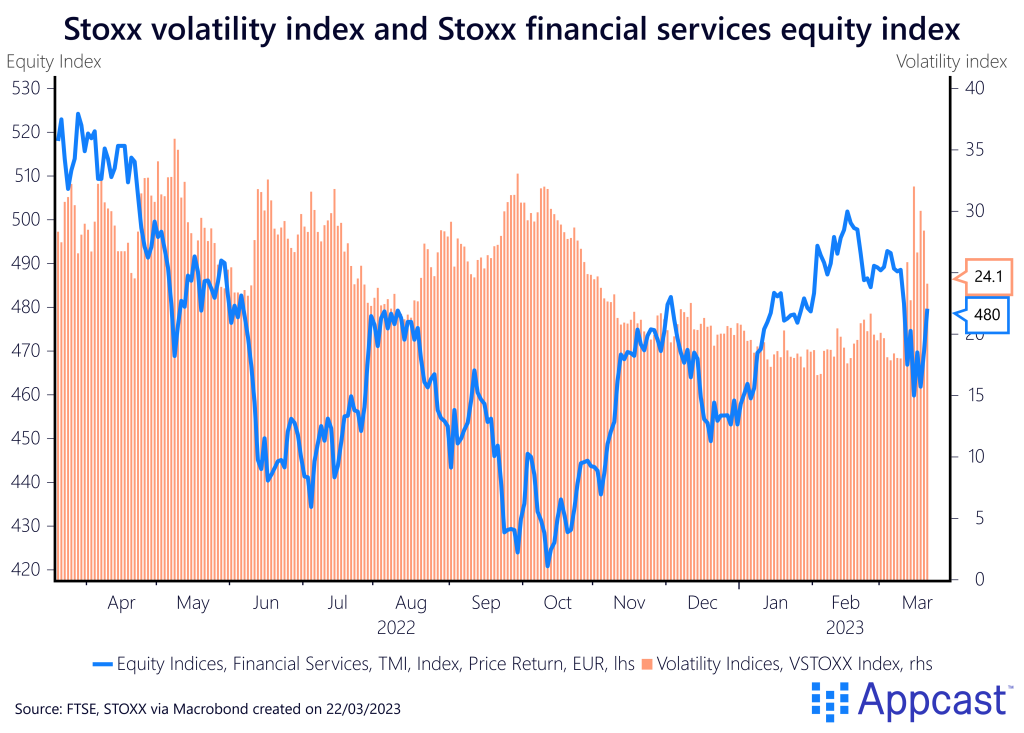

Financial markets have seen a return of volatility with the recent bank failures in the US and now Switzerland. The aggressive rate hike cycle over the last year is now leading to financial instability even as inflation is still significantly above target. Nevertheless, the ECB didn’t change course and increased its policy rate by another 0.5% last week even as some forecasters now worry that they are hiking the Eurozone into recession.

Record inflation in the Eurozone

Central banks in advanced economies have hiked their policy rates by a record amount since the beginning of 2022 to bring down inflation. The failure of Silicon Valley Bank in the U.S. and Credit Suisse in Europe has now sparked volatility in financial markets.

Nevertheless, the European Central Bank (ECB) decided to hike interest rates by 50 basis points on March 16th even as it became clear that the European banking sector might suffer a blowout from the failure of Credit Suisse. The big fear in this tightening cycle has always been that financial stability would be threatened before central banks achieved their inflation mandate. And maybe that is exactly what we are seeing right now.

