The manufacturing industry recovered early on during the pandemic but is now seeing a severe slowdown even as services are doing well. In the first two years of the pandemic, households shifted consumption from services to goods as advanced economies were in lockdown. But about a year ago, we began to see a rotation in the other direction, which is contributing to the current manufacturing contraction in Europe.

The big rotation from services to goods

Advanced economies experienced some fundamental shifts as the pandemic led to intermittent economic lockdowns for two years. One of those shifts was the massive increase in the consumption of goods relative to the consumption of services. The service sector was obviously severely affected by government-enforced lockdowns in the early stages of the pandemic before the COVID vaccine became available. These economic lockdowns in 2020 and 2021 were supposed to prevent the healthcare system from becoming overburdened but had disastrous side effects in the service sector.

In the U.S., household disposable income surged thanks to the extremely generous income support measures provided by the U.S. government several thousand dollars in stimulus checks, and vastly increased unemployment benefits. Thanks, Uncle Sam!

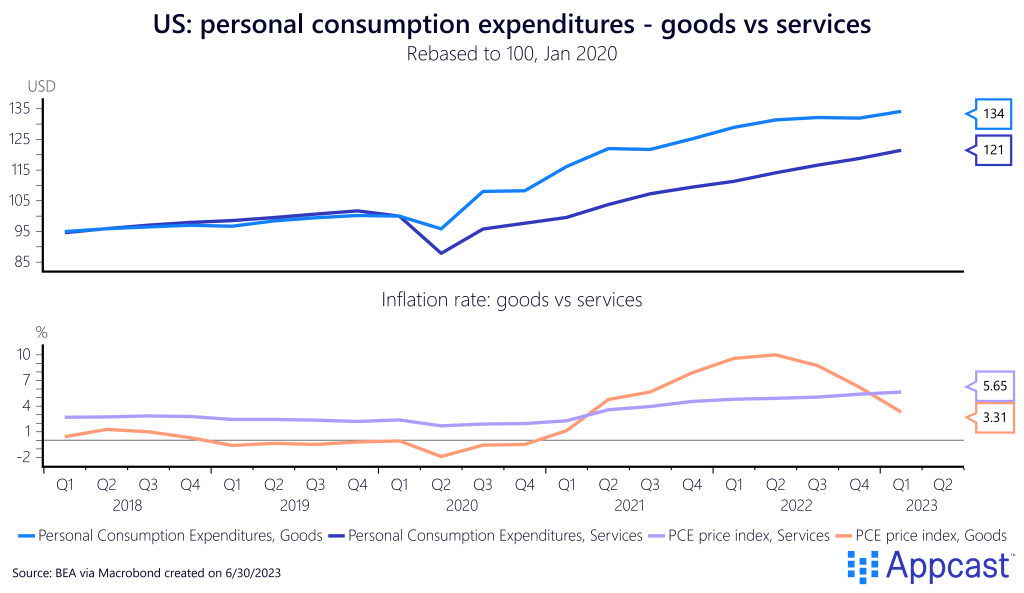

Households spent a large portion of this money on durable goods during the time when many services were of limited availability. As a result, personal consumption expenditures of goods relative to services surged. For the first time in several decades, the inflation rate on goods increased dramatically from less than 1% pre-pandemic to about 10% in early 2022, the result of the massive surge in demand combined with global supply chain disruptions.

