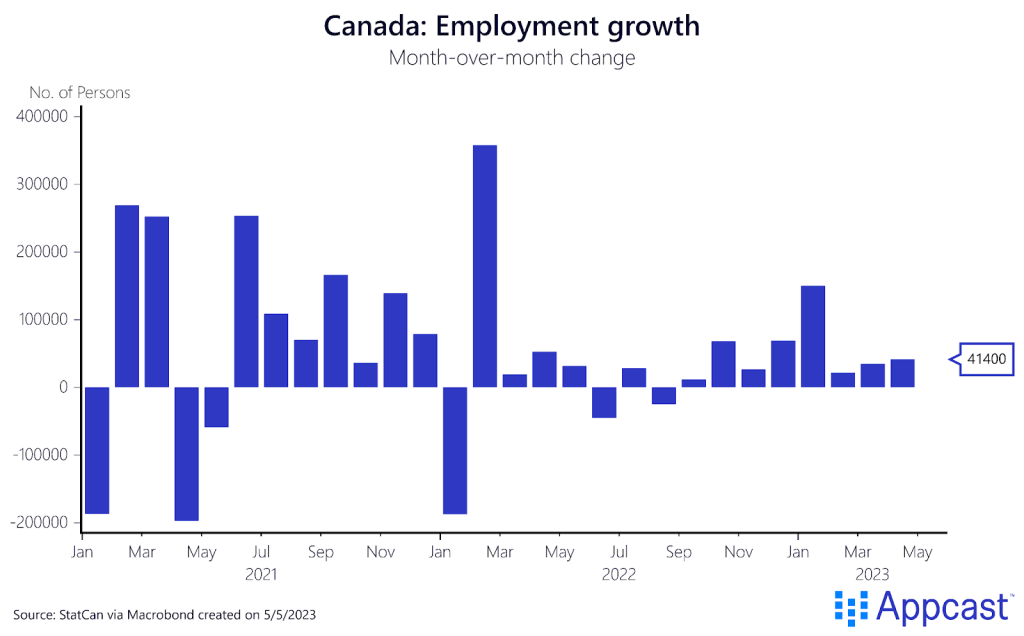

Canada saw another strong month of gains in April but this time the increase was driven by part-time work. Employment increased by 41,400 last month, with increases in part-time jobs (+47,600) making up for losses in full-time positions (-6,200). The increase being driven by part-time workers could mean a slight softening in the labor market. However, only 15.2% of workers wanted to work full-time, nearly unchanged from the same month in 2022, a particularly strong market.

The unemployment rate held steady at a near-record low of 5.0%, the fifth month in a row the rate has remained at this level.

With that 41,400 increase, total employment in Canada increased to 20.1 million.

