Even as the U.K. economy experienced a very shallow economic contraction last year, the labor market continued to add jobs. However, employment gains varied widely by industry. White-collar workers who mainly work at a desk, so called “sitting-down jobs,” are currently experiencing a much more difficult labor market than manual workers in “standing-up jobs,” meaning blue-collar occupations.

In this article we discuss how the U.K. economy is currently experiencing a white-collar recession.

The U.K. economy experienced a shallow contraction last year

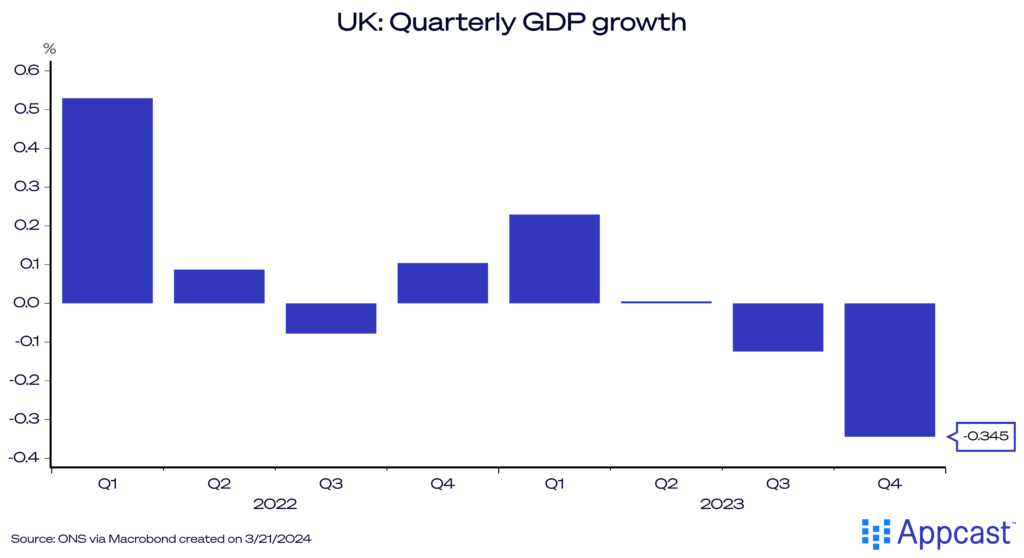

2023 was quite a mediocre year for the U.K. Compared to 2022, GDP only increased by about 0.1%. Moreover, the economy also fell into a technical recession since the last two quarters of 2023 recorded a negative growth rate.

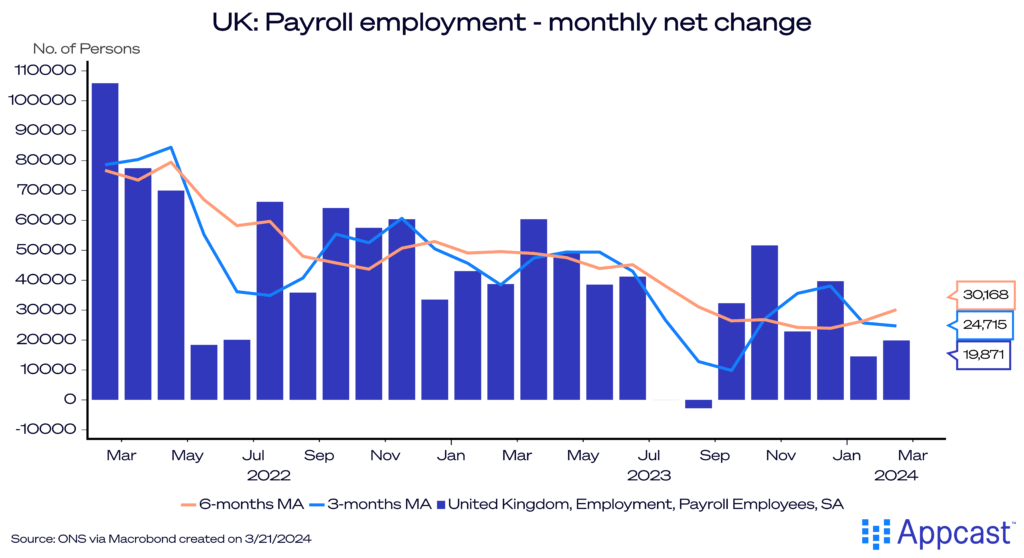

On the bright side, the economic contraction has been quite shallow. It has not been a typical recession because the labor market has continued to add jobs despite mediocre economic growth. In that sense, the recession is more like an income squeeze for households instead of a broad economic downturn.

