Spain’s economic recovery exceeds expectations

After being a speaker at the RecBuzz conference in Barcelona this April, I got inspired to write about the benefits of Tapas paired with a good Catalan red wine. Just kidding! This blog post is about the revival of Spain’s economy.

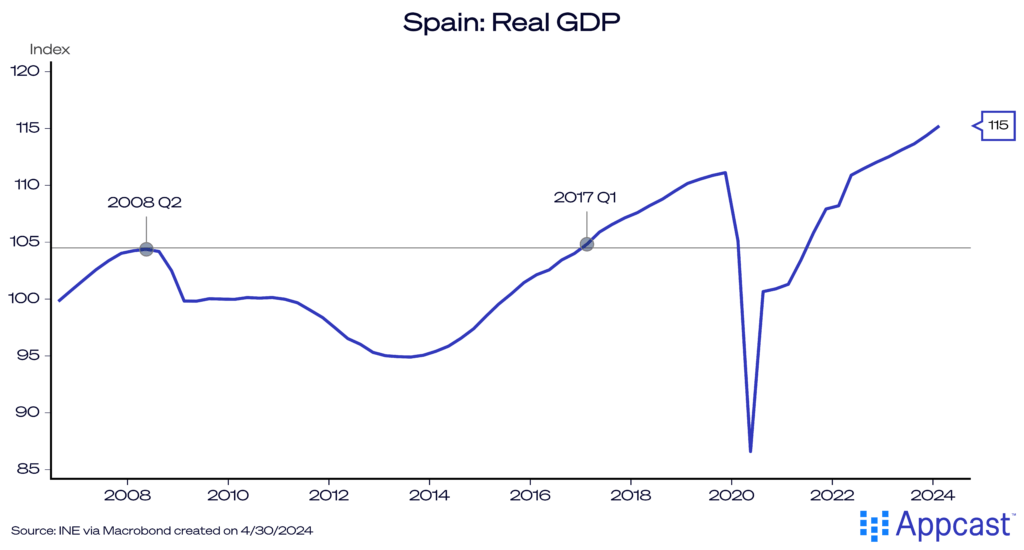

Spain was one of European economies that suffered heavily following the Great Recession of 2009. The country experienced a significant real estate boom in the run up to the crisis and the subsequent deflation of house prices together with a credit contraction led to a significant economic downturn that lasted for years. Austerity measures imposed by other Eurozone members also turned out to be harmful. It took Spain almost a decade to recover from the crisis.

While The COVID-19 economic plunge was even deeper, it was very short-lived. Spain’s economy recovered by 2022 and is now close to 4 percent larger than in early 2020, making it one of the better performers within the Eurozone.

Moreover, economic forecasts for 2024 and 2025 suggest that Spain will continue to do well. The Eurozone is currently experiencing a certain reversal of fortune with Southern Europe enjoying a better economic recovery and growth spell than the North.

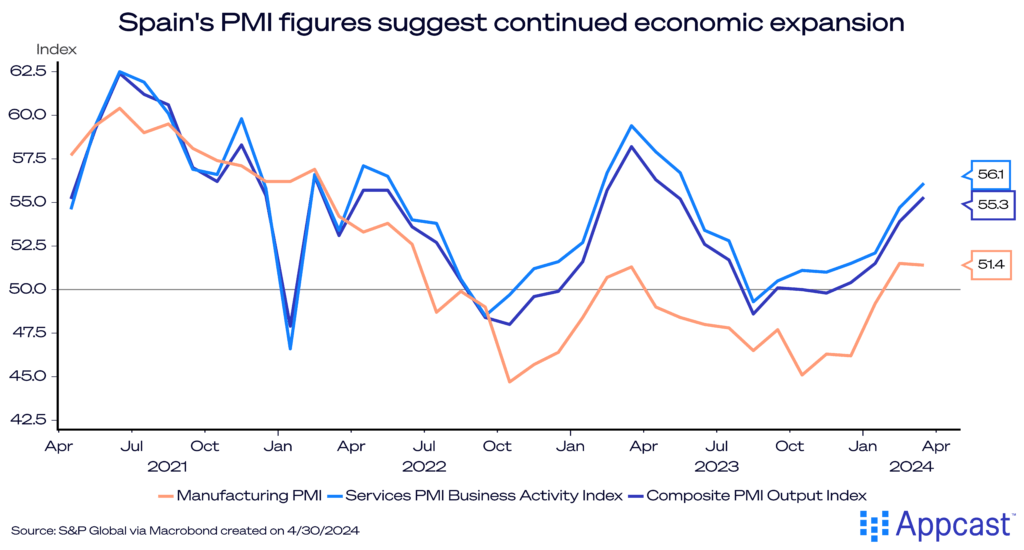

PMI (Purchasing Managers Index) data suggest that current economic momentum is relatively strong – values above 50 indicate economic expansion.

