Retail sales were unchanged in July, holding steady at a seasonally adjusted 0.0% from June. Consumers are still spending at retailers but high inflation and low confidence has impacted the level of spending. Retail sales numbers are not adjusted for inflation, so though consumers spent more, they got less.

Falling energy prices are partially responsible for the neutral growth, as consumers spent relatively less to fill their tanks in July compared to earlier in the year. Spending at gasoline stores fell 1.8% in July. Excluding gas stations and volatile motor vehicle and parts stores, retail sales were up 0.7% in July.

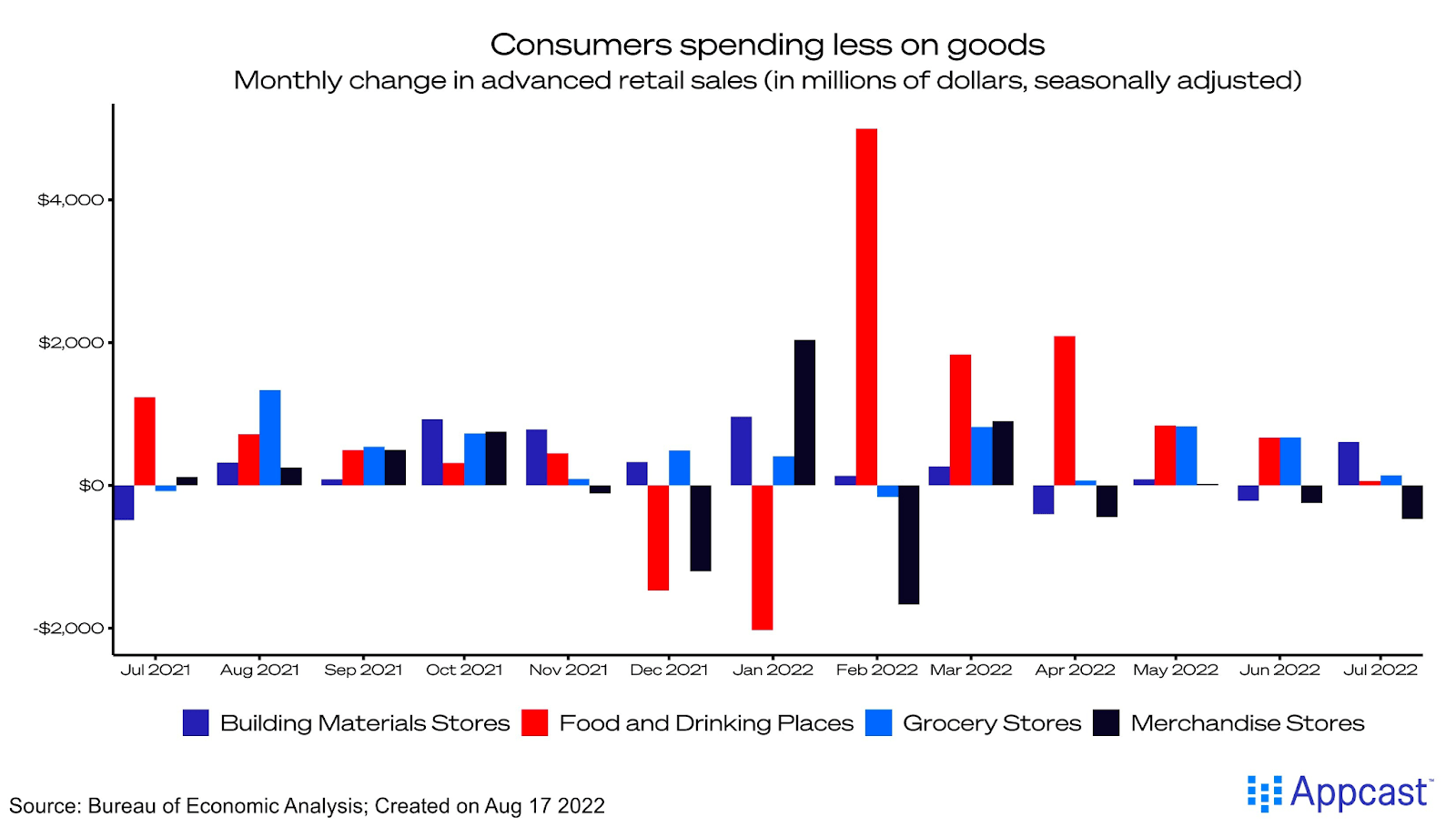

Consumers continue to shift their spending from goods to services, but spending at food and drinking places increased 0.1% in July. Meanwhile, spending at grocery stores rose 0.2%. Prices for food at home increased 13.1% from a year ago in July, and prices for food away from home increased 7.6% in the same period.

