What are service exports?

One of the fundamental changes economies have been going through over the last century is a shift in economic activity from industrial production to services. In advanced economies like the U.S. or the U.K., services accounted for less than 50% of GDP in 1900. Today’s share is closer to 75%. As people’s incomes rise, they consume more services – think about healthcare, education, leisure and hospitality, for example.

International trade flows have also undergone some change. When thinking about trade, most people picture big containerships full of Audis and BMWs. However, service exports are taking up an increasingly large share of international trade as the service economy grows.

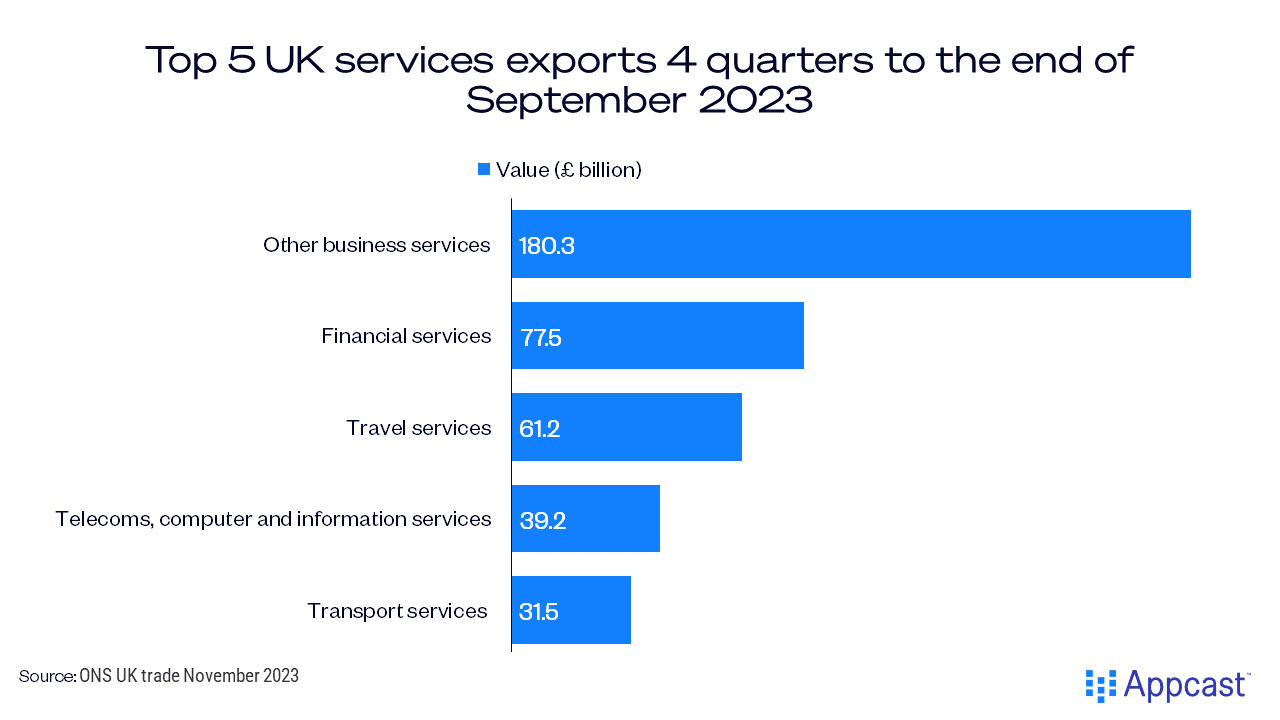

Tourism – international travel – counts as exports in national accounts. The ONS (Office for National Statistics) concisely explains spending of non-U.K. residents in the U.K. Tourism expenditures are treated as exports of goods or services in GDP statistics.

Other service exports besides travel are financial and business services.

The provision of services to another country, including law consultations, management consulting, accounting services, various marketing or market research activities, are all counted as service exports.

Telecommunication, computer and information services, and even education feature prominently among service exports. Non-resident foreign students coming to the U.K. and paying for language courses or other higher education courses are also part of that category.

