Inflation crawling back to target?

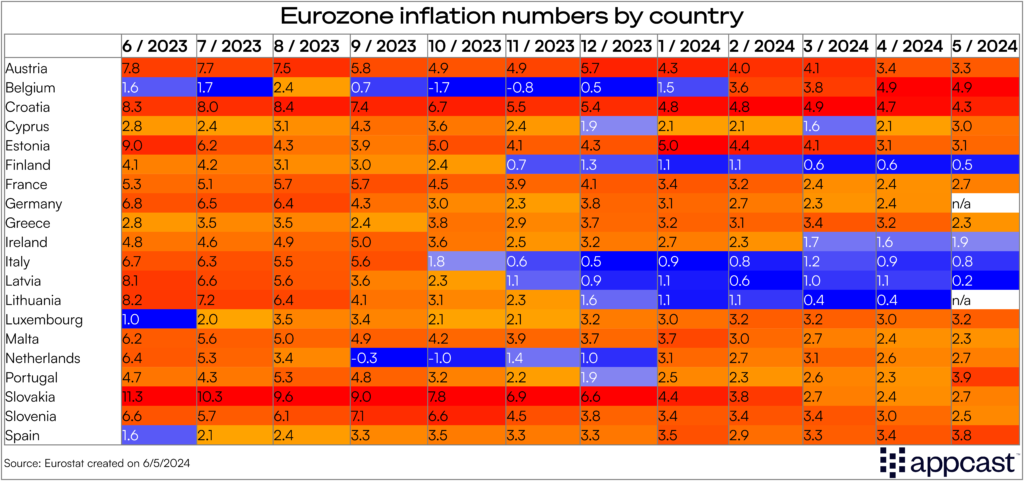

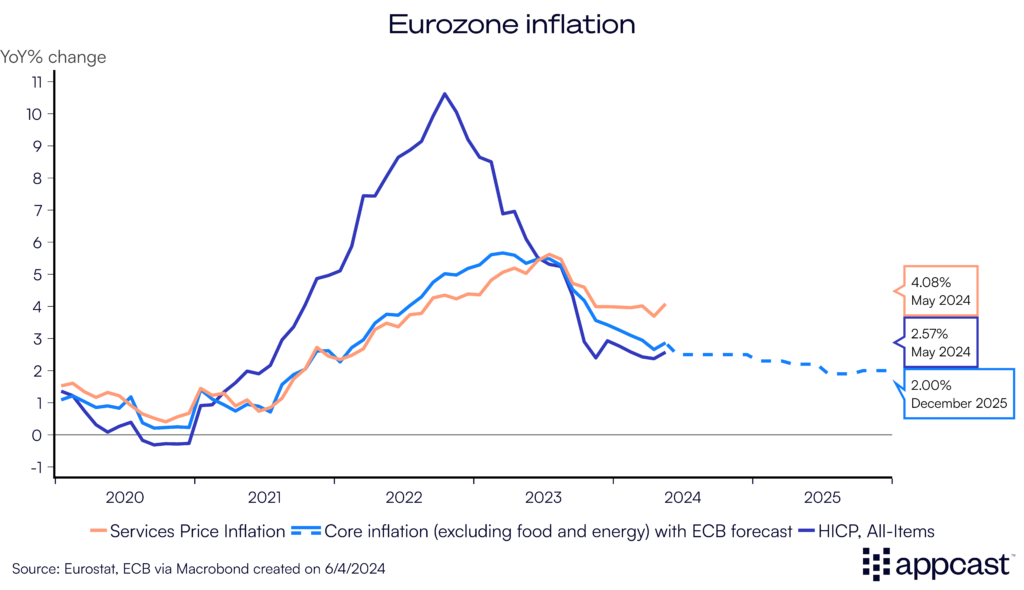

After the massive inflationary surge in recent years, inflation numbers in the Eurozone have been normalizing again over the last year and have been hovering just over 2.5% in recent months, edging closer to the ECB’s two percent inflation target.