Employment gains have been highly uneven

Employment gains by industry, however, have been highly uneven.

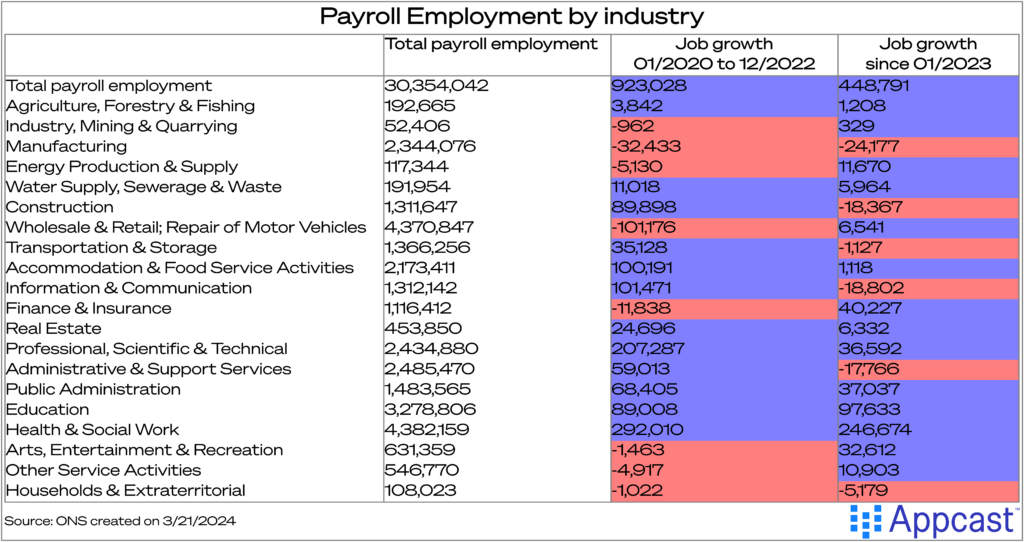

We all remember how the economy quickly recovered throughout 2021 and 2022 following the pandemic. The economic boom was particularly pronounced for white-collar workers and led to large job gains in the technology sector, finance and real estate, and professional and scientific jobs.

The tech sector added more than 100,000 jobs between January 2020 and December 2022, but has shed close to 20,000 since then. Administrative and support services gained 60,000 jobs between 2020 and the end of 2022 but have lost some 17,000 jobs since January 2023.

Similarly, more than 200,000 professional and scientific jobs were created between 2020 and 2022, but only some 40,000 since January 2023.

Employment gains in sectors that have many sitting-down jobs have thus moderated or even reversed last year as the economy stagnated.

Sitting-down jobs are struggling

We speculated more than a year ago that such a white-collar recession would hit the U.K labor market and events played out as we anticipated. To some extent, it was inevitable after the somewhat manic job boom in the aftermath of the pandemic and the economic weakness that followed.

