Inflation has been way above target for more than two years now, giving monetary policy makers at the Bank of England (BoE) a severe headache. In recent remarks, BoE officials have made it clear that they are now willing to sacrifice the labor market to bring down inflation. While this is problematic in itself, policy makers now face another serious problem related to the labor market data: the official unemployment rate figure in the U.K. has become unreliable!

The only advanced economy to cease publishing unemployment rate numbers

The Office of National Statistics (ONS) just confirmed that it will hold its release of its usual labor market report for a second month in a row. The data points that are being paused include series like the employment rate and unemployment rate for the U.K., which are part of the Labour Force Survey.

Over the last couple of years, the response rate for the survey has dropped to such an extent that the ONS does not seem to trust its own labor market estimates anymore. Estimates for certain subgroups of the population have become more uncertain since the start of the pandemic, according to one official.

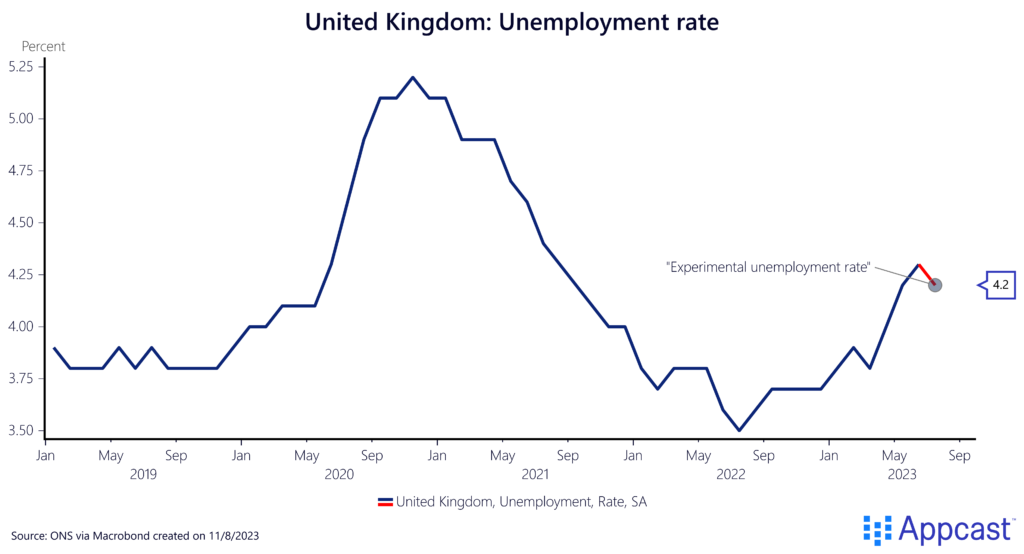

Consequently, the most recent labour market report published by the ONS used experimental statistics for the unemployment and employment rate based on HM Revenue and Customs’ (HMRC) pay-as-you-earn real-time information instead. The ONS announced it will reintroduce the ‘Transformed Labour Force Survey’ by next spring. The new “experimental statistics” show that the most recent unemployment number might only be at 4.2%, but economists question the accuracy of that estimate.

The truth of the matter is that policy makers are currently stabbing in the dark during a time in which the U.K. labor market seems to be quickly weakening. Bloomberg models suggest that the U.K. economy has already entered a recession in the third quarter – the official GDP numbers will be published later this week.

It is quite possible that the actual unemployment rate has already increased by more than what the official statistics suggest, with policy makers completely unaware of it.

