The U.K. economy has performed quite poorly since the beginning of the pandemic, being one of the few advanced economies that has not surpassed its 2019 Gross Domestic Product (GDP) level yet.

To make matters worse, Q3 2022 growth was already slightly negative. And given the Bank of England’s (BoE) rapid rate hikes to stifle inflation, the economy is expected to contract further in Q4 2022 and throughout 2023.

The U.K. has, of course, not just suffered from the series of economic lockdowns early during the pandemic, but also the negative effects of Brexit. According to research from the Centre for European Reform, GDP is down more than 5% and investment more than 10% lower in 2022 than if Britain had remained in the single market.

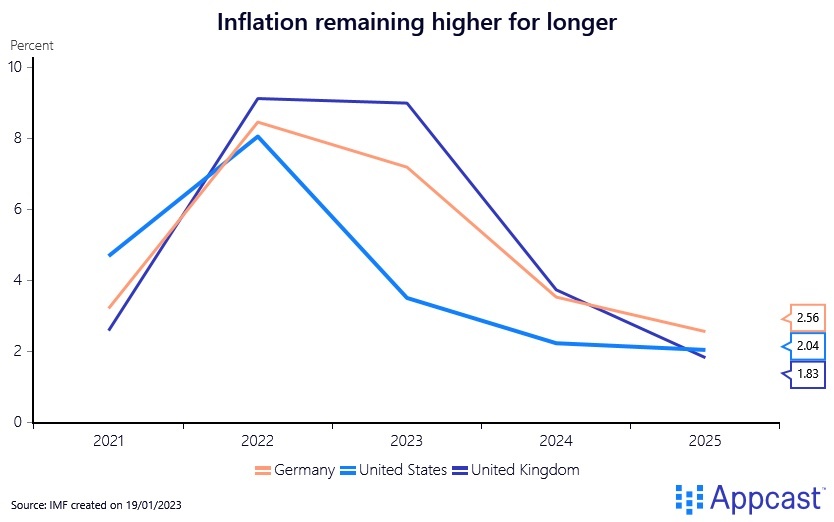

The depreciation of the pound and the trade frictions caused by Brexit have also contributed to higher inflation. The International Monetary Fund (IMF) estimates show that in the coming two years inflation is expected to remain significantly higher in the U.K. than in US and even the Eurozone.