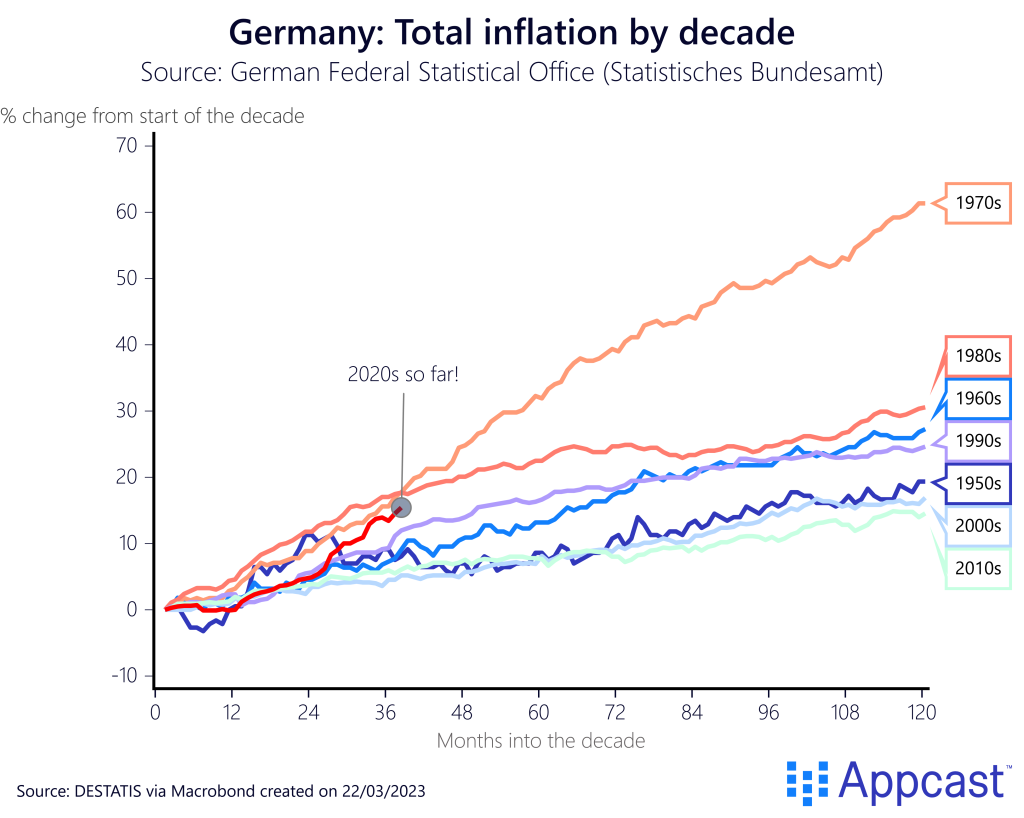

The chart below compares the inflation rate for Germany over several decades. As one can see, total CPI inflation in the first three years of this decade has already been higher than total price increases throughout the 2000s and 2010s when inflation was running at or below the ECB’s 2% target.

Core inflation, which is stripped of energy and food prices and is thus a better measure for underlying price pressures, reached an all-time high of above 5% in the beginning of this year. It is thus no wonder that the ECB is determined to continue rate increases even as financial volatility is increasing.