The U.K. has become a service export superpower

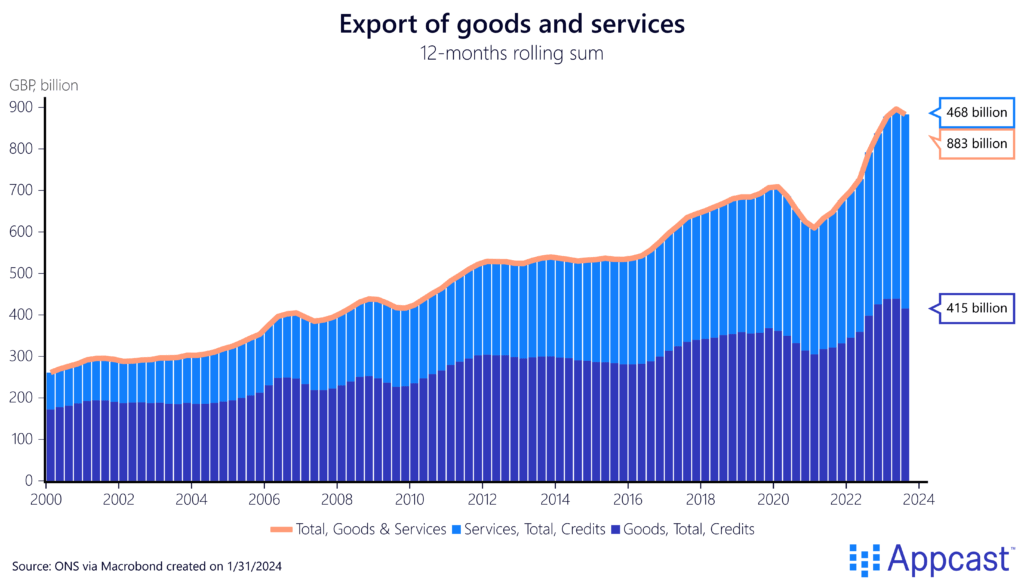

While U.K. exports of goods has stagnated – also due to Brexit – the country has become a leading service export superpower. Yearly exports to the rest of the world have recently reached £880 billion. More than half (around £470 billion) is service exports.

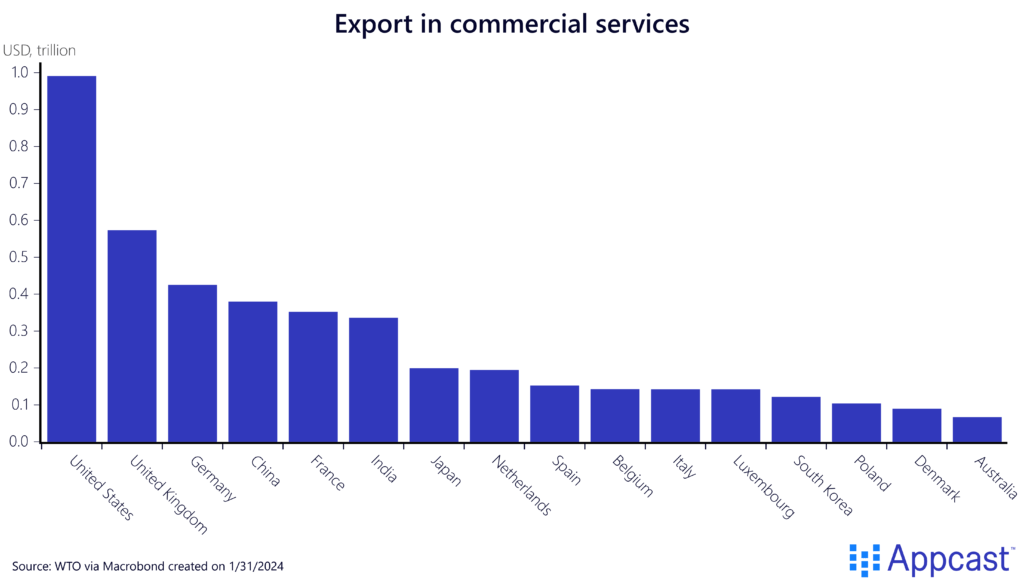

Globally, the U.K. is the second-largest service exporting nation in the world just behind the U.S. More notably, U.K. service exports are significantly larger than that of Germany or France – even though Germany’s economy is larger (and France’s is roughly similar in size).