The BoE allowed inflation to rise but the honeymoon is over…

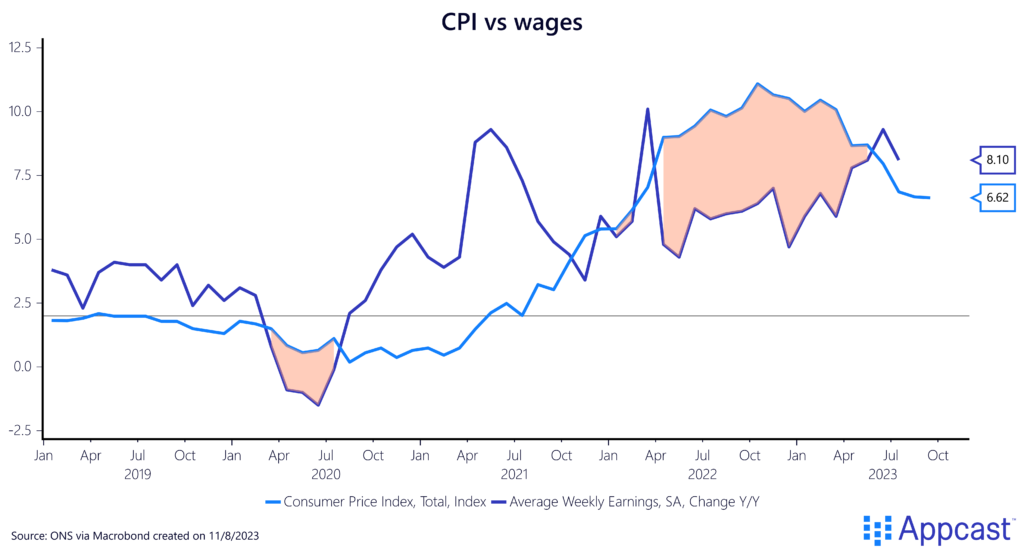

The BoE has allowed inflation to rise substantially above target because the economy still had some leeway to recover from the COVID-19 pandemic. Moreover, a substantial part of the inflation was due to supply shocks – surging commodity prices, global supply chain disruptions, labor shortages in the U.K. – and central banks can only affect inflation by bringing down total demand in the economy.

Policy makers therefore opted for higher inflation temporarily, instead of having to choke off a fickle recovery. But this “honeymoon” (if we can call high inflation and growth a honeymoon) seems to be over!

In recent statements, BoE officials have now made it abundantly clear that they will keep interest rates higher for longer because inflation and wage growth are still excessively high, quite inconsistent with the 2% inflation target. The U.K. economy therefore risks falling into a wage-price spiral.