The minor setback this spring was to be expected and is related to some one-off factors temporarily driving inflation higher. In Germany, service price inflation increased because the government’s railway fare reduction measure (introduced in May 2023) has ended. In Spain, electricity prices surged because the government’s VAT reduction for energy (introduced in 2021 during the energy price shock) has been scrapped.

Eurozone inflation has therefore been slightly stickier than anticipated in recent months, but the effects mentioned above should be temporary in nature and should not prevent the ECB from focusing on the broader picture.

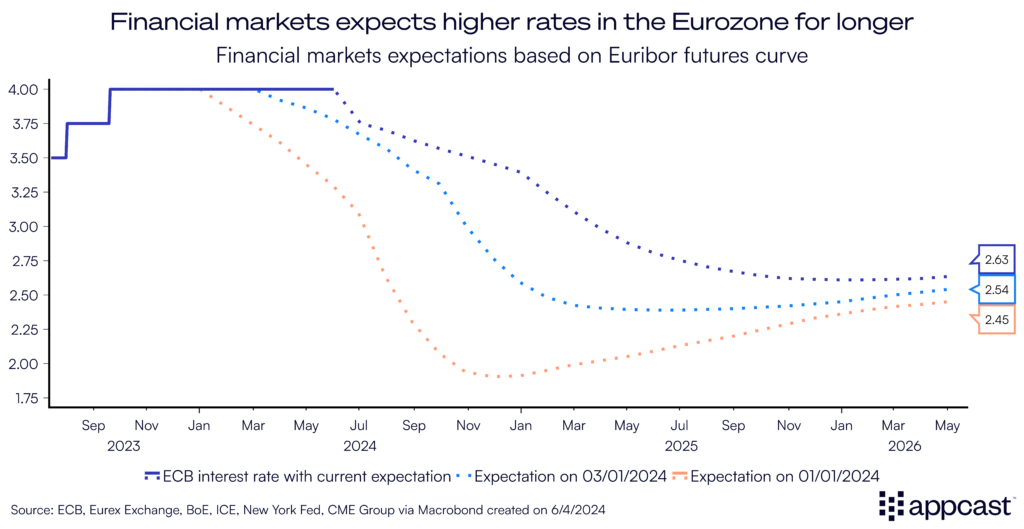

ECB economists forecast that Eurozone inflation will fall back to target by 2025 (and private sector forecasters widely share that assessment). At the same time, economic growth in the Eurozone was sluggish last year, stifled by high interest rates. It therefore makes sense that policy makers have penciled in a June rate cut, and financial markets anticipate another two rate cuts by end of year.

