The Labour government announced one of the most consequential Budgets in decades this past fall. The measures proposed – some of them good and others not so much – will affect the economy and labor market for years.

But there is one major thing that the Labour government did not attempt to fix: The United Kingdom’s atrocious income tax system, especially the insanely high marginal tax rates for certain workers, which are preventing the economy from reaching its full potential. As a reminder, the marginal rate is the tax you pay on the additional pound of employment income you earn.

This rate is important because it influences labor supply decisions, meaning the decision of workers to enter the labor market or to work more hours. High marginal tax rates are bad for economic growth because they reduce the labor force and contribute to workers logging fewer hours than they may like to.

And since nominal wages have grown significantly since 2020, more workers have been pushed into tax brackets where those high marginal tax rates are binding.

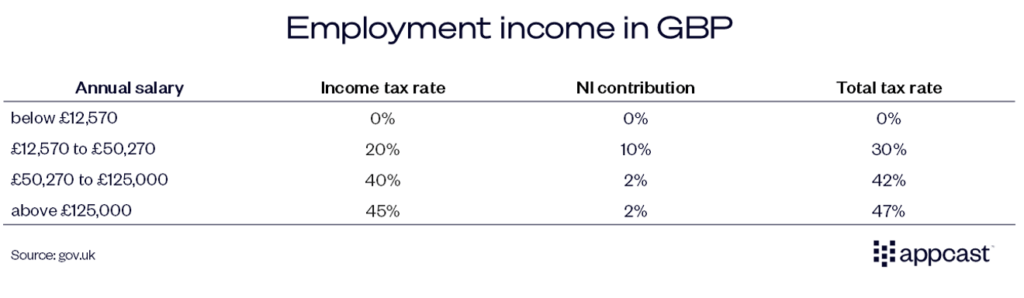

Let’s start with the basics: The tax rate workers pay in England and Wales is the income tax plus national insurance (NI). Income taxes are relatively low compared to most other European countries but get significantly steeper at higher levels (taxes in Scotland are even higher). Employees who earn more than £125k pay 47% in taxes on any additional pound they earn.

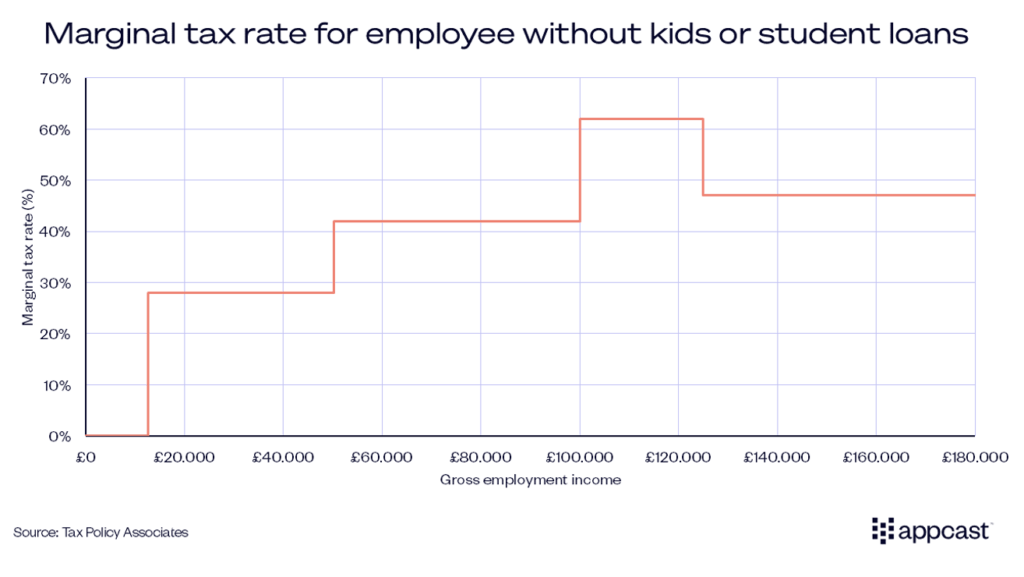

However, 47% is hardly the highest marginal tax rate. The personal allowance of £12,570 goes down by £1 for every £2 that you earn above £100k.

Therefore, workers earning between £100k and £125k face a marginal tax rate of 62% (40% income tax, plus 20% due to the allowance reduction, plus 2% national insurance tax).

This means that workers who earn £100k and get a £10k salary increase only see their net income increase by a meagre £3800 (62% of the raise goes to taxes). Now, you might say that somebody who earns that amount of money is quite well-off, and you wouldn’t be wrong: £100k easily puts you in the top five percent of income-earners in the U.K. But here, that is not the point.

The problem is that high marginal taxes reduce the incentive to work more hours. Many NHS doctors, for example, might end up being in the exact salary range where the 62% marginal tax rate applies.

With the NHS being overburdened, one way to help the system would be for doctors to work overtime, if they were willing. However, somebody earning only 38 pence on the pound has little incentive to do so. High marginal taxes are therefore not just constraining workers’ incomes but also negatively affecting the economy by reducing output. It is making some of the most productive members of our society work less than they otherwise would!

To be clear, a worker could avoid paying the 62% marginal tax via salary sacrifice, putting all their additional income into a workplace pension to enjoy a more comfortable retirement. But doing so means that the net salary is effectively capped, so their purchasing power does not improve even though you work and earn more.