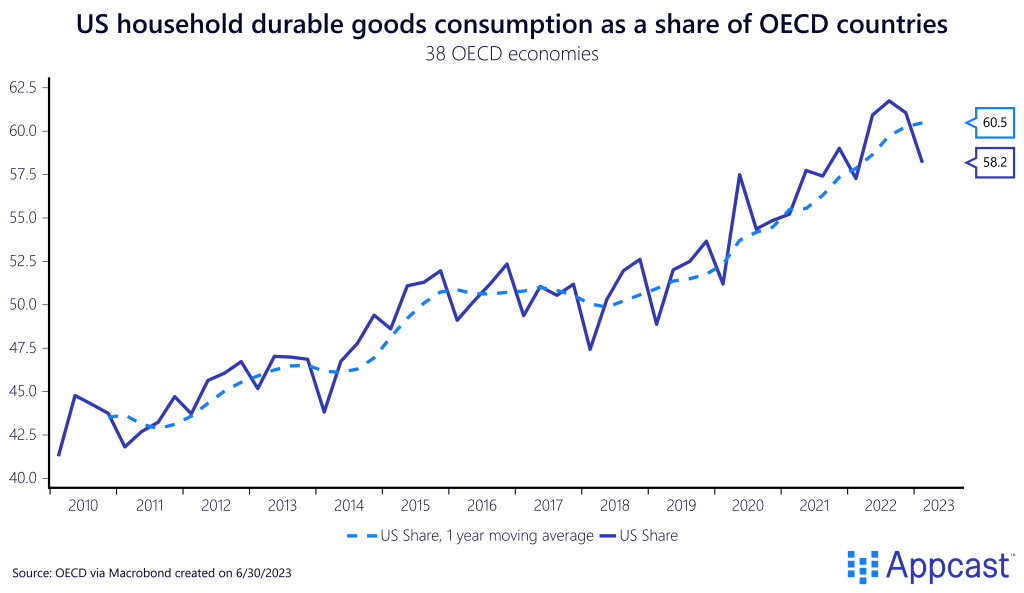

The U.S. consumer bailed out the world economy once more

It is fair to say that the U.S. consumer bailed out the world economy again. U.S. household consumption on durable goods as a share of all OECD durable goods consumption increased from about 50% pre-pandemic to now more than 60%. While part of this increase is due to the recent strengthening of the U.S. dollar (an exchange rate effect), the strong greenback itself is side-effect of U.S. economic outperformance vis-à-vis the rest of the world. Since early 2020, the largest share of the increase in global goods consumption comes from American household spending.

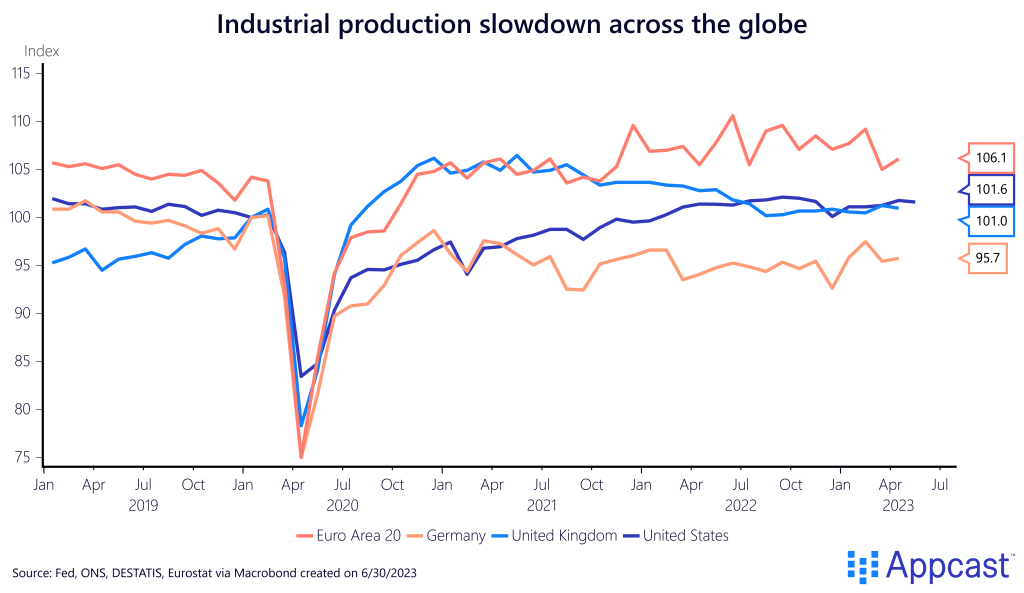

Industrial production bounced back quickly but is struggling now

Industrial production bounced back extremely quickly after the COVID-19 pandemic thanks to the surge in global demand in 2021 and 2022. Germany is the notable exception, but the industry has already been struggling for a while, even before the commodity price shock due to the war in Ukraine added additional pressure on the sector.