The service sector, in particular, is enjoying a very strong economic recover fueled by tourism spending.

Tourism and other booms

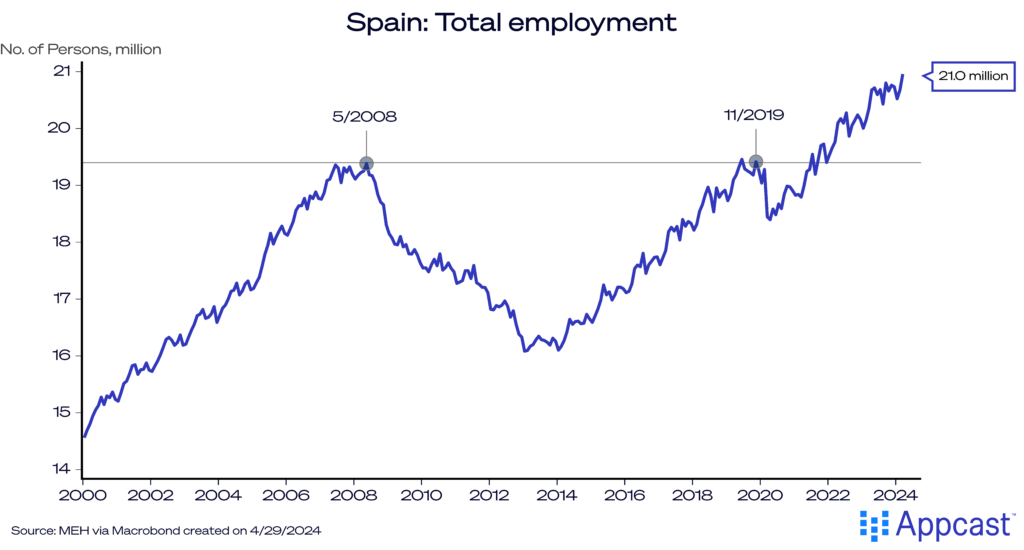

Following the Great Recession, it took an entire decade for the Spanish labor market to recover. Only in 2019 did total employment exceed its 2008 level. The COVID-19 economic shock, on the other hand, led to a very temporary dip that was followed by a strong labor market recovery. The total number of workers employed stands at about 21 million in early 2024, exceeding its 2019 peak by about 1.6 million.

