Today, the Federal Reserve faced its toughest decision perhaps in decades. In the last couple of weeks, an intense banking crisis complicated an already dicey fight against inflation.

The Fed considered these banking conditions, the unquestionably hot economy (pre-financial complications), and the surrounding uncertainty as it decided on a “dovish hike:” a 25 basis point increase, far more conservative than the previous eight hikes. With this decision, the Fed made it clear that cooling inflation was still the number one priority, although it signaled that rate hikes may be soon coming to an end.

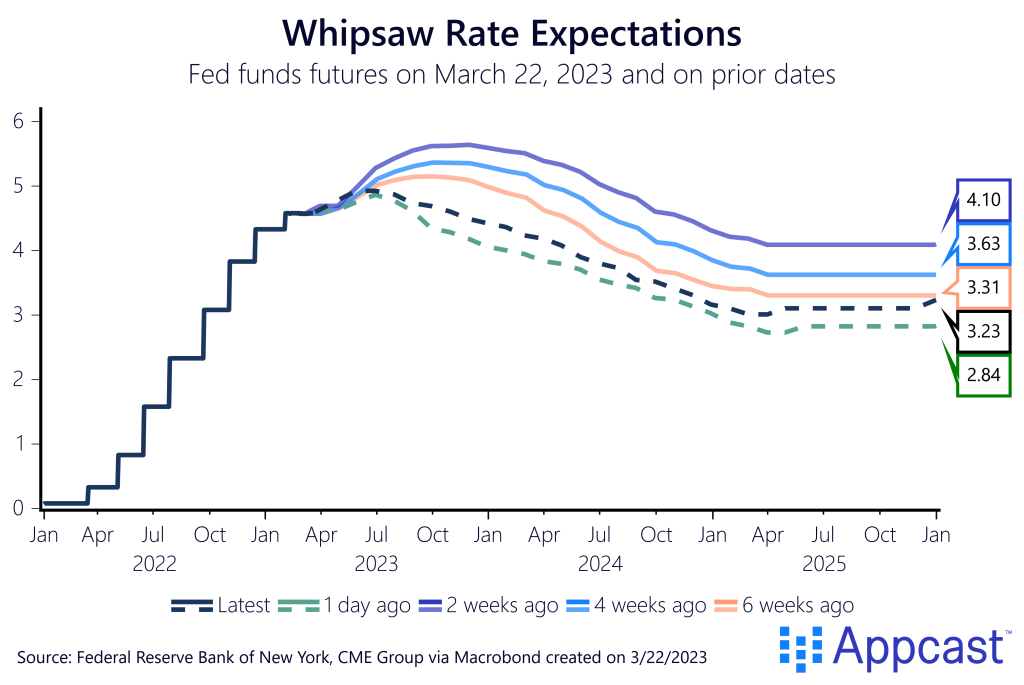

Take a look at the whipsawed futures markets over the last few weeks. Two weeks ago (solid purple line) markets expected higher future rates than two or four weeks earlier (solid blue and orange lines). That is largely because the jobs report for February came in stronger than expected. But on March 10, everything changed – that is when Silicon Valley Bank failed. It led to a lower futures curve as of yesterday (green dashed line). So with today’s quarter percentage point upward hike, markets expected a more subdued path of rates (dashed black line).

A Reflection on Uncertainty

The statement released recognizes the uncertain effects the recent turmoil in the banking sector might have, and chair Jerome Powell’s press conference began with a statement on the recent events in the banking system. The Federal Reserve believes the banking system is “sound and resilient.” However, this crisis will likely have effects on the larger economy through tighter credit conditions.

Though the committee admittedly considered pausing rate hikes altogether in light of the banking crisis, Powell noted that he and his cohorts are committed to long-term 2% inflation. The public currently believes in this commitment; long-term expectations of inflation remain anchored. In order to keep that trust, the Fed needed to prove the focus is on price stability, or “sustain public confidence with actions as well as words,” as Powell put it.

A Serious Shift

Just weeks ago, there was talk abound on the possibility of a higher terminal rate – the economy was running too hot, and inflation would not seem to calm down. Now, the Fed has changed its tune. No longer is Jerome Powell promising future rate hikes, the language has shifted to reflect the uncertainty of the current moment. Additionally, the Summary of Economic Projections held the appropriate policy rate at 5.1%. Despite the stubbornly hot economy, the Fed Funds rate is no longer the only tightening force in the economy, in light of shifting credit conditions from the banking crisis.