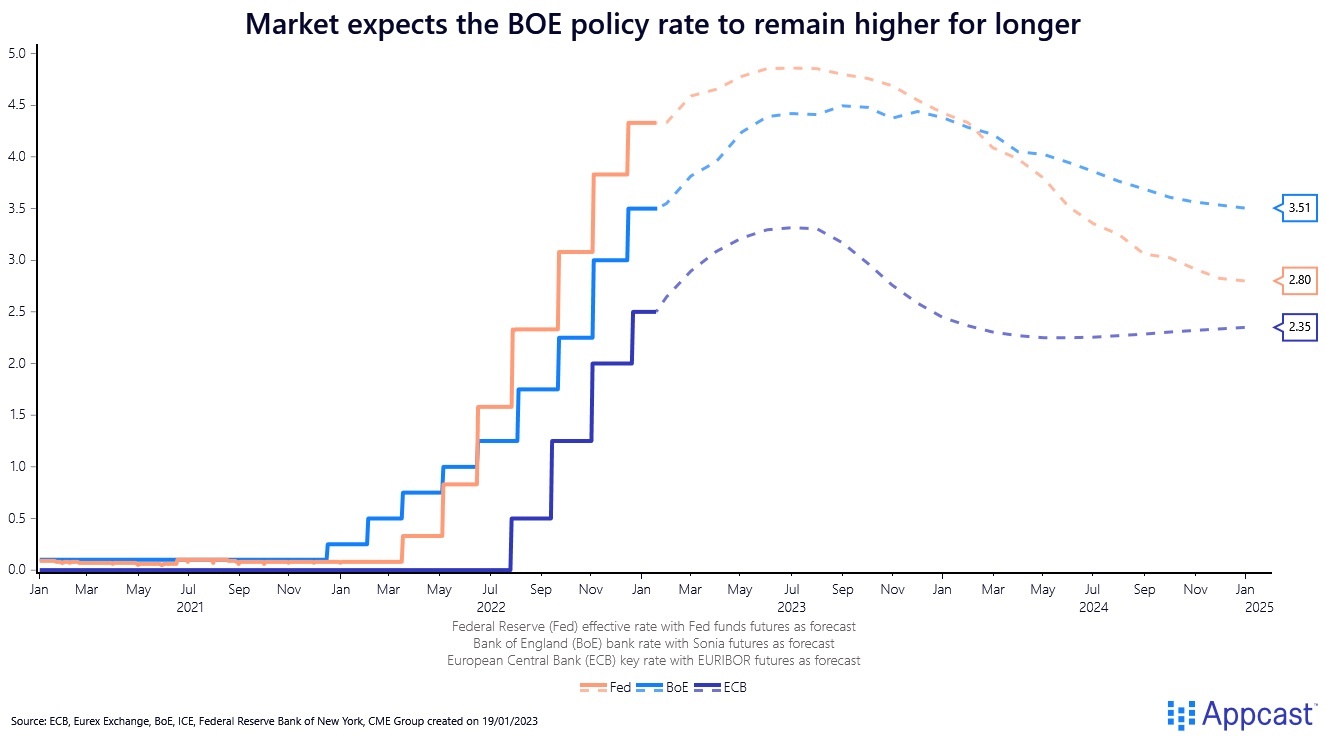

Because inflation is expected to be stickier in the U.K., the BoE will leave its policy rate higher for longer, which will lead to a contraction in economic activity. Financial markets are pricing in rate cuts for the second half of 2023 for the ECB and the Fed whereas the BoE policy rate is expected to remain above 4% until mid-2024.

The BoE has certainly indicated that it is now serious on the inflation-fighting front and is forecasting a prolonged recession throughout 2023 until the beginning of 2024.

What does that mean for the labor market?

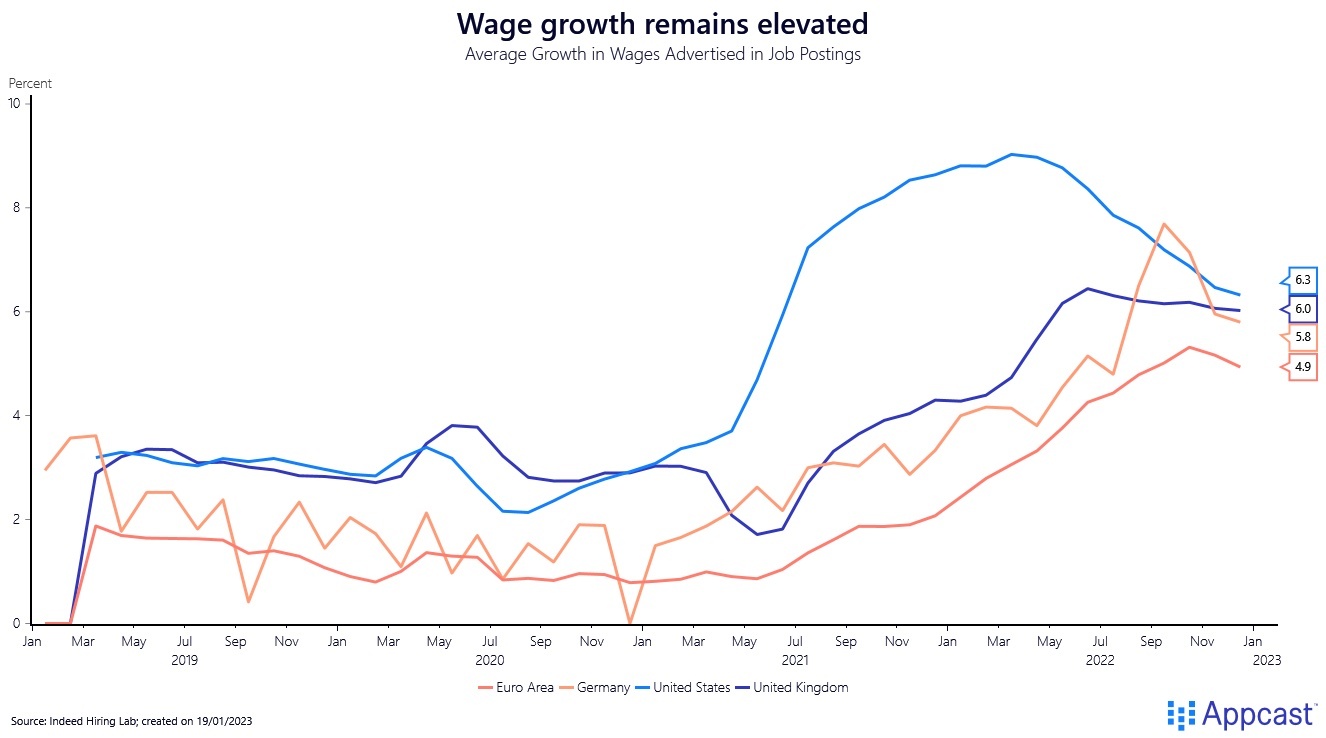

The rapid economic recovery last year has led to extremely hot labor markets in advanced economies. Wage growth has accelerated as workers have gained back some bargaining power and were able to push for higher salary increases amidst record high inflation.