…Really over, as some BoE members think unemployment needs to rise substantially

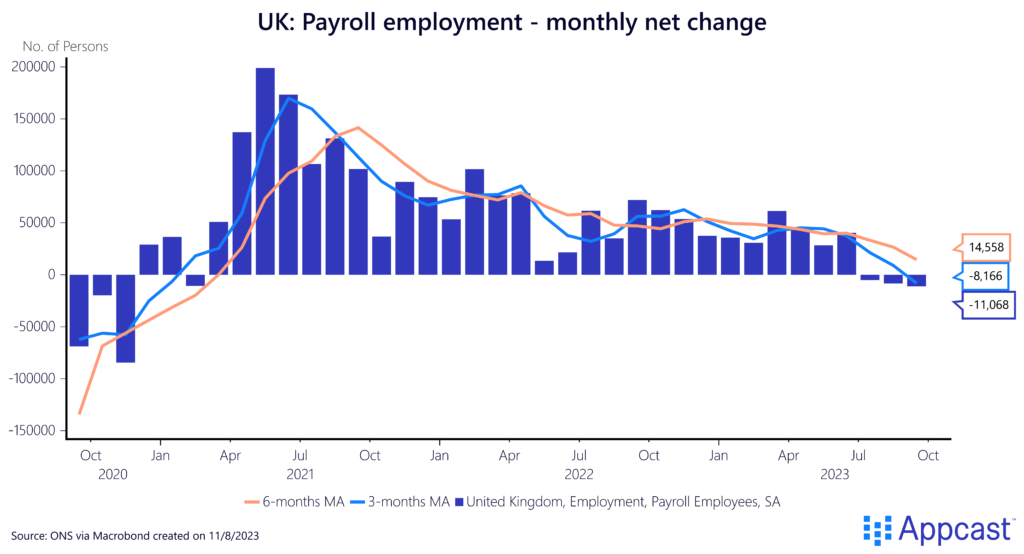

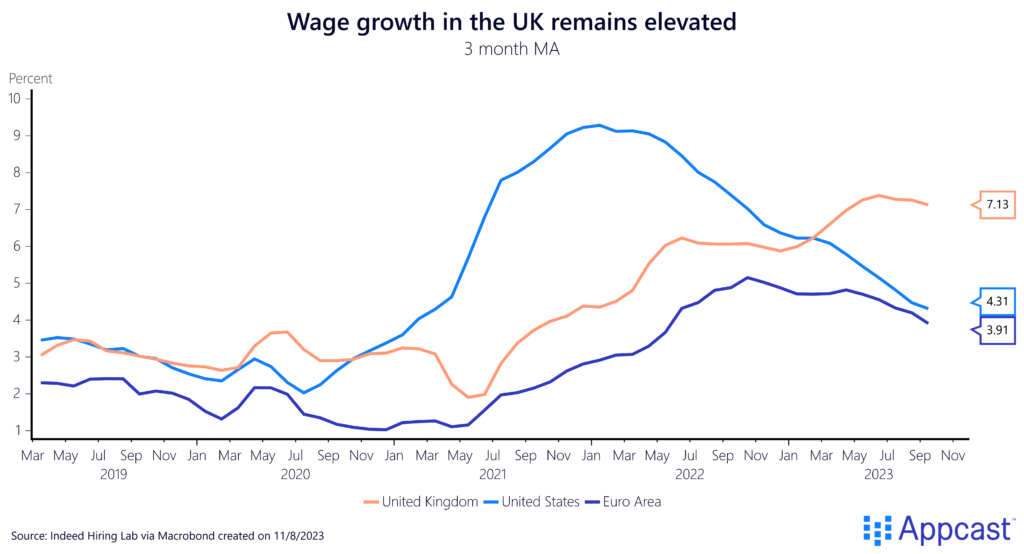

Recent labor market dynamics are what seems to worry monetary policy makers the most. While the unemployment rate has gone up in recent months and employment growth has turned negative, wage growth is still running at above 7%, according to official figures.

Of course, we need to put somewhat less weight on the official wage series from the ONS. But private sector data confirms that U.K. wage growth is still extremely elevated, while it has slowed in the U.S. and across the Eurozone.

These wage dynamics combined with the fact that open vacancies in the U.K. economy are still above pre-pandemic levels is exactly what worries BoE officials. Some monetary policy makers are so worried that they now believe that they need to substantially increase the unemployment rate to bring inflation back to target.

Labor shortages, caused by both Brexit and the pandemic, might have led to a large increase in the natural rate of unemployment – the unemployment rate that is consistent with stable inflation running at about 2%.

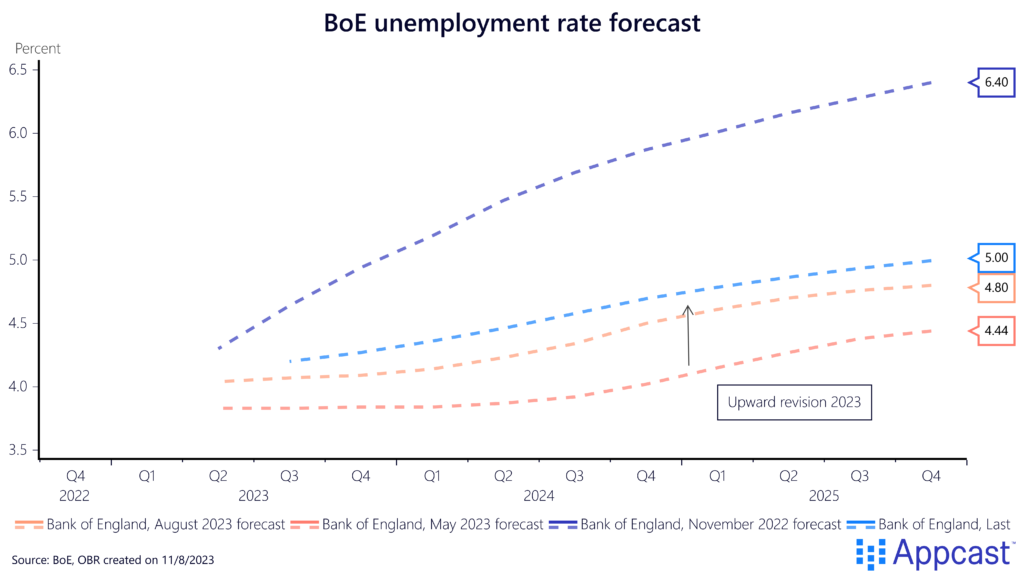

BoE official Jonathan Haskel recently remarked that this natural rate might have risen all the way to 6%! Though less pessimistic than those in 2022, BoE projections made throughout this year have been revised upwards and now show that the unemployment rate could rise to five percent or above by the end of 2025.

