The labor market data released in early February by the BLS (Bureau of Labor Statistics) was noteworthy primarily for two reasons.

First, the U.S. labor market is still doing very well, adding more than 170,000 jobs on a monthly basis over the last half year. And the figures for the final months of 2024 were revised up.

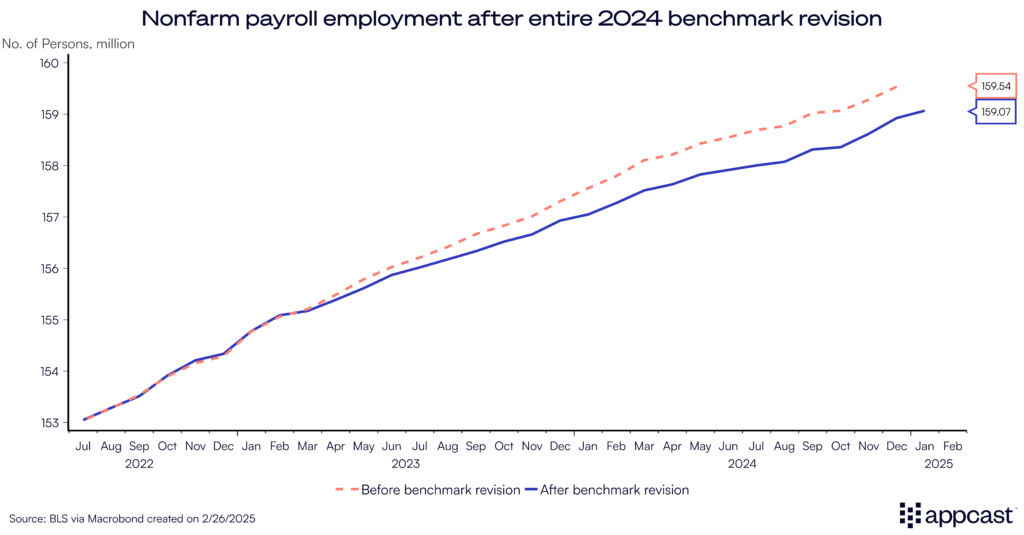

However, the second note to be made pertains to the annual benchmark revision to the employment numbers, which led to a downward revision of around 600,000 to the total number of payroll jobs. Furthermore, job growth in several industries that predominantly employ white-collar workers (think tech, finance, and professional services) saw some significant downward revisions. The white-collar recession therefore not only impacted vacancies and hires in 2024; These revisions showed us it impacted employment to a larger extent than originally believed.

The benchmark revision explained

Nonfarm payroll employment is based on the BLS’s monthly Current Employment Statistics (CES) survey, which collects data from approximately 122,000 businesses and government agencies, covering around 666,000 individual worksites across the country, ultimately a small subset of all U.S. employers. The BLS uses statistical methods to adjust for sample biases and missing data, but macroeconomic shifts or unaccounted population trends can lead to misestimations over time.

The annual benchmark revision that we get in January uses updated population statistics and more comprehensive employment data based on the Quarterly Census of Employment and Wages (QCEW). The QCEW covers (nearly) all U.S. employers who pay unemployment insurance taxes, so adjusting the payroll data to it more accurately reflects true employment trends.

As was widely anticipated by economists, job growth throughout 2023 and 2024 was revised down in the February jobs report. The BLS revised the level of nonfarm payroll jobs down by 600,000. The key takeaway is that the labor market was less tight than we thought. Don’t be too concerned, though. The U.S. economy still created just over two million jobs throughout 2024.

While the U.S. labor market therefore displayed very healthy overall job growth last year, the revisions did change the narrative of some key industries that performed quite a bit worse than the previous data suggested. With the revisions, job losses emerged across several industries that are predominantly white-collar. These losses, though minor, confirm the white-collar recession narrative that’s been in the media over the last year or so.

