As we explained in our Arizona piece, Trump is currently expected to win the swing states in the Sun Belt. The Southern states are more business-friendly and focused on construction and economic expansion. Residents there lean more towards the GOP, which has traditionally championed deregulation and other pro-business sentiments.

The swing states in the Rust Belt, characterized by their industrial economies and blue-collar workforce, are showing relatively stronger support for Kamala Harris. This reflects her appeal to traditional Democratic voters and her policies aimed at revitalizing American manufacturing.

Swing State Battlecard: Pennsylvania

In this blog post, we cover the state of Pennsylvania, which currently seems to be a toss-up between Harris and Trump. We provide some demographic, economic and labor market context. Every single one of these factors will influence which candidate will carry the state in this year’s election, but one may have an outsized influence in which way Pennsylvanians decide to vote.

While the buzzing national economy would usually favors the incumbent candidate, Rust Belt states have not fared as well as the rest of the country in recent years. Manufacturing was the backbone of the U.S. economy following World War II. Cities like Philadelphia and Pittsburgh were once among the richest on earth. But in recent decades, the local economy has suffered due to the rapid decline in manufacturing jobs. Economic stagnation created a lot of discontent and contributed to the Trump victory in 2016. Even as Harris’ economic agenda aims to revitalize American manufacturing, her margins in the Rust Belt seem to be razor thin.

Population dynamics

Demographic trends are one of the most important factors shaping how regional economies perform in the long run. Both local economic development and the demographic composition within states influence how people vote.

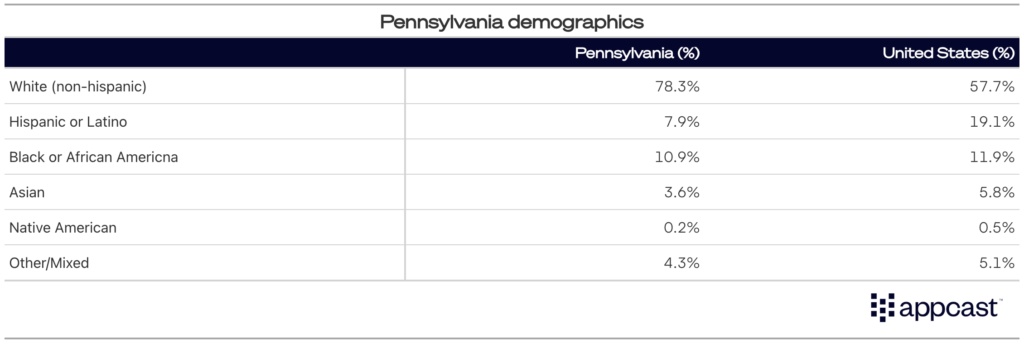

Pennsylvania is, on average, less ethnically diverse than many other states. Almost 80% of the state’s population is White compared to less than 60% nationwide. 11% of the state’s residents are African American, which is close to the national share. Less than 8% of the residents are Latino and only 3.5% of residents are Asian (19% and 6% for the U.S. as a whole).

The state’s population has stagnated since the late 2000s, and the regional economy has underperformed national economic growth. Net migration to other U.S. states has been negative for close to 20 years, reflecting the fact that some Pennsylvanians are moving elsewhere for better economic opportunities.

Historically, the Democratic party appealed to manufacturing workers, but recent history is more complicated. The so-called “China shock” in the early 2000s led to many years of economic stagnation and social discontent in large parts of the Rust Belt. Consequently, manufacturing workers turned their backs on Democrats and Republicans won Pennsylvania for the first time in decades in 2016.