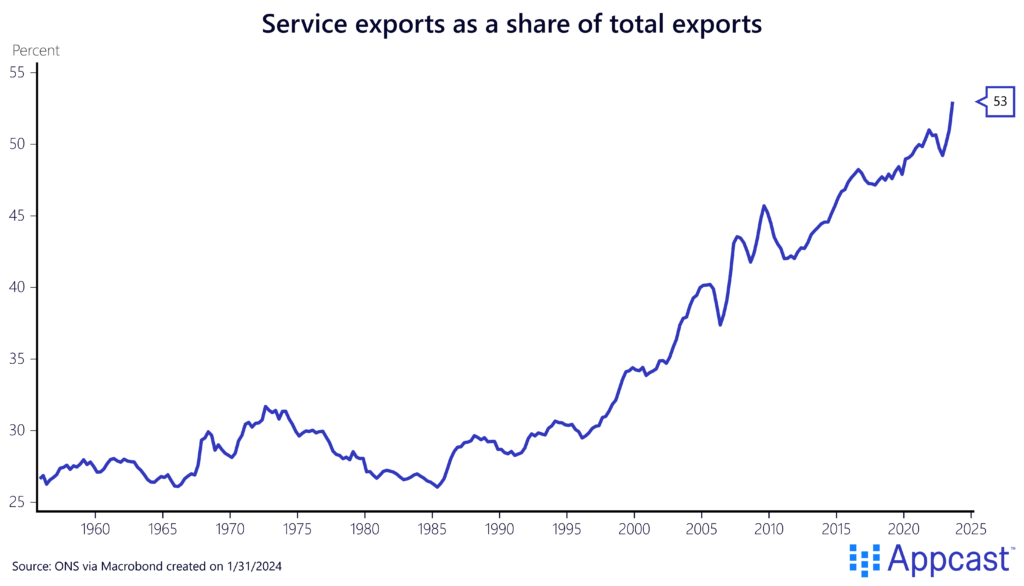

Since the 1990s, the U.K. share of service exports has been continuously increasing, from about 30% back then and now exceeding 50% of total exports since 2020.

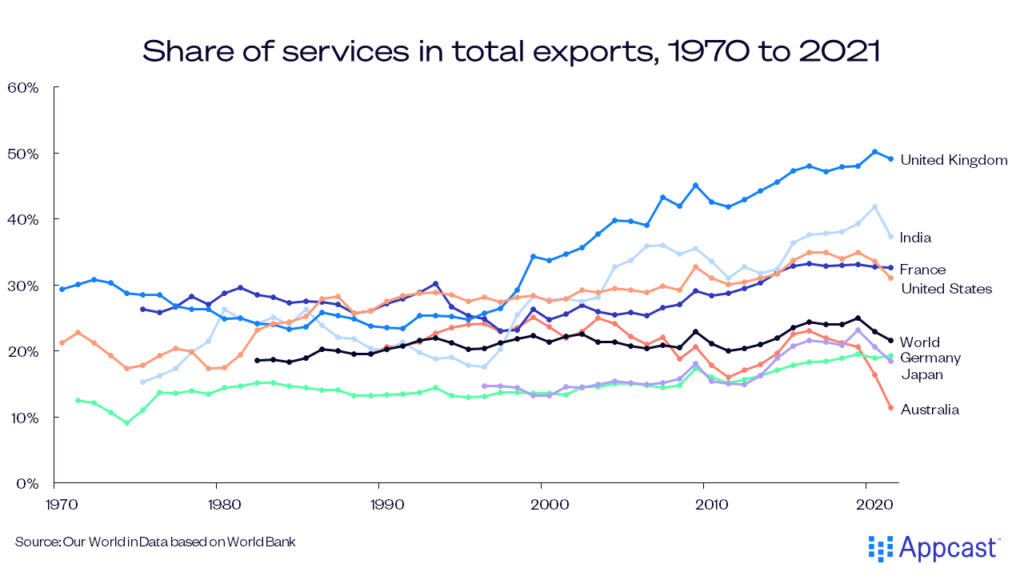

While other countries have also seen their service exports increase in recent decades, the U.K. is a clear international outlier with a much higher service export share than any other large, advanced economy.

The EU is the main trading partner

Brexit has been somewhat less consequential for service exports since no physical goods or services have to cross borders. Nevertheless, leaving the European Union has imposed large economic costs on the U.K. However, U.K. service exports have continued to do well even as exports of goods has suffered.

