The labor market is booming even more than we thought. The U.S. economy added a shocking 467,000 net new jobs in January 2022, far above expectations, despite the surge of Omicron cases that saw 15 million people get COVID last month. But perhaps more surprising, were revisions to monthly data for all of 2021 that radically changed our understanding of the labor market’s trajectory. Instead of a slowing trend from last summer, job growth looks to be holding steady, and finished 2021 with an upswing.

Radical revisions to 2021 data

Perhaps the mantra “the virus is the boss” is no longer the case. With today’s report, the labor market trajectory for 2021 changed dramatically. There were strong upward revisions to prior months’ data. The payroll gains in November and December 2021, combined, increased to the tune of over 700,000 jobs.

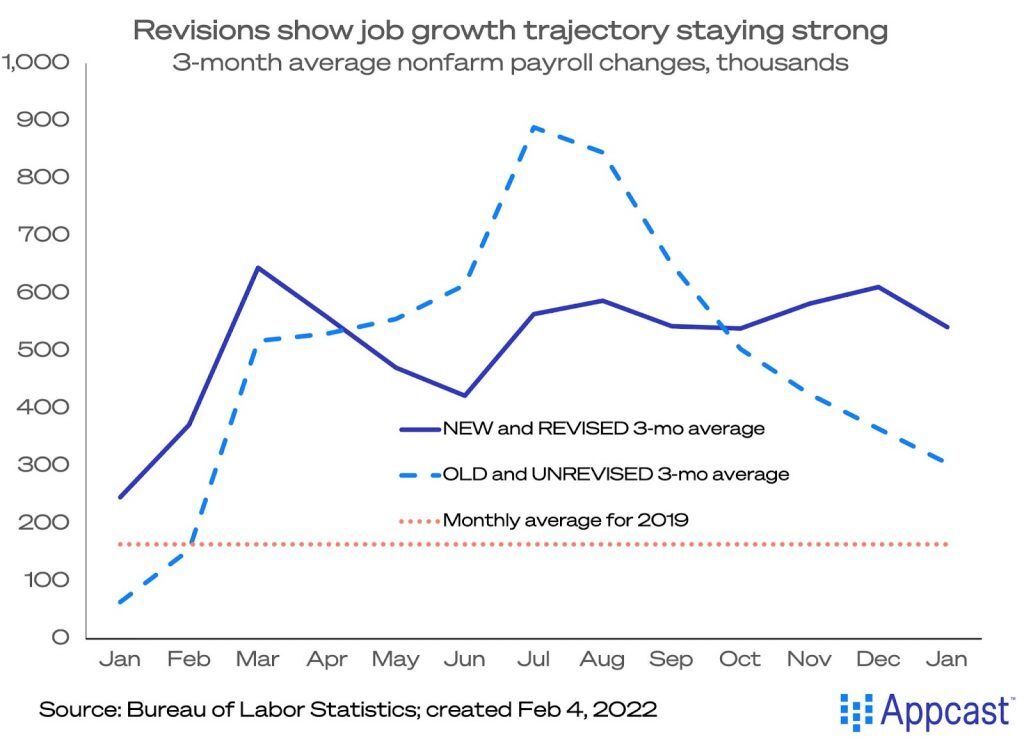

However, this was a special jobs report because it had revisions for the entire year of 2021. And now, the trajectory of the labor market looks totally different. The old, unrevised data had shown the 3-month average payroll increases peaking in the summer before declining through the second half of the year (dashed light-blue line in the graph below). This was a pace of job growth much higher than the average monthly gain in 2019, before the pandemic. But today’s revisions (solid dark-blue line) show a different path altogether: job growth accelerated upward in the second half of 2021. The three-month moving average rose from 422,000 in June 2021 to 611,000 in December 2021, before moderating to 541,000 in January. This uptick has occurred despite the rise of the Delta and now Omicron variants!