More recently, however, industrial production has stagnated or even declined across advanced economies as global economic growth has cooled down substantially with central banks around the world hiking interest rates rapidly to ease inflationary pressures.

Supply chains are back to normal

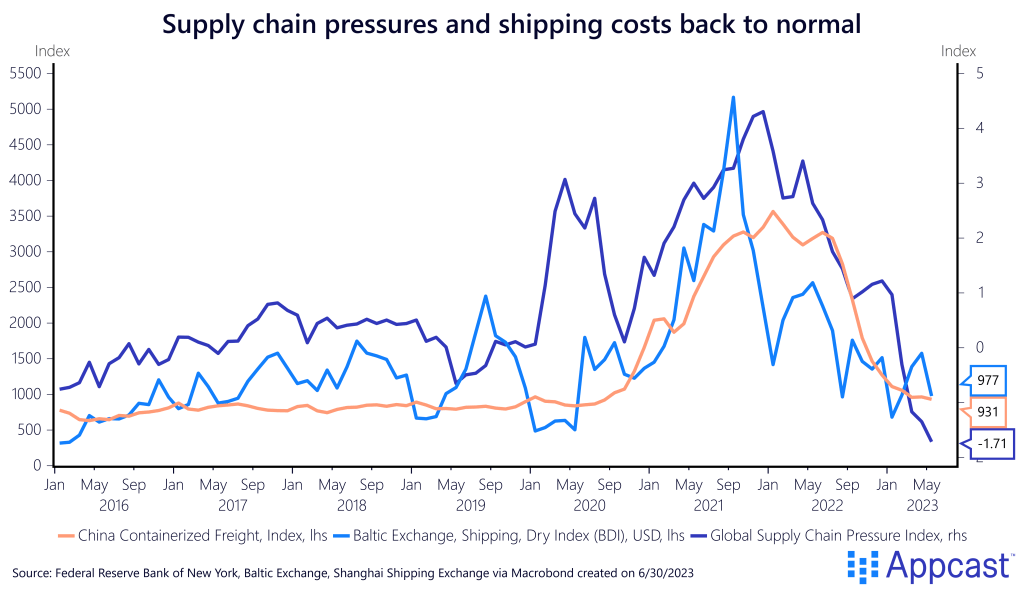

As global demand has noticeably cooled down, supply chains across the globe have normalized as well. While the shutdowns in response to the pandemic led to an interruption in supply chains in 2020 and early 2021, the researchers at the New York Fed who constructed the global supply chain pressure index observed that a large part of the surge thereafter was rather the result of rising global demand.

Shipping rates, such as the Baltic Dry Index and the China Containerized Freight Index, increased by a few hundred percent within just a year as the global economy recovered quickly once the shutdowns were over and vaccination campaigns had started.

As the chart shows, after surging to more than 5,000 in late 2021 and early 2022, both freight indices have now fallen to just under 1,000, which is similar to pre-pandemic levels. The New York Fed global supply chain pressure index has completely normalized as well. Supply chains are therefore easing as global demand for goods has fallen.