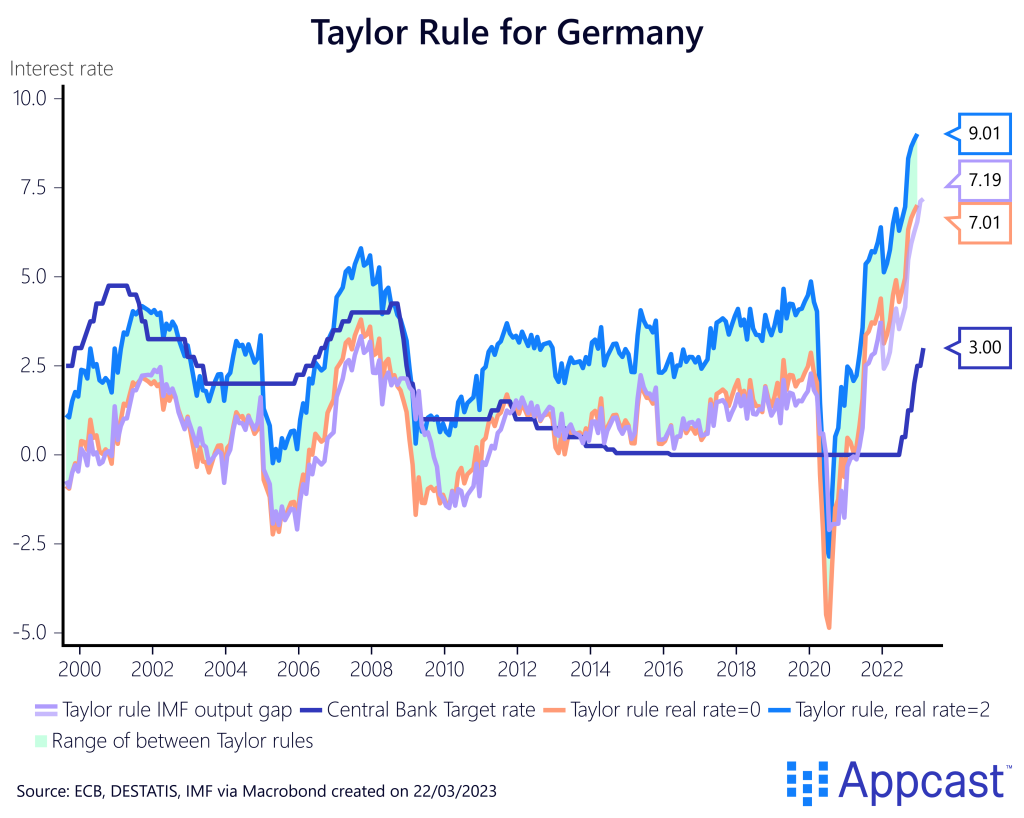

The chart below shows that the actual ECB benchmark interest rate is still much lower than what some policy rate rules suggest for the German economy. The so-called Taylor rule advocates that the central bank’s interest rate should be a function of the natural interest rate, inflation deviations from target, and GDP deviations from trend (the output gap).

The natural rate is the hypothetical interest rate that is consistent with full employment and price stability in the economy. The output gap is a measure of whether GDP is above or below trend.

While there can be some disagreements on how to measure these two concepts, two things stand out from this chart. First, even “dovish” measures of the Taylor rule suggest that the ECB policy rate should be higher right now. Second, the German economy performed better in the decade before the pandemic than most southern European countries, but the ECB can only set one interest rate for the entire currency area. As a result, ECB policy was already too expansionary for the German economy during the years from 2015 to 2020.