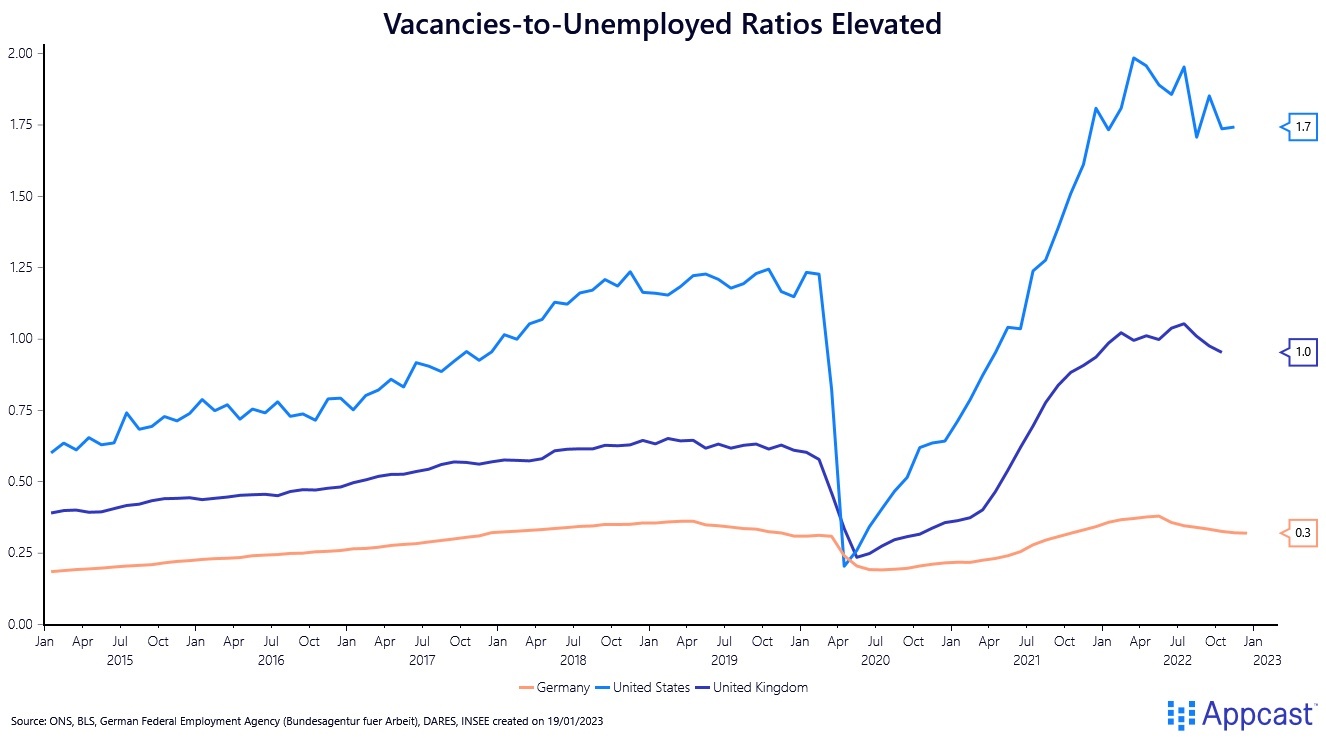

The ratio of vacancies to unemployed shows that the labor market is historically tight, which is precisely why workers have been able to negotiate higher wages.

New research from the Fed is indicating that the passthrough from inflation expectations to wages is now significantly higher compared to the pre-pandemic period. While fears of a wage-price spiral might be somewhat overblown because Central Banks today have more credibility than a few decades ago, most economies have seen a quite substantial acceleration in wage growth. Data from Indeed shows it is now easily twice as high or more than before the pandemic.