Tax insanity at lower incomes

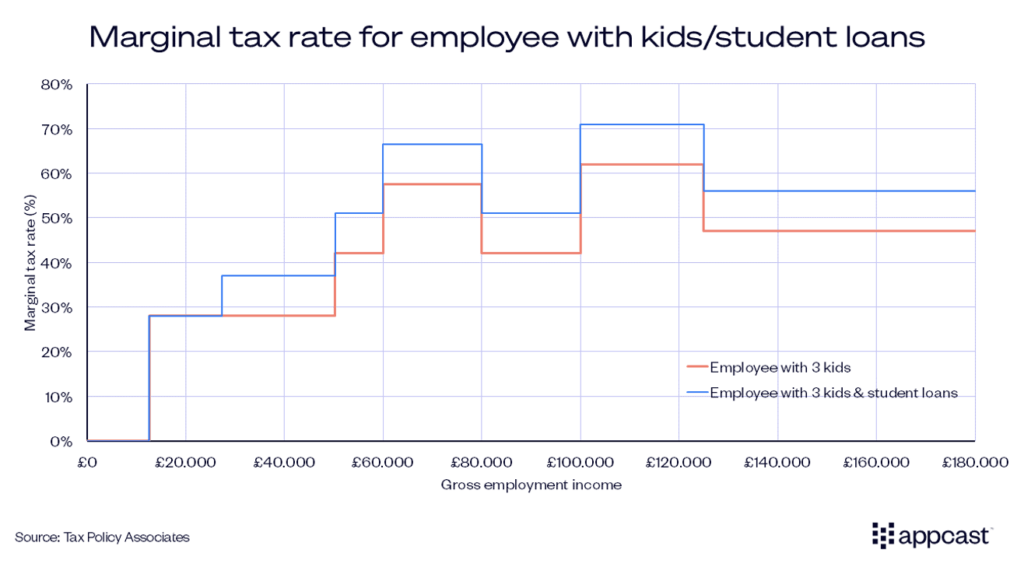

Unfortunately, even workers on lower incomes face high marginal tax rates. The reason is that some state benefits like childcare allowance are reduced above a certain income threshold. The reduction in benefits is creating the very same effect of increasing a person’s marginal tax rate to well over 50%. Even the Tory-sponsored salary threshold increase in the spring of 2024 did not solve the problem.

Here are some examples that Dan Neidle at Tax Policy Associates has modeled for us. The child allowance is £25.60 for the first child per week and £16.95 for each additional child per week, some £3,094 pounds in total for three children per year, for example. Now let’s assume a worker makes £60k. As this is the threshold above which benefits are being phased out, their marginal tax rate increases from 42% to about 57.5%. And this is true all the way up to an income of £80k. A worker’s salary therefore needs to increase by more than a third to escape the marginal rate trap.

And it gets even worse. Let’s assume that the same worker also has student debt. In the U.K., student debt repayment does not depend on the total amount owed. Instead, it’s a function of income. Once a worker’s salary exceeds the threshold of £27,295, they will have to pay back their loans at a rate of 9% of their income. Therefore, with student loans and three kids, a worker’s marginal tax rate jumps to 51% once their salary reaches £50k and increases to 66.5% between the income of £60k and £80k. Good times!

What does that mean for labor supply and the economy?

An article in the FT describes how the rail industry in the U.K. is suffering from massive worker shortages. For years, the industry had relied on the fact that many workers would simply work overtime. But guess what? A lot of train drivers in the U.K. earn close to £60k, putting them exactly at the tax threshold where high marginal rates start to bind if workers have children. At that income level, the incentive to work overtime is low. And this is of course not just a problem for train drivers but many other occupations that pay overtime.

High marginal tax rates are therefore a killer for labor supply! Some of the most productive members of our society work less than they otherwise would because additional work does not pay.

Though it is difficult to precisely quantify the macroeconomic effects, removing all marginal tax rates exceeding 50% across the board would certainly increase total hours worked in the U.K. economy. An impact on working hours can have huge results: a reasonable estimate suggests that a 10% increase in labor supply (hours worked) boosts GDP by about 6.6% in the long-run (two-thirds of 10%, equal to the labor share of GDP).

And this is not all. Removing high marginal tax rates also increases productivity. That is because productive workers would work longer hours, and professionals have an incentive to pursue profitable side-gigs like consultancy work or even starting their own businesses, all of which would boost GDP.

Summing up, the macroeconomic distortions and negative effects created by such high marginal taxes are not trivial at all. And making the system better could boost growth and increase living standards. But some hard political choices on reducing benefits would have to be made.

What does that mean for recruiters?

While this will not apply to everybody, recruiters in the U.K. should be aware that some workers might face painfully large marginal tax rates in this country. While only the government can fix this mess, companies can do a few things to help their own employees and potential hires who are facing this insanity.

With marginal tax rates exceeding 60% or more, a 10% increase in gross salary ends up being only a very small gain in net income. In such a case, companies might ask workers whether other benefits are worth more to them. For example, increasing the employers’ pension contribution by 10% would cost the company less than increasing the worker’s salary by 10% (because employers do not need to pay NI on pension contributions). This point will become even more important this April as the employers’ NI contribution is due to rise. And it probably makes little difference to the employee in question who might end up sacrificing their salary increase into a workplace pension anyways to avoid the high marginal taxes.

In similar spirit, employees or hires who face steep marginal tax rates might value other benefits like free healthcare, dental insurance, and company gift vouchers more than the additional salary they need to pay taxes on.

Recruiters should therefore be aware of the tax situation their own employees and new hires face, which will depend on personal circumstances like the number of children the person has, whether there are student loan debt repayments to be made, etc.