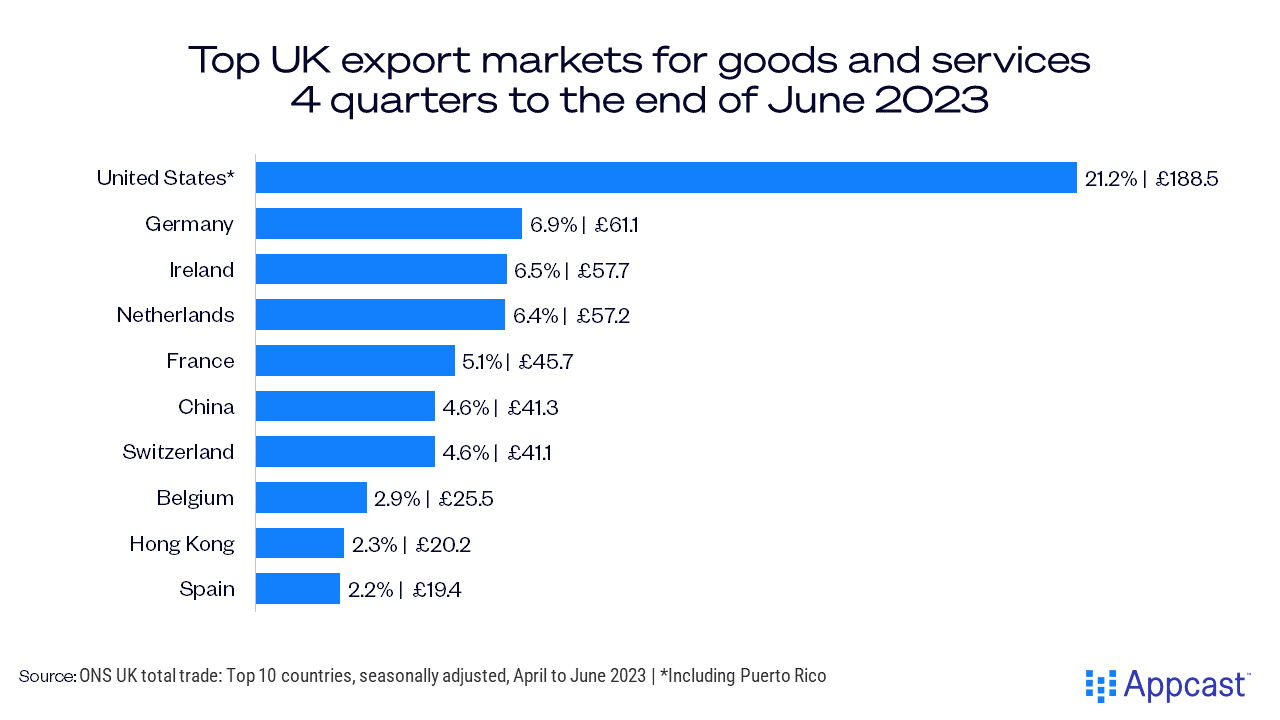

Notice that for service exports “gravity” matters, too. Gravity in this context means that countries tend to trade the most with partners that are geographically close (the U.S. economy is large enough to partially offset this effect). Interestingly enough, the principle does not just apply to goods but also to service exports (and even financial flows).

After the U.S., the largest importers of U.K. goods and services are Germany, Ireland, the Netherlands and France (the country ranking for just service exports looks very similar). The EU is also the U.K.’s top trading partner when it comes to services.

London continues to dominate service exports

Despite the government’s effort to “level up” and implement growth policies that would help regions in the U.K. that have fallen behind, some economic forces are hard simply too hard to reverse. Despite globalization and a rising share of remote or hybrid work, the attraction of large cities remains as strong as ever. Network effects, an abundant supply of talent, the availability of finance and complementary services, and even the existence of various amenities can all explain why high value-added jobs remain most prevalent in London

While some companies have made some efforts in recent years to relocate some economic activities to cities like Birmingham, London remains the city of choice for many employers. This is especially true for the service sector.