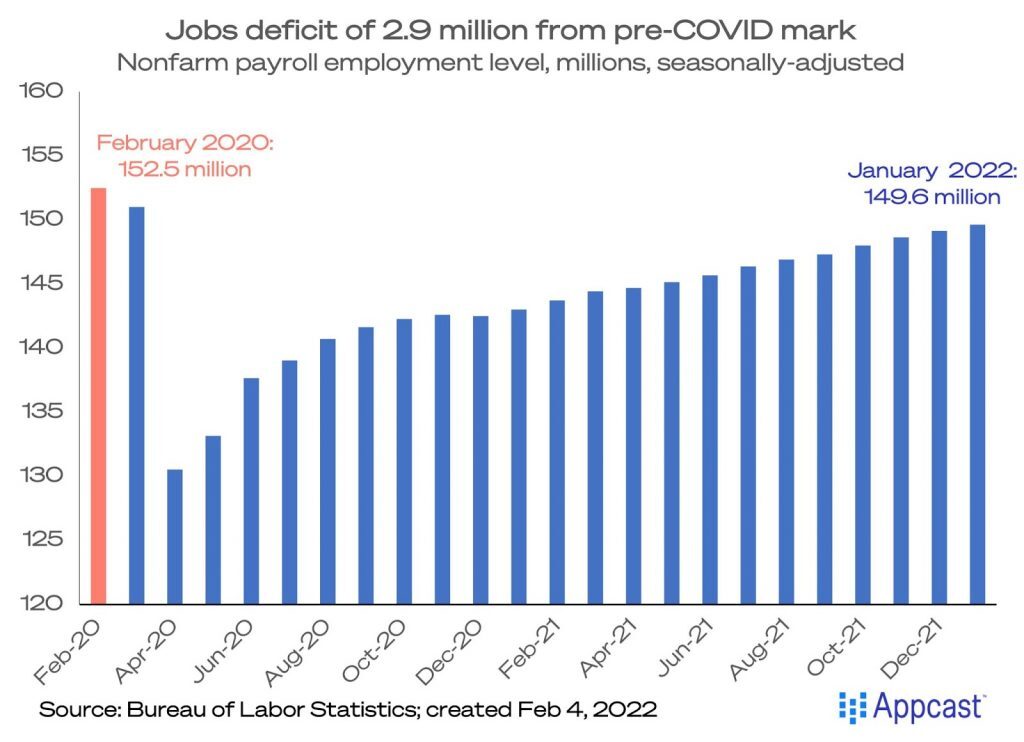

There is still a lot of catching up to do. While the US economy added an upwardly-revised 6.7 million jobs in 2021, compared to 6.5 million pre-revisions, the job deficit compared to pre-pandemic times is 2.9 million, or 1.9% below February 2020 levels. So, despite all the hooray about a strong reading, we’re still nearly 3 million jobs short of where we were.

