put a lid on further job losses.

What does that mean for recruiters?

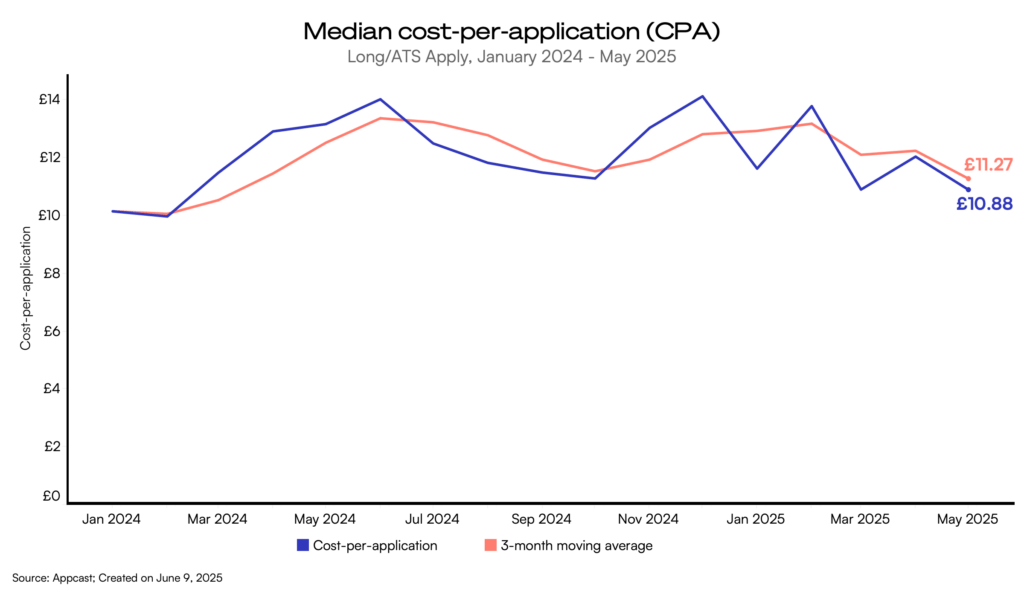

With the labor market weakening, recruitment for a variety of job functions has become easier. Compared to two years ago, most job postings are clearly not struggling with volume anymore. Apply rates are relatively high, and the cost-per-application continues to be relatively low. Our recent data confirms that median CPAs continue to run at around £11, which is not that significantly higher than where they were when they bottomed out in early 2024. Right now, quality is more important than volume.