The U.S. economy added a solid 390,000 net new jobs in May 2022. The unemployment rate remained unchanged at 3.6%, nearly a 50-year low. Broad-based job gains (aside from retail), moderating wage growth, and labor force participation recovering – all these are signs the jobs recovery is in the home stretch, meaning that in the next few months employment will crest above pre-pandemic levels.

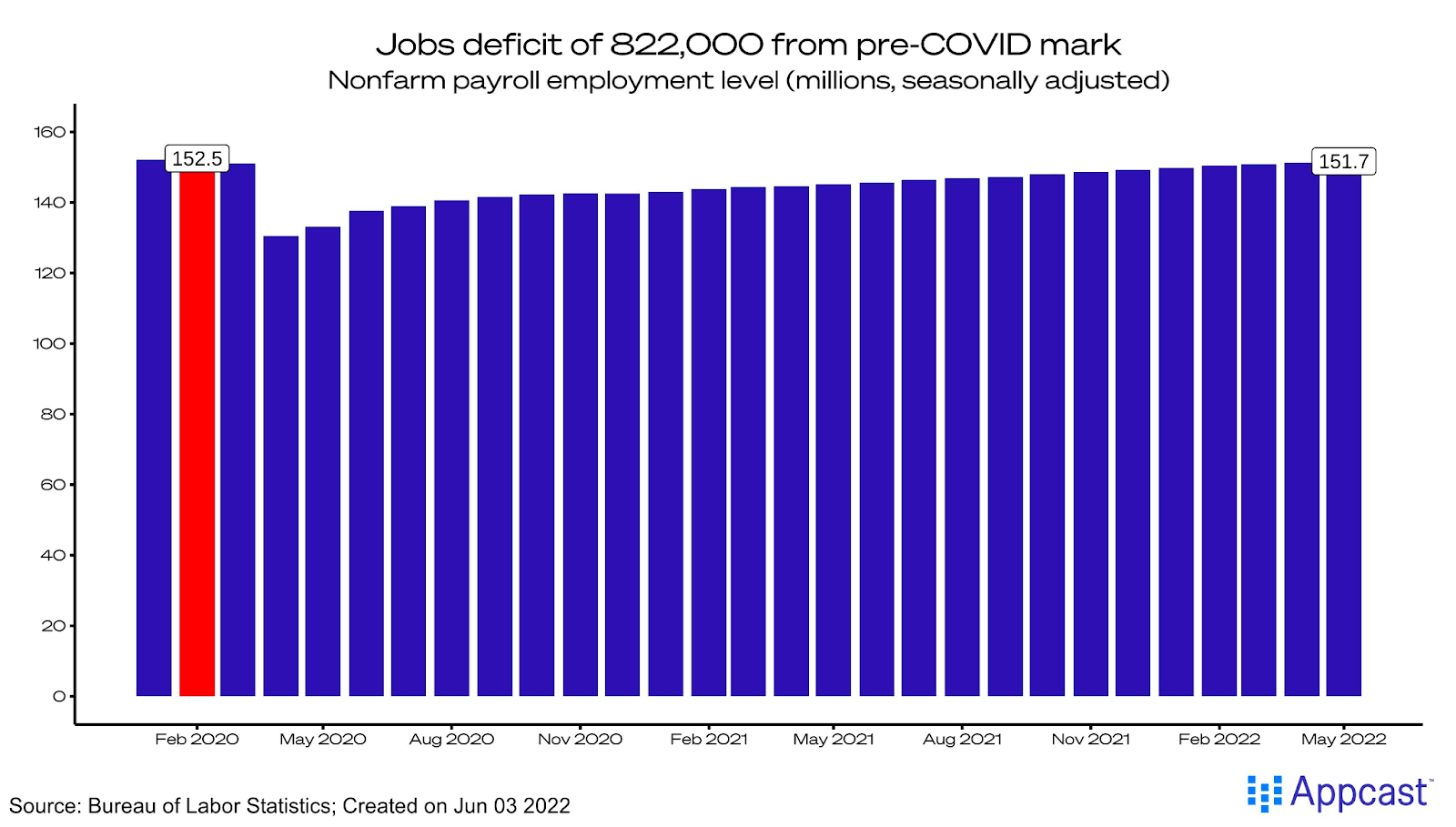

COVID “job deficit” continues to shrink

The three-month moving average of employment gains is around 400,000 – that is far from a recession. These gains occurred despite the Federal Reserve hiking interest rates amid elevated inflation. The “job deficit” shrunk further from its pre-COVID level – and now stands at 822,000. The jobs recovery is in the home stretch; it should be complete by sometime this summer.