Strong job growth in COVID-affected industries

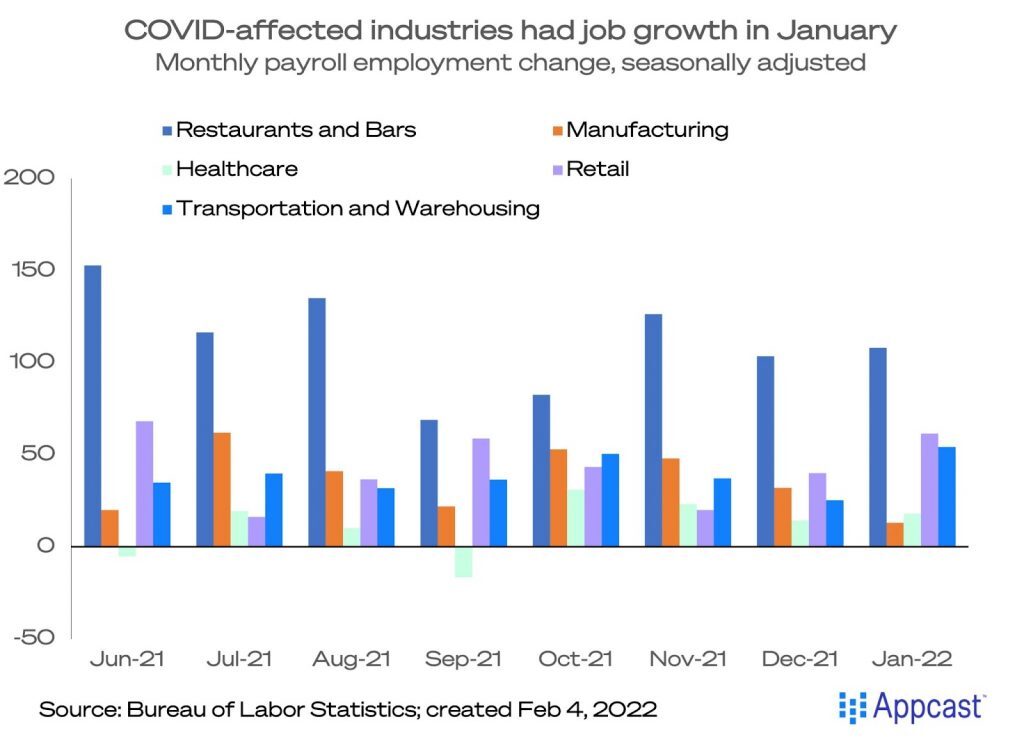

The industry-level breakdowns were positive. Leisure and hospitality jobs grew by 151,000 although still down by over 10% from its pre-pandemic level. Retail jobs grew by 61,000. Transportation and warehousing saw strong growth of 54,000. Healthcare was up 18,000 and manufacturing by 13,000. There is not much sign of an Omicron impact. If anything, the slowing growth in manufacturing could reflect an easing of supply chain bottlenecks.

I was quoted last month as calling the seasonal adjustments “wacky” in 2021, as the pandemic has distorted typical hiring patterns. That’s true, and it still might be the case. Why? These seasonally-adjusted, revised numbers show accelerating payroll gains in retail and transportation and warehousing – the very industries that are most affected by the holiday shopping season. Perhaps employers held onto those workers who they would normally let go after the holiday season ended; that is just an informed guess.

Labor force participation rebounded during peak COVID

Amazingly, the total U.S. labor force grew by over 1.5 million in January, at a point of peak COVID cases and hospitalizations. That is shocking! This is part of the explanation for why it was “good” that the unemployment rate ticked up from 3.9% to 4.0% – it’s because the denominator grew. The labor force participation rate was up one-third of a percentage point to 62.2%, and the employment-to-population ratio again rose slightly, to 59.7%.