Worker’s bargaining power is improving again

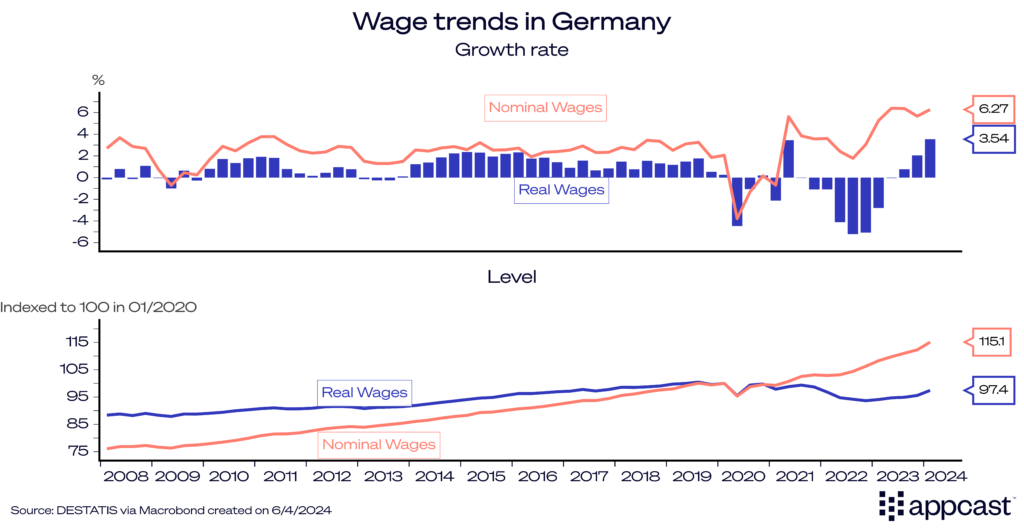

However, there are several data points that might concern European monetary policy makers in Frankfurt. Germany, the Eurozone’s largest economy (more than 25% of the region’s GDP), has seen a massive uptick in wage growth in the beginning of this year. Nominal wages surged to above 6% and real wage growth ticked up to 3.5%, the highest level in more than 15 years.

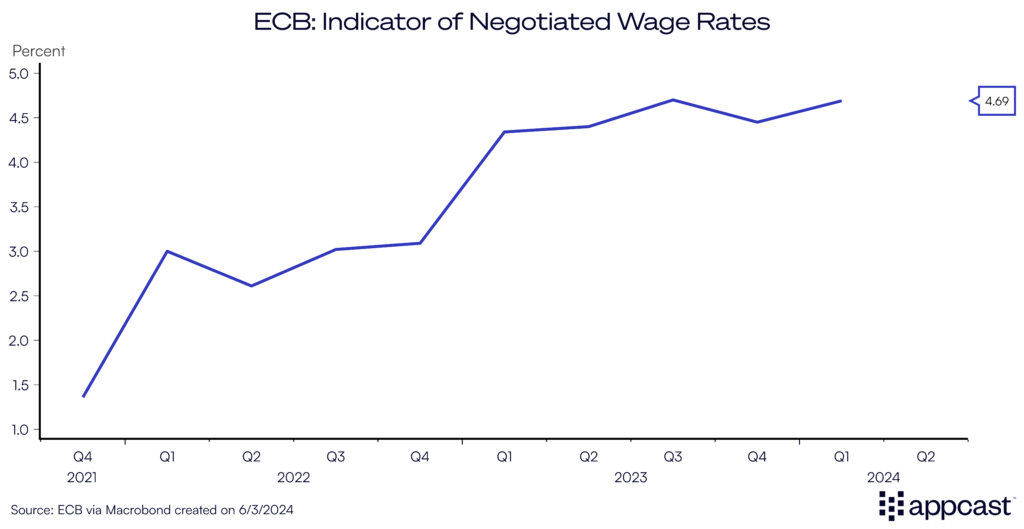

The ECB has constructed an index of “negotiated wages” since roughly 80% of all Eurozone employees are subject to collective bargaining agreements. With such a substantial share of wages being covered by collective action, the wage tracker will pick up general Eurozone wage dynamics fairly well.

The ECB’s indicator shows that negotiated wage growth remains slightly elevated growing at a rate of more than 4%. However, this is also driven by one-off effects that will not be repeated. In Germany, for example, public sector employees received a substantial one-time inflation compensation worth €1,920 in the first quarter of 2024.

Nevertheless, the fact that nominal wage growth remains sticky at such an elevated level for now even as inflation has come down quickly points towards the fact that workers are gaining bargaining power.