Some white-collar sectors have seen minor job losses

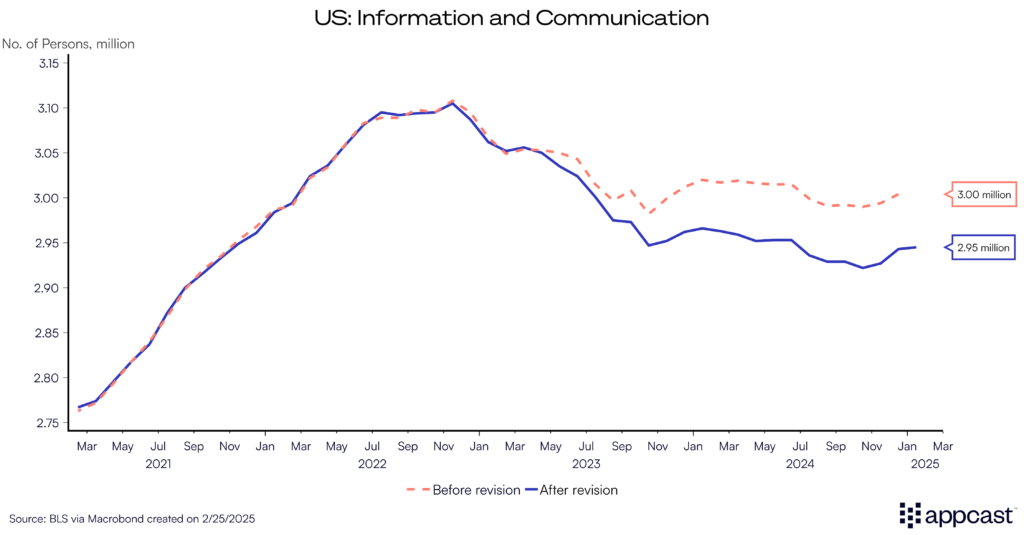

Pre-revision, we believed the information and communication sector experienced some minor job losses throughout early 2023 but then maintained a steady employment level around 3.0 million over the last year and a half. However, the revised data reveals a more pronounced decline, with employment dropping to approximately 2.95 million by early 2024, indicating greater job losses in the sector than previously estimated.

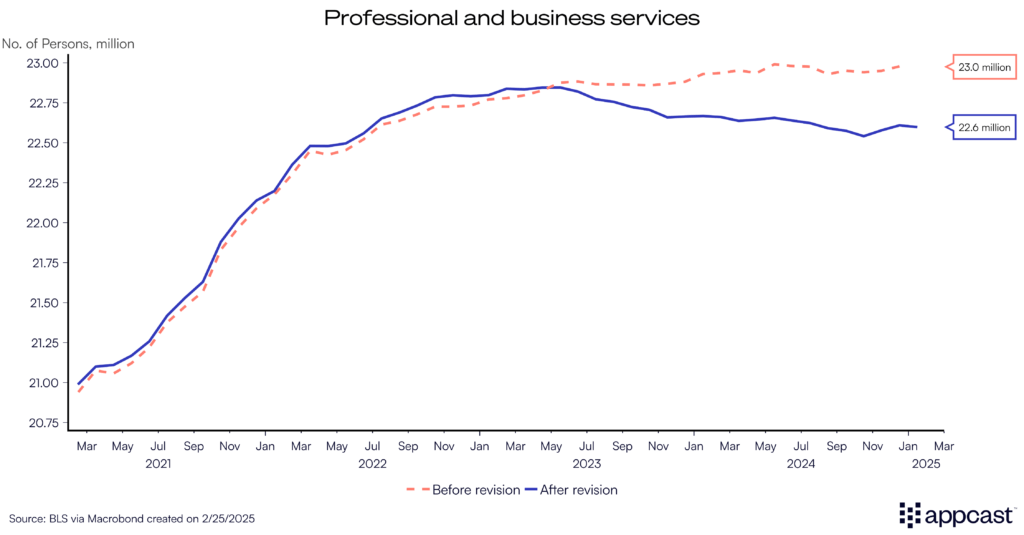

Employment in professional and business services initially seemed to grow steadily, albeit at a very slow pace, reaching approximately 23.0 million by mid-2023. However, the revised data indicates that employment peaked in early 2023 and has fallen by about 150,000 ever since, suggesting a less optimistic employment scenario in the sector than originally reported.