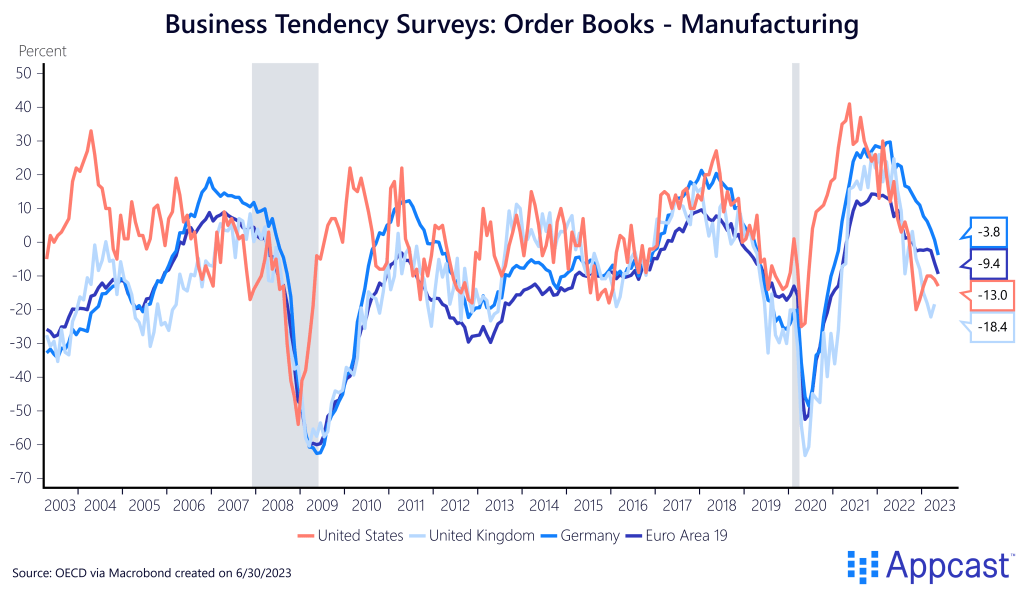

Order books show falling demand

Order books show the demand for manufactured goods declining rapidly across advanced economies. Just as orders reached a record high in 2021, they are now falling off a cliff. In the U.S. and U.K., the indicator is well below the long-run average, consistent with a contraction in that sector.