More ECB rate hikes to come amidst financial market instability

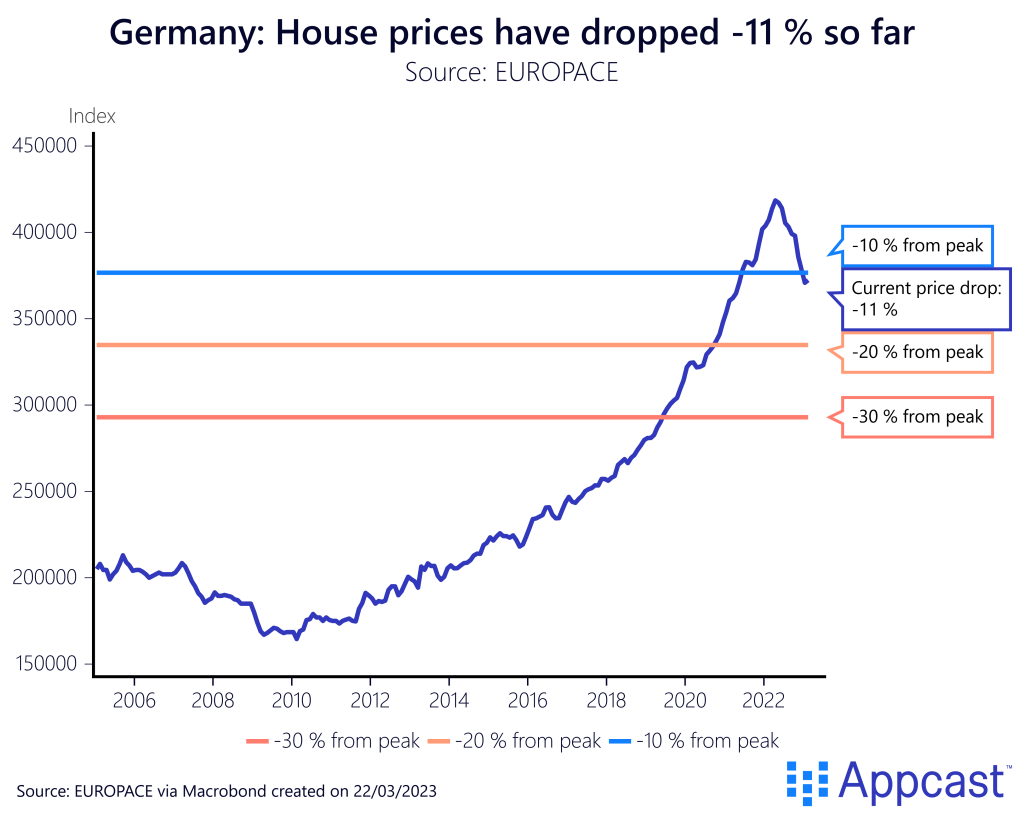

Easy monetary policy most likely contributed to the spectacular surge in house prices that Germany has seen during the 2010s. While German house prices had previously stagnated for decades, they almost doubled in between 2010 and 2021.

Since the beginning of the hike rate cycle last year, house prices in Germany have now fallen by more than 10% from peak already. With mortgage rates surging, real estate transactions are declining rapidly, and the construction sector will suffer too.

Some economists are now warning that the ECB will repeat the mistake that they did in 2008 when they hiked the Eurozone into recession. Financial volatility has increased sharpy and European banking stocks have plunged in recent days.

Labor shortages remain the biggest problem for the German economy

The most recent forecasts suggest that the German economy will not contract this year despite the commodity price shock and gas shortages that occurred in 2022. The German economic research institutes HWWI and RWI are anticipating close to zero growth this year and a return to trend growth between 1.4 and 2% next year.

The big downside risk to the growth outlook would be a large financial shock or real estate shock that could plunge the German and Eurozone economies into recession. And this could also lead to surging unemployment rates.

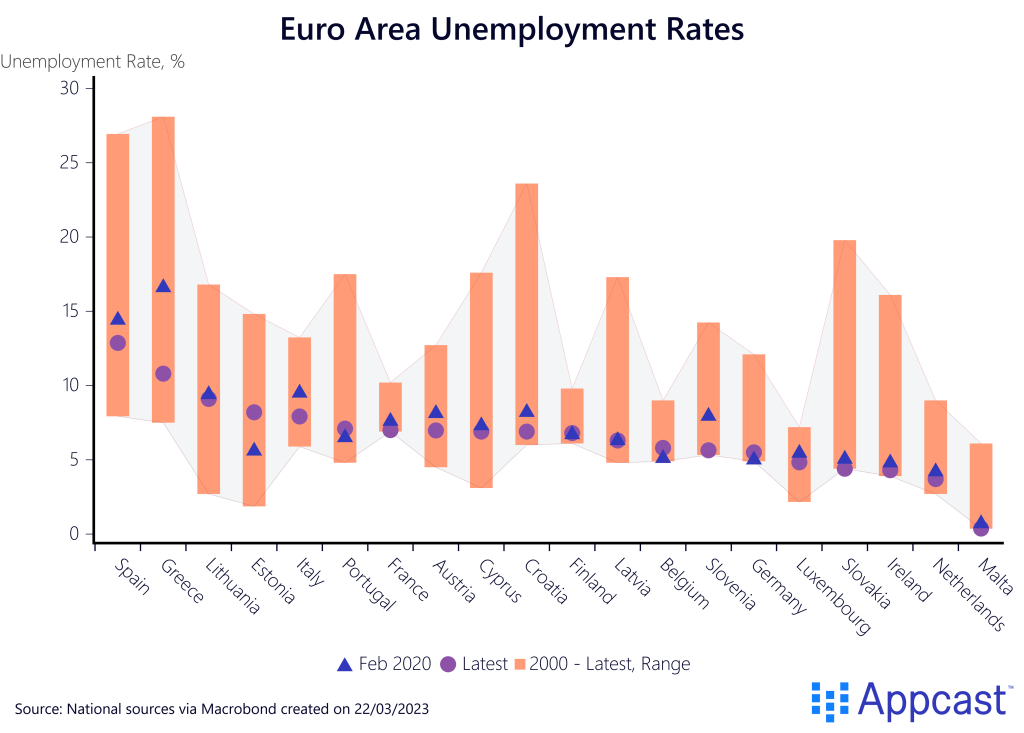

As the following chart shows, Euro area unemployment rates are reaching record lows in most countries as the labor market has become increasingly tight with the economic recovery from the COVID recession.