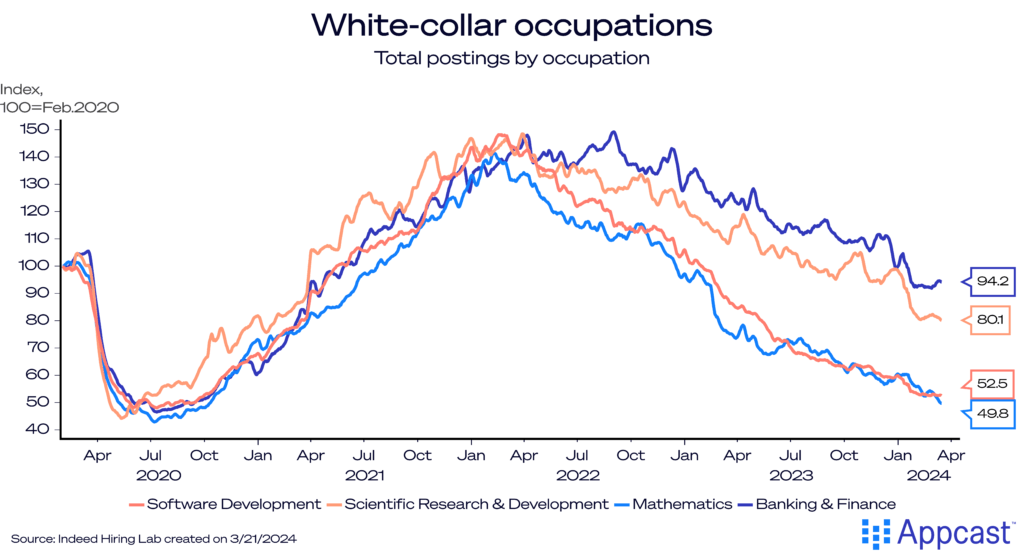

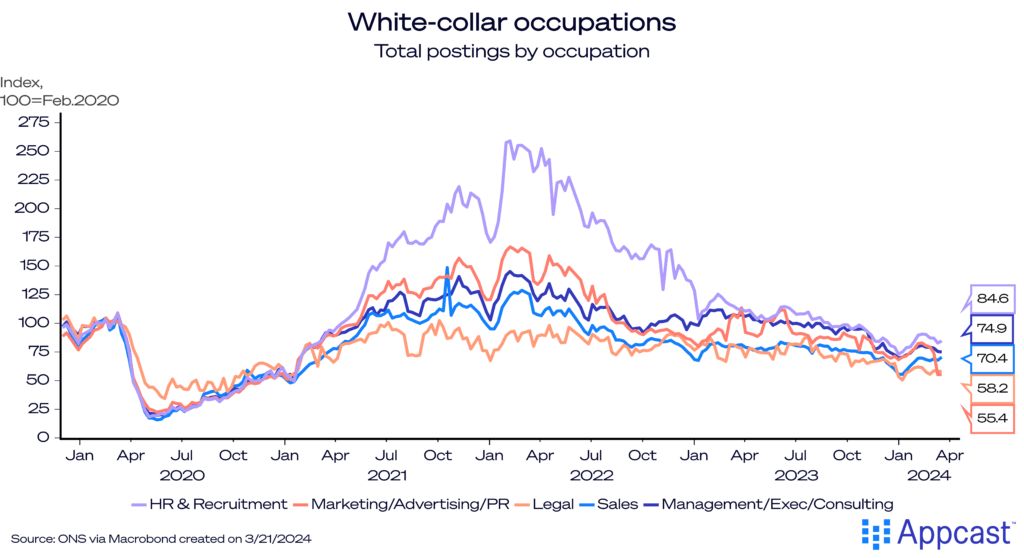

While not too many sitting-down jobs have been lost so far, the demand for new hires has slowed down significantly. This is extremely evident when looking at job postings data.

Job postings for scientific roles, software development, and banking and finance have fallen for more than one-and-a-half years in row now and are significantly lower than before the pandemic.

The same is true for management and consulting roles, sales and legal occupations, marketing, and recruitment roles. Job postings have declined by as much as 30 or 40% or more compared to February 2020 levels, depending on the specific occupation in question.

Standing-up jobs are doing better due to labor shortages

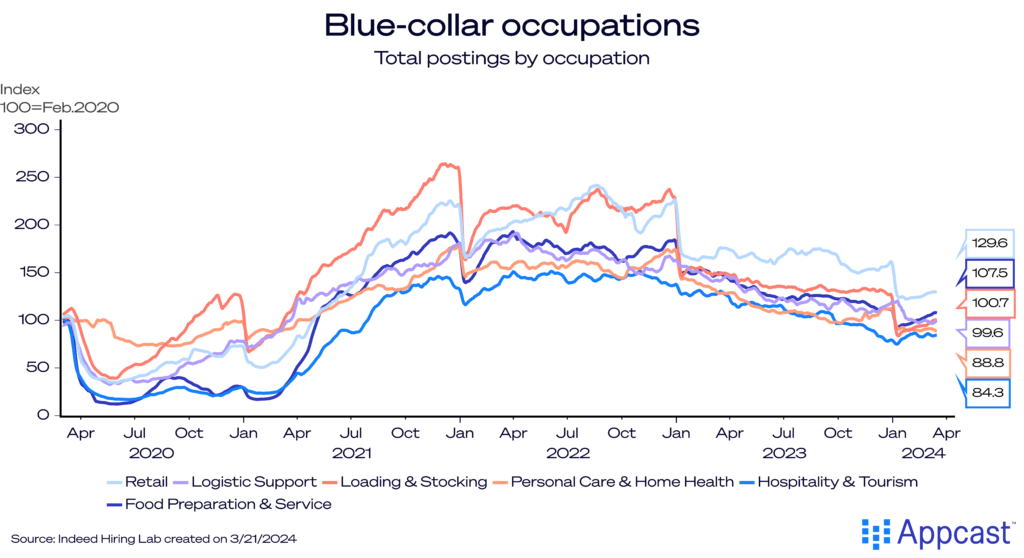

What we call “standing-up jobs,” those that require more manual labor, have been doing better, on the other hand.