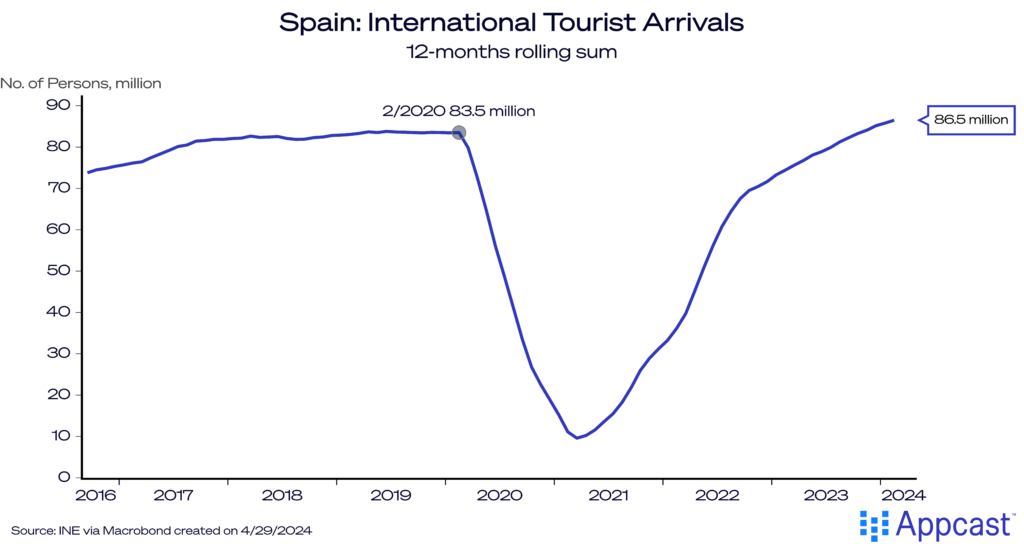

The global travel and tourism boom is one major factor that is lifting the Spanish economy right now. After global travel came to a standstill during the pandemic, tourism has now bounced back strongly and the number of international arrivals in Spain has exceeded 85 million in 2023, thereby surpassing the pre-pandemic peak.

But it’s not just tourists that the country is attracting. Several surveys are showing that Spain frequently tops the list as number one destination for digital nomads – international remote workers. Having been to Spain multiple times, this isn’t too surprising. The wine and food culture is amazing. The weather and the beaches are great. The cost of living is low relative to Northern Europe and North America.

Southern Europe is not just a place to comfortably retire. It is now increasingly attracting remote workers from all over the world as the government has made it more attractive for non-EU workers to move there. Not only are there certain tax advantages (15% income tax instead of the usual 24% for the first four years), but also the salary threshold to qualify is kept quite low at €28,000.

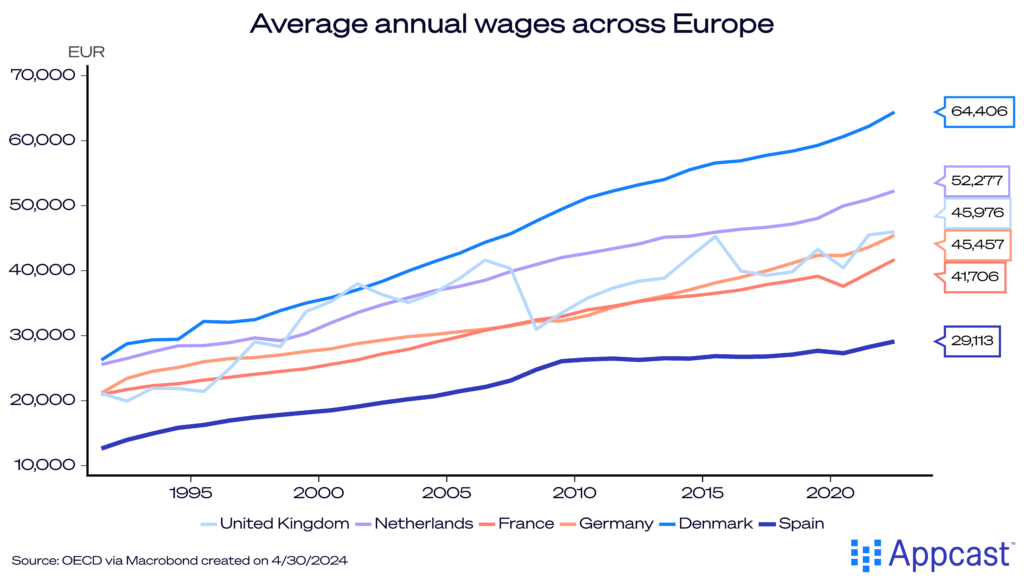

Another factor that might be helping the Spanish economy right now is that the wage level is lower than in Northern Europe. Of course, competitiveness is a tricky concept. Labor costs are only one factor among many that determine where to locate production.

Nevertheless, with the rise of remote work since the pandemic, companies had a higher incentive to outsource certain functions to markets where they can attract talent at a cheaper cost. With Spanish wages in nominal terms being half of what they are in Denmark, for example, it makes sense for small startups or international businesses to broaden their recruitment to alternative markets with an existing skilled workforce.