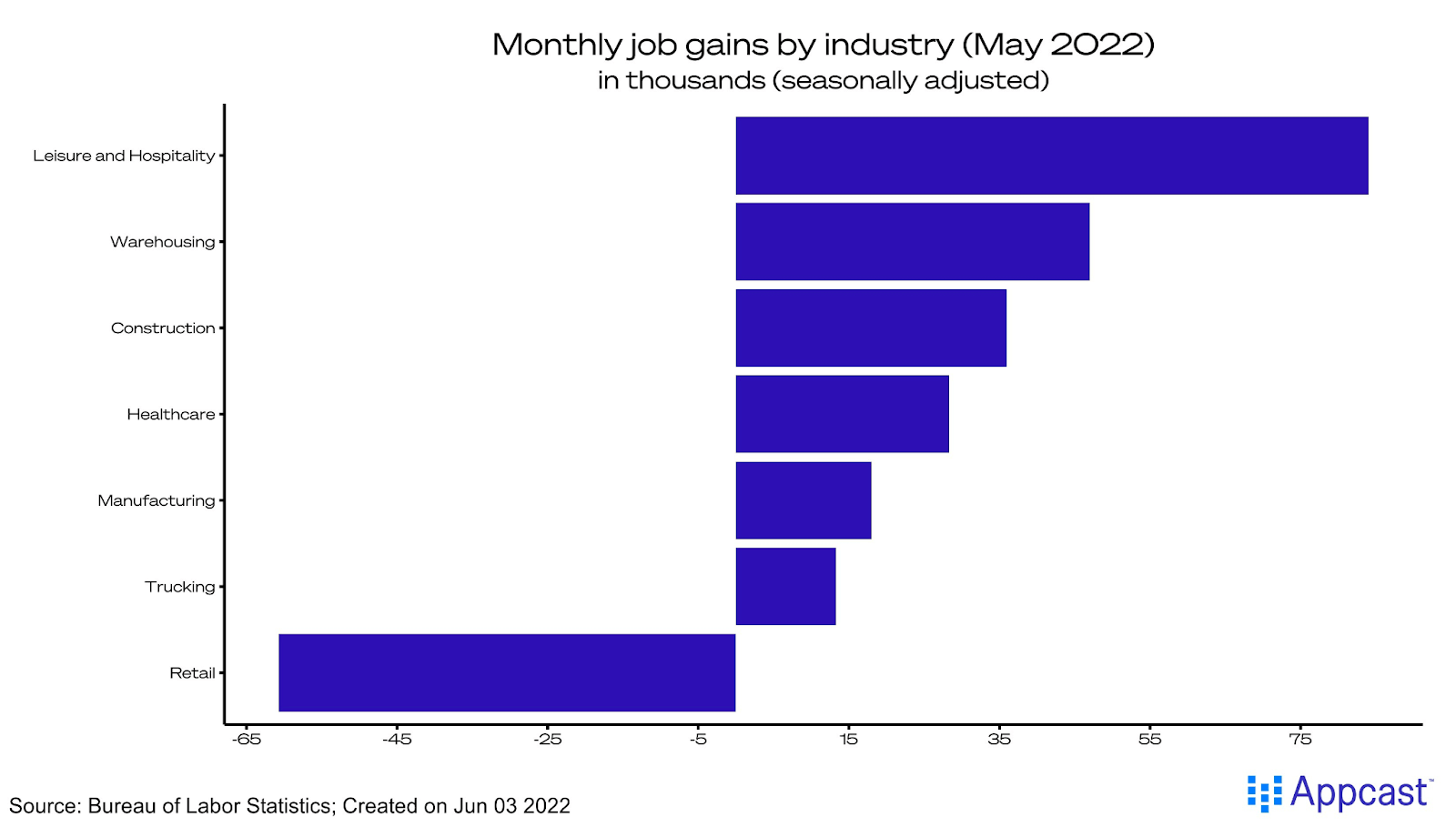

Broad-based job gains, but retail is the laggard

Gains were broad-based across most major industries. Leisure and hospitality led the way with 84,000 new jobs. But while consumers are returning to restaurants and hotels, they’re not shopping like before. Retail stood out as the laggard in May, as the sector lost 61,000 jobs. Ecommerce remains a vital part of the economy despite the loosening of COVID restrictions and a return to in-person activities. Transportation and warehousing added 47,000 jobs in May.