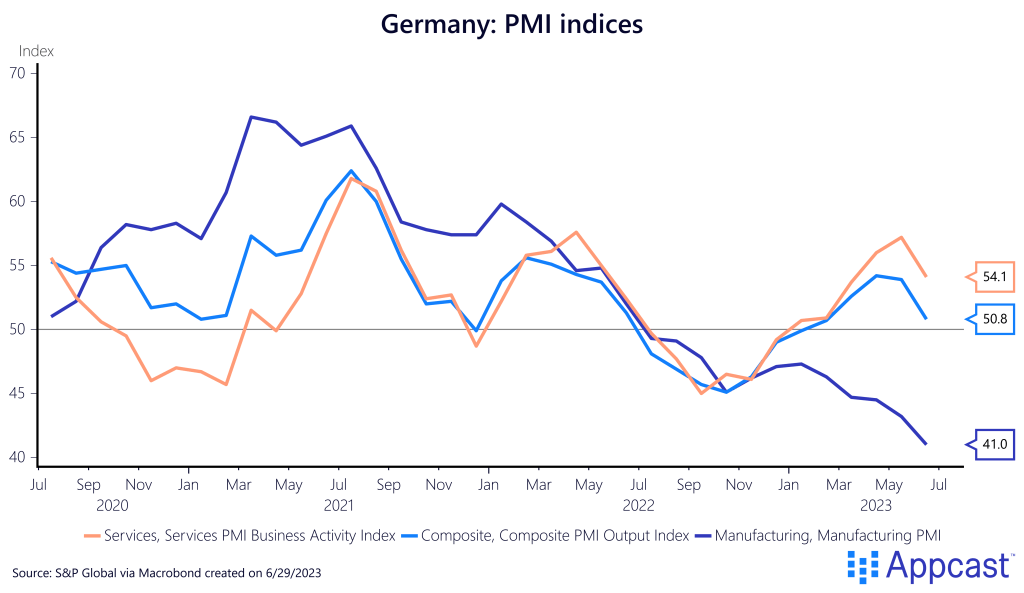

PMI data shows a manufacturing downturn amidst a service boom

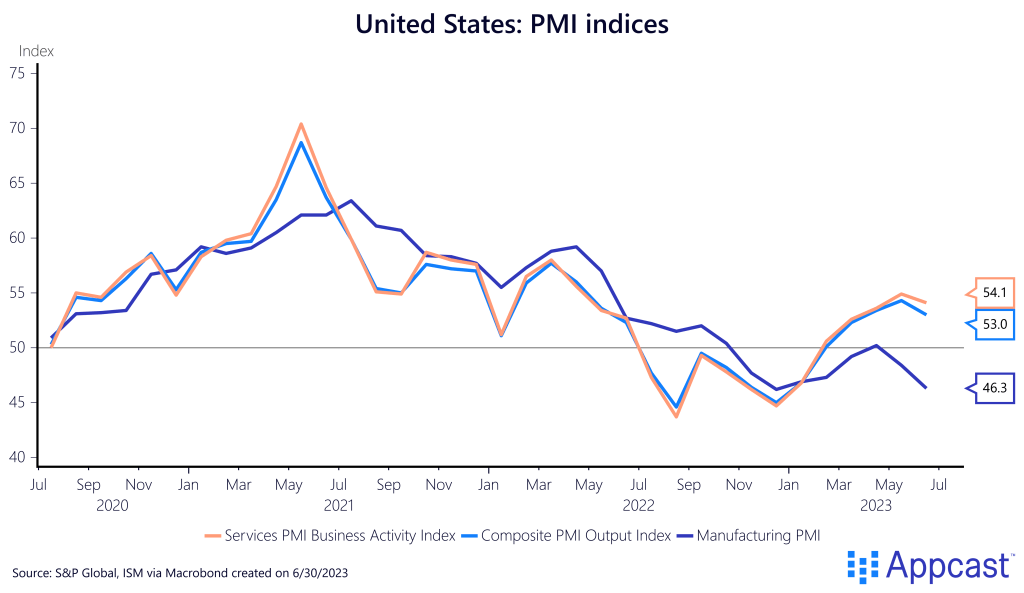

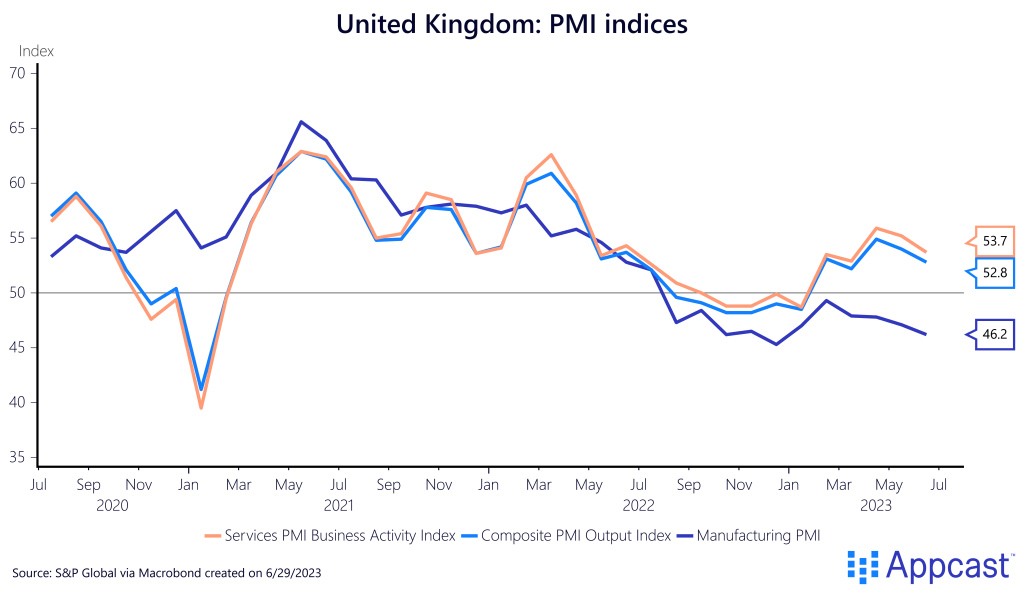

The Purchasing Managers Index (PMI) is survey-based data that indicated whether a particular sector is in expansion territory (values above 50) or contraction territory (values below 50). The data for the U.S., the U.K., and Germany is fairly synchronized, showing the extent to which global economic shocks have dominated since 2020, starting with the pandemic to the global supply chain crisis, the war in Ukraine, and now the global central bank rate hike cycle to combat inflation.

What the chart below shows is that there was a significant economic boom in 2021 and 2022 with both the service and manufacturing PMI surging to values comfortably above 60 at the time, which is well above their long-run averages: the long-run average value for the manufacturing PMI in the U.S. is just under 54, for example.