A rising tide lifts all boats

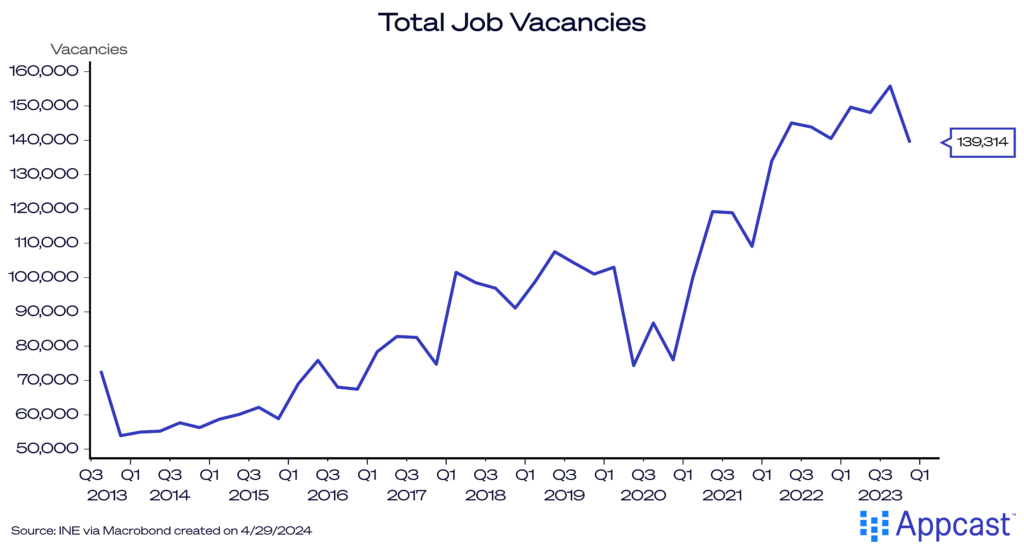

With the improving economy and labor market, job vacancies have surged in Spain above pre-pandemic levels and comfortably remain some 40% higher than 2019 levels, at least for now.

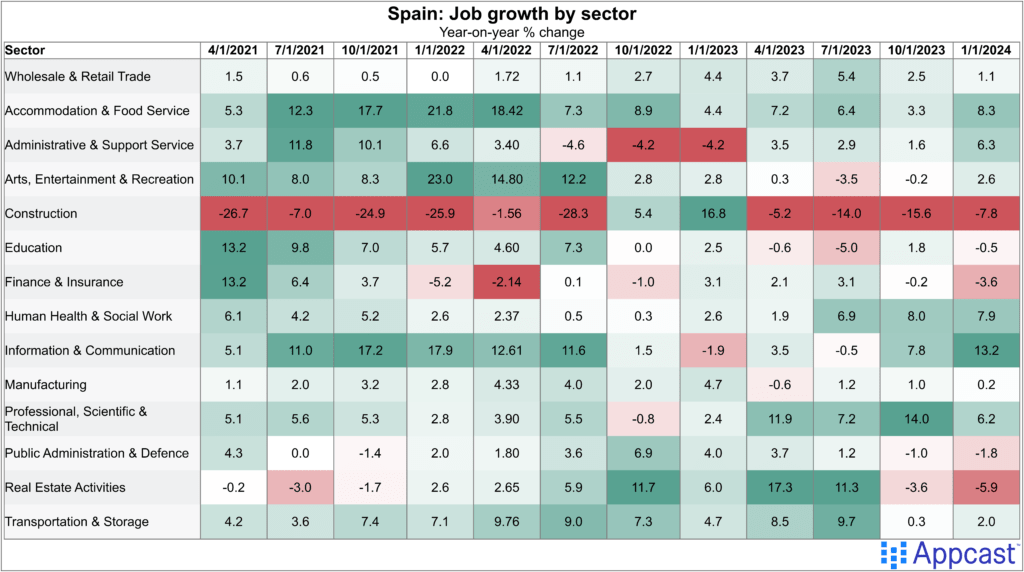

One thing to note is that the economy seems to be vibrant across many sectors, with growth occurring beyond food, hospitality, and accommodation, all of which are being supported by the tourism boom.

Employment in information and communication is growing even as other countries have seen temporary stagnation. The construction sector keeps adding jobs despite relatively high interest rates. Health and social work and professional, scientific and technical jobs are growing at a healthy pace of more than 6% year-on-year. Only real estate seems to be in a brief contraction right now, but job growth is generally healthy across all major industries.