There are several factors that have led to this. First, the U.K. has seen a net outflow of EU workers, and many of those had previously worked in industries like trucking, hospitality and accommodation, and food services. Second, there has also been a significant uptick of people who left the labor force completely since COVID due to long-term health issues. Both of these trends have decreased labor supply.

Third, many blue-collar occupations shed a lot of jobs during the pandemic when the service sector was shut down. The job recovery in food and accommodation jumpstarted in 2022 once everybody was vaccinated and people were able to spend more of their income on services again – so-called “revenge-spending” following the pandemic.

For these reasons, job postings for “standing-up jobs” have remained quite elevated, at least until last fall (the first two months of this year have also seen a decline in blue-collar postings).

White-collar workers are now more exposed to global shocks

One additional factor that is currently playing into the weak job market for white-collar workers is because the U.K. has become a service-exporting superpower. The U.K. is the only advanced economy that is now exporting more services to other countries than actual goods. to other countries than actual goods.

These service exports include management and consulting, financial services, law services, etc.

Research from the Resolution Foundation shows that it is workers in such white-collar occupations who are now more likely to suffer from global shocks because their industries have become much more dependent on foreign demand.

In the past, domestic manufacturing was one of the more exposed industries subject to foreign competition and shifts in foreign demand. As the U.K. economy has deindustrialized and shifted towards the service sector, it is now U.K. bankers, lawyers, and consultants who are more exposed.

And currently, the global demand for these services seems to be stagnating.

What about recruitment challenges and costs?

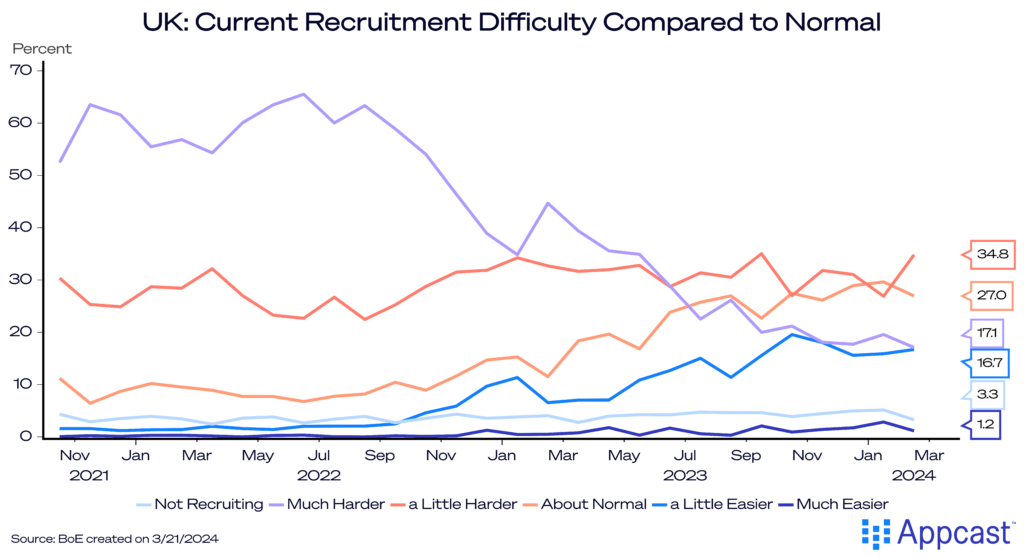

Recruitment difficulties have eased as data from the Bank of England shows. Less than 20% of recruiters currently think it is much harder to recruit. This value stood above 60% throughout most of 2022.

But the U.K. labor market is currently fragmented. The ease of hiring and finding talent varies significantly not just across regions but also across industries. For more manual work, so-called standing-up jobs, it might still be relatively hard to attract workers. Salaries at the bottom of the distribution rose proportionally faster last year and more workers changed jobs for better compensation and benefits. The competition for blue-collar workers is still high and recruiters might not find it that easy to fill certain roles.