Housing market and rental prices

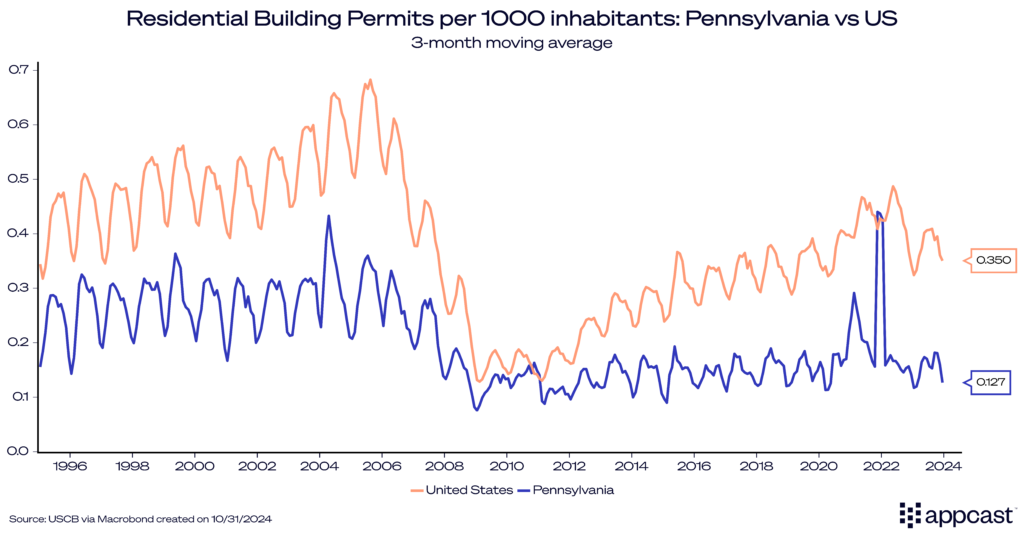

For several decades now, Pennsylvania has had significantly lower rates of housing construction compared to the U.S. And it would be wrong to attribute this to the stagnating resident population and local economy. Even on a per capita basis, residential building permits in Pennsylvania have been significantly lower than in most other U.S. regions since the late 1990s, contributing to a housing shortage. In fact, the state is currently building at less than half the rate of the national average!

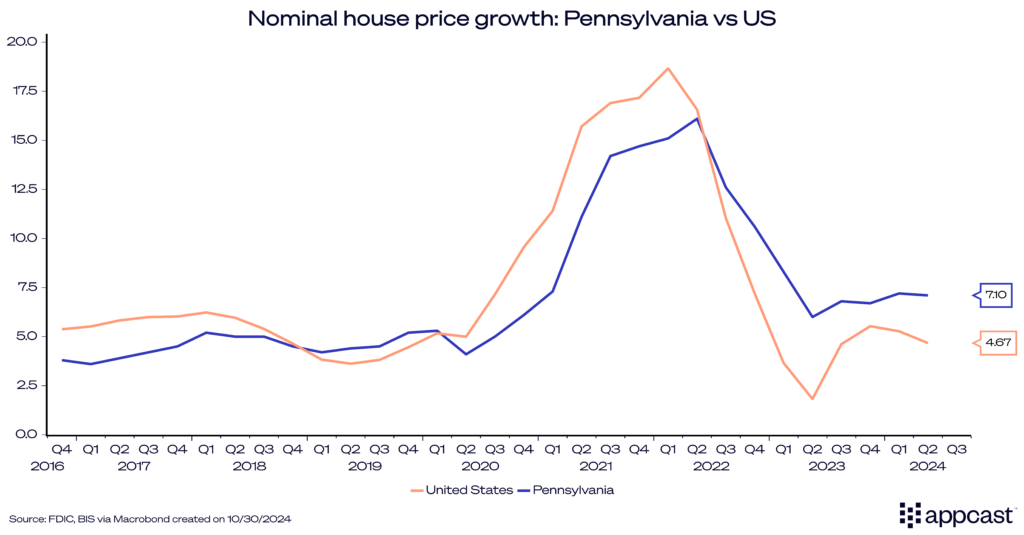

Given the lack of supply, it is therefore not surprising that residential house prices have recently outpaced the country as a whole by some margin.