Labor Market Conditions

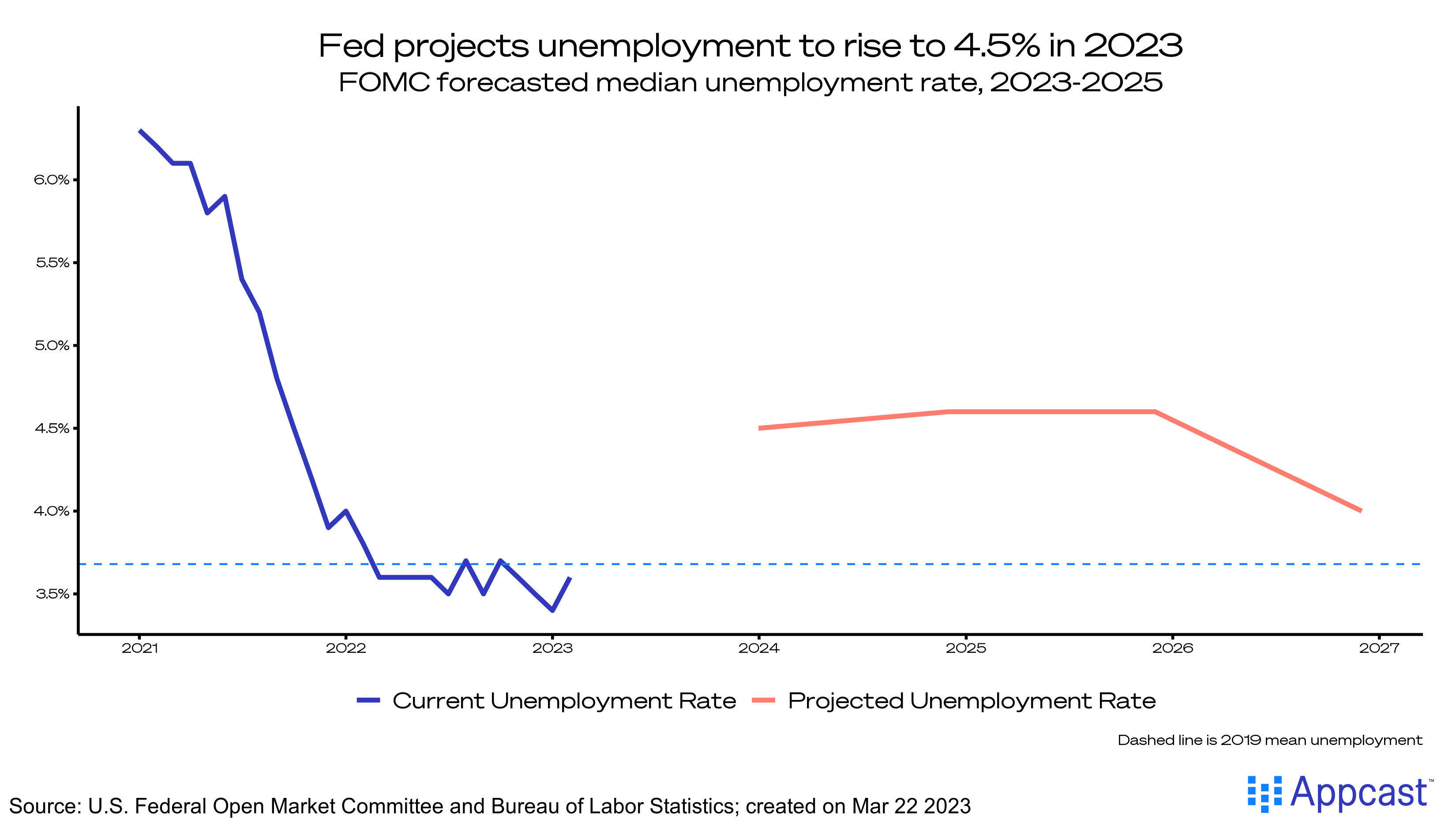

Despite the dovish lift, the Fed is keeping a hawkish eye on the labor market – it simply remains too tight. Even with the latest increase in the labor force participation rate, supply and demand is incredibly unbalanced. While the Fed has changed the tune on future rate increases, it remains committed to making decisions meeting by meeting and “closely monitoring incoming data,” especially on the labor market. Projections of the unemployment rate show the Fed believes it can slow the hot labor market – though still to a level that’s historically solid – while bringing down inflation.

Co-author: Andrew Flowers