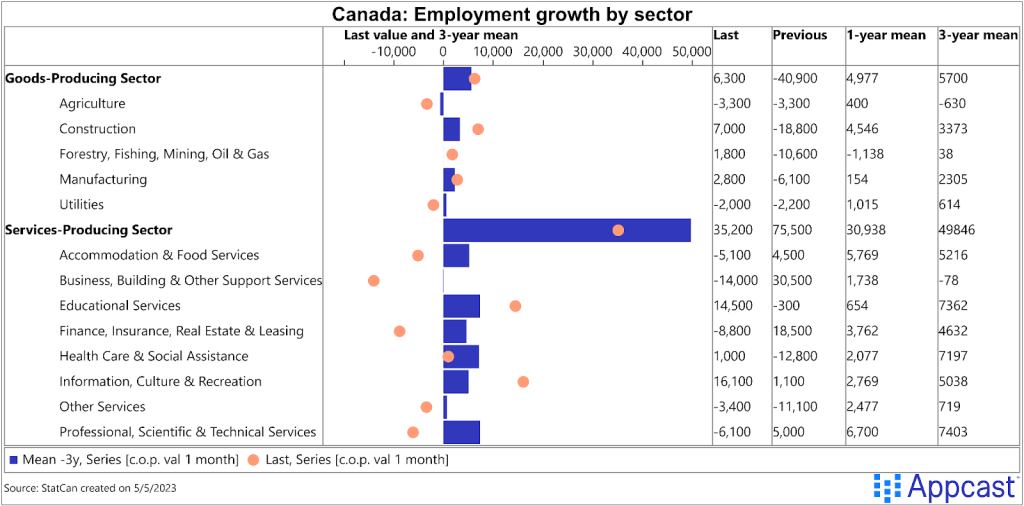

Looking into the sectors that drove growth last month, one can see why part-time employment growth was so hot. Employment changes were strong within wholesale and retail trade (+24,000), transportation and warehousing (+16,500), and information, culture and recreation (+16,100) – sectors that include a myriad of part-time positions. Sectors that saw losses include finance, insurance, real estate, rental and leasing (-8,800) and professional and technical services (-6,100). Employment in accommodation and food services also decreased in April by 5,100, interesting to note because of the continued strength this sector is showing in the U.S. labor market.

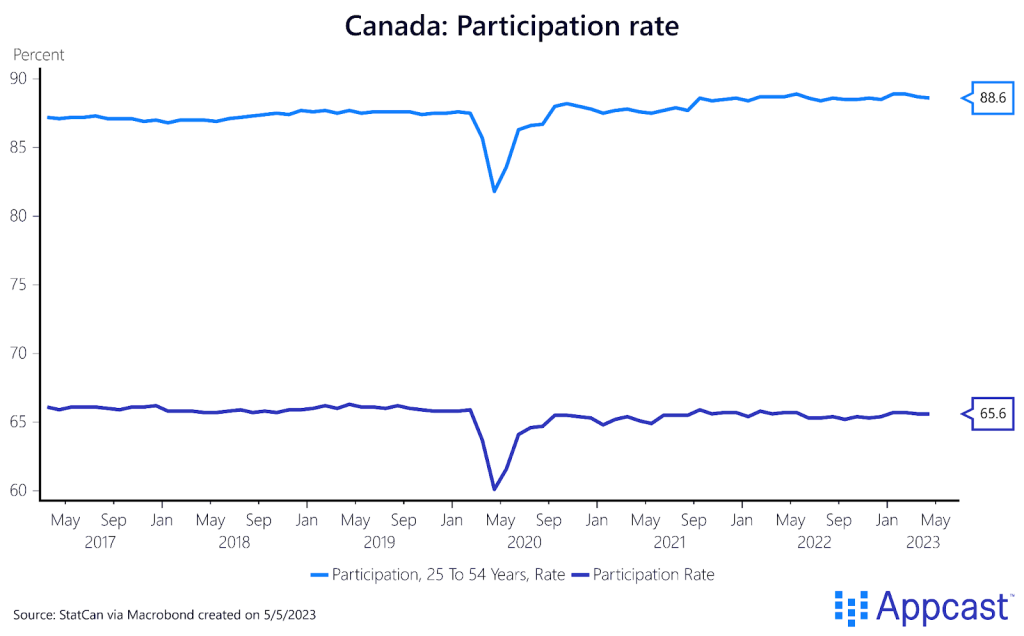

Overall labor force participation was strong last month, remaining at 65.6% – still slightly below pre-pandemic levels. Prime-age (ages 25-54) labor force participation decreased slightly to 88.6% in April. These levels suggest a strong workforce, despite the demographic issue of an aging population. Canada has done a particularly good job of bolstering their labor force through immigration.

What does this mean for recruiters?

Canadian employers should be happy to see the continued strength of the job market, as it’s proving resilient to inflation worries and the Bank of Canada’s tightening efforts.

However, the labor market remains tight – with job openings far above pre-pandemic levels in all industries. This tight market is driving strong wage growth, which is worrisome for the central bank in its fight against inflation. But, the Bank of Canada still expects inflation to ease and has stopped its interest rate hikes – Canada may achieve the soft landing that many advanced economies have been chasing throughout this bout of inflation.