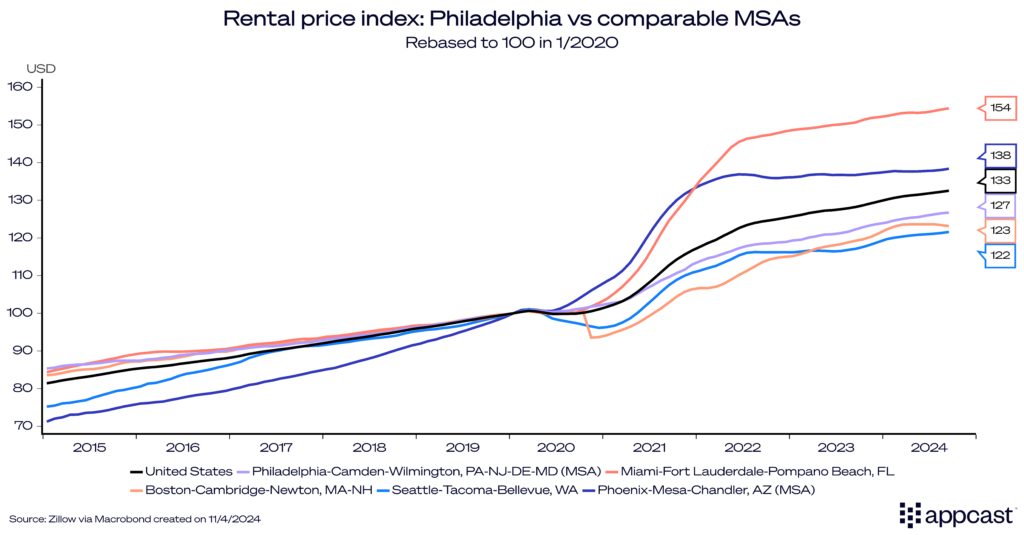

While rental prices in the metropolitan statistical area (MSA) of Philadelphia have gone up by close to 30% since 2020, the increase remains somewhat smaller than the price surge seen in many other MSAs of similar size, such as the booming South (Miami and Phoenix, for example).

The relative economic underperformance of the Rust Belt is thus keeping rental prices somewhat in check even as Pennsylvania has been horrible in terms of building new homes for its residents.

Labor market outcomes

Pennsylvania’s labor market has been quite weak for many years. State employment had only just recovered from the Great Recession by 2016, and the manufacturing sector has been shedding jobs for decades.

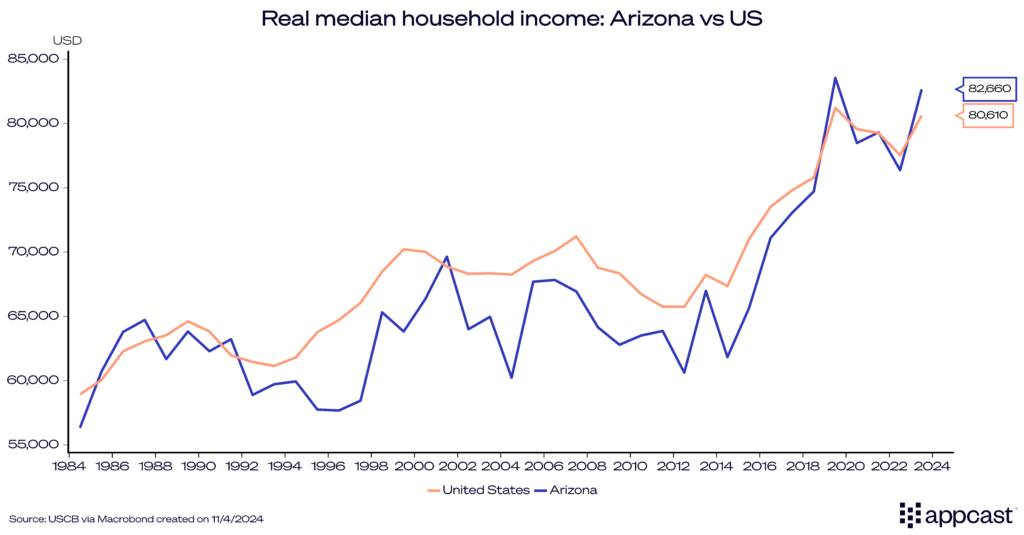

Nevertheless, real median household income in Pennsylvania is bang on average and has performed in line with nationwide household income since the mid-1980s.