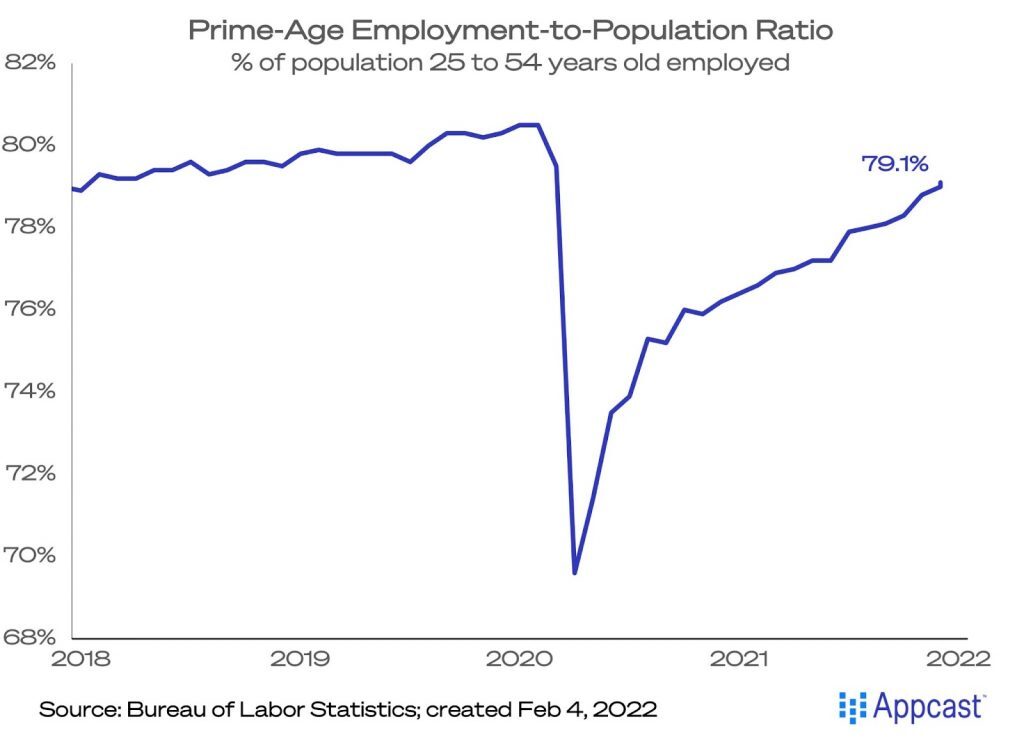

The best metric for labor supply – the prime-age employment-to-population ratio – rose one-tenth, to 79.1%. People who want a job are finding plenty of openings available but a lot of folks are still on the sidelines: 5.7 million people want a job but aren’t actively looking. The labor force is rebounding toward pre-pandemic levels, if not quite there.

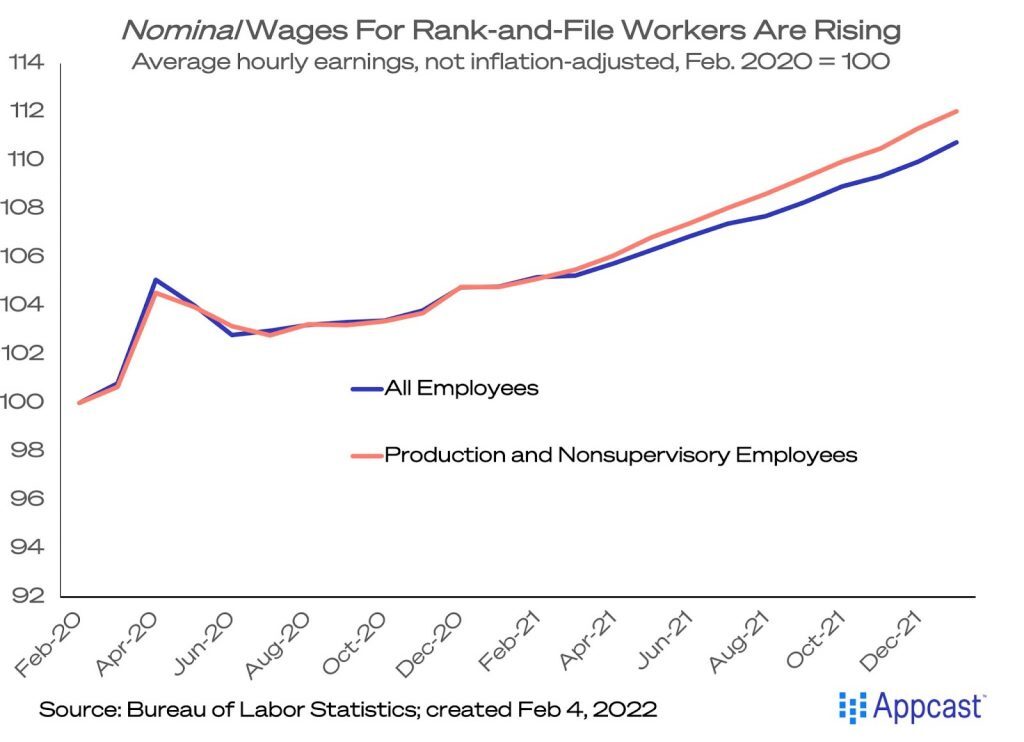

Wage growth continues to be strong, but so does inflation

Wage growth continues to be very strong. Average hourly earnings for all workers accelerated to 5.7% year-over-year. Average hourly earnings for rank-and-file workers – production and nonsupervisory employees – were up 6.9% year-over-year. From February 2020, nominal wages are 12.0% higher for rank-and-file employees, and up 10.7% for all workers. But as we all know, these are nominal gains – or not adjusted for inflation – and consumer price inflation is at a 40-year high.

What does this mean for recruiters?

What does this mean for recruiters? Employer demand for workers seems stronger than we previously understood it to be – that means competition is intense. The rebound in labor force participation despite the prevalence of the virus is a bullish indicator that workers could return to the labor force, easing labor shortages. Still, it’s a workers’ market and recruiting remains very challenging.