The Euro area is, of course, facing severe demographic headwinds in the long run. Birth rates in countries like Germany and Italy have been well below the replacement rate for several decades now.

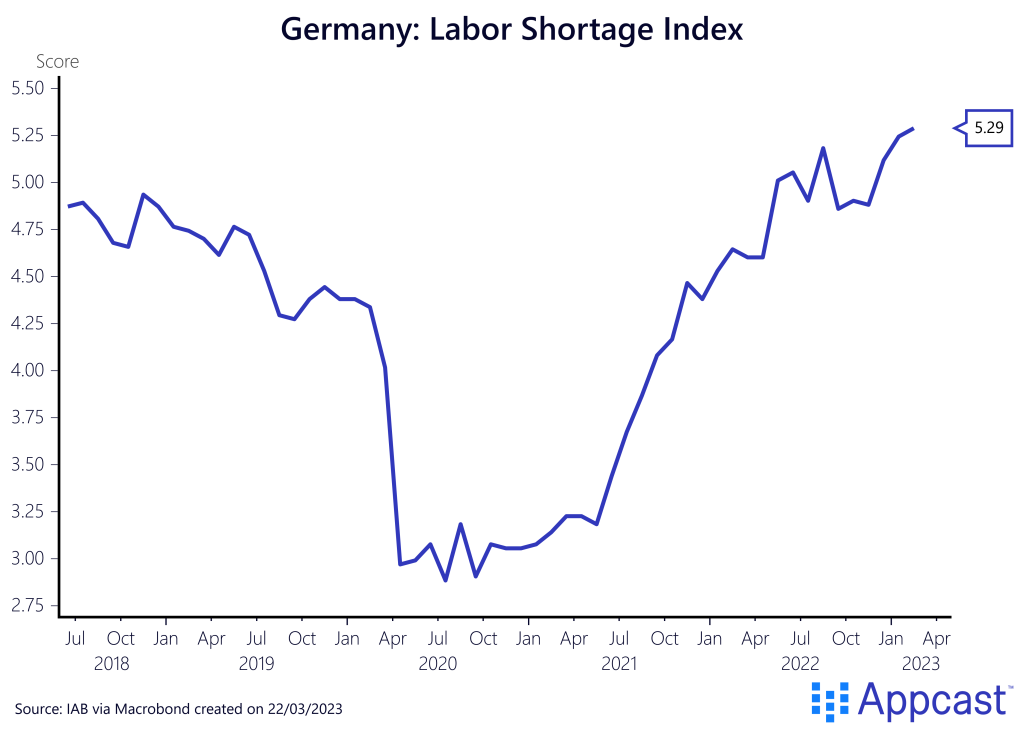

This means that the future labor market will be one of increasing tightness. The IAB labor shortage index for Germany just reached its highest level. Similar to the U.S., the German economy is currently experiencing a combination of very low unemployment and record high vacancy levels. Companies are reporting that skill and labor shortages are increasingly holding them back and constraining production.

Conclusion

The ECB is determined to continue its tightening path amidst record-high Euro area inflation even as financial market volatility is surging. The financial system has become much more stable since the last crisis and the ECB has tools to support the banking sector with liquidity injections, for example, while increasing the policy rate further.

Absent a large economic shock, it is not a lack of spending that will hold back the Euro area economic recovery. Companies in Germany are increasingly reporting that it is a lack of skilled labor that is holding back production amidst a record tight labor market. Given the long-run demographic outlook, labor shortages will shape the economy of the future.