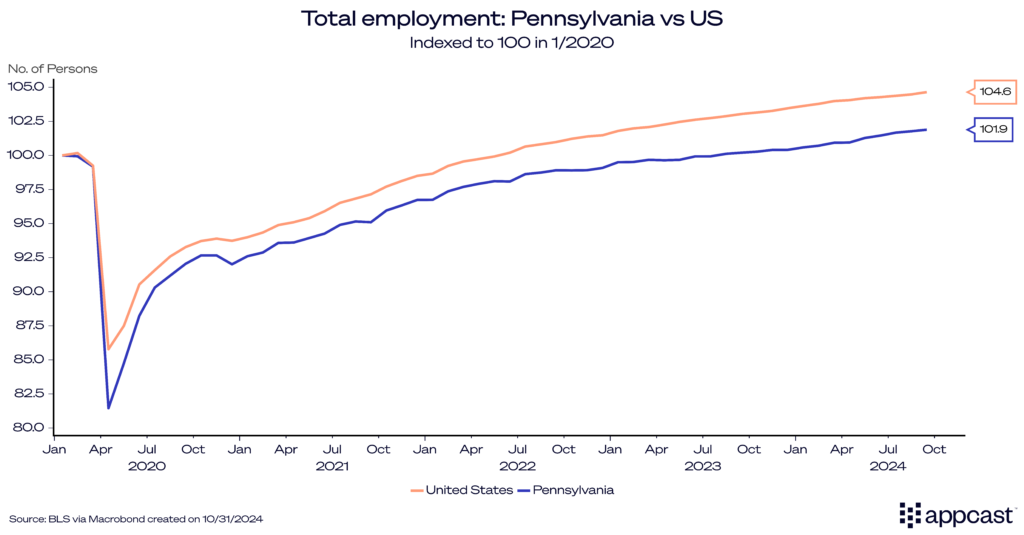

In terms of employment growth, Pennsylvania is a clear underperformer. While payroll employment in the U.S. is now exceeding its pre-COVID peak by more than 4.5%, employment growth in Pennsylvania has been less than half that rate (it’s barely up by 2%).

The weak pace of job growth is due to a sluggish local economy and weak demographics, which itself are a result of a lack of economic opportunities within the state.