Spending at building supply stores was up a seasonally-adjusted 1.5% in July, a surprising rally considering declining new housing starts and higher interest rates. Spending at merchandise stores fell 0.7%.

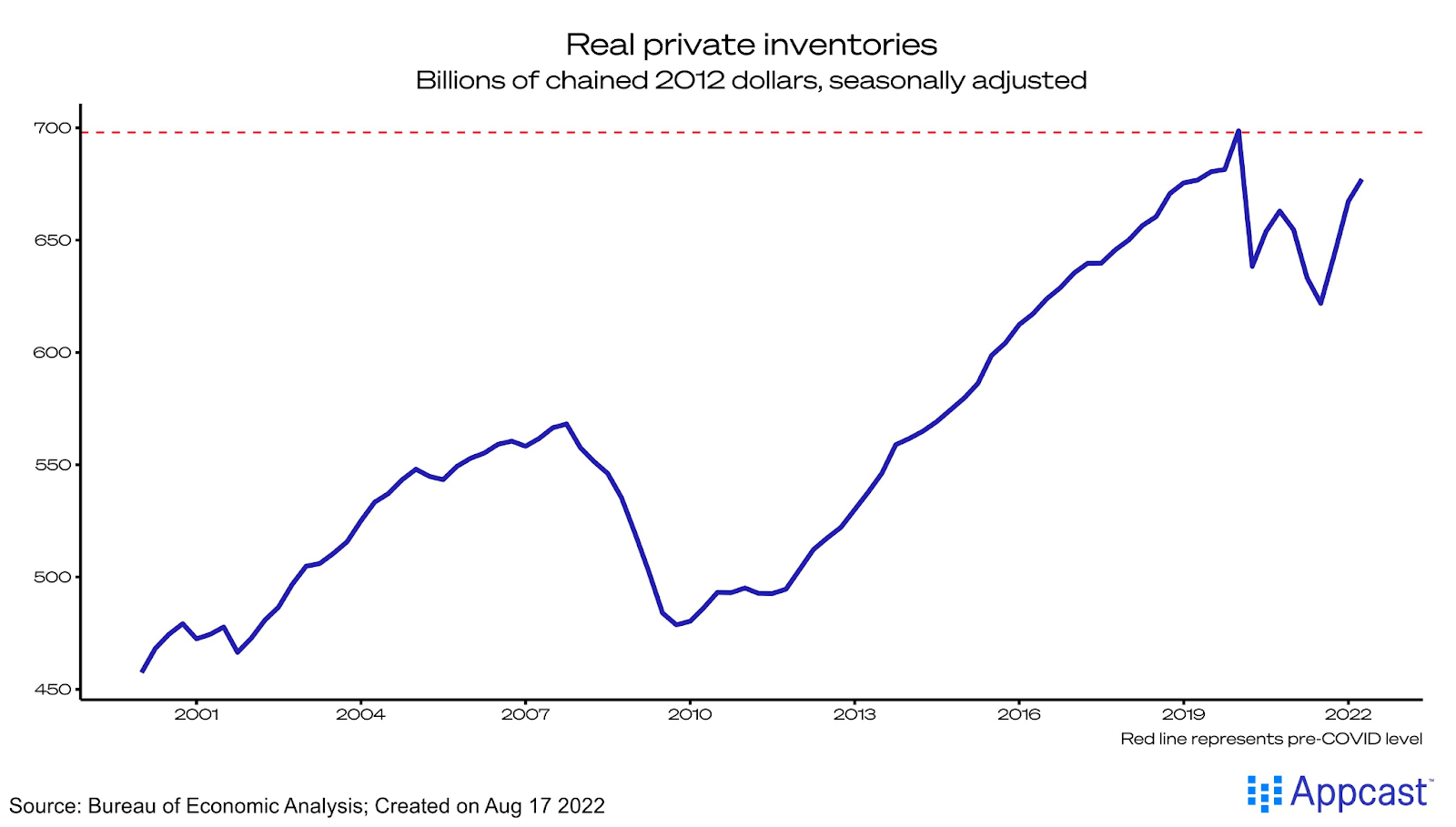

After an exhilarating two years of pandemic-induced retail spending sprees, companies had a difficult time adjusting to shifting consumer demand. These complications, paired with supply chain disruptions, have pushed retailers’ inventories up. Safeguarding against future complications is shifting how retailers plan lead times and inventories.