However, there is no doubt though that the upcoming U.K. recession might put a significant dent in the labor market. Historically, a one percentage point decline in growth can lead to an increase in the unemployment rate of about 0.5 percentage points.

Suppose the U.K. economy contracts by 2% or more this year. Then, according to the historical relationship mentioned earlier, the unemployment rate could increase by more than two percentage points. In fact, this is the BoE’s baseline forecast!

What does that mean for job openings and recruitment?

But what if historical patterns don’t hold in today’s economy? In other words, what about this incipient downturn is different? With the record tight labor market from last year and labor shortages due to Brexit, companies might prefer to hoard labor instead of letting people go.

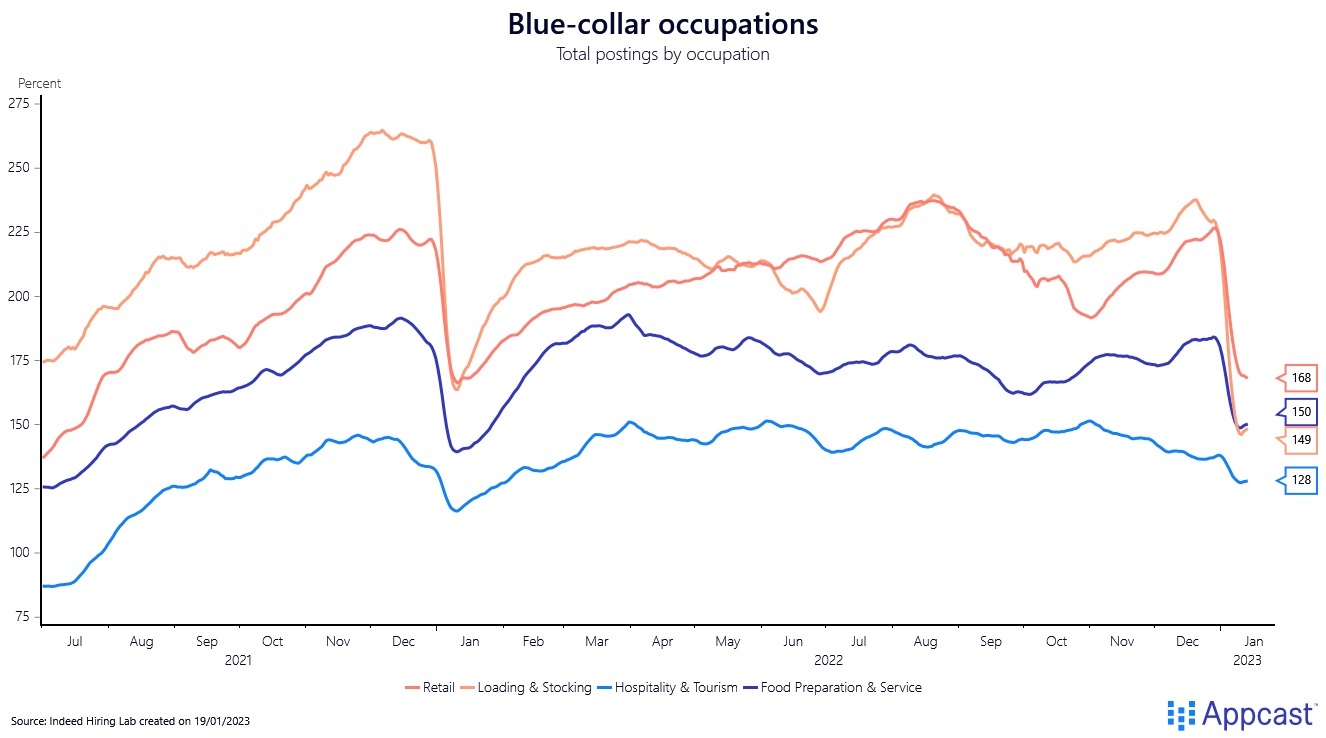

Usually, blue-collar workers tend to suffer more during economic downturns. The chance of getting laid off is significantly higher for these workers. However, Brexit has led to an acute shortage of low-wage workers in various industries like hospitality and tourism, food preparation, retail, loading and stocking, etc.

Will we see a white-collar recession this time?