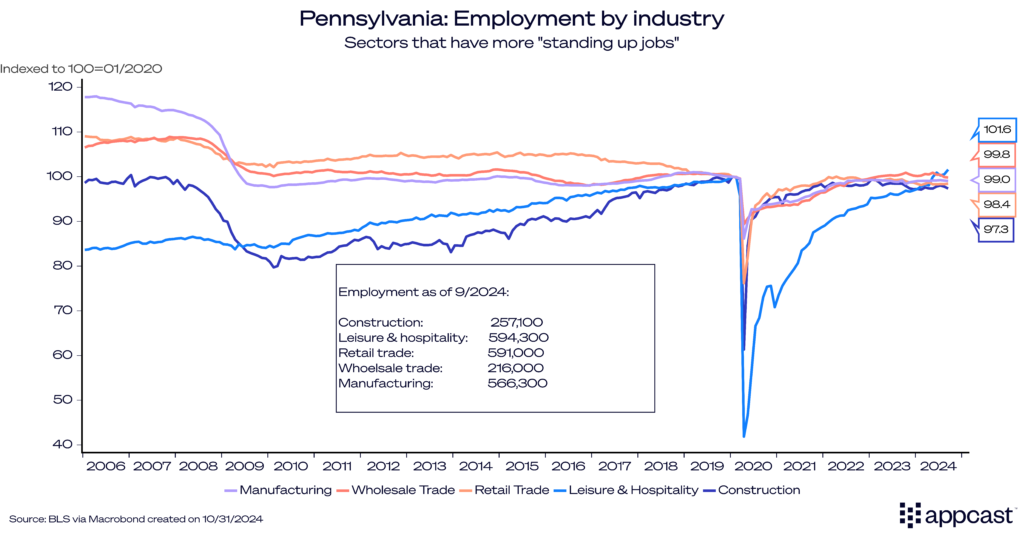

As Pennsylvania has underperformed many other states in terms of job growth, employment in many other sectors has been quite stagnant. We previously reported how blue-collar jobs are thriving in places like Arizona where the economy is buzzing. In Pennsylvania, on the other hand, almost every single sector that is predominantly blue-collar (“standing-up jobs”) is still employing fewer people than before the pandemic (leisure and hospitality being the notable exception).

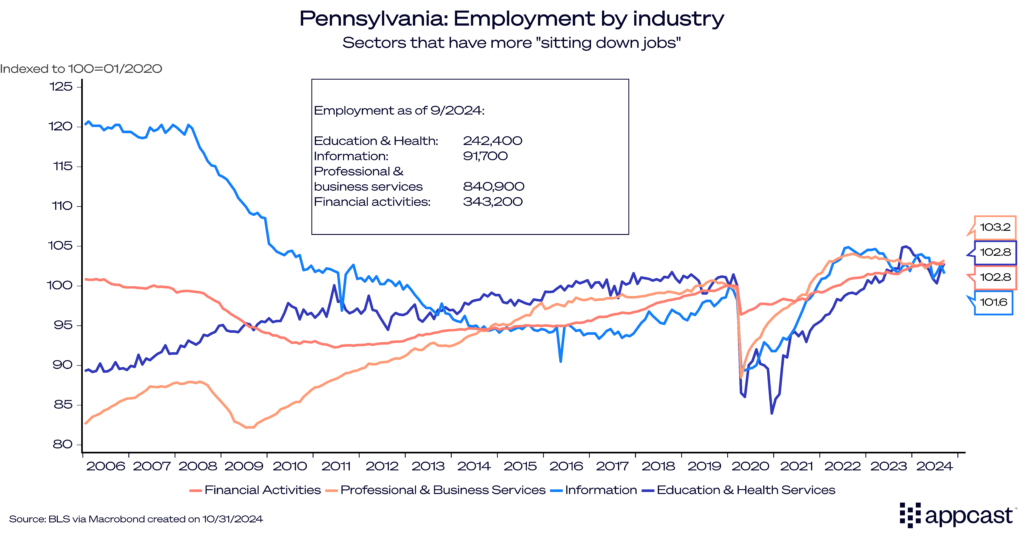

Sectors that have more white-collar jobs are doing slightly better in Pennsylvania. The information sector and professional and business services are both up by almost 3% relative to January 2020. Similar to the national trend, education and healthcare has also been adding a lot of jobs in the state (it’s up by slightly over 3%).

Pay growth is restoring local purchasing power

The local economy and labor market have been relatively weak compared to the nation, which explains why the incumbent party has only a marginal edge in the Rust Belt states right now.