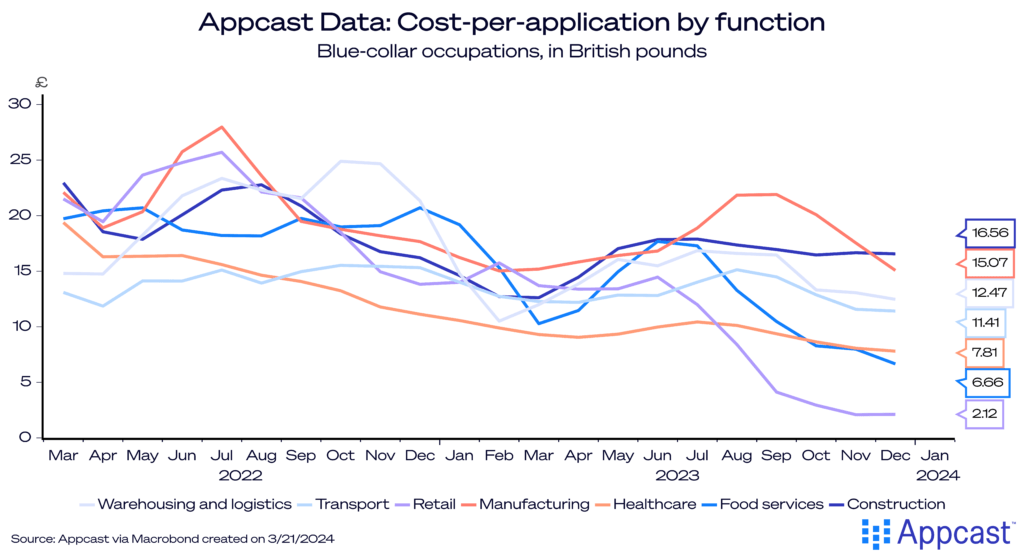

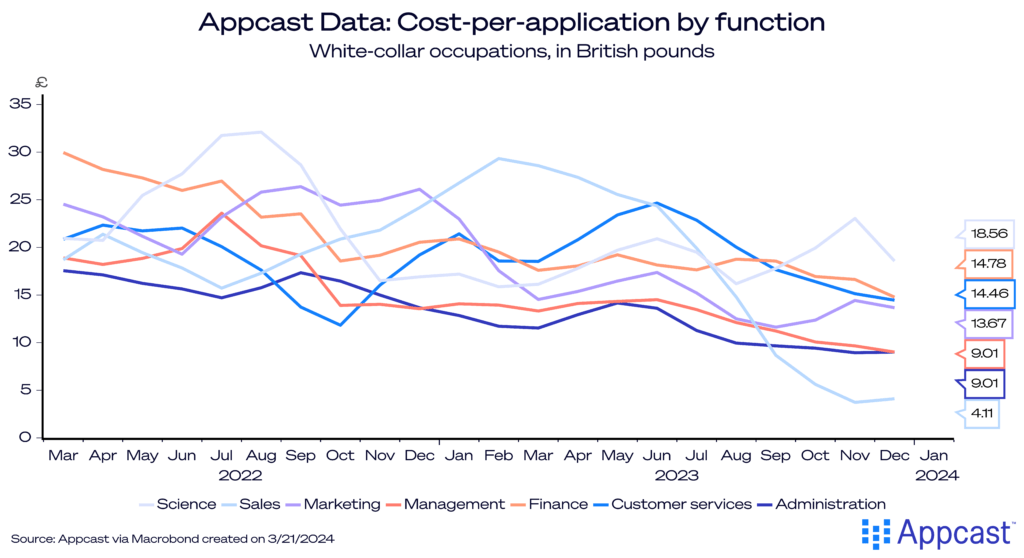

This is also reflected in our Appcast benchmark data. Cost-per-application (CPA) measures show how expensive it is to get one application per job posting. CPAs have been declining across all sectors in the U.K., showing that the labor market has eased in general and that is has become less costly to recruit.

But certain blue-collar job functions have seen their CPAs decline less so than white-collar jobs. CPAs in manufacturing and construction only declined by about one-third between early 2022 and late 2023.

For white-collar workers, on the other hand, the job market has deteriorated more quickly. While the unemployment rate is low, hiring has slowed down or even stopped. Recruiting for sitting-down jobs should have become easier compared to the immediate post-pandemic period. CPAs have fallen by half or more for finance, administration and sales jobs between early 2022 and late 2023.

What does this mean for recruiters?

This dual labor market means that you need a flexible recruitment strategy to keep up with changes. First, retention strategies have become more important to address high churn for blue-collar occupations. Second, when budgeting for recruitment, focus on the areas where it’s most difficult to hire. Finally, if you as an employer have the budget, it might make sense to hire for “sitting-down jobs” right now before demand picks up again and hiring become more challenging, which is bound to happen once the current economic weakness is overcome.