…which would lead to a significant economic contraction

Most importantly, it should be noted that the BoE is not an innocent bystander here but very much the actual culprit behind this rise in unemployment. Monetary policy makers are now keeping interest rates higher for longer and sufficiently restrictive to weaken the economy as to bring down inflation.

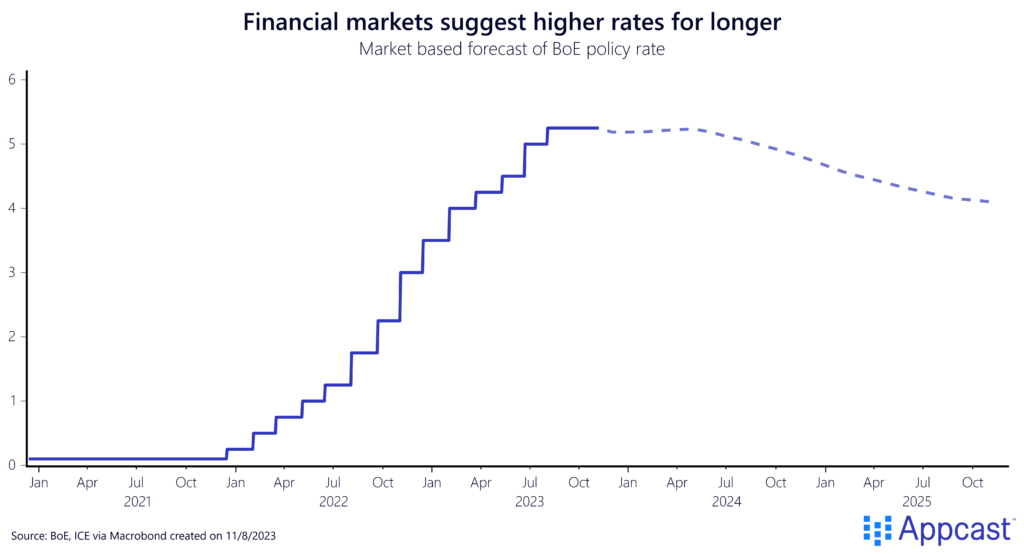

Financial markets are now assuming that rates will stay above 4% until the end of 2025, which will weigh heavily on business investment and household consumption. It will also negatively impact the housing market – mortgage rates have already surged. Ultimately, this will all spill over into the labor market.

What does that mean for recruiters?