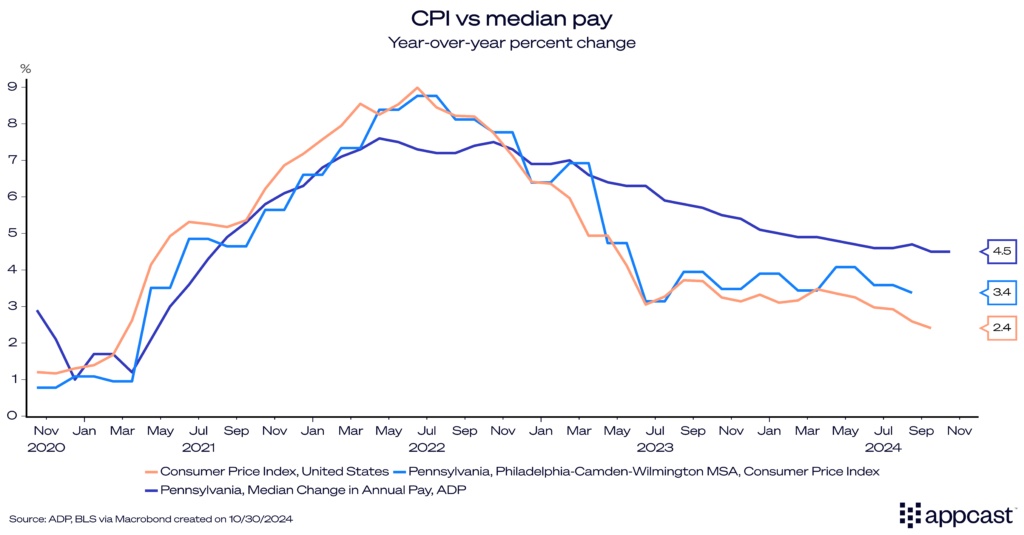

Additionally, many Americans have been fed up with the rapidly rising price level since 2020 (even though inflation is basically back at the Federal Reserve 2% target today). While many large metropolitan areas in growing states have seen significantly higher inflation rates than the national average, Philadelphia’s inflation rate did not surge to a similar extent throughout the pandemic. Instead, it followed the national CPI quite closely.

Regional annual pay growth has exceeded the local inflation rate since mid-2023, meaning that most Pennsylvanians have experienced positive real wage growth since last summer.

What does that mean for recruiters?