Since the end of last year, advanced economies have seen a different development though, with the service PMI surging while the manufacturing PMI is now well in contraction territory.

In the U.S., the manufacturing PMI has now dipped below 50 even as the service PMI has surged to 54. One should remember though that U.S. manufacturing experienced a veritable boom throughout 2020 and 2021, so the recent decline represents more of slow cooling rather than a severe contraction.

In the U.K., the manufacturing PMI has been below 50 since last summer, showing prolonged weakness, while the service sector expanded in the beginning of 2023.

Germany shows the largest divergence between services and manufacturing as the service sector seems to be doing rather well while German manufacturing has struggled for years. Germany’s service PMI has recently surged to over 57 while the manufacturing PMI keeps dropping and now stands at 43.

What does this mean for manufacturing employment?

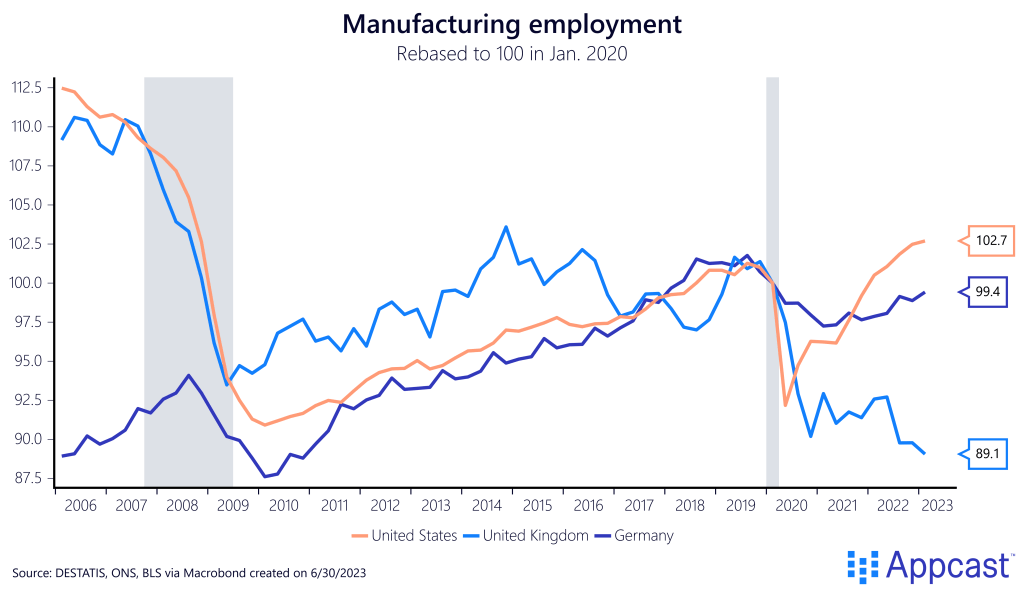

Manufacturing employment fell off a cliff in the U.S. and U.K. during the Great Recession while Germany’s manufacturing employment only fell slightly. During the decade before COVID, both the U.S. and the U.K. have gained back some of those manufacturing jobs even as the previous level from before 2008 is still out of reach.

Unfortunately, the COVID pandemic together with the Brexit shock have turned out to be another blow for the U.K. manufacturing sector, which saw employment decline sharply. Meanwhile, Germany is now struggling as well since one of its most important industries – car manufacturing – is unable to shake off a decade-long stagnation. Moreover, substantially higher domestic energy prices than before the war in Ukraine are another burden for industrial production.

Manufacturing employment in the U.S., on the other hand, bounced back sharply and the country is currently experiencing a manufacturing renaissance. Cheap domestic energy prices, targeted government subsidies as well as the difficult geo-political environment have led to a massive construction boom in the sector.

Our tentative prediction for the foreseeable future is that the manufacturing sector in the U.K. and Germany will continue to stagnate – albeit for different reasons – while U.S. manufacturing will perform much better thanks to the substantial domestic investments that are being undertaken right now.