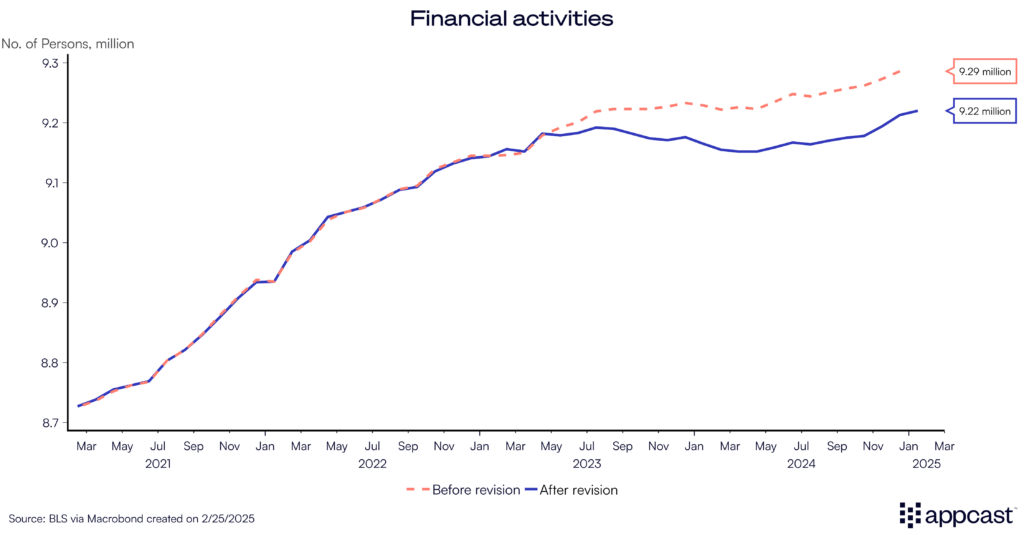

Last but not least, employment in financial activities has also grown at a much slower rate than previously thought. Since July 2023, payroll employment in the sector has been stagnant whereas the old data showed moderate growth.

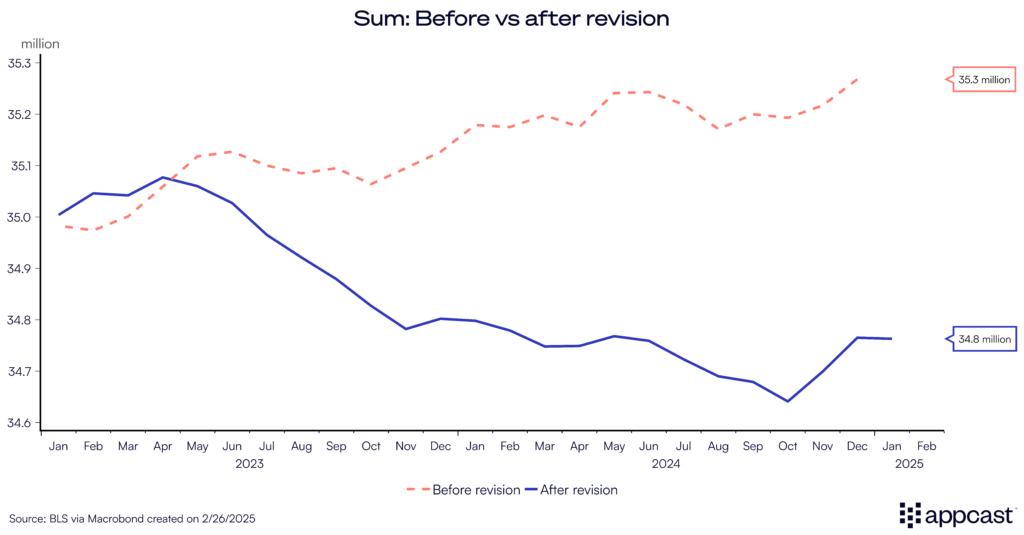

Summing up employment across these three sectors—information and communication, professional and business services, and financial activities—shows a significant disparity between the pre-revision and post-revision data. Initially, the data suggested a steady increase in total employment with a peak at approximately 35.3 million by early 2025. However, the revised data reveals a different trend, with employment figures declining by about 300,000 to around 34.8 since spring of 2023. The difference between the pre-revision and post-revision data is quite substantial, amounting to 500,000 jobs (more than 80% of the entire downward revision of 600,000 jobs!).