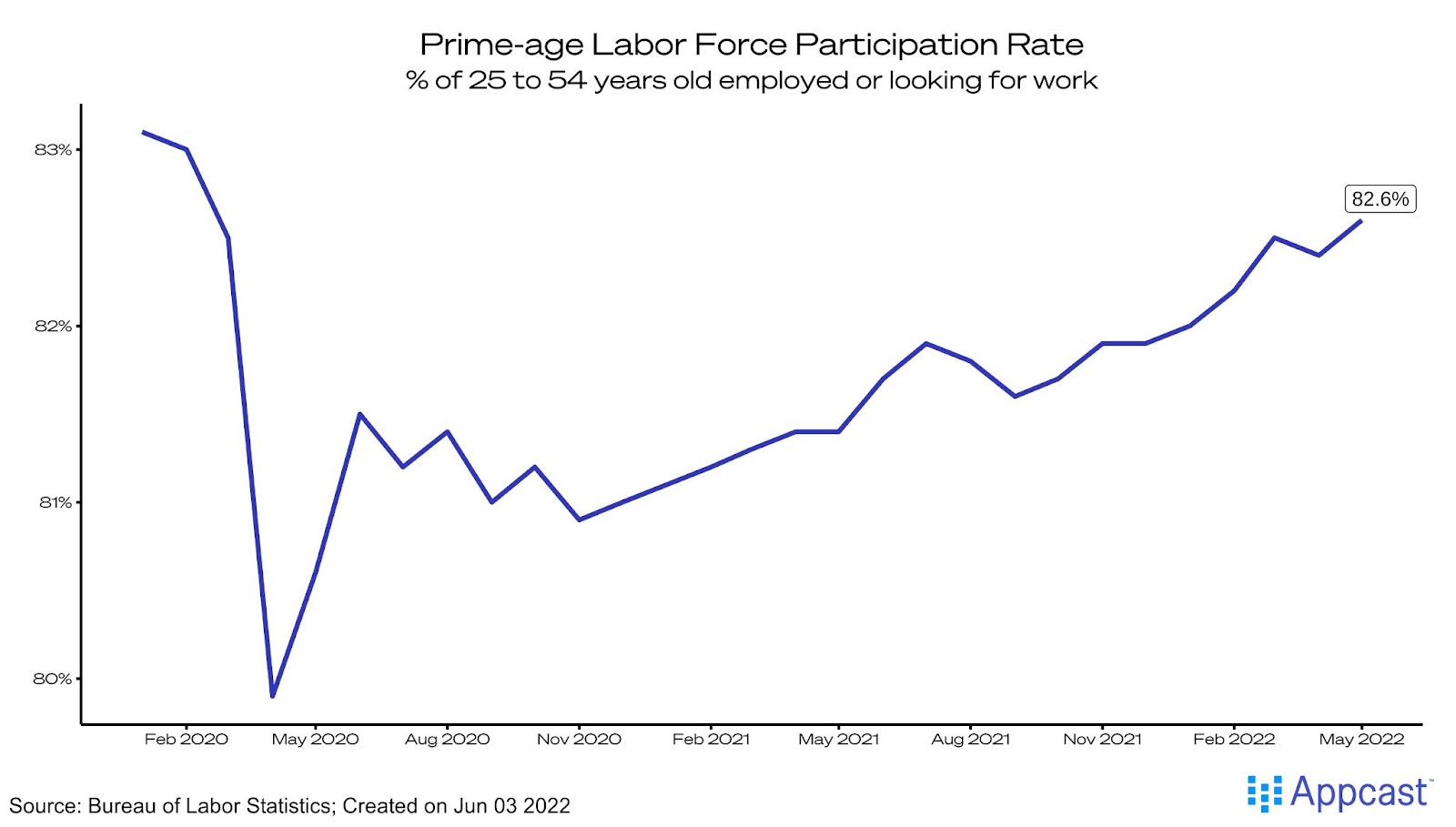

Trend of greater labor force participation returned

Labor supply measures improved or held steady. The labor force (the pool of hireable workers) grew by 330,000, even as the unemployment rate remained unchanged at 3.6%, nearly a 50-year low. Labor force participation overall rose to 62.3%, and for prime-age workers it was up to 82.6%. This rebound in labor force growth, compared to the April report, is a good sign that workers will be there to hire, even if recruiting remains challenging.

The best metric for the goal of “full employment” – the prime-age employment-to-population ratio –ticked up to 80.0%. But some people remain on the sidelines: the number who say they want a job but aren’t actively looking rose to 5.7 million, which is trending down but still up from 5.0 million before the pandemic.