Structural problems continue to be a problem for the economy and labor market

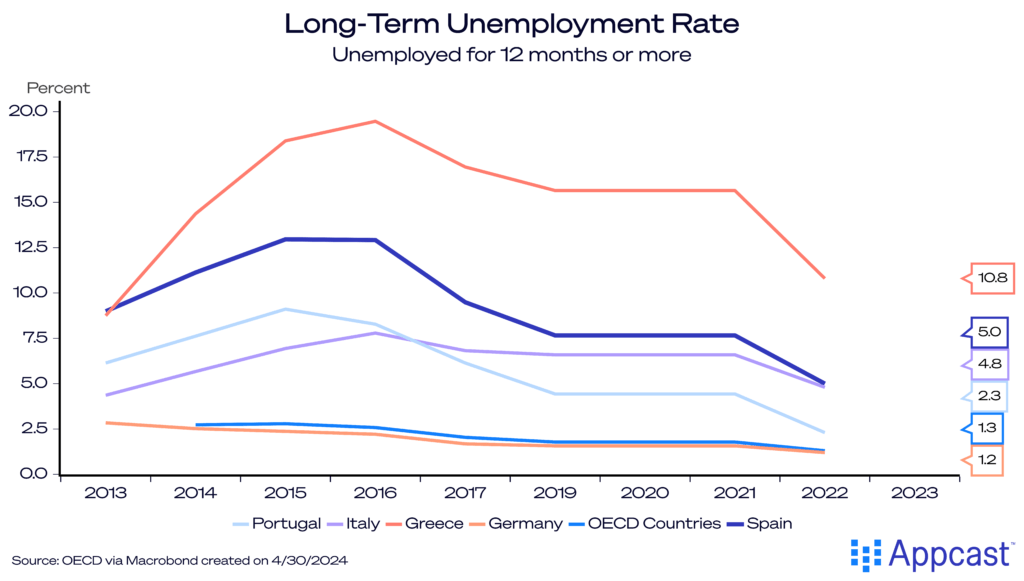

Despite its recent successes, there are structural problems that are holding back Spain that need addressing. Long-term unemployment, for example, continues to be a significant challenge for many Southern European economies, including Spain. Workers are long-term unemployed if they are looking for work for more than 12 months. While across OECC economies, long-term unemployment stood at less than 1.5%, it was more than three times higher in Spain (5%).

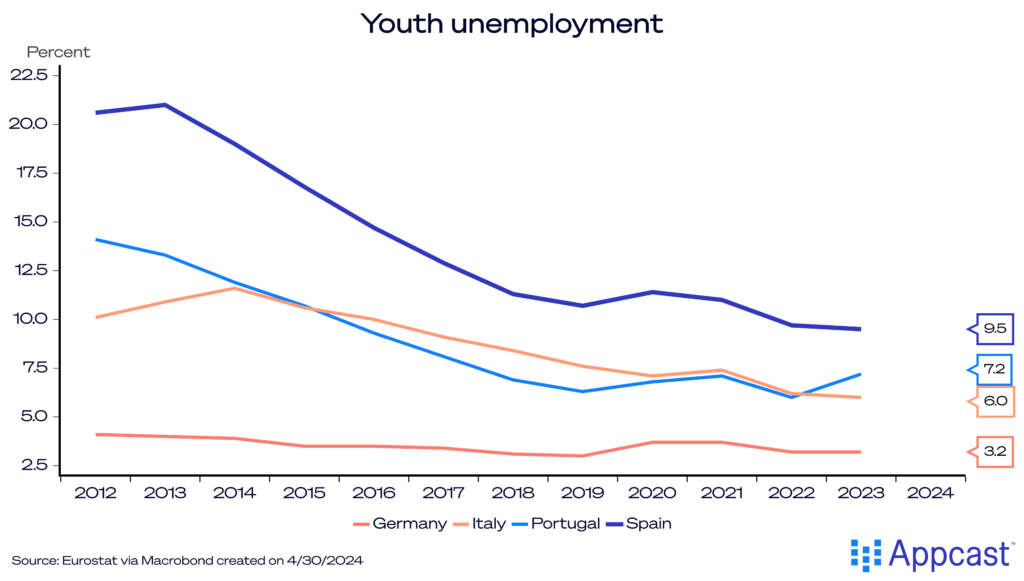

Moreover, Spain also has an excessive amount of youth unemployment. Following the Great Recession of 2008, youth unemployment stood above 20%. Economic stagnation at home produced a brain drain, as many young Spanish graduates left the country for better employment opportunities and higher wages in Northern Europe.