The revision revealed, therefore, that the three predominantly white-collar sectors have experienced a downturn in employment levels, while other sectors grew at a healthy pace. The white-collar recession, then, is not just a decrease in job openings across the sectors, but also job losses, contributing to the dour mood among white-collar professionals.

What about other markets abroad?

The white-collar recession in the labor market is not contained to the U.S. On the contrary, it is pretty much an international phenomenon that can be explained by global macroeconomic factors.

During the worst of the pandemic, central banks and governments injected stimulus into the economy, rapidly increasing consumer demand. That surge in demand required new workers, and uber-tight labor markets were created as vacancies surged, especially in the white-collar space (remember all the tech you had to use?).

Hiring initially accelerated across sectors but eventually ran out of steam, especially once central banks started their rapid tightening cycle to bring down inflation. There mat have been an element of too-optimistic “over-hiring” as well.

As the steam ran out, white-collar workers suddenly started to struggle as hiring came down rapidly. The international tech sector neatly tells the story of the pandemic employment boom and post-pandemic job bust.

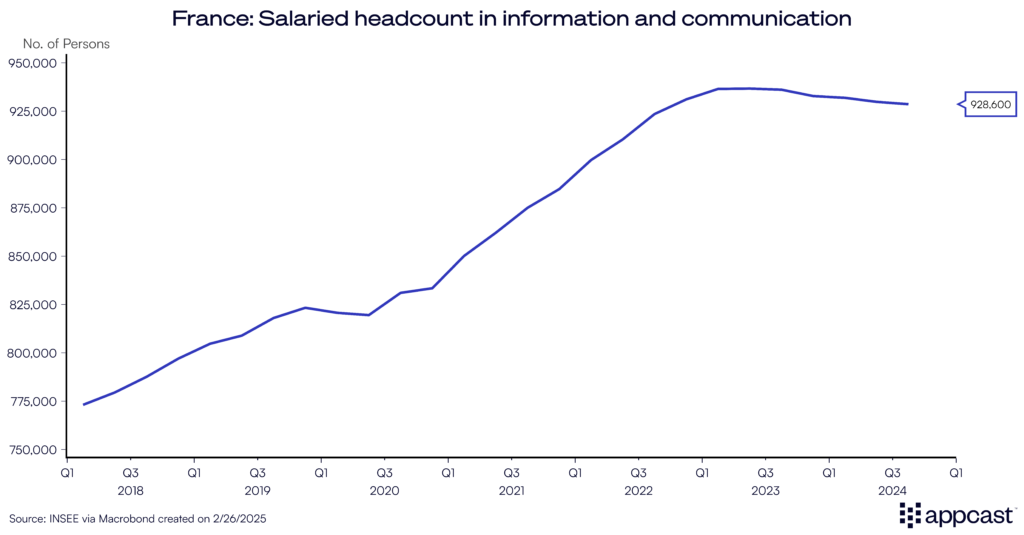

In France, salaried employment in the information and communication sector saw rapid gains throughout 2020 to 2022, increasing by about 100,000 within just a couple of years. Since early 2023, employment has dipped down by a few thousand jobs. While these are marginal job losses, it shows that employment growth in the sector came to a stop more than two years ago.