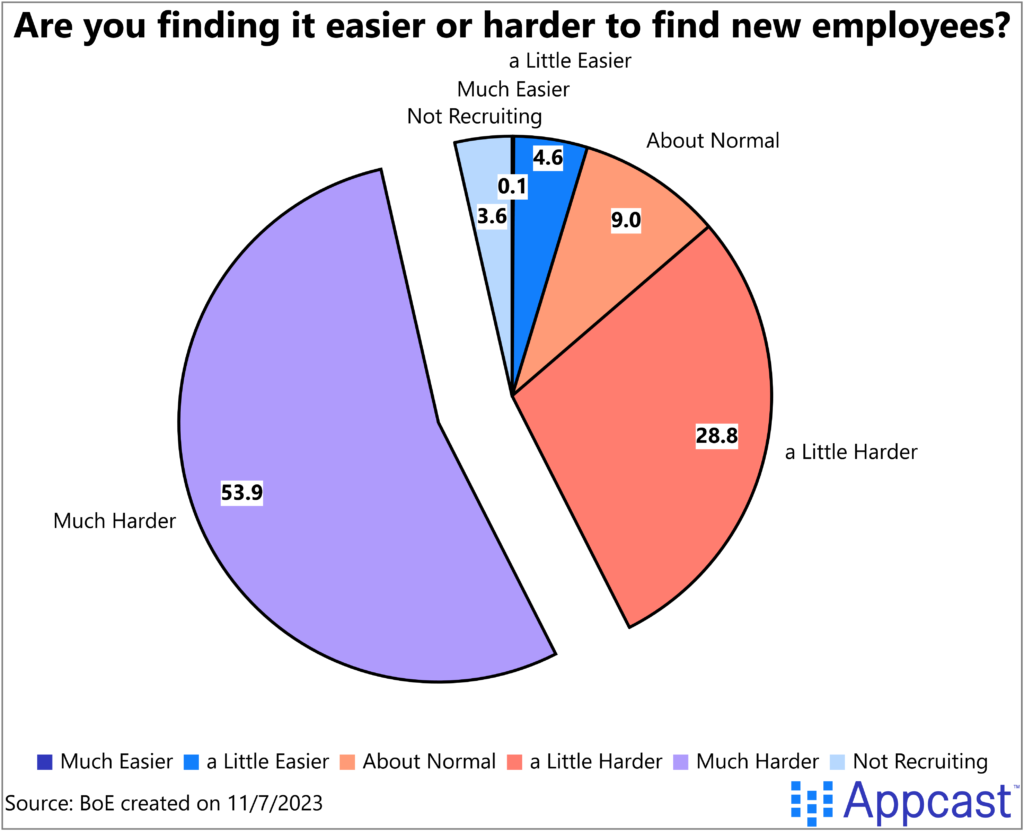

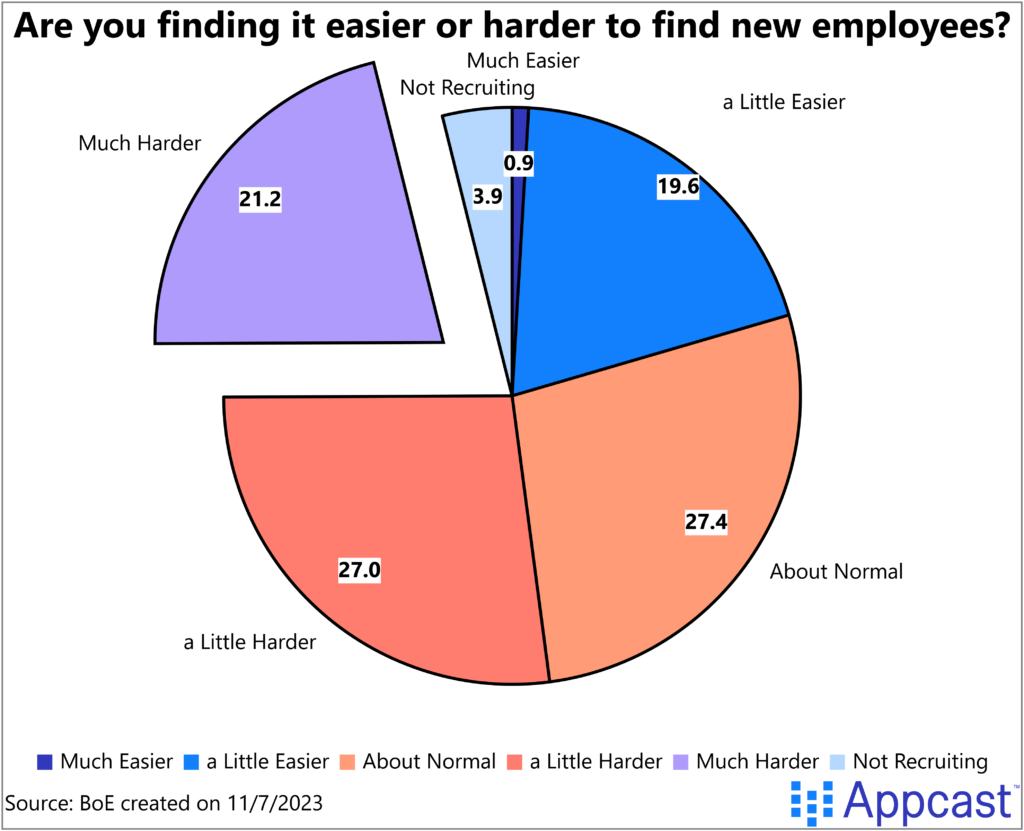

With the economy weakening, hiring difficulties have clearly eased compared to the record tight labor market of last year. Recruiters found it extremely difficult to fill positions throughout 2022 and more than half of them reported that it was “much harder to recruit than usual” in October of last year. This share has now gone down to 21%.

October 2022

October 2023

Of course, it will be much easier to find workers in a weakening labor market. While this might seem like good news at first, do not forget that the BoE is now intent to bring down the inflation rate at the expense of economic growth – it’s not likely they will stop before a recession in imminent! Higher interest rates and weaker demand will affect all sectors in the economy. And while businesses will find it easier to hire at first, weak demand will sooner or later translate into hiring freezes and potentially even layoffs. There are signs that this is already happening throughout the U.K. as employment growth turned negative – but of course, those measurements no longer reliably reflect the labor market’s strength.