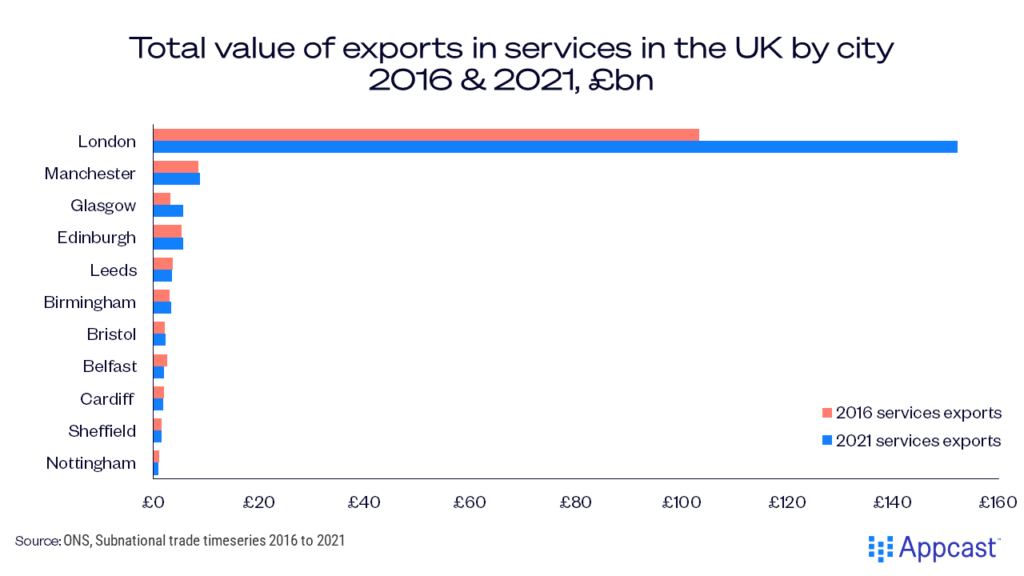

The ONS provides granular data for service exports in the U.K. by metropolitan area. London increased its service exports by a considerable amount, from about £100 billion in 2016 to almost £160 billion in 2021.

This even dwarfs the service exports from the next ten largest cities in the U.K. combined. High-value add services, especially in finance, tech, and law, remain extremely London-centric. Leveling-up is a lofty goal, but London’s draw is just too large to ignore.

What does this mean for the labor market?

Brexit has created large trade barriers with the EU. There is no doubt that the U.K.’s macroeconomic performance has suffered. Trade in goods has grown at a mediocre pace. Investments into the U.K. have suffered as well.

On the plus side, the country has become the second-largest service exporter in the world behind the U.S. And the U.K. is standing out as having a significantly higher service export share than any other large, advanced economy.

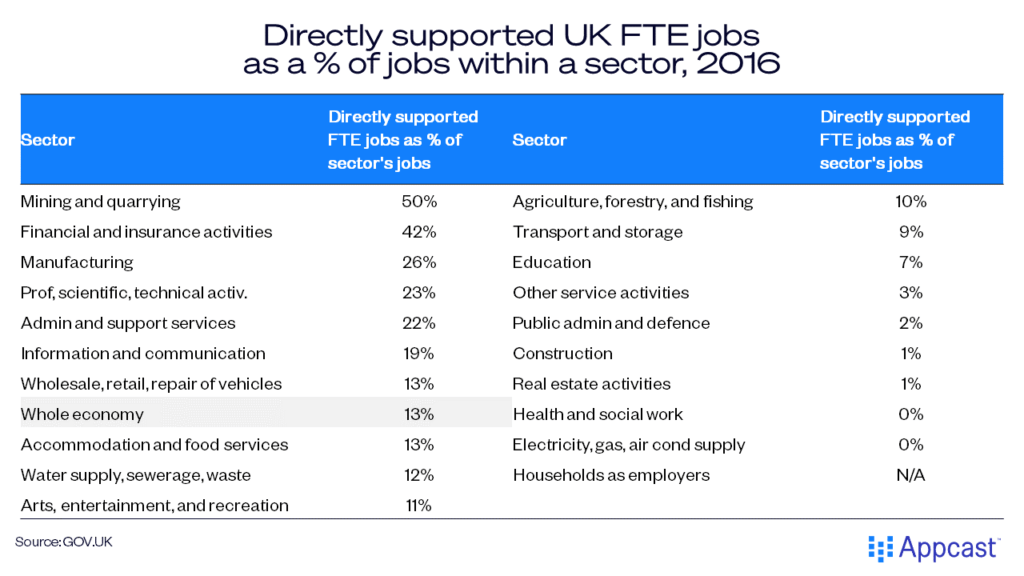

An analysis by the Department of International Trade estimated that back in 2016 more than 6 million full-time equivalent jobs in the U.K – more than 20% of total – were supported by international trade. The following table breaks down the share by industry.

Services will become a larger share of global economic output as the world becomes richer. Moreover, jobs in finance, information and communication, law and accounting, education are usually high-value jobs. And this also means that wages tend to be higher in those occupations compared to the rest of the economy.

In the post-Brexit world then, the U.K. should focus on remaining a leading service export economy. One obvious strategy going forward would be to create more of these service sector jobs in other British cities. As I wrote in a previous piece, too many graduate workers are working in non-graduate jobs outside of London because the U.K. economy does not create enough high-skilled jobs in other regions.

If the U.K. wants to remain a service exporting superpower, diversifying away from London and creating more high-skilled service-sector jobs in other large cities like Birmingham, Leeds, Liverpool and Manchester is crucial. The government’s efforts to level up will only succeed if the policies focus on larger cities that are capable of attracting such talent. This would require a significant increase in regional investments in education, public infrastructure, and the housing market.