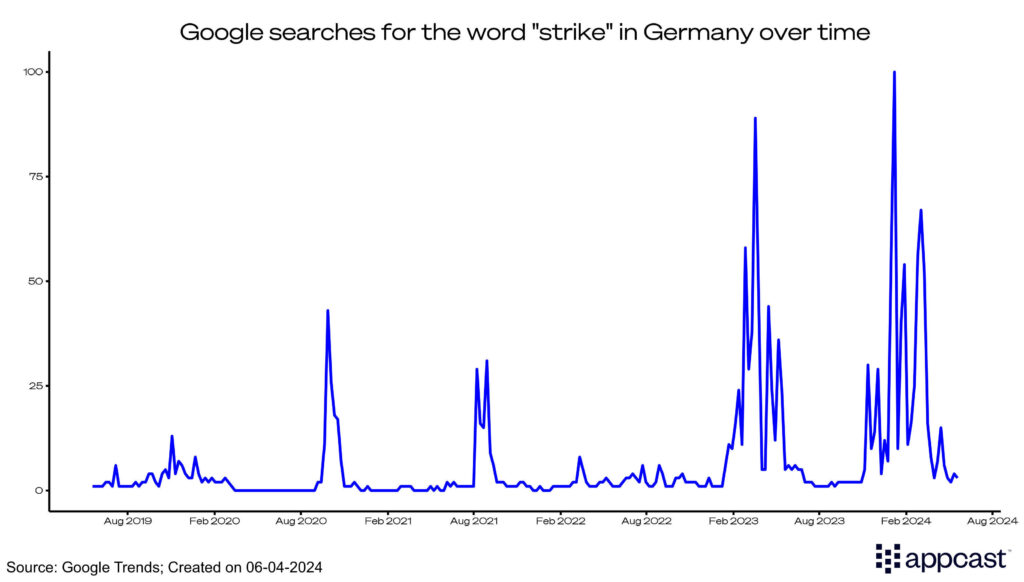

Industrial action has been rising since 2023, particularly in Germany. Google Trends data shows to what extent striking activity has increased relative to previous years. There has been a barrage of news reports in 2024 covering worker strikes in the public sector, including the transportation sector (rail and airports), with the German trade union Verdi negotiating on behalf of more than 2.5 million employees.

Amidst worker shortages due to adverse demographic developments, workers in the Eurozone will likely see their bargaining power improve further. While this is obviously good news, it might be a thorny issue for monetary policy makers who want to make more progress on the inflation front.

The ECB should disregard the wage growth numbers for now…

Alternative data points on wage growth are showing a more benign picture. The Indeed tracker shows that wage growth for job postings is normalizing quickly across the Eurozone (with the Netherlands being the notable exception for now).

The decline of wage growth for new hires speaks to the fact that the demand for labor is cooling and rebalancing after showing signs of overheating throughout 2021 and 2022.

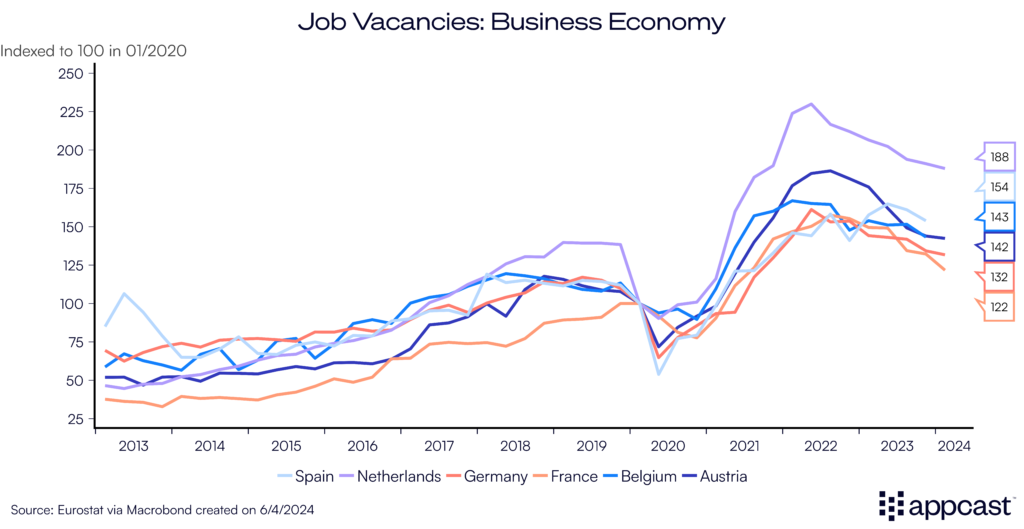

Vacancies in the private sector continue to fall back to pre-pandemic levels. The labor market is cooling down as job postings head back to normal and job-to-job transitions decline from their elevated levels.