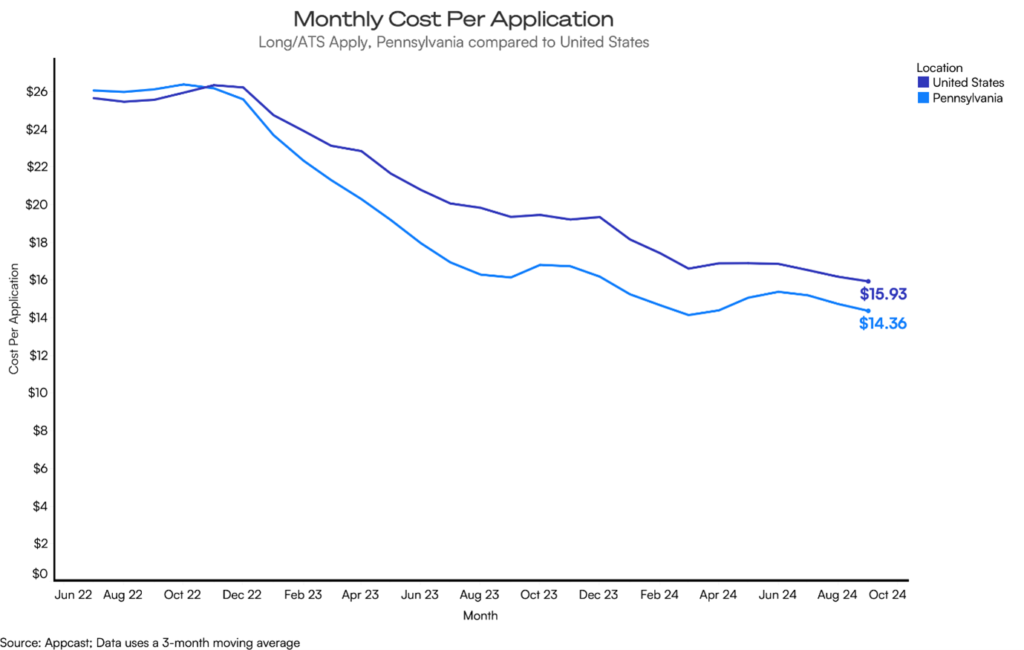

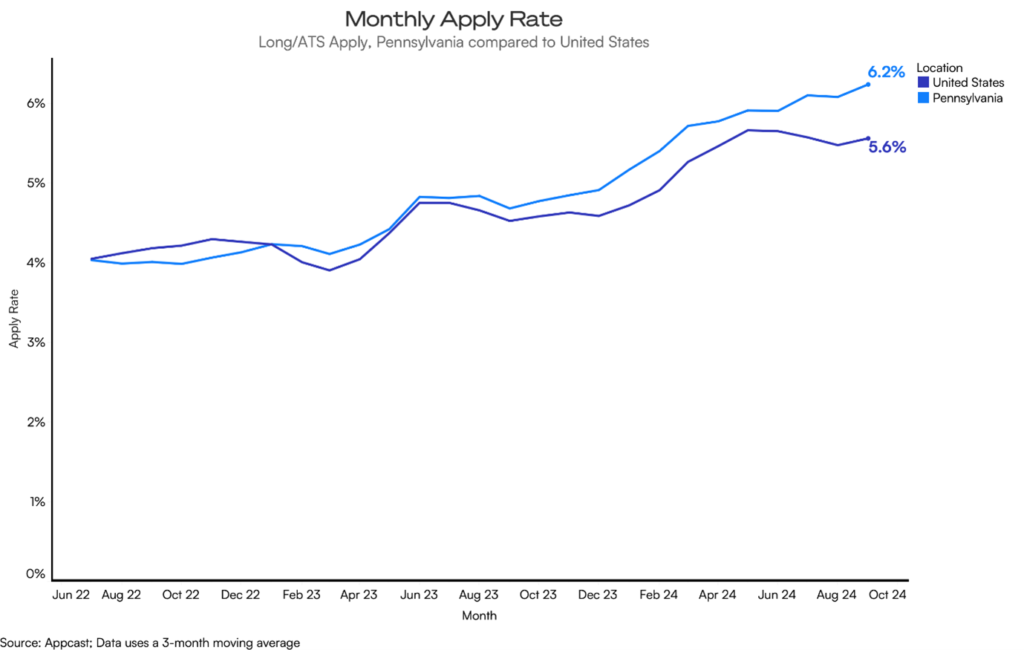

Recruitment costs, as measured by the cost-per-application, are lower in Pennsylvania compared to many other states. Apply rates are almost one percentage point higher than the national average. Given the weaker labor market in the state, recruiters should face less difficulties filling vacancies in Pennsylvania than in many other U.S. regions where the labor market is much tighter.

However, a weak economy is a double-edged sword. While local recruitment might be easier, companies might struggle to attract talented people from elsewhere, given that the state is significantly less dynamic than other regions in the country. After all, Pennsylvania continues to lose population to the rest of the country as workers migrate towards more vibrant labor markets.

One advantage that recruiters can leverage though is living costs. As other parts of the country like the Northeast and West Coast have become increasingly unaffordable, more and more workers started to migrate to the South where they enjoy better purchasing power, thanks to cheaper housing. But vibrant economies like Arizona and Texas have seen such an economic boom recently that prices have started to surge there as well. As the cost-of-living crisis is still on many workers’ minds, this could mean that Rust Belt states become more attractive again, simply because your income stretches further in Pennsylvania than elsewhere!

What’s the outlook?

Pennsylvania’s economy and labor market have been more stagnant than the rest of the country. The regional economy is losing people to other states. Employment in sectors that are predominantly blue-collar remains below pre-pandemic levels. White-collar sectors, on the other hand, are doing better and have seen some growth.

After voting for Democrats for many years, Pennsylvania somewhat surprisingly turned to Trump in the 2016 election. The gradual disappearance of many manufacturing jobs due to the China shock made many blue-collar more susceptible to Trump’s more populist agenda.

For the first time in decades, the U.S. economy is currently seeing a domestic manufacturing renaissance. Friendshoring due to geopolitical tensions with China are one reason. But the very ambitious economic agenda by the Biden administration that explicitly subsidized domestic manufacturing, pouring billions of dollars into various projects via the CHIPS Act, has also played an important role. Somewhat ironically though, it is the fast-growing states in the South of the country (Sunbelt) that have benefitted the most so far. Construction spending on manufacturing plants has been booming in places like Arizona, Georgia, and Texas. The traditional Rust Belt states have been less fortunate, which might help explain why the state is basically a toss-up between Democrats and Republicans. While there has been some economic revival of the Rust Belt in recent years, the region continues to be an underperformer for now.