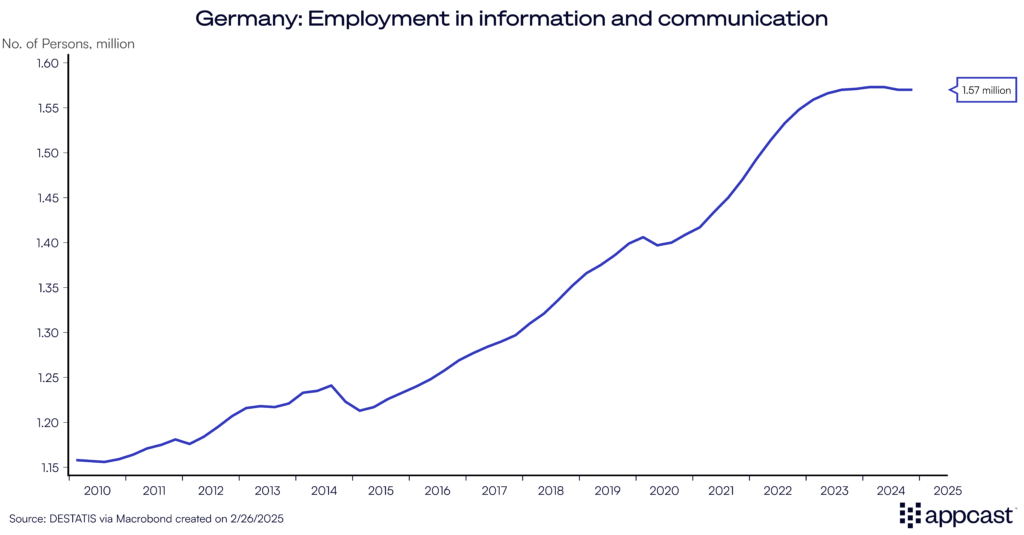

Germany looks a lot like France in this regard. Employment in the tech sector grew from about 1.4 million in early 2020 to more than 1.55 million by early 2023. Ever since then, job growth has been completely stagnant.

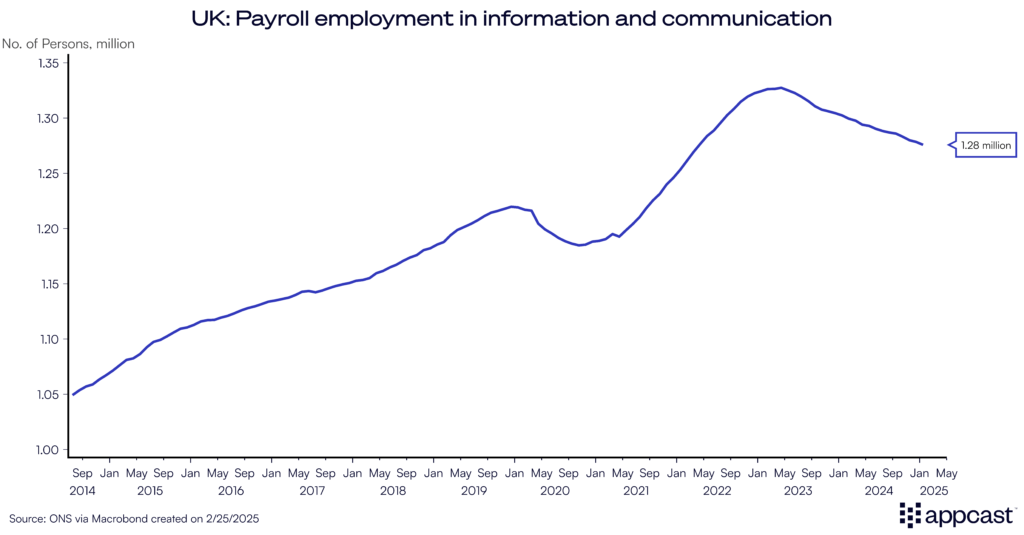

In the United Kingdom, payroll employment in information and communication rapidly expanded during the early stage of the recovery from about 1.2 million pre-pandemic to more than 1.3 million by 2022. Contrary to Germany and France, the tech sector in the U.K. has seen some job losses, contracting by some 50,000 over the last two-and-a-half years. As we have written previously, the labor market in the U.K. has slowed down substantially in recent years and the economy is experiencing a relatively severe white-collar recession. And unlike continental Europe, the white-collar sector has been shedding jobs on this side of the pond as well.

Conclusion

The benchmark revision to the payroll employment data in the U.S. revealed that total employment was some 600,000 lower than previously assumed. Generally speaking, this did not change the narrative of a pretty decent labor market that still added some two million jobs last year. However, it did make a big difference to some sectors, particularly white-collar sectors. Instead of being stagnant, information and communication and professional and business services actually saw some job losses over the last two years. More than 80% of the downward revision was concentrated in these three sectors, predominantly employing white-collar workers. The white-collar recession was thus slightly worse than we previously thought. And the latest figures show that employment in the space has not fully recovered yet, neither in the U.S., nor in other international markets like France, Germany, and the U.K.