Wage growth cooled slightly but remains elevated

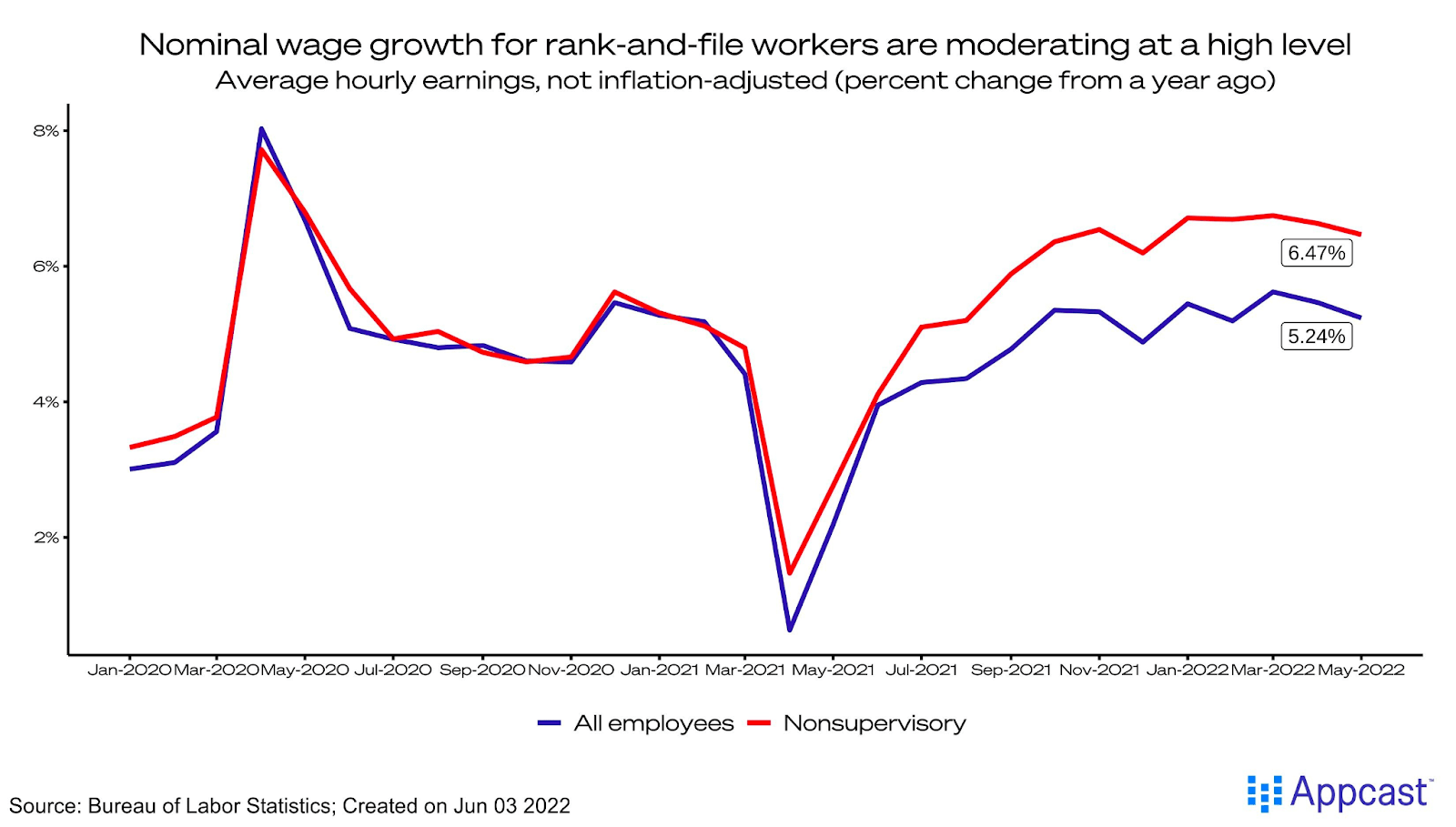

Wage growth moderated in May. Average hourly earnings were up 5.2% year-over-year (not adjusted for inflation), which is down a smidge from the previous month. That is the second consecutive month of cooling, a reassuring sign for the Fed: record-high inflation isn’t feeding into a wage-price spiral.

Average hourly earnings for rank-and-file workers – production and nonsupervisory employees – were up 6.5% from a year ago. However, these are nominal gains – not adjusted for inflation – and consumer price inflation is near a 40-year high.

What does this mean for recruiters?

Recruiting continues to be challenging in this ultra-tight labor market, with near record-high job vacancies. Workers have leverage and are exercising it – quit rates are elevated and job switchers are getting strong raises but there are headwinds. With war in Eastern Europe, energy and commodity prices have spiked, exacerbating inflation that is already at record levels. At this point, there is no sign of the war and inflationary environment creating a pull back on hiring plans. And wage growth remains strong while continuing to moderate – perhaps a positive sign for inflation dynamics.

Bottom line: This is an encouraging jobs report, and reflects strong hiring demand in the U.S. during a period in which the Russia-Ukraine war was ongoing and the Fed began to aggressively hike interest rates.