With the labor market normalizing and inflation falling back to target, economists widely anticipate that the ECB will follow through with a rate cut this week, especially since policy makers will not want to backpedal on their earlier announcement. However, another rate cut in July now looks increasingly unlikely.

While the ECB seems to be willing to look through the higher wage growth numbers to some extent, financial markets are now pricing in fewer rate hikes throughout 2024 and 2025 compared to the beginning of the year.

Sticky inflation and wage growth numbers combined with the fact that Eurozone GDP number generally surprised on the upside in Q1 after last year’s recession mean that interest rates will have to stay higher for longer than anticipated.

… but some inflation risks remain

And even as inflation figures in the Eurozone have generally been moving in the right direction, some risks remain.

First and foremost, workers’ bargaining power has been improving substantially, also thanks to demographic factors. Workers will want to see their material well-being improve again following the decline in real wages they had to endure during the pandemic. And this might mean increasing wage pressure for years to come.

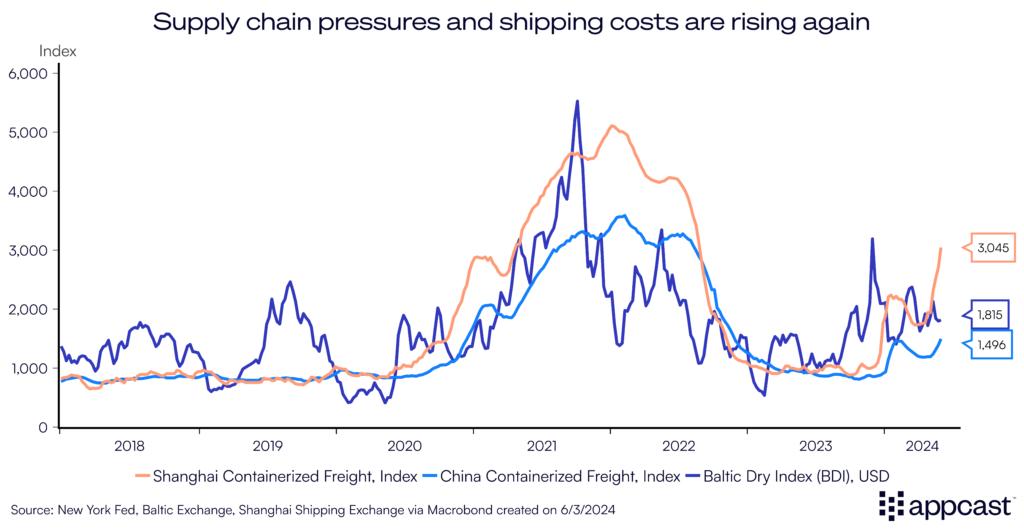

Another substantial risk comes from geopolitical factors that are outside of European policy makers’ control. The conflict in the Red Sea has led to a rerouting of shipping routes. Maersk and other shipping giants have been redirecting container ships around Africa instead, thus adding several weeks to their route to Europe. This has led to a sizeable increase in shipping costs.

While rising trade costs have not reached the level yet seen at the height of the supply chain disruptions during the pandemic, they will put pressure on European inflation data in the year to come if the situation persists. And this, of course, is exactly the opposite of what the ECB would like to see and would mean higher European interest rates for longer, at the expense of the domestic economy.

Conclusion

For now, ECB policy makers should disregard the elevated German wage growth numbers. Real wages in Germany are still depressed and barely exceed 2018 levels. It is therefore no wonder that workers are trying to claw back some lost purchasing power. Furthermore, alternative wage data like the Indeed wage tracker and other labor market data like declining vacancies indicate that labor markets across the Eurozone are not as overheated as they were two years ago. While the ECB should not disregard elevated wage growth completely, current inflation risks rather come from geopolitical events, increasing trade and shipping costs, and climate change, all of which are outside the ECB’s control.

For recruiters, this means that compensation will remain front and center for many jobseekers due to the recent cost-of-living crisis. Nominal wage demands will remain historically elevated, at least for now. Do not expect a return to the period of subdued nominal wage growth that advanced economies experienced in the 2010s any time soon.