And even as economic conditions have recently, youth unemployment remains stubbornly high at close to 10%. For reference, this is roughly three times higher than the youth unemployment rate figure in Germany.

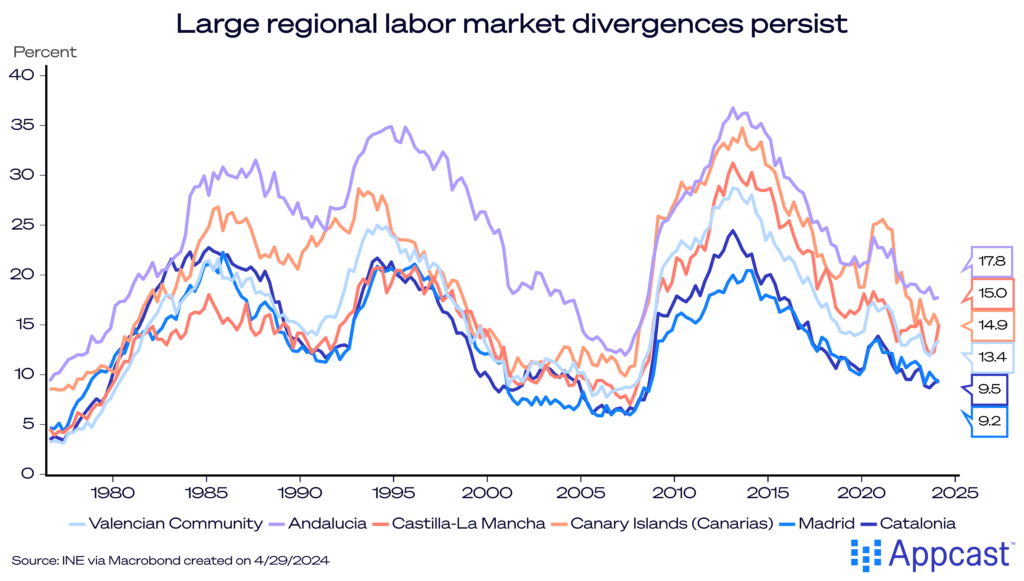

The third challenge that the Spanish economy is facing is related to large regional divergences that persist within the economy. Differences in unemployment rates across Spanish regions are shockingly high, ranging from below 9% in Catalonia to about 18% in Andalusia in the South of Spain, for example.

This shows that there is a significant market imperfection in the economy as idle workers do not seem to be incentivized to move to areas with better labor market opportunities and lower unemployment rates.

Research by the IMF shows that several key factors are holding back labor mobility between regions.

First, cultural and social factors are probably a reason. Close family ties and established social networks are decreasing the likelihood of moving to far-away places despite better employment opportunities.

Second, Spain’s labor market has historically been characterized by very high levels of short-term and contract work. In 2020, for example, 24% of workers aged 25 to 54 were employed on temporary or fixed-term contracts. Such job insecurity makes it less likely for workers to relocate across regions. Workers move for long-term employment opportunities, though not so much short-run gigs.

Third, high house prices in the regions with lower unemployment are representing a barrier for workers to move to those regions. Note that this is not just a Spanish problem per se. House prices are high across OECD economies and are actively hurting the labor market.

What does that mean for recruiters?

Spain is currently one of the more vibrant economies within the Eurozone. The labor market is adding jobs across sectors and the country is attracting more immigrants, including a large number of digital nomads.

Global employers or even small international startups might consider outsourcing certain roles or tasks to Spain, given that the country has an educated workforce, but wages remain significantly lower than in Northern Europe.

At the same time, Spain’s economy continues to suffer from some severe structural issues like chronic long-term and youth unemployment in some of its weaker regions.

In 2021, the Spanish government implemented labor market reforms and passed a law that aimed to dramatically reduce the number of workers on short-term contracts. Employers now have no choice other than to hire for permanent positions in many cases. While more rigid labor market rules often have detrimental side effects, Spain has continued to add jobs at a more rapid over the last two years. On the contrary, the reforms might turn out to be welfare-improving if it incentivizes more people within Spain to move towards better employment opportunities on account of being offered a permanent role.