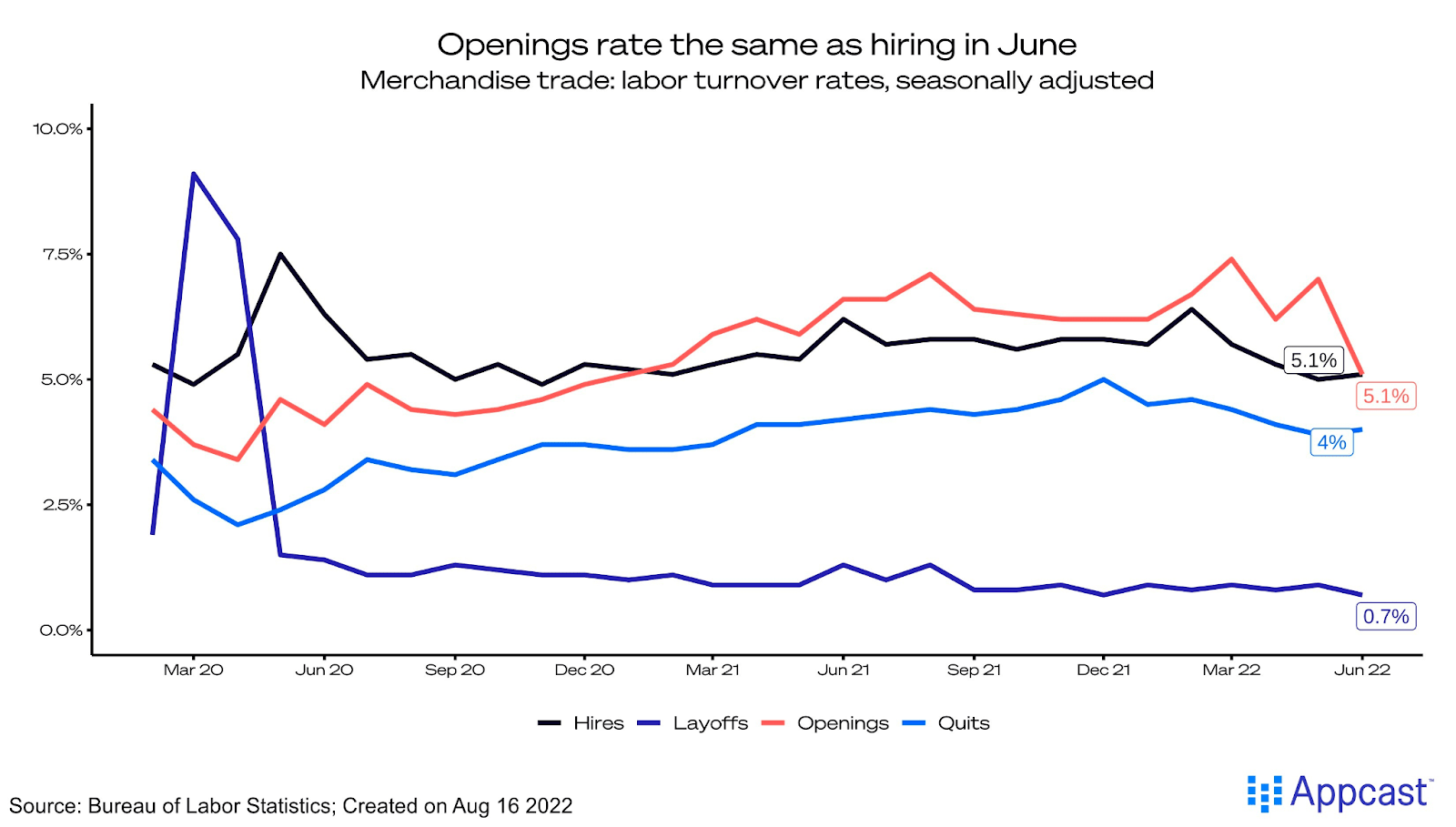

Demand for workers in retail fell in June as companies ramped up their inventories. Though retail sales have stayed relatively constant, the continued shift of consumer demand is impacting the labor market in retail. However, labor demand is set to increase as retailers move into the busy holiday season.