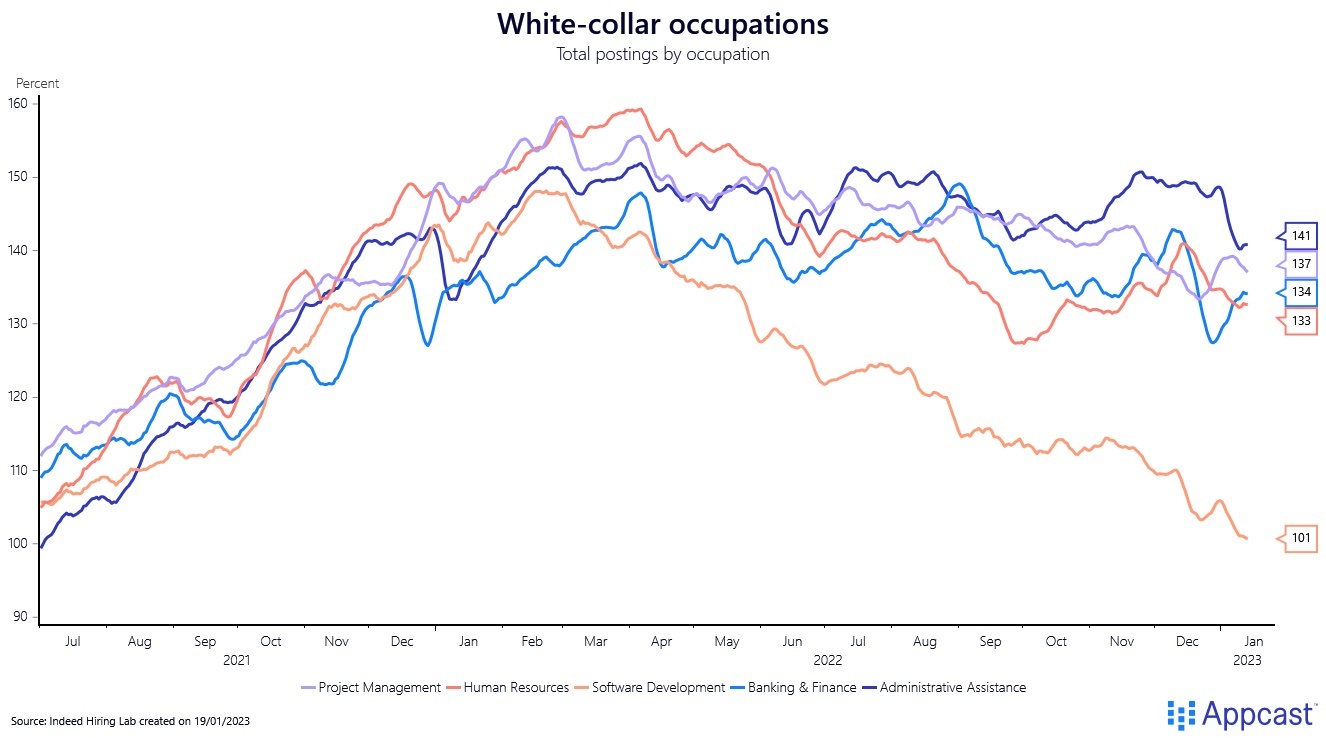

High frequency data shows that job openings have already declined in white-collar occupation since H2 2022. Job postings in software development, human resources, and project management are down 27%, 8%, and 5%, respectively, compared to a year ago.

Blue-collar occupations, on the other hand, have been holding up quite well – until recently.

Brexit has obviously strained those sectors more than white-collar occupations where employers have the means to finance skilled-worker visa for high-earning workers.

This is obviously much more difficult in blue-collar occupations where salaries are lower. Due to Brexit, there has been an acute shortage of workers in blue-collar sectors.

In Q3 of 2022, job postings in retail were still around 20% higher and in hospitality and tourism more than 15% higher compared to Q3 of 2021. But in December 2022, this reversed, with job postings in blue-collar occupations suddenly plunging as well. It remains to be seen whether this is just a temporary dip or a sign of a prolonged downturn.

Conclusion

In a few months, it will most likely be confirmed that the U.K. economy has entered a recession – commonly defined by financial markets in the U.K. as two consecutive quarters of negative GDP growth (although in the U.S. the debate is more complicated). If the recession remains relatively shallow, unemployment will not increase as much as the BoE forecast suggests because of labor hoarding.

Instead, more companies might implement hiring freezes and so job postings will plunge. With the record tight labor market from 2022 and labor shortages due to Brexit, employers might think twice though about letting people go; they know getting them back post-recession might not be as straightforward as in the past.